Annual Report 2012 - Acino

Annual Report 2012 - Acino

Annual Report 2012 - Acino

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

14<br />

ACINO | PerfOrmANCe rePOrt<br />

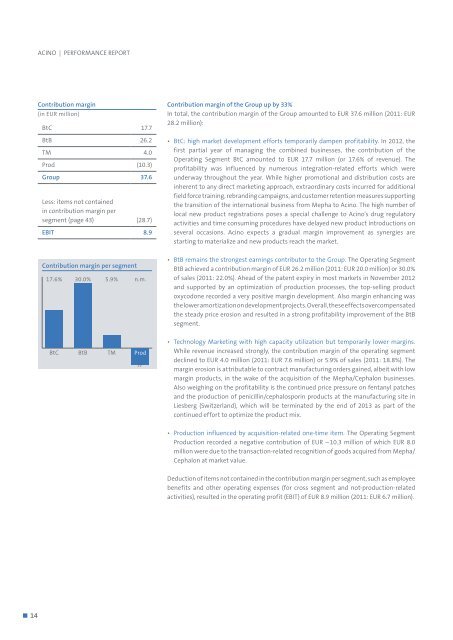

Contribution margin<br />

(in eUr million)<br />

BtC 17.7<br />

BtB 26.2<br />

tm 4.0<br />

Prod (10.3)<br />

Group 37.6<br />

Less: items not contained<br />

in contribution margin per<br />

segment (page 43) (28.7)<br />

EBIT 8.9<br />

Contribution margin per segment<br />

17.6% 30.0% 5.9% n.m.<br />

BtC BtB tm Prod<br />

⁄⁄<br />

Contribution margin of the Group up by 33%<br />

In total, the contribution margin of the Group amounted to eUr 37.6 million (2011: eUr<br />

28.2 million):<br />

• BtC: high market development efforts temporarily dampen profitability. In <strong>2012</strong>, the<br />

first partial year of managing the combined businesses, the contribution of the<br />

Operating Segment BtC amounted to eUr 17.7 million (or 17.6% of revenue). the<br />

profitability was influenced by numerous integration-related efforts which were<br />

underway throughout the year. While higher promotional and distribution costs are<br />

inherent to any direct marketing approach, extraordinary costs incurred for additional<br />

field force training, rebranding campaigns, and customer retention measures supporting<br />

the transition of the international business from mepha to <strong>Acino</strong>. the high number of<br />

local new product registrations poses a special challenge to <strong>Acino</strong>’s drug regulatory<br />

activities and time consuming procedures have delayed new product introductions on<br />

several occasions. <strong>Acino</strong> expects a gradual margin improvement as synergies are<br />

starting to materialize and new products reach the market.<br />

• BtB remains the strongest earnings contributor to the Group. the Operating Segment<br />

BtB achieved a contribution margin of eUr 26.2 million (2011: eUr 20.0 million) or 30.0%<br />

of sales (2011: 22.0%). Ahead of the patent expiry in most markets in November <strong>2012</strong><br />

and supported by an optimization of production processes, the top-selling product<br />

oxycodone recorded a very positive margin development. Also margin enhancing was<br />

the lower amortization on development projects. Overall, these effects overcompensated<br />

the steady price erosion and resulted in a strong profitability improvement of the BtB<br />

segment.<br />

• technology marketing with high capacity utilization but temporarily lower margins.<br />

While revenue increased strongly, the contribution margin of the operating segment<br />

declined to eUr 4.0 million (2011: eUr 7.6 million) or 5.9% of sales (2011: 18.8%). the<br />

margin erosion is attributable to contract manufacturing orders gained, albeit with low<br />

margin products, in the wake of the acquisition of the mepha/Cephalon businesses.<br />

Also weighing on the profitability is the continued price pressure on fentanyl patches<br />

and the production of penicillin/cephalosporin products at the manufacturing site in<br />

Liesberg (Switzerland), which will be terminated by the end of 2013 as part of the<br />

continued effort to optimize the product mix.<br />

• Production influenced by acquisition-related one-time item. the Operating Segment<br />

Production recorded a negative contribution of eUr – 10.3 million of which eUr 8.0<br />

million were due to the transaction-related recognition of goods acquired from mepha/<br />

Cephalon at market value.<br />

Deduction of items not contained in the contribution margin per segment, such as employee<br />

benefits and other operating expenses (for cross segment and not-production-related<br />

activities), resulted in the operating profit (eBIt) of eUr 8.9 million (2011: eUr 6.7 million).