Annual Report 2010-2011 - Western Australian Museum

Annual Report 2010-2011 - Western Australian Museum

Annual Report 2010-2011 - Western Australian Museum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

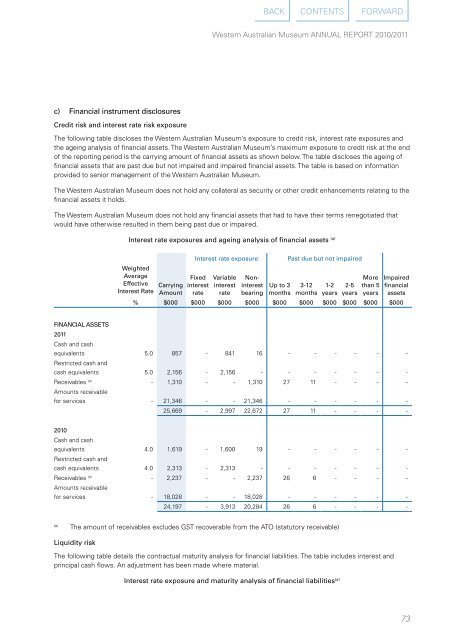

c) financial instrument disclosures<br />

credit risk and interest rate risk exposure<br />

<strong>Western</strong> <strong>Australian</strong> <strong>Museum</strong> ANNUAL REPORT <strong>2010</strong>/<strong>2011</strong><br />

The following table discloses the <strong>Western</strong> <strong>Australian</strong> <strong>Museum</strong>’s exposure to credit risk, interest rate exposures and<br />

the ageing analysis of financial assets. The <strong>Western</strong> <strong>Australian</strong> <strong>Museum</strong>’s maximum exposure to credit risk at the end<br />

of the reporting period is the carrying amount of financial assets as shown below. The table discloses the ageing of<br />

financial assets that are past due but not impaired and impaired financial assets. The table is based on information<br />

provided to senior management of the <strong>Western</strong> <strong>Australian</strong> <strong>Museum</strong>.<br />

The <strong>Western</strong> <strong>Australian</strong> <strong>Museum</strong> does not hold any collateral as security or other credit enhancements relating to the<br />

financial assets it holds.<br />

The <strong>Western</strong> <strong>Australian</strong> <strong>Museum</strong> does not hold any financial assets that had to have their terms renegotiated that<br />

would have otherwise resulted in them being past due or impaired.<br />

interest rate exposures and ageing analysis of financial assets (a)<br />

weighted<br />

Average<br />

effective<br />

interest Rate carrying<br />

Amount<br />

interest rate exposure past due but not impaired<br />

fixed<br />

interest<br />

rate<br />

variable<br />

interest<br />

rate<br />

noninterest<br />

bearing<br />

up to 3<br />

months<br />

3-12<br />

months<br />

1-2<br />

years<br />

2-5<br />

years<br />

More<br />

than 5<br />

years<br />

impaired<br />

financial<br />

assets<br />

% $000 $000 $000 $000 $000 $000 $000 $000 $000 $000<br />

finAnciAl Assets<br />

<strong>2011</strong><br />

Cash and cash<br />

equivalents<br />

Restricted cash and<br />

5.0 857 - 841 16 - - - - - -<br />

cash equivalents 5.0 2,156 - 2,156 - - - - - - -<br />

Receivables (a) Amounts receivable<br />

- 1,310 - - 1,310 27 11 - - - -<br />

for services - 21,346 - - 21,346 - - - - - -<br />

25,669 - 2,997 22,672 27 11 - - - -<br />

<strong>2010</strong><br />

Cash and cash<br />

equivalents<br />

Restricted cash and<br />

4.0 1,619 - 1,600 19 - - - - - -<br />

cash equivalents 4.0 2,313 - 2,313 - - - - - - -<br />

Receivables (a) Amounts receivable<br />

- 2,237 - - 2,237 26 6 - - - -<br />

for services - 18,028 - - 18,028 - - - - - -<br />

24,197 - 3,913 20,284 26 6 - - - -<br />

(a) The amount of receivables excludes GST recoverable from the ATO (statutory receivable)<br />

liquidity risk<br />

BACK CONTENTS FORWARD<br />

The following table details the contractual maturity analysis for financial liabilities. The table includes interest and<br />

principal cash flows. An adjustment has been made where material.<br />

interest rate exposure and maturity analysis of financial liabilities (a)<br />

73