RLB GB engl.44-68 - Raiffeisenlandesbank Niederösterreich-Wien

RLB GB engl.44-68 - Raiffeisenlandesbank Niederösterreich-Wien

RLB GB engl.44-68 - Raiffeisenlandesbank Niederösterreich-Wien

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

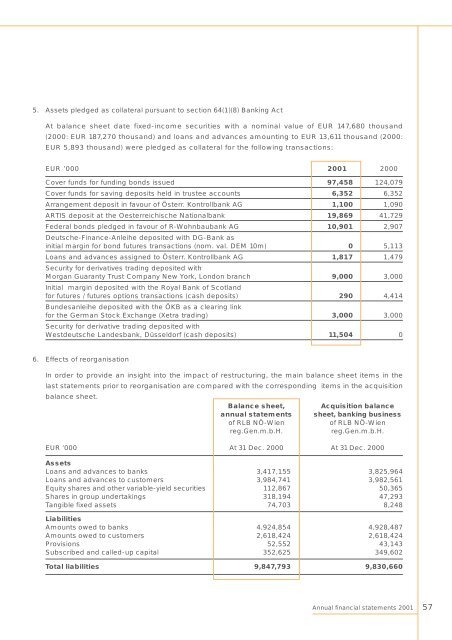

5. Assets pledged as collateral pursuant to section 64(1)(8) Banking Act<br />

At balance sheet date fixed-income securities with a nominal value of EUR 147,<strong>68</strong>0 thousand<br />

(2000: EUR 187,270 thousand) and loans and advances amounting to EUR 13,611 thousand (2000:<br />

EUR 5,893 thousand) were pledged as collateral for the following transactions:<br />

EUR ’000 2001 2000<br />

Cover funds for funding bonds issued 97,458 124,079<br />

Cover funds for saving deposits held in trustee accounts 6,352 6,352<br />

Arrangement deposit in favour of Österr. Kontrollbank AG 1,100 1,090<br />

ARTIS deposit at the Oesterreichische Nationalbank 19,869 41,729<br />

Federal bonds pledged in favour of R-Wohnbaubank AG<br />

Deutsche-Finance-Anleihe deposited with DG-Bank as<br />

10,901 2,907<br />

initial margin for bond futures transactions (nom. val. DEM 10m) 0 5,113<br />

Loans and advances assigned to Österr. Kontrollbank AG<br />

Security for derivatives trading deposited with<br />

1,817 1,479<br />

Morgan Guaranty Trust Company New York, London branch<br />

Initial margin deposited with the Royal Bank of Scotland<br />

9,000 3,000<br />

for futures / futures options transactions (cash deposits)<br />

Bundesanleihe deposited with the ÖKB as a clearing link<br />

290 4,414<br />

for the German Stock Exchange (Xetra trading)<br />

Security for derivative trading deposited with<br />

3,000 3,000<br />

Westdeutsche Landesbank, Düsseldorf (cash deposits) 11,504 0<br />

6. Effects of reorganisation<br />

In order to provide an insight into the impact of restructuring, the main balance sheet items in the<br />

last statements prior to reorganisation are compared with the corresponding items in the acquisition<br />

balance sheet.<br />

Balance sheet, Acquisition balance<br />

annual statements sheet, banking business<br />

of <strong>RLB</strong> NÖ-<strong>Wien</strong> of <strong>RLB</strong> NÖ-<strong>Wien</strong><br />

reg.Gen.m.b.H. reg.Gen.m.b.H.<br />

EUR ’000 At 31 Dec. 2000 At 31 Dec. 2000<br />

Assets<br />

Loans and advances to banks 3,417,155 3,825,964<br />

Loans and advances to customers 3,984,741 3,982,561<br />

Equity shares and other variable-yield securities 112,867 50,365<br />

Shares in group undertakings 318,194 47,293<br />

Tangible fixed assets 74,703 8,248<br />

Liabilities<br />

Amounts owed to banks 4,924,854 4,928,487<br />

Amounts owed to customers 2,618,424 2,618,424<br />

Provisions 52,552 43,143<br />

Subscribed and called-up capital 352,625 349,602<br />

Total liabilities 9,847,793 9,830,660<br />

Annual financial statements 2001<br />

57