bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

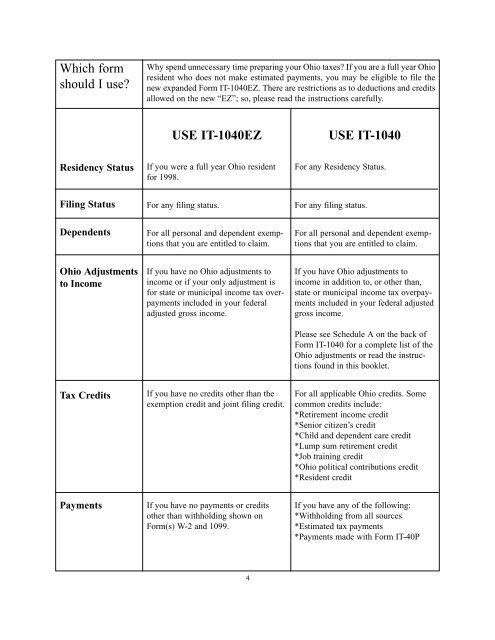

Which form<br />

should I use?<br />

Residency Status<br />

Filing Status<br />

Dependents<br />

<strong>Ohio</strong> Adjustments<br />

to Income<br />

Tax Credits<br />

Payments<br />

Why spend unnecessary time preparing your <strong>Ohio</strong> taxes? If you are a full year <strong>Ohio</strong><br />

resident who does not make estimated payments, you may be eligible to file the<br />

new expanded Form IT-1040EZ. There are restrictions as to deductions and credits<br />

allowed on the new “EZ”; so, please read the instructions carefully.<br />

USE IT-1040EZ<br />

If you were a full year <strong>Ohio</strong> resident<br />

for 1998.<br />

For any filing status.<br />

For all personal and dependent exemptions<br />

that you are entitled to claim.<br />

If you have no <strong>Ohio</strong> adjustments to<br />

income or if your only adjustment is<br />

for state or municipal income tax overpayments<br />

included in your federal<br />

adjusted gross income.<br />

If you have no credits other than the<br />

exemption credit and joint filing credit.<br />

If you have no payments or credits<br />

other than withholding shown on<br />

Form(s) W-2 and 1099.<br />

4<br />

USE IT-1040<br />

For any Residency Status.<br />

For any filing status.<br />

For all personal and dependent exemptions<br />

that you are entitled to claim.<br />

If you have <strong>Ohio</strong> adjustments to<br />

income in addition to, or other than,<br />

state or municipal income tax overpayments<br />

included in your federal adjusted<br />

gross income.<br />

Please see Schedule A on the back <strong>of</strong><br />

Form IT-1040 for a complete list <strong>of</strong> the<br />

<strong>Ohio</strong> adjustments or read the instructions<br />

found in this booklet.<br />

For all applicable <strong>Ohio</strong> credits. Some<br />

common credits include:<br />

*Retirement income credit<br />

*Senior citizen’s credit<br />

*Child and dependent care credit<br />

*Lump sum retirement credit<br />

*Job training credit<br />

*<strong>Ohio</strong> political contributions credit<br />

*Resident credit<br />

If you have any <strong>of</strong> the following:<br />

*Withholding from all sources<br />

*Estimated tax payments<br />

*Payments made with Form IT-40P