Annual report 2008, 1.19 MB - Telenor

Annual report 2008, 1.19 MB - Telenor

Annual report 2008, 1.19 MB - Telenor

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

<strong>Telenor</strong> Group<br />

PAGE 28<br />

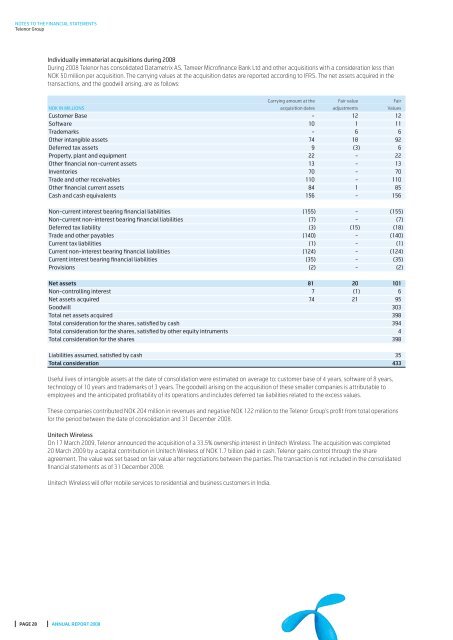

Individually immaterial acquisitions during <strong>2008</strong><br />

During <strong>2008</strong> <strong>Telenor</strong> has consolidated Datametrix AS, Tameer Microfi nance Bank Ltd and other acquisitions with a consideration less than<br />

NOK 50 million per acquisition. The carrying values at the acquisition dates are <strong>report</strong>ed according to IFRS. The net assets acquired in the<br />

transactions, and the goodwill arising, are as follows:<br />

Carrying amount at the Fair value Fair<br />

NOK IN MILLIONS acquisition dates adjustments Values<br />

Customer Base - 12 12<br />

Software 10 1 11<br />

Trademarks - 6 6<br />

Other intangible assets 74 18 92<br />

Deferred tax assets 9 (3) 6<br />

Property, plant and equipment 22 - 22<br />

Other fi nancial non-current assets 13 - 13<br />

Inventories 70 - 70<br />

Trade and other receivables 110 - 110<br />

Other fi nancial current assets 84 1 85<br />

Cash and cash equivalents 156 - 156<br />

Non-current interest bearing fi nancial liabilities (155) - (155)<br />

Non-current non-interest bearing fi nancial liabilities (7) - (7)<br />

Deferred tax liability (3) (15) (18)<br />

Trade and other payables (140) - (140)<br />

Current tax liabilities (1) - (1)<br />

Current non-interest bearing fi nancial liabilities (124) - (124)<br />

Current interest bearing fi nancial liabilities (35) - (35)<br />

Provisions (2) - (2)<br />

Net assets 81 20 101<br />

Non-controlling interest 7 (1) 6<br />

Net assets acquired 74 21 95<br />

Goodwill 303<br />

Total net assets acquired 398<br />

Total consideration for the shares, satisfi ed by cash 394<br />

Total consideration for the shares, satisfi ed by other equity intruments 4<br />

Total consideration for the shares 398<br />

Liabilities assumed, satisfi ed by cash 35<br />

Total consideration 433<br />

Useful lives of intangible assets at the date of consolidation were estimated on average to: customer base of 4 years, software of 8 years,<br />

technology of 10 years and trademarks of 3 years. The goodwill arising on the acquisition of these smaller companies is attributable to<br />

employees and the anticipated profi tability of its operations and includes deferred tax liabilities related to the excess values.<br />

These companies contributed NOK 204 million in revenues and negative NOK 122 million to the <strong>Telenor</strong> Group’s profi t from total operations<br />

for the period between the date of consolidation and 31 December <strong>2008</strong>.<br />

Unitech Wireless<br />

On 17 March 2009, <strong>Telenor</strong> announced the acquisition of a 33.5% ownership interest in Unitech Wireless. The acquisition was completed<br />

20 March 2009 by a capital contribution in Unitech Wireless of NOK 1.7 billion paid in cash. <strong>Telenor</strong> gains control through the share<br />

agreement. The value was set based on fair value after negotiations between the parties. The transaction is not included in the consolidated<br />

fi nancial statements as of 31 December <strong>2008</strong>.<br />

Unitech Wireless will offer mobile services to residential and business customers in India.<br />

ANNUAL REPORT <strong>2008</strong>