spRING 2011 GlobAl MARKETs INTERNATIoNAl - Willis

spRING 2011 GlobAl MARKETs INTERNATIoNAl - Willis

spRING 2011 GlobAl MARKETs INTERNATIoNAl - Willis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5<br />

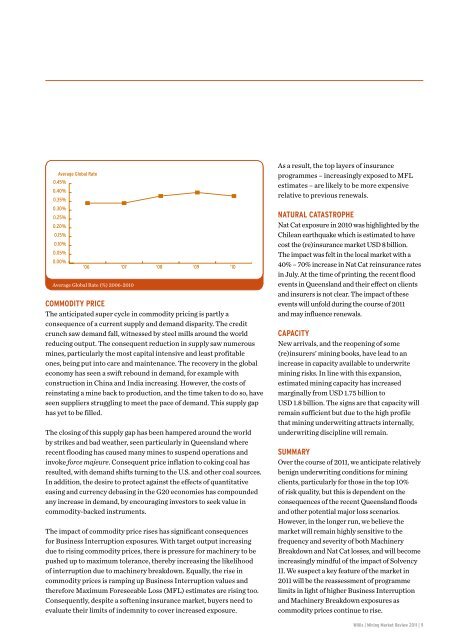

Average Global Rate<br />

0.45%<br />

0.40%<br />

0.35%<br />

0.30%<br />

0.25%<br />

0.20%<br />

0.15%<br />

0.10%<br />

0.05%<br />

0.00%<br />

‘06 ‘07 ‘08 ‘09 ‘10<br />

Average Global Rate (%) 2006-2010<br />

CoMModity PRiCe<br />

The anticipated super cycle in commodity pricing is partly a<br />

consequence of a current supply and demand disparity. The credit<br />

crunch saw demand fall, witnessed by steel mills around the world<br />

reducing output. The consequent reduction in supply saw numerous<br />

mines, particularly the most capital intensive and least profitable<br />

ones, being put into care and maintenance. The recovery in the global<br />

economy has seen a swift rebound in demand, for example with<br />

construction in China and India increasing. However, the costs of<br />

reinstating a mine back to production, and the time taken to do so, have<br />

seen suppliers struggling to meet the pace of demand. This supply gap<br />

has yet to be filled.<br />

The closing of this supply gap has been hampered around the world<br />

by strikes and bad weather, seen particularly in Queensland where<br />

recent flooding has caused many mines to suspend operations and<br />

invoke force majeure. Consequent price inflation to coking coal has<br />

resulted, with demand shifts turning to the U.S. and other coal sources.<br />

In addition, the desire to protect against the effects of quantitative<br />

easing and currency debasing in the G20 economies has compounded<br />

any increase in demand, by encouraging investors to seek value in<br />

commodity-backed instruments.<br />

The impact of commodity price rises has significant consequences<br />

for Business Interruption exposures. With target output increasing<br />

due to rising commodity prices, there is pressure for machinery to be<br />

pushed up to maximum tolerance, thereby increasing the likelihood<br />

of interruption due to machinery breakdown. Equally, the rise in<br />

commodity prices is ramping up Business Interruption values and<br />

therefore Maximum Foreseeable Loss (MFL) estimates are rising too.<br />

Consequently, despite a softening insurance market, buyers need to<br />

evaluate their limits of indemnity to cover increased exposure.<br />

As a result, the top layers of insurance<br />

programmes – increasingly exposed to MFL<br />

estimates – are likely to be more expensive<br />

relative to previous renewals.<br />

NatuRal CatastRoPhe<br />

Nat Cat exposure in 2010 was highlighted by the<br />

Chilean earthquake which is estimated to have<br />

cost the (re)insurance market USD 8 billion.<br />

The impact was felt in the local market with a<br />

40% – 70% increase in Nat Cat reinsurance rates<br />

in July. At the time of printing, the recent flood<br />

events in Queensland and their effect on clients<br />

and insurers is not clear. The impact of these<br />

events will unfold during the course of <strong>2011</strong><br />

and may influence renewals.<br />

CaPaCity<br />

New arrivals, and the reopening of some<br />

(re)insurers’ mining books, have lead to an<br />

increase in capacity available to underwrite<br />

mining risks. In line with this expansion,<br />

estimated mining capacity has increased<br />

marginally from USD 1.75 billion to<br />

USD 1.8 billion. The signs are that capacity will<br />

remain sufficient but due to the high profile<br />

that mining underwriting attracts internally,<br />

underwriting discipline will remain.<br />

suMMaRy<br />

Over the course of <strong>2011</strong>, we anticipate relatively<br />

benign underwriting conditions for mining<br />

clients, particularly for those in the top 10%<br />

of risk quality, but this is dependent on the<br />

consequences of the recent Queensland floods<br />

and other potential major loss scenarios.<br />

However, in the longer run, we believe the<br />

market will remain highly sensitive to the<br />

frequency and severity of both Machinery<br />

Breakdown and Nat Cat losses, and will become<br />

increasingly mindful of the impact of Solvency<br />

II. We suspect a key feature of the market in<br />

<strong>2011</strong> will be the reassessment of programme<br />

limits in light of higher Business Interruption<br />

and Machinery Breakdown exposures as<br />

commodity prices continue to rise.<br />

<strong>Willis</strong> | Mining Market Review <strong>2011</strong> |