- Page 1 and 2:

BOARD OF COUNTY COMMISSIONERS LEON

- Page 3 and 4:

Board of County Commissioners Regul

- Page 5 and 6:

Board of County Commissioners Regul

- Page 7 and 8:

Board of County Commissioners Regul

- Page 9 and 10:

Board of County Commissioners Regul

- Page 11 and 12:

Board of County Commissioners Regul

- Page 13 and 14:

Leon County Board of County Commiss

- Page 15 and 16:

Attachment #1 Page 2 of 12 2. Autho

- Page 17 and 18:

15. Acceptance of Status Report on

- Page 19 and 20:

Commissioner Desloge commented that

- Page 21 and 22:

Chairman Maddox confirmed there wer

- Page 23 and 24:

County Administrator Long: Offered

- Page 25 and 26:

Adjourn: There being no further bus

- Page 27 and 28:

To: Leon County Board of County Com

- Page 29 and 30:

Board of County Commissioners Leon

- Page 31 and 32:

Attachment #1 Page 3 of 11 Travel P

- Page 33 and 34:

Attachment #1 Page 5 of 11 Travel P

- Page 35 and 36:

Attachment #1 Page 7 of 11 Travel P

- Page 37 and 38:

Attachment #1 Page 9 of 11 Travel P

- Page 39 and 40:

Attachment #1 Page 11 of 11 Travel

- Page 41 and 42:

Leon County Board of County Commiss

- Page 43:

Title: Authorization to Amend the 2

- Page 48 and 49:

CHURCH OFFICE 8501222·8440 FAX 850

- Page 50 and 51:

To: Leon County Board of County Com

- Page 52 and 53:

Leon County Board of County Commiss

- Page 54 and 55:

Title: Acceptance of the FY 2012/20

- Page 56 and 57:

Leon County, Florida Board of Count

- Page 58 and 59:

To: Leon County Board of County Com

- Page 60 and 61:

Comparative Data This section provi

- Page 62 and 63:

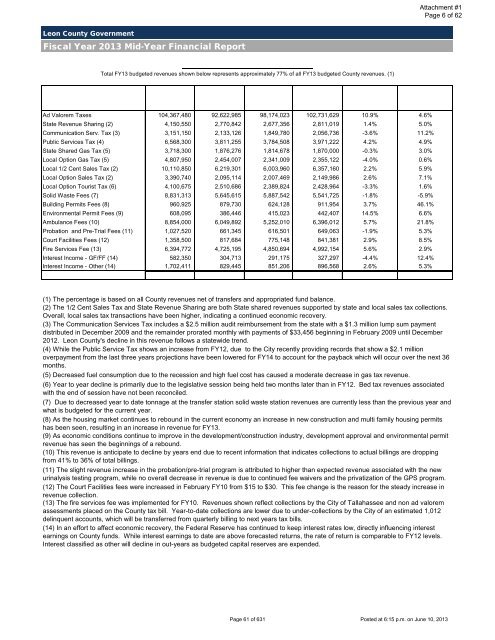

Leon County Government Fiscal Year

- Page 64 and 65:

GENERAL FUND /FINE AND FORFEITURE-

- Page 66 and 67:

Fiscal Year Actuals & Projections M

- Page 68 and 69:

Fiscal Year Actuals & Projections $

- Page 70 and 71:

Fiscal Year Actuals & Projections $

- Page 72 and 73: Fiscal Year Actuals & Projections 5

- Page 74 and 75: Fiscal Year Actuals & Projections M

- Page 76 and 77: Fiscal Year Actuals & Projections $

- Page 78 and 79: Fiscal Year Actuals & Projections $

- Page 80 and 81: Leon County Government Fiscal Year

- Page 82 and 83: Leon County Government FY 2013 Mid-

- Page 84 and 85: Leon County Government Fiscal Year

- Page 86 and 87: Leon County Government Fiscal Year

- Page 88 and 89: Leon County Government Fiscal Year

- Page 90 and 91: Leon County Government FY 2013 Mid-

- Page 92 and 93: Leon County Government FY 2013 Mid-

- Page 94 and 95: Leon County Government FY 2013 Mid-

- Page 96 and 97: Population Thousands 300 225 150 75

- Page 98 and 99: Total County Labor Force Thousands

- Page 100 and 101: Name Smith Interest General Partner

- Page 102 and 103: Violent Crime Rate Per 100,000 Resi

- Page 104 and 105: Intergovernmental Revenues Percent

- Page 106 and 107: Revenues Per Capita $900 $825 $750

- Page 108 and 109: Debt Service Percentage of Total Op

- Page 110 and 111: Countywide Population (2012) Thousa

- Page 112 and 113: Total Net Budget (FY13) Millions $3

- Page 114 and 115: 2,000 1,600 1,200 800 400 18.0 16.0

- Page 116 and 117: Percent of Exempt Property County %

- Page 118 and 119: Leon County, Florida Board of Count

- Page 120 and 121: To: Leon County Board of County Com

- Page 124 and 125: Leon County Government Fiscal Year

- Page 126 and 127: GENERAL FUND /FINE AND FORFEITURE-

- Page 128 and 129: Fiscal Year Actuals & Projections M

- Page 130 and 131: Fiscal Year Actuals & Projections $

- Page 132 and 133: Fiscal Year Actuals & Projections $

- Page 134 and 135: Fiscal Year Actuals & Projections 5

- Page 136 and 137: Fiscal Year Actuals & Projections M

- Page 138 and 139: Fiscal Year Actuals & Projections $

- Page 140 and 141: Fiscal Year Actuals & Projections $

- Page 142 and 143: Leon County Government Fiscal Year

- Page 144 and 145: Leon County Government FY 2013 Mid-

- Page 146 and 147: Leon County Government Fiscal Year

- Page 148 and 149: Leon County Government Fiscal Year

- Page 150 and 151: Leon County Government Fiscal Year

- Page 152 and 153: Leon County Government FY 2013 Mid-

- Page 154 and 155: Leon County Government FY 2013 Mid-

- Page 156 and 157: Leon County Government FY 2013 Mid-

- Page 158 and 159: Population Thousands 300 225 150 75

- Page 160 and 161: Total County Labor Force Thousands

- Page 162 and 163: Name Smith Interest General Partner

- Page 164 and 165: Violent Crime Rate Per 100,000 Resi

- Page 166 and 167: Intergovernmental Revenues Percent

- Page 168 and 169: Revenues Per Capita $900 $825 $750

- Page 170 and 171: Debt Service Percentage of Total Op

- Page 172 and 173:

Countywide Population (2012) Thousa

- Page 174 and 175:

Total Net Budget (FY13) Millions $3

- Page 176 and 177:

2,000 1,600 1,200 800 400 18.0 16.0

- Page 178 and 179:

Percent of Exempt Property County %

- Page 180 and 181:

Leon County Board of County Commiss

- Page 182 and 183:

Title: Request to Schedule a First

- Page 184 and 185:

Title: Request to Schedule a First

- Page 186 and 187:

Title: Request to Schedule a First

- Page 188 and 189:

Title: Request to Schedule a First

- Page 190 and 191:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 192 and 193:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 194 and 195:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 196 and 197:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 198 and 199:

Leon County Board of County Commiss

- Page 200 and 201:

Title: Approval of Utility Easement

- Page 202 and 203:

Rev/01-15-2013 Water and Sewer Util

- Page 208 and 209:

Leon County Board of County Commiss

- Page 210 and 211:

Title: Request to Schedule a First

- Page 212:

Affordable Housing Property List #

- Page 216 and 217:

Leon County Board of County Commiss

- Page 218 and 219:

Title: Request to Schedule a First

- Page 220 and 221:

To: Leon County Board of County Com

- Page 222 and 223:

Title: Approval of a Proposed Lease

- Page 224 and 225:

Attachment #1 Page 2 of 6 3. PAYMEN

- Page 226 and 227:

Attachment #1 Page 4 of 6 19. HOLDI

- Page 228 and 229:

Attachment #1 Page 6 of 6 TENANT no

- Page 230 and 231:

Development (Visit Tallahassee), in

- Page 232 and 233:

To: Leon County Board of County Com

- Page 234 and 235:

Title: Acceptance of the Lake Jacks

- Page 237 and 238:

2 Lake Jackson Town Center at Hunti

- Page 239 and 240:

TABLE OF CONTENTS I. ‘Sense of Pl

- Page 241 and 242:

6 Lake Jackson Town Center at Hunti

- Page 243 and 244:

8 Lake Jackson Town Center at Hunti

- Page 245 and 246:

---- - Attachment #1 Page 10 of 30

- Page 248 and 249:

CREATING A COHESIVE DISTRICT Lake J

- Page 250 and 251:

Please see page 24 for an explanati

- Page 252 and 253:

Many local residents utilize non-au

- Page 254 and 255:

Vacant property immediately west of

- Page 256 and 257:

Lake Jackson Town Center at Hunting

- Page 258 and 259:

SOURCES Lake Jackson Town Center at

- Page 260 and 261:

• Wooded/ ravine areas are homele

- Page 262 and 263:

• Street lighting • Improve str

- Page 264 and 265:

Lake Jackson Town Center at Hunting

- Page 266 and 267:

Leon County Board of County Commiss

- Page 268 and 269:

Title: Approval of Detailed Work Pl

- Page 270 and 271:

ADAM H. PUTNAM Florida Department o

- Page 272 and 273:

To: Leon County Board of County Com

- Page 274 and 275:

Title: Approval of Agreements Perta

- Page 276 and 277:

2. Conditions Precedent. a. The fol

- Page 278 and 279:

6. Dispute Resolution. a. The Parti

- Page 280 and 281:

f. Entire Agreement. This Agreement

- Page 282 and 283:

Diesel Gallon Equivalent (DGE) per

- Page 284 and 285:

COMPRESSED NATURAL GAS FUELING AND

- Page 286 and 287:

“Royalty Payment” means the mon

- Page 288 and 289:

(iii) If any of the Conditions Prec

- Page 290 and 291:

(c) purchase Fuel and pay the Fuel

- Page 292 and 293:

thereof, Nopetro shall reduce the F

- Page 294 and 295:

Section 9. Notice. Notices required

- Page 296 and 297:

terms and conditions of the Waste C

- Page 298 and 299:

confidential and not subject to dis

- Page 300 and 301:

performed by or on behalf of Nopetr

- Page 302 and 303:

communications, representations, or

- Page 304 and 305:

Florida. Venue for all actions aris

- Page 306 and 307:

EXHIBIT A RATES, PRICE AND STATION

- Page 308 and 309:

Leon County Board of County Commiss

- Page 310 and 311:

Title: Approval of the Agreement Ex

- Page 312 and 313:

FIRST AMENDMENT TO THE DESANTIS PRO

- Page 314 and 315:

DeSANTIS PROPORTIONATE SHARE TRAFFI

- Page 316 and 317:

Attachment #1 Page 5 of 17 WHEREAS,

- Page 319 and 320:

Attachment #1 Page 8 of 17 would ot

- Page 321:

Attachment #1 Page 10 of 17 16. Thi

- Page 327 and 328:

,_. N ExhibitC ITE Trip Generation

- Page 329 and 330:

Leon County Board of County Commiss

- Page 331 and 332:

Title: Request to Schedule a First

- Page 333 and 334:

Title: Request to Schedule a First

- Page 335 and 336:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 337 and 338:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 339 and 340:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 341 and 342:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 343 and 344:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 345 and 346:

1 2 3 4 5 6 7 8 9 10 11 12 13 F98-0

- Page 347 and 348:

3. Winching capacity ..... 50,000 L

- Page 349 and 350:

3. Wheel lift extended rating 2,500

- Page 351 and 352:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 353 and 354:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 355 and 356:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 357 and 358:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 359 and 360:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 361 and 362:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 363 and 364:

(a) It shall be unlawful for any pe

- Page 365 and 366:

c. Within the previous five years,

- Page 367 and 368:

Sec. 20-165 164. - Authorization. (

- Page 369 and 370:

equest to remove the specific vehic

- Page 371 and 372:

operation of a business is impeded

- Page 373 and 374:

towing company owners by October 31

- Page 375 and 376:

(1) Garage liability insurance in a

- Page 377 and 378:

Monday Mileage rate per-mile charge

- Page 379 and 380:

(2) Effective July 1, 2009, the max

- Page 381 and 382:

e charged three days after the tow

- Page 383 and 384:

Leon County Board of County Commiss

- Page 385 and 386:

Title: Acceptance of Status Report

- Page 387 and 388:

Title: Acceptance of Status Report

- Page 389 and 390:

To: Leon County Board of County Com

- Page 391 and 392:

Title: Acceptance of Status Report

- Page 393:

ART LN PAGE RD BISMARK RD 1.9 OL D

- Page 402 and 403:

To: Leon County Board of County Com

- Page 404 and 405:

Title: Acceptance of Cultural Plan

- Page 406 and 407:

EDUCATION Attachment #1 Page 2 of 7

- Page 408 and 409:

Attachment #1 Page 4 of 7 additiona

- Page 410 and 411:

levels of the organization. Priorit

- Page 412 and 413:

Summary of Cultural Contract Fundin

- Page 414 and 415:

To: Leon County Board of County Com

- Page 416 and 417:

Title: Acceptance of a Status Repor

- Page 418 and 419:

DELICIOUS TASTES Dinner Prix Fixe M

- Page 420 and 421:

DELICIOUS TASTES Dinner Prix Fixe M

- Page 422 and 423:

Leon County Board of County Commiss

- Page 424 and 425:

Title: Acceptance of the 2013 Flori

- Page 426 and 427:

Title: Acceptance of the 2013 Flori

- Page 428 and 429:

Title: Acceptance of the 2013 Flori

- Page 430 and 431:

Title: Acceptance of the 2013 Flori

- Page 432 and 433:

Title: Acceptance of the 2013 Flori

- Page 434 and 435:

Title: Acceptance of the 2013 Flori

- Page 436 and 437:

Title: Acceptance of the 2013 Flori

- Page 438 and 439:

Title: Acceptance of the 2013 Flori

- Page 440 and 441:

Title: Acceptance of the 2013 Flori

- Page 442 and 443:

Title: Acceptance of the 2013 Flori

- Page 444 and 445:

Title: Acceptance of the 2013 Flori

- Page 446 and 447:

Title: Acceptance of the 2013 Flori

- Page 448 and 449:

Title: Acceptance of the 2013 Flori

- Page 450 and 451:

Fiscal Impact: This item does not h

- Page 452 and 453:

Attachment #1 Page 4 of 13 State Lo

- Page 454 and 455:

PROPOSED LEON COUNTY 2013 STATE LEG

- Page 456 and 457:

Attachment #1 Page 8 of 13 Action:

- Page 458 and 459:

Attachment #1 Page 10 of 13 The ser

- Page 460 and 461:

Attachment #1 Page 12 of 13 Staff h

- Page 462 and 463:

BOARD OF COUNTY COMMISSIONERS INTER

- Page 464 and 465:

May 16,2013 Page 3 agricultural by

- Page 466 and 467:

May 16,2013 Page 5 Attachment #2 Pa

- Page 468 and 469:

May 16,2013 Page 7 House Bill 437-

- Page 470 and 471:

May 16,2013 Page 9 Attachment #2 Pa

- Page 472 and 473:

May 16,2013 Page 11 Attachment #2 P

- Page 474 and 475:

May 16,2013 Page 13 The Florida Sma

- Page 476 and 477:

May 16,2013 Page 15 Attachment #2 P

- Page 478 and 479:

May 16,2013 Page 17 Attachment #2 P

- Page 480 and 481:

May 16,2013 Page 19 House Bill537-

- Page 482 and 483:

May 16,2013 Page 21 Attachment #2 P

- Page 484 and 485:

CAPITOL NEWS FOR 2013 LEGISLATIVE S

- Page 486 and 487:

Attachment #3 Page 4 of 21 addition

- Page 488 and 489:

Attachment #3 Page 6 of 21 economic

- Page 490 and 491:

Schedule for Bill Signings - The Go

- Page 492 and 493:

Attachment #3 Page 10 of 21 • Gen

- Page 494 and 495:

Attachment #3 Page 12 of 21 • Gen

- Page 496 and 497:

comprehensive plan or map amendment

- Page 498 and 499:

public purpose, to exempt such use

- Page 500 and 501:

Attachment #3 Page 18 of 21 SB 518

- Page 502 and 503:

_______________ HB 1193 - Relating

- Page 504 and 505:

Commissioners BILL PROCfOR District

- Page 506:

Attachment #4 Page 3 of 3 Now, Ther

- Page 509 and 510:

Attachment #6 Page 2 of 11 Rules of

- Page 511 and 512:

Attachment #6 Page 4 of 11 Rules of

- Page 513 and 514:

Attachment #6 Page 6 of 11 Rules of

- Page 515 and 516:

Attachment #6 Page 8 of 11 Rules of

- Page 517 and 518:

Attachment #6 Page 10 of 11 Rules o

- Page 519 and 520:

MEMORANDUM To: Leon County Board of

- Page 521 and 522:

Memorandum Page 3 collect the tax b

- Page 523 and 524:

-2- Attachment #7 Page 5 of 7 Patto

- Page 525:

AGREEMENT BETWEEN LEON COUNTY AND P

- Page 531 and 532:

AGREEMENT BETWEEN LEON COUNTY AND C

- Page 535 and 536:

AGREEMENT BETWEEN LEON COUNTY AND C

- Page 537 and 538:

To: Leon County Board of County Com

- Page 539 and 540:

Title: Approval to Award a Bid to S

- Page 543:

Albert Sessions - Approved applicat

- Page 547 and 548:

To: Leon County Board of County Com

- Page 549:

Title: Approval to Award Bid to Thy

- Page 553 and 554:

To: Leon County Board of County Com

- Page 555 and 556:

Title: Approval of Agreement Awardi

- Page 557 and 558:

AGREEMENT BETWEEN LEON COUNTY AND A

- Page 559 and 560:

AGREEMENT BETWEEN LEON COUNTY AND A

- Page 561 and 562:

AGREEMENT BETWEEN LEON COUNTY AND A

- Page 564 and 565:

AGREEMENT BETWEEN LEON COUNTY AND A

- Page 566 and 567:

Bid Title: Sidewalk and Associated

- Page 568:

Bid Title: Sidewalk and Associated

- Page 571 and 572:

Bid Title: Sidewalk and Associated

- Page 573 and 574:

Bid Title: Sidewalk and Associated

- Page 575 and 576:

Bid Title: Sidewalk and Associated

- Page 577 and 578:

Bid Title: Sidewalk and Associated

- Page 579 and 580:

Bid Title: Sidewalk and Associated

- Page 581 and 582:

Bid Title: Sidewalk and Associated

- Page 583 and 584:

Bid Title: Sidewalk and Associated

- Page 586:

Bid Title: Sidewalk and Associated

- Page 589 and 590:

Bid Title: Sidewalk and Associated

- Page 591 and 592:

Bid Title: Sidewalk and Associated

- Page 593 and 594:

Bid Title: Sidewalk and Associated

- Page 595 and 596:

Bid Title: Sidewalk and Associated

- Page 602:

·Bid Title: Sidewalk and Associate

- Page 605:

'Bid Title: Sidewalk and Associated

- Page 618 and 619:

BID PRICING SHEET SIDEWALK CONTINUI

- Page 620 and 621:

Hale Contracting, Inc. met the M/WB

- Page 622 and 623:

RJP Enterprises, Inc. did not meet

- Page 624 and 625:

To: Leon County Board of County Com

- Page 626 and 627:

Title: Authorization to Negotiate a

- Page 628 and 629:

REQUEST FOR PROPOSALS FOR COMMERCIA

- Page 630 and 631:

Commercial Property Assessment Clea

- Page 632 and 633:

Commercial Property Assessment Clea

- Page 634 and 635:

Commercial Property Assessment Clea

- Page 636 and 637:

Commercial Property Assessment Clea

- Page 638 and 639:

Commercial Property Assessment Clea

- Page 640 and 641:

Commercial Property Assessment Clea

- Page 642 and 643:

Commercial Property Assessment Clea

- Page 644 and 645:

Commercial Property Assessment Clea

- Page 646 and 647:

Commercial Property Assessment Clea

- Page 648 and 649:

Commercial Property Assessment Clea

- Page 650 and 651:

Commercial Property Assessment Clea

- Page 652 and 653:

Commercial Property Assessment Clea

- Page 654 and 655:

Commercial Property Assessment Clea

- Page 656 and 657:

Commercial Property Assessment Clea

- Page 658:

RFP Title: Request for Proposals fo

- Page 661 and 662:

To: Leon County Board of County Com

- Page 663 and 664:

Title: Consideration of Full Board

- Page 665 and 666:

Contact Person/Staff: County: Ryan

- Page 667 and 668:

Yarbrough, J. Cameron Begin Term: 3

- Page 669 and 670:

Enterprise Zone Development Agency

- Page 671 and 672:

Members: Bowers, Keith Small Busine

- Page 673 and 674:

January 6, 2012 To Whom It May Conc

- Page 675 and 676:

RESOLUTION: 13 -___ RESOLUTION OF B

- Page 677 and 678:

MEMBERS Proctor, Stewart Structure

- Page 679 and 680:

From: "Snyder, Russell" To: "Coble

- Page 681 and 682:

Members: Shipman, Martin Seamons, F

- Page 683 and 684:

WQRKF,QRCE Your Employment Solution

- Page 685 and 686:

To: Leon County Board of County Com

- Page 687 and 688:

Title: First and Only Public Hearin

- Page 689 and 690:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

- Page 691 and 692:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15