bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

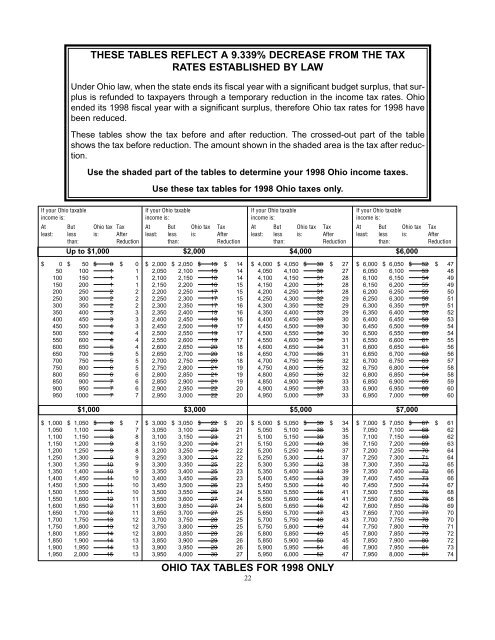

THESE TABLES REFLECT A 9.339% DECREASE FROM THE <strong>TAX</strong><br />

RATES ESTABLISHED BY LAW<br />

Under <strong>Ohio</strong> law, when the state ends its fiscal year with a significant budget surplus, that surplus<br />

is refunded to taxpayers through a temporary reduction in the income tax rates. <strong>Ohio</strong><br />

ended its 1998 fiscal year with a significant surplus, therefore <strong>Ohio</strong> tax rates for 1998 have<br />

been reduced.<br />

These tables show the tax before and after reduction. The crossed-out part <strong>of</strong> the table<br />

shows the tax before reduction. The amount shown in the shaded area is the tax after reduction.<br />

Use the shaded part <strong>of</strong> the tables to determine your 1998 <strong>Ohio</strong> income taxes.<br />

If your <strong>Ohio</strong> taxable<br />

income is:<br />

At But <strong>Ohio</strong> tax Tax<br />

least: less is: After<br />

than: Reduction<br />

Use these tax tables for 1998 <strong>Ohio</strong> taxes only.<br />

If your <strong>Ohio</strong> taxable<br />

income is:<br />

At But <strong>Ohio</strong> tax Tax<br />

least: less is: After<br />

than: Reduction<br />

If your <strong>Ohio</strong> taxable<br />

income is:<br />

At But <strong>Ohio</strong> tax Tax<br />

least: less is: After<br />

than: Reduction<br />

Up to $1,000 $2,000 $4,000 $6,000<br />

$ 0 $ 50 $ 0 $ 0<br />

50 100 1 1<br />

100 150 1 1<br />

150 200 1 1<br />

200 250 2 2<br />

250 300 2 2<br />

300 350 2 2<br />

350 400 3 3<br />

400 450 3 3<br />

450 500 4 3<br />

500 550 4 4<br />

550 600 4 4<br />

600 650 5 4<br />

650 700 5 5<br />

700 750 5 5<br />

750 800 6 5<br />

800 850 6 6<br />

850 900 7 6<br />

900 950 7 6<br />

950 1000 7 7<br />

$ 1,000 $ 1,050 $ 8 $ 7<br />

1,050 1,100 8 7<br />

1,100 1,150 8 8<br />

1,150 1,200 9 8<br />

1,200 1,250 9 8<br />

1,250 1,300 9 9<br />

1,300 1,350 10 9<br />

1,350 1,400 10 9<br />

1,400 1,450 11 10<br />

1,450 1,500 11 10<br />

1,500 1,550 11 10<br />

1,550 1,600 12 11<br />

1,600 1,650 12 11<br />

1,650 1,700 12 11<br />

1,700 1,750 13 12<br />

1,750 1,800 13 12<br />

1,800 1,850 14 12<br />

1,850 1,900 14 13<br />

1,900 1,950 14 13<br />

1,950 2,000 15 13<br />

$ 2,000 $ 2,050 $ 15 $ 14<br />

2,050 2,100 15 14<br />

2,100 2,150 16 14<br />

2,150 2,200 16 15<br />

2,200 2,250 17 15<br />

2,250 2,300 17 15<br />

2,300 2,350 17 16<br />

2,350 2,400 18 16<br />

2,400 2,450 18 16<br />

2,450 2,500 18 17<br />

2,500 2,550 19 17<br />

2,550 2,600 19 17<br />

2,600 2,650 20 18<br />

2,650 2,700 20 18<br />

2,700 2,750 20 18<br />

2,750 2,800 21 19<br />

2,800 2,850 21 19<br />

2,850 2,900 21 19<br />

2,900 2,950 22 20<br />

2,950 3,000 22 20<br />

$ 3,000 $ 3,050 $ 22 $ 20<br />

3,050 3,100 23 21<br />

3,100 3,150 23 21<br />

3,150 3,200 24 21<br />

3,200 3,250 24 22<br />

3,250 3,300 24 22<br />

3,300 3,350 25 22<br />

3,350 3,400 25 23<br />

3,400 3,450 25 23<br />

3,450 3,500 26 23<br />

3,500 3,550 26 24<br />

3,550 3,600 27 24<br />

3,600 3,650 27 24<br />

3,650 3,700 27 25<br />

3,700 3,750 28 25<br />

3,750 3,800 28 25<br />

3,800 3,850 28 26<br />

3,850 3,900 29 26<br />

3,900 3,950 29 26<br />

3,950 4,000 30 27<br />

22<br />

$ 4,000 $ 4,050 $ 30 $ 27<br />

4,050 4,100 30 27<br />

4,100 4,150 31 28<br />

4,150 4,200 31 28<br />

4,200 4,250 31 28<br />

4,250 4,300 32 29<br />

4,300 4,350 32 29<br />

4,350 4,400 33 29<br />

4,400 4,450 33 30<br />

4,450 4,500 33 30<br />

4,500 4,550 34 30<br />

4,550 4,600 34 31<br />

4,600 4,650 34 31<br />

4,650 4,700 35 31<br />

4,700 4,750 35 32<br />

4,750 4,800 35 32<br />

4,800 4,850 36 32<br />

4,850 4,900 36 33<br />

4,900 4,950 37 33<br />

4,950 5,000 37 33<br />

$ 5,000 $ 5,050 $ 38 $ 34<br />

5,050 5,100 38 35<br />

5,100 5,150 39 35<br />

5,150 5,200 40 36<br />

5,200 5,250 40 37<br />

5,250 5,300 41 37<br />

5,300 5,350 42 38<br />

5,350 5,400 43 39<br />

5,400 5,450 43 39<br />

5,450 5,500 44 40<br />

5,500 5,550 45 41<br />

5,550 5,600 46 41<br />

5,600 5,650 46 42<br />

5,650 5,700 47 43<br />

5,700 5,750 48 43<br />

5,750 5,800 49 44<br />

5,800 5,850 49 45<br />

5,850 5,900 50 45<br />

5,900 5,950 51 46<br />

5,950 6,000 52 47<br />

If your <strong>Ohio</strong> taxable<br />

income is:<br />

At But <strong>Ohio</strong> tax Tax<br />

least: less is: After<br />

than: Reduction<br />

$ 6,000 $ 6,050 $ 52 $ 47<br />

6,050 6,100 53 48<br />

6,100 6,150 54 49<br />

6,150 6,200 55 49<br />

6,200 6,250 55 50<br />

6,250 6,300 56 51<br />

6,300 6,350 57 51<br />

6,350 6,400 58 52<br />

6,400 6,450 58 53<br />

6,450 6,500 59 54<br />

6,500 6,550 60 54<br />

6,550 6,600 61 55<br />

6,600 6,650 61 56<br />

6,650 6,700 62 56<br />

6,700 6,750 63 57<br />

6,750 6,800 64 58<br />

6,800 6,850 64 58<br />

6,850 6,900 65 59<br />

6,900 6,950 66 60<br />

6,950 7,000 66 60<br />

$1,000 $3,000 $5,000 $7,000<br />

OHIO <strong>TAX</strong> TABLES FOR 1998 ONLY<br />

$ 7,000 $ 7,050 $ 67 $ 61<br />

7,050 7,100 68 62<br />

7,100 7,150 69 62<br />

7,150 7,200 69 63<br />

7,200 7,250 70 64<br />

7,250 7,300 71 64<br />

7,300 7,350 72 65<br />

7,350 7,400 72 66<br />

7,400 7,450 73 66<br />

7,450 7,500 74 67<br />

7,500 7,550 75 68<br />

7,550 7,600 75 68<br />

7,600 7,650 76 69<br />

7,650 7,700 77 70<br />

7,700 7,750 78 70<br />

7,750 7,800 78 71<br />

7,800 7,850 79 72<br />

7,850 7,900 80 72<br />

7,900 7,950 81 73<br />

7,950 8,000 81 74