bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

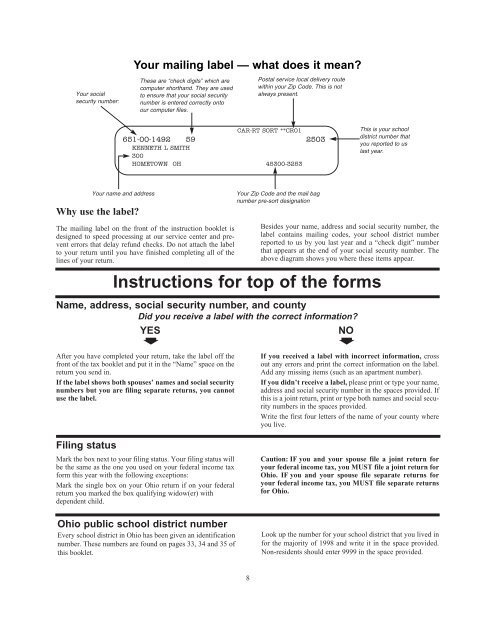

Your social<br />

security number:<br />

Why use the label?<br />

Your mailing label — what does it mean?<br />

These are “check digits” which are<br />

computer shorthand. They are used<br />

to ensure that your social security<br />

number is entered correctly onto<br />

our computer files.<br />

The mailing label on the front <strong>of</strong> the instruction booklet is<br />

designed to speed processing at our service center and prevent<br />

errors that delay refund checks. Do not attach the label<br />

to your return until you have finished completing all <strong>of</strong> the<br />

lines <strong>of</strong> your return.<br />

Postal service local delivery route<br />

within your Zip Code. This is not<br />

always present.<br />

CAR-RT SORT **CR01<br />

651-00-1492 59 2503<br />

KENNETH L SMITH<br />

300<br />

HOMETOWN OH 45300-3253<br />

Your name and address<br />

Your Zip Code and the mail bag<br />

number pre-sort designation<br />

8<br />

This is your school<br />

district number that<br />

you reported to us<br />

last year.<br />

Besides your name, address and social security number, the<br />

label contains mailing codes, your school district number<br />

reported to us by you last year and a “check digit” number<br />

that appears at the end <strong>of</strong> your social security number. The<br />

above diagram shows you where these items appear.<br />

Instructions for top <strong>of</strong> the forms<br />

Name, address, social security number, and county<br />

Did you receive a label with the correct information?<br />

YES NO<br />

After you have completed your return, take the label <strong>of</strong>f the<br />

front <strong>of</strong> the tax booklet and put it in the “Name” space on the<br />

return you send in.<br />

If the label shows both spouses’ names and social security<br />

numbers but you are filing separate returns, you cannot<br />

use the label.<br />

Filing status<br />

➧<br />

Mark the box next to your filing status. Your filing status will<br />

be the same as the one you used on your federal income tax<br />

form this year with the following exceptions:<br />

Mark the single box on your <strong>Ohio</strong> return if on your federal<br />

return you marked the box qualifying widow(er) with<br />

dependent child.<br />

<strong>Ohio</strong> public school district number<br />

Every school district in <strong>Ohio</strong> has been given an identification<br />

number. These numbers are found on pages 33, 34 and 35 <strong>of</strong><br />

this booklet.<br />

➧<br />

If you received a label with incorrect information, cross<br />

out any errors and print the correct information on the label.<br />

Add any missing items (such as an apartment number).<br />

If you didn’t receive a label, please print or type your name,<br />

address and social security number in the spaces provided. If<br />

this is a joint return, print or type both names and social security<br />

numbers in the spaces provided.<br />

Write the first four letters <strong>of</strong> the name <strong>of</strong> your county where<br />

you live.<br />

Caution: IF you and your spouse file a joint return for<br />

your federal income tax, you MUST file a joint return for<br />

<strong>Ohio</strong>. IF you and your spouse file separate returns for<br />

your federal income tax, you MUST file separate returns<br />

for <strong>Ohio</strong>.<br />

Look up the number for your school district that you lived in<br />

for the majority <strong>of</strong> 1998 and write it in the space provided.<br />

Non-residents should enter 9999 in the space provided.