The Burgundy Briefing - Sarah Marsh Home Page

The Burgundy Briefing - Sarah Marsh Home Page

The Burgundy Briefing - Sarah Marsh Home Page

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> <strong>Burgundy</strong> <strong>Briefing</strong><br />

news, views and tastings <strong>Sarah</strong> <strong>Marsh</strong> MW<br />

Issue 5, May/June 2006<br />

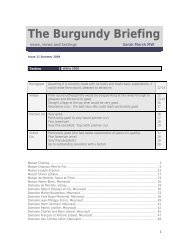

Market report<br />

a. Production and export of the 2004 vintage<br />

b. Current market in the UK: sales in 2005 (2003s) and the en<br />

primeur market for 2004<br />

c. Review of wines sold auction in the UK and States in 2005<br />

Credits: All production and export figures in this document have been sourced directly from the<br />

BIVB. Matthew Martin Bird has contributed to this market report.<br />

a. Production and export of the 2004 vintage<br />

<strong>The</strong> recent production of <strong>Burgundy</strong> is plotted over the past 21 years in the following graph.<br />

(figures are found in the table below). In the mid 1980s the volume of red wine produced was<br />

not significantly more than white. However since 1984 (with the exception of 1986), the volume<br />

of white wine has steadily increased and now far outstrips the production of red. Although the<br />

quantity of red wine produced has increased from 427,079 hectolitres in 1984, to 507,509<br />

hectolitres in 2005, an increase of approximately 20%, this is small in comparison with the 140%<br />

increase in white wine (417,217 hectares in 1984 to 1,007,283 in 2005). <strong>The</strong> graph highlights the<br />

much reduced crop of 2003 as a sharp drop, immediately followed by the substantial 2004<br />

harvest. <strong>The</strong> 2005 vintage is smaller than 2004, showing a decrease of 2% in red production. In<br />

the last 20 years only 2003, 1997 and 1991 had smaller red vintages. However the picture is<br />

quite different for white. <strong>The</strong> decrease in the production of white wine is 4%, but this represents<br />

the largest vintage, after 2004, of the past 20 years.<br />

Volume<br />

(Hl)<br />

4,000,000<br />

3,000,000<br />

2,000,000<br />

1,000,000<br />

0<br />

Volume of <strong>Burgundy</strong> Harvest 1984-2005<br />

1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005<br />

Year<br />

Total<br />

Whites<br />

Reds

-3%<br />

1,514,792<br />

-4%<br />

1,007,283<br />

-2%<br />

507,509<br />

2005<br />

43%<br />

1,568,974<br />

44%<br />

1,052,955<br />

41%<br />

516,019<br />

2004<br />

-28%<br />

1,098,027<br />

-24%<br />

733,291<br />

-35%<br />

364,736<br />

2003<br />

3%<br />

1,530,439<br />

6%<br />

970,968<br />

-2%<br />

559,471<br />

2002<br />

-4%<br />

1,487,784<br />

-3%<br />

915,866<br />

-6%<br />

571,918<br />

2001<br />

-4%<br />

1,550,706<br />

-1%<br />

943,180<br />

-8%<br />

607,526<br />

2000<br />

14%<br />

1,608,190<br />

9%<br />

950,598<br />

23%<br />

657,592<br />

1999<br />

3%<br />

1,404,868<br />

0%<br />

869,477<br />

8%<br />

535,391<br />

1998<br />

-7%<br />

1,366,193<br />

2%<br />

870,752<br />

-20%<br />

495,441<br />

1997<br />

10%<br />

1,473,630<br />

9%<br />

855,649<br />

11%<br />

617,981<br />

1996<br />

1%<br />

1,336,597<br />

5%<br />

782,144<br />

-4%<br />

554,453<br />

1995<br />

3%<br />

1,321,747<br />

2%<br />

744,089<br />

4%<br />

577,658<br />

1994<br />

-1%<br />

1,287,135<br />

-1%<br />

731,639<br />

-1%<br />

555,496<br />

1993<br />

21%<br />

1,302,797<br />

26%<br />

739,489<br />

16%<br />

563,308<br />

1992<br />

-12%<br />

1,076,339<br />

-8%<br />

589,071<br />

-16%<br />

487,268<br />

1991<br />

8%<br />

1,219,621<br />

11%<br />

639,076<br />

4%<br />

580,545<br />

1990<br />

2%<br />

1,130,193<br />

2%<br />

573,915<br />

2%<br />

556,278<br />

1989<br />

5%<br />

1,110,293<br />

9%<br />

563,514<br />

2%<br />

546,779<br />

1988<br />

-9%<br />

1,052,519<br />

1%<br />

519,019<br />

-16%<br />

533,500<br />

1987<br />

23%<br />

1,151,318<br />

9%<br />

514,685<br />

37%<br />

636,633<br />

1986<br />

11%<br />

936,640<br />

13%<br />

472,836<br />

9%<br />

463,804<br />

1985<br />

N/A<br />

844,296<br />

N/A<br />

417,217<br />

N/A<br />

427,079<br />

1984<br />

% Change<br />

Total<br />

% Change<br />

Whites<br />

% Change<br />

Reds<br />

Year<br />

<strong>The</strong> Evolution of the <strong>Burgundy</strong> Harvest 1984 -2005

However at the top end of the market, from village to grand cru on the Côte d’Or, markedly more<br />

red wine is produced than white, as can be seen in the graph and table which follow. About three<br />

and a half (3.57) times as much red wine has been made from grand cru sites as white – and<br />

2.98 times more at village and premier cru level. However over the last six years, there has been<br />

a slight downward trend in the volume produced of red village and premier cru wines (although<br />

1999 does represent a peak in production).<br />

Volume (in hectolitres) at Various Quality Levels of the Cote d’Or 1999 -2005<br />

Village and 1er Cru Blancs<br />

Village and 1er Cru Reds<br />

Grand Cru Whites<br />

Grand Cru Reds<br />

Volume (hl)<br />

1999<br />

68,188<br />

229,612<br />

4,447<br />

15,330<br />

2000<br />

65,242<br />

196,527<br />

4,191<br />

14,148<br />

2001<br />

62,432<br />

188,586<br />

4,016<br />

14,274<br />

2002<br />

65,371<br />

187,913<br />

4,012<br />

13,561<br />

2003<br />

43,142<br />

125,186<br />

2,884<br />

9,434<br />

Production at Various Quality Levels of the Cote d'Or<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

1999 2000 2001 2002 2003 2004 2005<br />

Year<br />

2004<br />

69,365<br />

172,855<br />

4,012<br />

12,571<br />

Village and 1er Cru<br />

Reds<br />

Village and 1er Cru<br />

Blancs<br />

Grand Cru Reds<br />

Grand Cru W hites<br />

2005<br />

58,817<br />

175,674<br />

3,692<br />

13,214<br />

More detailed figures on the production of red and white in specific villages on the cotes may be<br />

found in tables at the end of this document.<br />

<strong>The</strong> following tables and pie charts have been sourced (as seen) from the BIVB.

Export figures for Wines from <strong>Burgundy</strong> 2004-05 (BIVB)

. Current market: UK sales in 2005 (2003s) and the en-primeur market for 2004<br />

This section takes a look at the UK market over the past year. <strong>The</strong> following merchants were<br />

consulted: Domaine Direct (Hilary Gibbs); Hayes, Hanson and Clarke (Jim Eustace); Lay and<br />

Wheeler (Amanda Skinner); O.W. Loeb (Jason Hayes). <strong>The</strong> general mood of the market is<br />

considered, together with emerging trends in buying habits; sales in 2005/6 and the impact of<br />

price and vintage on them.<br />

<strong>The</strong> merchants were then asked to select domaines which offered decent prices in 2004 and<br />

choose growers who have increased prices very reasonably over the past decade.<br />

Just to round up, the merchants were asked to consider en primeur prices in relation to quality<br />

over the past ten years.<br />

This exercise draws on a tiny sample of UK merchants who have shared their thoughts and<br />

observations. It is only an impression of the market and does not pretend to be a comprehensive<br />

reflection.<br />

Mood:<br />

Amanda Skinner CEO of Lay and Wheeler sets the scene with a positive feeling about <strong>Burgundy</strong><br />

from both consumer and trade customers. “<strong>The</strong> client perception is definitely that <strong>Burgundy</strong><br />

offers better value; that the pricing is more “correct” i.e. better price:quality ratio. <strong>The</strong>re is<br />

definitely a recognition of the great strides in quality that have been made in the region in the<br />

past twenty years and I think that the wine merchants have made more effort to clarify the<br />

<strong>Burgundy</strong> “story” and introduce the growers through literature and tastings/dinners. It has to be<br />

said that this has not totally been done for the love of our friends on the Côtes – the margins<br />

that the merchants can achieve on Bordeaux sales are falling all the time – high(er) pricing at the<br />

outset, cellaring and financing costs waiting for maturity, lack of demand and “out of vogue” and<br />

thus it makes commercial sense to focus more strongly on <strong>Burgundy</strong> where the pricing at the<br />

outset may be more realistic, the cellaring and financing costs do not have to be bourne for such<br />

a long period, the wines are more approachable for amateur tasting and assessment, the<br />

quantities are smaller and thus the consumer is encouraged to buy at an earlier stage etc. and all<br />

this contributes to a better margin.”<br />

Jason Hayes also attributes the high level of interest in <strong>Burgundy</strong> to the increased commentary<br />

and information available, pointing out that buying Bordeaux used to be a much simpler task<br />

than buying <strong>Burgundy</strong>, which was little more complicated than “having to choose between buying<br />

Latour or Lafite. Whereas choosing between half a dozen different appellations from two different<br />

growers (even if they are based in the same village) demands careful consideration and no little<br />

knowledge.”<br />

Hayes is also optimistic. “Overall the general mood for <strong>Burgundy</strong> is positive. It is still very much<br />

an evolving market. As recently as ten years ago many of today's household names had no UK<br />

importer.” He, like Amanda Skinner, links this with quality being higher and more consistent than<br />

it has ever been, “the greater technology (and know how) available to growers allows them to<br />

take risks safe in the knowledge that they can get themselves out of jail if the need arises. <strong>The</strong><br />

minimum quality level among the top growers appears to be much higher than previously and<br />

disaster vintages (touch wood) seem a thing of the past.”

At Domaine Direct Hilary Gibbs, who is among the most experienced people in the UK market for<br />

<strong>Burgundy</strong>, finds the recent market mood quite buoyant, “partly because 2003 was quite small, as<br />

well as atypical, so the 2004s for general and everyday consumption and selling have been<br />

welcomed.”<br />

Jim Eustace a director of Hayes, Hanson and Clarke sounds a note of caution. He has noticed<br />

that the bottom end of the market the mood is a bit gloomy. “<strong>The</strong> prices are low and there is a<br />

lot of wine in the cellars. It’s a bit worrying. However for the vineyards in good sites and for the<br />

well-known growers the mood is very buoyant. <strong>The</strong>re is a good market for <strong>Burgundy</strong> with the<br />

exception of the people who have continually increased prices. <strong>The</strong>se wines are sticking in the<br />

2004 vintage however trendy they are.”<br />

Style and colour<br />

Sales trends:<br />

Hayes Hanson and Clarke report that fewer customers are “prepared to shell out for high prices<br />

often linked with bigger showier style, “ says Eustace. “Certain high profile domaines have made<br />

a reputation for a style based upon full maturity, concentration and richness.” Whereas style and<br />

name will probably buffer high prices in the States, in the UK it is not surprising to find<br />

merchants and consumers with reservations.” <strong>The</strong> wines maybe very attractive in youth, but the<br />

worry is over how they will age. <strong>The</strong>se wines are based on tiny yields, for example 25 hl/ha for<br />

village wines,” says Eustace. When yields are this low, he rightly draws attention to the problem<br />

of alcohol, “This may not be apparent at first often, but comes though later as harshness on the<br />

finish.” Hayes, Hanson and Clarke are sufficiently concerned that more reserved elegant style<br />

might be overlooked for showier wine, to wait until September to hold tasting for their<br />

consumers. “We look for finesse and like domaines such as Chandon de Briailles, who use no<br />

new oak. While we want to offer a range of style, we lean to lighter styles. Why pay £500 IB for<br />

a case of village wine that could easily be made somewhere else.”<br />

In the UK the film Sideways had no effect on the sales of red <strong>Burgundy</strong>. At Lay and Wheeler red<br />

<strong>Burgundy</strong> sales are increasing faster than white, but Amanda skinner attributes this is a bias in<br />

their portfolio, the ABC effect and health factors.<br />

Skinner also considers that the effects of better education is resulting in “consumers definitely<br />

know what they like more and more, and village styles are becoming more common parlance –<br />

there is a discernable trend now amongst consumers of the “I know that I love Volnay, what can<br />

you recommend” type of enquiry.”<br />

Quality level<br />

In terms of growth trends in a specific quality level from generic wines to grand cru, this is very<br />

vintage dependent. At Loeb, Hayes comments, “In a great vintage like 2002 one could buy<br />

confidently across the board and village wines offered terrific value. In 2001 the best vineyards<br />

really showed why they are classified so and it was a vintage to concentrate one's purchases on<br />

the top sites.” However at Lay and Wheeler, sales of entry level wine (Olivier Leflaive’s Côte<br />

Chalonnais and Nicolas Potel’s reds from the Hautes Côtes and Nuits St George Vieilles Vignes)<br />

reveal little movement. <strong>The</strong> growth is coming from 1er Cru and Grand Cru level wines from the<br />

Côtes de Beaune and Côtes de Nuits.

A worrying trend towards investment and cherry picking:<br />

Jason Hayes observes a worrying trend in buying habits. “Those who can afford the top vintages<br />

(in Bordeaux) now tend to buy only the top vintages and this trend appears to be creeping in to<br />

the <strong>Burgundy</strong> market as customers overbuy in the best vintages and under buy in those just<br />

below the top level. For example many of the top red wines in 2001 were on a par or just a<br />

fraction below their 2002 equivalent but sales in 2002 of those wines was between five and<br />

tenfold those of 2001. It seems that demand for 2005 may well outstrip the two other recent top<br />

red <strong>Burgundy</strong> vintages of 2002 and 1999 as this trend gathers pace.”<br />

“Clearly increased information makes it is easier for investors to consider <strong>Burgundy</strong> in place of<br />

Bordeaux, although limited quantities make significant purchases difficult. But these new 'cherry<br />

pickers' are still able to have an impact on the market for the top wines, which are in ever more<br />

demand, although again this tends to be only in the very best vintages. Investors lack the loyalty<br />

and the intellectual interest to buy other vintages.” Hayes worried that “we will see a more roller<br />

coaster range of prices over the next ten years, but hopefully not to the extent of Bordeaux.”<br />

It seems that SIPPS had no effect on sales of <strong>Burgundy</strong>. Cautious merchants who waited to see<br />

how they would work before doing anything about it took the right approach. Some merchant<br />

consider that SIPPS would certainly have had an effect on the secondary market for <strong>Burgundy</strong>,<br />

but all agree that any impact on the en primeur market would have been minimal given the<br />

insufficient volume of wine.<br />

A move from Bordeaux I favour of <strong>Burgundy</strong>?<br />

At Lay and Wheeler <strong>Burgundy</strong> sales are increasing as a percentage of total sales and specifically<br />

against Bordeaux sales outside the en primeur cycle. Although Amanda Skinner comments that<br />

they are unlikely to be able to source enough wine to contribute more than 10% of total sales,<br />

she anticipates selling at least twice as much <strong>Burgundy</strong> as Bordeaux in general sales. At the entry<br />

level Skinner comments that people are more inclined to open a bottle of Hautes Cotes de Nuits<br />

2001, from Nicolas Potel than a 2001 Medoc. “You are likely to get much more satisfaction from a<br />

bottle of negociant level Red <strong>Burgundy</strong> than from a Bordeaux Superieur.”<br />

Prices and Vintage style and their effect on sales in 2005:<br />

Hayes sums up the market: “<strong>The</strong>re is rarely a big hike from one year to the next (unlike in<br />

Bordeaux), although some 2003s were increased too much for the market to withstand. Having<br />

said that it was a very, very small vintage. Almost all growers who increased their prices in 2003<br />

brought them back to the level of 2002 for 2004s and some to just below. Certainly price<br />

increases for some of the 2003s, although logical in terms of achieving an aggregate income,<br />

were hard to justify to collectors who has bought heavily in 2002 and felt no great need to buy<br />

wines that overall were less good and in terms of the whites had very limited ageing potential.<br />

Despite lowering our margins significantly sales of 2003 white <strong>Burgundy</strong> en primeur were<br />

negligible.”<br />

Some producers who increased their prices dramatically in 2003 found their agents decided to<br />

‘pass.’ <strong>The</strong> 2003 vintage was so small hardly mattered, but in 2004, even with decreased prices,<br />

some producers may have found their agents less interested in taking wine than before. When<br />

the momentum of sales vintage on vintage has been interrupted and the relationship between<br />

producer-merchant-customer broken, it can take a while to mend.

In 2003 the tiny volumes opened up opportunities for growers beyond the Côte d’Or to make an<br />

impression on the overseas markets. At Lay and Wheeler they turned to the Maçonnais as a<br />

source of entry level chardonnay. (For more on good quality and reasonable priced wines from<br />

the Maçonnais, see Tasting 3 in this issue).<br />

2003 Reds: “2003 reds were not easy to sell either because of the price,” comments Eustace<br />

and HH&C chose not to buy from some domaines whose prices were “definitely too high. It was<br />

damaging when domaines increased 25%, as customers were not interested in buying.” Eustace<br />

considers that it has to be viewed as a vintage where one was not going to make money and<br />

comments that it was a mistake for growers to set their prices to compensate for low yields.<br />

Those who “took a hit” and priced sensibly included Christophe Roumier and Blain-Gagnard.<br />

Sales of white in 2005:<br />

2003 white: Eustace also reports sales of white <strong>Burgundy</strong> were down in the 2003 vintage.<br />

“People had it in their heads that 2003 whites were not very good, but this is a shame since the<br />

2003 whites are delicious. <strong>The</strong>se are not wines for keeping, but for drinking and enjoying when<br />

young. This is a vintage where the grapes were fully ripe, no rot, absolutely lovely, yet people<br />

are turning their backs on it. Ridiculous!” It seems that wines sold well enough at the bottom to<br />

middle level, but at the top end, sales were sluggish as people, understandably, are not keen to<br />

spend £50 on a wine they cannot keep.<br />

Chablis: Chablis was perhaps less affected. Eustace found sales as normal with the 2003 vintage<br />

(Domaines Raveneau, Christian Moreau and Daniel Dampt). Hayes concurs, remarking that<br />

restaurant sales are very consistent for Chablis across the various levels, but finds collectors tend<br />

to stick to the top vintages. Amanda Skinner confirms this “2003 was undoubtedly a hard sell to<br />

the purists but being quite showy and for earlier drinking, sales were definitely made up amongst<br />

the hotel and restaurant and corporate clientele.”<br />

At Loeb, Hayes comments that Chablis “is often viewed as an alternative to white <strong>Burgundy</strong> when<br />

considering what to pluck from the cellar and therefore tends to have a limited role. Also, its<br />

ageing ability is often overlooked.” This is a pity and I agree wholeheartedly with Amanda<br />

Skinner, who comments “I think that the 2004 Chablis were outstanding personally and but I<br />

suspect that with all the hype over 2005, 2004 will be one of those vintages which is not<br />

recognised for what it offers and is rather overlooked. Happy the people who have bought these<br />

wines – they are getting exceptional value for money and have a great deal of pleasure to look<br />

forward to.” It is not surprising that Hilary Gibbs has discerned some excitement in Domaine<br />

Direct customers (hard core <strong>Burgundy</strong> lovers) with the return in the 2004s of more classical<br />

structured wine.<br />

2004s: This was a vintage that suffered from a bad press early on, particularly reds, which was<br />

a pity as there is plenty of good wine in 2004. However Loeb report that customers who tasted<br />

the wines at their London tasting in January actually bought more reds. <strong>The</strong> merchants felt<br />

growers’ prices were a little too high for the 2004 vintage and would have liked to them come<br />

down more than they did post the 2003 vintage. However most merchants lowered their margins<br />

in 2004 to encourage sales. <strong>The</strong>re was a general feeling that customers didn’t need to buy – a<br />

combination of good recent vintages in several regions and the 2005 on the horizon. 2004 was<br />

always going to be difficult as people are waiting for 2005, although Hilary Gibbs considers the<br />

effect was mainly for reds for cellaring (Domaine Direct chose not to do an offer for 2004). <strong>The</strong>re<br />

are some good buys to be had in 2004 and in the future it may well be considered an under<br />

estimated vintage. (I made a selection of best buys in issue 4 and the merchants give their tips<br />

below). Also it offers the opportunity for new customers to get on the allocation ladder by buying<br />

some 2004, putting them in a preferential position to get hold of 2005.

£$£$£$£$£$£$<br />

Price:<br />

<strong>The</strong> merchants select domaines which have decreased their prices sensibly in 2004<br />

and represent good value.<br />

Eustace selects Blain-Gagnard and Franck Grux’s domaine wine. (He has a point - compare Grux’s<br />

prices versus domain Guy Roulot the domaine where he used to be winemaker. <strong>The</strong> latter has<br />

wonderful, but much more expensive wines.) Domaine Etienne Sauzet offers particularly good<br />

value for a big name in 2004. Blain-Gagnard and Mugneret-Gibourg were also well priced. Hilary<br />

Gibbs cites Lafon’s Héritiers du Comte Lafon as an example of a wine where the grower sensibly<br />

decreased his price in 2004.<br />

Growers who have increased their prices steadily in recent years to show a<br />

reasonable increase over the past 10 years<br />

Domaines Mugneret-Gibourg and Chandon de Briailies “Corton, Le Clos du Roi is an affordable<br />

wines to buy and keep for ten years.” I like Jim Eustace’s comment “both domaines are run by<br />

women with their heads screwed on. Both lovely wines not extracted or over oaked.” Jason<br />

Hayes comments, “Top world renowned domaines such as Ramonet, Niellon, Marquis d'Angerville<br />

and Henri Gouges (amongst others) have all demonstrated an admiral attitude towards pricing<br />

that the top properties in Bordeaux would do well to mimic.” Hilary Gibbs selects Roumier and<br />

Dauvissat (but excludes the 2003 for both).<br />

2005 Price indication<br />

Olivier Leflaive trades very early, which is unusual for <strong>Burgundy</strong>, where it is normal for the trade<br />

to buy in the autumn following the vintage. However prices have already been released at Olivier<br />

Leflaive. At the entry to mid-level they have not increased that much, but with the top vineyards<br />

prices have increased much more dramatically. Note that prices increases will probably be<br />

accentuated by the decreased yields in 2005.<br />

<strong>The</strong> merchants were asked to comment upon and grade en primeur prices in relation<br />

to quality over the past year on a scale of 1=poor to 5 =good price/quality. (stars in<br />

bold)<br />

En primeur release prices have been very fair overall over the past ten years.<br />

Vintage Score Comment<br />

1995 ***** Fair to good<br />

1996 ***** Fair (perhaps a touch high for the reds?)<br />

1997 ***** ’97 saw a general price decrease so the price; quality was about right<br />

1998 ***** <strong>The</strong> general consensus was very fair although Amanda Skinner considers<br />

they could have been less expensive “I think that these wines should<br />

have been priced lower, especially as the 1999s looked so promising.<br />

One of the benefits that the Burgundians have over the Bordelais in<br />

terms of their en primeur is their release dates but one which they could

work a little harder on, for the consumer’s benefit!”<br />

1999 ***** Higher prices, but higher quality. Some dissention here. Some thought<br />

prices were little bit expensive, but Eustace says, “A fabulous vintage<br />

with a big crop and not overpriced.”<br />

2000 ***** Maybe the price was a bit high given the millennium factor<br />

2001 ***** Jim Eustace “Not so expensive, but it needed to be good value and it<br />

wasn’t. <strong>The</strong> thing about en primeur is it has to be good value to<br />

persuade people to buy early. It was a difficult vintage to sell. <strong>The</strong><br />

producers did not want to bring prices down, arguing that it was a good<br />

vintage. <strong>The</strong> problem was that customers already had plenty of the good<br />

1999 vintage in their cellars. In 2000 the market had also been good. It<br />

was so delicious and customers bought it to drink while waiting for the<br />

1999, so 2001 suffered – it was not cheap and not forward – a firm<br />

vintage. It was a bit like 1991, people just did not want to buy it. Yet<br />

now 2001 village wine from Côte de Nuits is coming round and is<br />

delicious.”<br />

2002 *****<br />

2003 *****<br />

Everyone agrees that now it is an underestimated vintage for the Côte<br />

de Nuits and for this area it represents good value<br />

Fair value given the quality. Prices were up, but most thought they were<br />

justified.<br />

Is it overpriced for the quality? “Yes,” says Eustace “for top end white<br />

<strong>Burgundy</strong>. As for the reds it is difficult to say as they might turn out to<br />

be the best bottles ever made. <strong>The</strong>y could be very good value, but we<br />

don’t know how they will evolve.”<br />

2004 ***** A little high. Skinner voices the general opinion, “I think that the<br />

decreases should have been greater, especially given the quality of the<br />

up-coming vintage.”

c. Review of wines sold auction and traded<br />

Soethby’s and Christies commented on the auction market in the United States and the UK in<br />

2005, and Berry Brothers & Rudd’s broking department on the trade in the UK.<br />

<strong>The</strong> auction market for fine <strong>Burgundy</strong> is, of course, small in comparison with Bordeaux. “<strong>The</strong>re is<br />

not enough <strong>Burgundy</strong> to satisfy the demands of a blue chip market,” says Damien Tillson of<br />

Soethby’s, London. Small, but not insignificant according to David Elswood, International head of<br />

Christie’s wine department, who remarks that the demand for fine <strong>Burgundy</strong> is “particularly<br />

strong in the US, as the real rarity of the top wines is becoming apparent.”<br />

Over 2005 the UK and US economies have shown varying levels of growth and consumer<br />

confidence. <strong>The</strong> UK continues its above average growth in Europe, while in the US the widening<br />

trade gap is causing concern. However the auction market in the US seems mostly unaffected by<br />

the wider economic picture with many wines being sold above estimate, sometimes dramatically<br />

exceeding their target price. Total sales in Sotheby’s New York <strong>Burgundy</strong> and Rhône sale in<br />

December 2005 reached $4,677,146, the fourth highest total for this auction house. <strong>The</strong> pre-sale<br />

estimate for the wines was $3.2 million and over fifty records were established, emphasising the<br />

level of interest for fine <strong>Burgundy</strong> at auction and in particularly in Domaine de la Romanée-Conti.<br />

It was billed as the most important collection of DRC wines seen at auction, spanning over three<br />

decades including wine from all seven of their grand cru vineyards. All of the 1,771 bottles of<br />

DRC were sold.<br />

Considering the five-year auction performance of three grand cru from Domaine de la Romanée-<br />

Conti (tables given below), it is evident that prices in the US market fluctuate considerably more<br />

than in the UK. Damian Tillson, of Sotheby’s Wine Department comments. “<strong>The</strong> UK market<br />

consists of a higher percentage of trade both buying and selling at auction. With our auctions<br />

being held on a monthly basis the prices tend to fluctuate less. US auctions are less regular and a<br />

far higher percentage of the buyers and sellers are private (the majority in fact).”<br />

Rarity<br />

<strong>The</strong> combination of fewer auctions and private buyers can lead to unexpectedly high prices for<br />

wines in limited supply, as is the case for fine <strong>Burgundy</strong>. At Sotheby’s New York on 1 st December<br />

2001, seven bottles of Montrachet 1978 from DRC estimated at between $7,000 and $10,000<br />

fetched a spectacular $167,500. Although this was an exceptional result, it illustrates the<br />

possibilities for prices far exceeding estimates. Tillson comments, “1978 DRC does well because<br />

you only see it at auction, but even a poor vintage like 1974, which is unlikely to have matured<br />

well, may do surprisingly well, because of its rarity value.” Large formats are particularly in<br />

demand.<br />

<strong>The</strong> high profile of the Sotheby’s auction in December 2005 (only <strong>The</strong> Millennium Wine Cellar and<br />

the Andrew Lloyd Webber Collection can be compared), fuelled exceptional interest, bidders and<br />

prices. However Robert Sleigh at Sotheby’s, New York, reports that prices have remained at<br />

around that level.<br />

On the trading front Berry Brothers and Rudd use the example of La Tâche to show the strength<br />

of the demand for key wines. 1999 La Tâche was released for £225 per bottle. Its value was<br />

£410 in June 2005 and is currently £600 plus.

Domaines most often traded or auctioned in 2005:<br />

David Elswood, observes that “the major auction activity is limited to the very best wines from<br />

top domains with heavy emphasis on the best vintages,” He identifies the most important<br />

Domaines at auction as Jayer, Meo-Camuzet, Faiveley, Coche-Dury, Dugat-Py, Leroy, Rousseau,<br />

Leflaive, de Vogue, Ramonet and Sauzet (in no particular order) and the top three domaines as<br />

DRC, Coche-Dury and Jayer.<br />

It pays to focus domaines with a track record. Tillson remarks that the auction market for<br />

<strong>Burgundy</strong>, outside the few key domaines, can be fickle. Dominique Laurent wines fetched<br />

surprisingly high prices at Sotheby’s in April 2004. “It seems this was a flash in the pan,” says<br />

Tillson. “<strong>The</strong> have subsequently decreased to half the price.”<br />

<strong>The</strong> list of the most tradable twenty domaines brokered by Berry Brothers and Rudd are DRC,<br />

Vogue, Roumier, Mugnier, Cathiard, Engel, Dujac, Rouget, H. Jayer, Bachelet, Serafin, Rousseau,<br />

Lafarge, Lafon, Coche-Dury, Leflaive, A. Ente, Bonneau du Martray, Niellon and Ramonet with<br />

DRC, de Vogue and Leflaive being the strongest performers. BB&R have seen a move towards<br />

purer and more fruit driven styles and demand for wine from the Côte de Nuit above Côte de<br />

Beaune.<br />

As this piece is mentioning specific domaines, it is worth noting that the Burgundians are very<br />

different to the Bordelais. <strong>The</strong>y do not like to see their wine being auctioned or brokered. Quite<br />

rightly they like to see it going to cellars, like yours and mine, where it will be matured to be<br />

drunk and enjoyed, and not to be used as an investment. DRC and Coche are particularly<br />

unhappy to see their wine at auction.<br />

Best performing vintages:<br />

At auction: Elswood reports the older vintages of 1962, 1969, 1971, 1978 and 1985 are showing<br />

the most growth in value, as well as the more recent vintages of 1990, 1999 and 2002.<br />

Berry Bros identify 1985, 1990, 1999 and 2002 as the vintages in most demand. Recent vintages<br />

showing the most growth are 1990 and 1999 and older vintages (pre 1990) are 1978 and 1985.<br />

Good buys:<br />

Vintages in little demand which are undervalued and represent a decent buy to add to your cellar<br />

for more immediate drinking.<br />

Auction: Elswood recommends 1988, 1993, 1995 or the 2001.<br />

Broking: Berry Brothers suggests 2000 and 2001<br />

Looking forward<br />

David Elswood comments, “Rarest <strong>Burgundy</strong> from top domaines and vintages with (most<br />

important) traceable provenance will continue to increase in price in the foreseeable future.” This<br />

has already been illustrated at Christie’s New York (Finest and Rarest March 2,2006) where the<br />

top lot of the sale was a six-magnum case of 1985 Romanée-Conti. This set a new world record

for a case of wine at auction fetching $170,375, the equivalent of over $14,200 a bottle<br />

confirming Elswood’s observation that “rare wines with provenance have almost no top limit for<br />

determined buyers.”<br />

La Tâche , Domaine Romanée-Conti<br />

Vintage<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

Format<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Methuselah<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Magnums<br />

Methuselah<br />

Quantity<br />

Romanée St Vivant, Domaine Romanée-Conti<br />

Vintage<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

Format<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Magnums<br />

Methuselah<br />

Normal<br />

Normal<br />

6<br />

6<br />

3<br />

12<br />

6<br />

3<br />

6<br />

1<br />

6<br />

1<br />

12<br />

6<br />

6<br />

1<br />

Quantity<br />

6<br />

12<br />

12<br />

6<br />

6<br />

6<br />

6<br />

3<br />

12<br />

6<br />

1<br />

12<br />

12<br />

Date Sold<br />

Jun-00<br />

Nov -00<br />

Jan-01<br />

Mar-01<br />

Jul -01<br />

Oct-01<br />

Feb-02<br />

Nov -02<br />

Jun-03<br />

Sep -03<br />

Sep -03<br />

May -04<br />

Nov -05<br />

Nov -05<br />

Date Sold<br />

Jun -00<br />

Nov -00<br />

Nov -00<br />

May -01<br />

Jul -01<br />

Nov -01<br />

Jun -03<br />

Jun -05<br />

Nov -05<br />

Nov -05<br />

Nov -05<br />

Nov -05<br />

Nov -05<br />

Price<br />

£1,430<br />

$3,680<br />

$1,725<br />

$5,175<br />

£1,595<br />

$1,840<br />

$3,738<br />

$5,875<br />

£1,955<br />

$499<br />

$6,169<br />

£2,760<br />

$21,150<br />

$27,025<br />

Price<br />

£770<br />

$2,875<br />

$2,415<br />

$2,185<br />

£825<br />

$1,380<br />

£1,150<br />

£575<br />

$5,288<br />

$11,750<br />

$15,275<br />

£2,530<br />

£2,300<br />

Price per 75cl<br />

£238<br />

$307<br />

$575<br />

$431<br />

£266<br />

$613<br />

$623<br />

$734<br />

£326<br />

$499<br />

$514<br />

£460<br />

$1,763<br />

$3,378<br />

Price per 75cl<br />

£128<br />

$240<br />

$201<br />

$364<br />

£138<br />

$230<br />

£192<br />

£192<br />

$441<br />

$979<br />

$1909<br />

£211<br />

£192

Romanée-Conti, Domaine Romanée-Conti<br />

Vintage<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

1996<br />

Format<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Normal<br />

Jeroboam<br />

Quantity<br />

3<br />

4<br />

2<br />

3<br />

6<br />

1<br />

1<br />

6<br />

1<br />

Date Sold<br />

Nov -00<br />

Mar-01<br />

May -02<br />

Sep-02<br />

Jun -03<br />

Dec-03<br />

May -04<br />

Nov -04<br />

Nov -05<br />

Price<br />

$4,888<br />

$6,038<br />

$4,112<br />

$7,344<br />

£8,625<br />

£1,380<br />

£1840<br />

$15,275<br />

$24,675<br />

Price per 75cl<br />

$1629<br />

$1,510<br />

$2,056<br />

$2,448<br />

£1,438<br />

£1,380<br />

£1,840<br />

$2,546<br />

$6,169

More detailed figures on the production of red and white wine in specific villages on<br />

the Côtes de Nuits and Beaune<br />

Cote de Nuits Production of Red Wine 2004 -05<br />

Chambolle Musigny<br />

Chambolle Musigny 1er cru<br />

Cote de Nuits Villages<br />

Fixin<br />

Fixin 1er cru<br />

Gevrey Chambertin<br />

Gevrey Chambertin 1er cru<br />

Marsannay<br />

Morey Saint Denis<br />

Morey Saint Denis 1er cru<br />

Nuits Saint Georges<br />

Nuits Saint Georges 1er cru<br />

Vosne Romanee<br />

Vosne Romanee 1er cru<br />

Vougeot<br />

Vougeot 1er cru<br />

Volume<br />

(hectolitres)<br />

Appellations 2004 2005 % Change<br />

4,276<br />

2,348<br />

6,754<br />

3,175<br />

708<br />

14,101<br />

3,434<br />

7,870<br />

2,181<br />

1,611<br />

7,202<br />

5,671<br />

4,309<br />

2,380<br />

74<br />

366<br />

3,841<br />

2,087<br />

6,512<br />

3,104<br />

789<br />

15,252<br />

3,575<br />

7,298<br />

2,113<br />

1,793<br />

7,482<br />

5,691<br />

3,791<br />

2,154<br />

95<br />

338<br />

Cote de Nuits Production of White Wine 2004 -05<br />

Cote de Nuits Villages<br />

Fixin<br />

Fixin 1er cru<br />

Marsannay<br />

Morey Saint Denis<br />

Morey Saint Denis 1er cru<br />

Nuits Saint Georges<br />

Nuits Saint Georges 1er cru<br />

Vougeot<br />

Vougeot 1er cru<br />

334<br />

0<br />

0<br />

1,464<br />

161<br />

74<br />

90<br />

522<br />

25<br />

156<br />

Volume<br />

(hectolitres)<br />

18<br />

1,390<br />

119<br />

50<br />

136<br />

185<br />

27<br />

110<br />

-10%<br />

-11%<br />

-4%<br />

-2%<br />

11%<br />

8%<br />

4%<br />

-7%<br />

-3%<br />

11%<br />

4%<br />

0%<br />

-12%<br />

-9%<br />

28%<br />

-8%<br />

Appellation 2004 2005 % Change<br />

282<br />

125<br />

-16%<br />

N/A<br />

N/A<br />

-5%<br />

-26%<br />

-32%<br />

51%<br />

-65%<br />

8%<br />

-29%

Cote de Beaune Production of Red Wine 2004 -05<br />

Aloxe Corton<br />

Aloxe Corton 1er cru<br />

Auxey Duresses<br />

Auxey Duresses 1er cru<br />

Beaune<br />

Beaune 1er cru<br />

Blagny<br />

Blagny 1er cru<br />

Chassagne Montrachet<br />

Chassagne Montrachet 1er cru<br />

Chorey Les Beaune<br />

Cote de Beaune<br />

Cote de Beaune Villages<br />

Ladoix Serrigny<br />

Ladoix Serrigny 1er cru<br />

Maranges<br />

Maranges 1er cru<br />

Meursault<br />

Meursault 1er cru<br />

Monthelie<br />

Monthelie 1er cru<br />

Pernand Vergelesses<br />

Pernand Vergelesses 1er cru<br />

Pommard<br />

Pommard 1er cru<br />

Puligny Montrachet<br />

Puligny Montrachet 1er cru<br />

Saint Aubin<br />

Saint Aubin 1er cru<br />

Saint Romain<br />

Santenay<br />

Santenay 1er cru<br />

Savigny Les Beaune<br />

Savigny Les Beaune 1er cru<br />

Volnay<br />

Volnay 1er cru<br />

Volume (hectolitres)<br />

Appellations 2004<br />

2005 % Change<br />

3650<br />

1504<br />

3105<br />

1205<br />

3066<br />

9116<br />

29<br />

167<br />

4660<br />

1661<br />

5825<br />

872<br />

22<br />

2875<br />

794<br />

3343<br />

3670<br />

499<br />

27<br />

4069<br />

1241<br />

1752<br />

1712<br />

8060<br />

4110<br />

45<br />

25<br />

797<br />

1634<br />

1684<br />

8178<br />

4845<br />

8131<br />

5393<br />

4027<br />

4602<br />

3842<br />

1537<br />

2845<br />

1181<br />

3496<br />

12285<br />

32<br />

172<br />

3669<br />

1571<br />

6266<br />

950<br />

240<br />

2966<br />

713<br />

3114<br />

3469<br />

513<br />

122<br />

3771<br />

1158<br />

1835<br />

1889<br />

9019<br />

5037<br />

49<br />

24<br />

753<br />

1557<br />

1869<br />

6151<br />

3626<br />

8186<br />

6091<br />

4178<br />

5583<br />

5%<br />

2%<br />

-8%<br />

-2%<br />

14%<br />

35%<br />

10%<br />

3%<br />

-21%<br />

-5%<br />

8%<br />

9%<br />

991%<br />

3%<br />

-10%<br />

-7%<br />

-5%<br />

3%<br />

352%<br />

-7%<br />

-7%<br />

5%<br />

10%<br />

12%<br />

23%<br />

9%<br />

-4%<br />

-6%<br />

-5%<br />

11%<br />

-25%<br />

-25%<br />

1%<br />

13%<br />

4%<br />

21%

Cote de Beaune Production of White Wine 2004 -05<br />

Aloxe Corton<br />

Aloxe Corton 1er cru<br />

Auxey Duresses<br />

Auxey Duresses 1er cru<br />

Beaune<br />

Beaune 1er cru<br />

Chassagne Montrachet<br />

Chassagne Montrachet 1er cru<br />

Chorey Les Beaune<br />

Cote de Beaune<br />

Ladoix Serrigny<br />

Ladoix Serrigny 1er cru<br />

Maranges<br />

Maranges 1er cru<br />

Meursault<br />

Meursault 1er cru<br />

Monthelie<br />

Monthelie 1er cru<br />

Pernand Vergelesses<br />

Pernand Vergelesses 1er cru<br />

Puligny Montrachet<br />

Puligny Montrachet 1er cru<br />

Saint Aubin<br />

Saint Aubin 1er cru<br />

Santenay<br />

Santenay 1er cru<br />

Savigny Les Beaune<br />

Savigny Les Beaune 1er cru<br />

St Romain<br />

Volume (hectolitres)<br />

Appellations 2004<br />

2005 % Change<br />

26<br />

0<br />

1798<br />

106<br />

612<br />

1753<br />

4077<br />

6401<br />

290<br />

51p8<br />

438<br />

473<br />

261<br />

50<br />

16212<br />

5309<br />

582<br />

92<br />

1607<br />

738<br />

6492<br />

5377<br />

1435<br />

4702<br />

1845<br />

912<br />

1415<br />

457<br />

2561<br />

65<br />

0<br />

1648<br />

66<br />

660<br />

1643<br />

3447<br />

4696<br />

288<br />

346<br />

433<br />

479<br />

200<br />

54<br />

13831<br />

4805<br />

509<br />

90<br />

1569<br />

724<br />

5685<br />

4528<br />

1242<br />

4204<br />

310<br />

293<br />

1468<br />

450<br />

2642<br />

150%<br />

0%<br />

-8%<br />

-38%<br />

8%<br />

-6%<br />

-15%<br />

-27%<br />

-1%<br />

-33%<br />

-1%<br />

1%<br />

-23%<br />

8%<br />

-15%<br />

-9%<br />

-13%<br />

-2%<br />

-2%<br />

-2%<br />

-12%<br />

-16%<br />

-13%<br />

-11%<br />

-83%<br />

-68%<br />

4%<br />

-2%<br />

3%