Annual Report 2010-2011 - Western Australian Museum

Annual Report 2010-2011 - Western Australian Museum

Annual Report 2010-2011 - Western Australian Museum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Western</strong> <strong>Australian</strong> <strong>Museum</strong> ANNUAL REPORT <strong>2010</strong>/<strong>2011</strong><br />

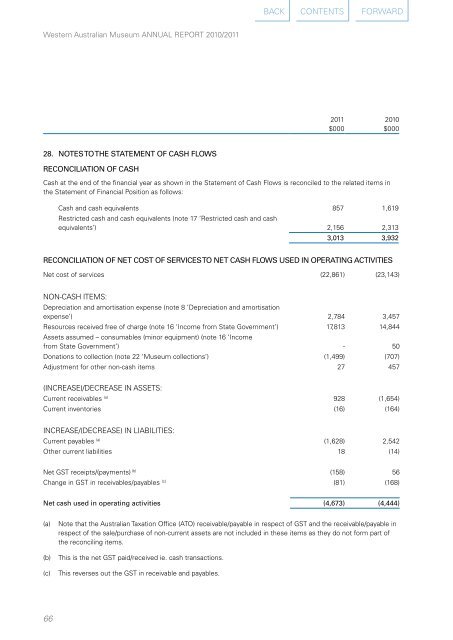

28. notes to tHe stAteMent of cAsH flows<br />

ReconciliAtion of cAsH<br />

66<br />

<strong>2011</strong><br />

$000<br />

Cash at the end of the financial year as shown in the Statement of Cash Flows is reconciled to the related items in<br />

the Statement of Financial Position as follows:<br />

<strong>2010</strong><br />

$000<br />

Cash and cash equivalents<br />

Restricted cash and cash equivalents (note 17 ‘Restricted cash and cash<br />

857 1,619<br />

equivalents’) 2,156 2,313<br />

3,013 3,932<br />

ReconciliAtion of net cost of seRvices to net cAsH flows useD in opeRAtinG Activities<br />

Net cost of services (22,861) (23,143)<br />

NON-CASH ITEMS:<br />

Depreciation and amortisation expense (note 8 ‘Depreciation and amortisation<br />

expense’) 2,784 3,457<br />

Resources received free of charge (note 16 ‘Income from State Government’)<br />

Assets assumed – consumables (minor equipment) (note 16 ‘Income<br />

17,813 14,844<br />

from State Government’) - 50<br />

Donations to collection (note 22 ‘<strong>Museum</strong> collections’) (1,499) (707)<br />

Adjustment for other non-cash items 27 457<br />

(INCREASE)/DECREASE IN ASSETS:<br />

Current receivables (a) 928 (1,654)<br />

Current inventories (16) (164)<br />

INCREASE/(DECREASE) IN LIABILITIES:<br />

Current payables (a) (1,628) 2,542<br />

Other current liabilities 18 (14)<br />

Net GST receipts/(payments) (b) (158) 56<br />

Change in GST in receivables/payables (c) (81) (168)<br />

net cash used in operating activities (4,673) (4,444)<br />

(a) Note that the <strong>Australian</strong> Taxation Office (ATO) receivable/payable in respect of GST and the receivable/payable in<br />

respect of the sale/purchase of non-current assets are not included in these items as they do not form part of<br />

the reconciling items.<br />

(b) This is the net GST paid/received ie. cash transactions.<br />

(c) This reverses out the GST in receivable and payables.<br />

BACK CONTENTS FORWARD