Annual report 2008, 1.19 MB - Telenor

Annual report 2008, 1.19 MB - Telenor

Annual report 2008, 1.19 MB - Telenor

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

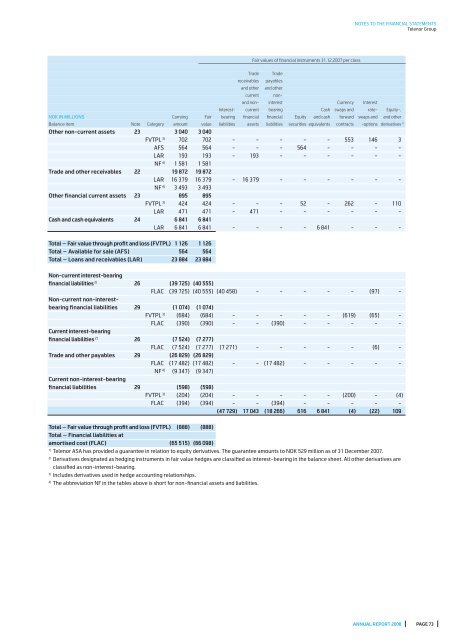

Fair values of fi nancial instruments 31.12.2007 per class<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

<strong>Telenor</strong> Group<br />

Trade Trade<br />

receivables payables<br />

and other and other<br />

current nonand<br />

non- interest Currency Interest<br />

Interest- current bearing Cash swaps and rate- Equity-,<br />

NOK IN MILLIONS Carrying Fair bearing fi nancial fi nancial Equity and cash forward swaps and and other<br />

Balance item Note Category amount value liabilities assets liabilities securities equivalents contracts -options derivatives 1)<br />

Other non-current assets 23 3 040 3 040<br />

FVTPL 3) 702 702 - - - - - 553 146 3<br />

AFS 564 564 - - - 564 - - - -<br />

LAR 193 193 - 193 - - - - - -<br />

NF 4) 1 581 1 581<br />

Trade and other receivables 22 19 872 19 872<br />

LAR 16 379 16 379 - 16 379 - - - - - -<br />

NF 4) 3 493 3 493<br />

Other fi nancial current assets 23 895 895<br />

FVTPL 3) 424 424 - - - 52 - 262 - 110<br />

LAR 471 471 - 471 - - - - - -<br />

Cash and cash equivalents 24 6 841 6 841<br />

LAR 6 841 6 841 - - - - 6 841 - - -<br />

Total – Fair value through profi t and loss (FVTPL) 1 126 1 126<br />

Total – Available for sale (AFS) 564 564<br />

Total – Loans and receivables (LAR) 23 884 23 884<br />

Non-current interest-bearing<br />

fi nancial liabilities 2) 26 (39 725) (40 555)<br />

FLAC (39 725) (40 555) (40 458) - - - - - (97) -<br />

Non-current non-interestbearing<br />

fi nancial liabilities 29 (1 074) (1 074)<br />

FVTPL 3) (684) (684) - - - - - (619) (65) -<br />

FLAC (390) (390) - - (390) - - - - -<br />

Current interest-bearing<br />

fi nancial liabilities 2) 26 (7 524) (7 277)<br />

FLAC (7 524) (7 277) (7 271) - - - - - (6) -<br />

Trade and other payables 29 (26 829) (26 829)<br />

FLAC (17 482) (17 482) - - (17 482) - - - - -<br />

NF 4) (9 347) (9 347)<br />

Current non-interest-bearing<br />

fi nancial liabilities 29 (598) (598)<br />

FVTPL 3) (204) (204) - - - - - (200) - (4)<br />

FLAC (394) (394) - - (394) - - - - -<br />

(47 729) 17 043 (18 266) 616 6 841 (4) (22) 109<br />

Total – Fair value through profi t and loss (FVTPL)<br />

Total – Financial liabilities at<br />

(888) (888)<br />

amortised cost (FLAC) (65 515) (66 098)<br />

1) <strong>Telenor</strong> ASA has provided a guarantee in relation to equity derivatives. The guarantee amounts to NOK 529 million as of 31 December 2007.<br />

2) Derivatives designated as hedging instruments in fair value hedges are classifi ed as interest-bearing in the balance sheet. All other derivatives are<br />

classifi ed as non-interest-bearing.<br />

3) Includes derivatives used in hedge accounting relationships.<br />

4) The abbreviation NF in the tables above is short for non-fi nancial assets and liabilities.<br />

ANNUAL REPORT <strong>2008</strong> PAGE 73