bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

bw98-TAX BOOK.QUARK FILE - Ohio Department of Taxation ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

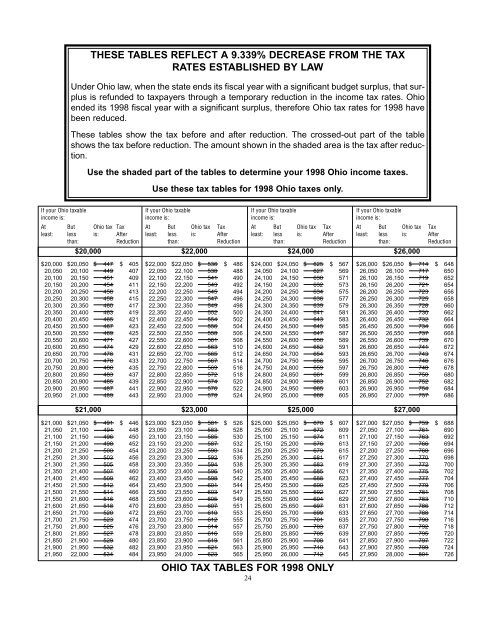

THESE TABLES REFLECT A 9.339% DECREASE FROM THE <strong>TAX</strong><br />

RATES ESTABLISHED BY LAW<br />

Under <strong>Ohio</strong> law, when the state ends its fiscal year with a significant budget surplus, that surplus<br />

is refunded to taxpayers through a temporary reduction in the income tax rates. <strong>Ohio</strong><br />

ended its 1998 fiscal year with a significant surplus, therefore <strong>Ohio</strong> tax rates for 1998 have<br />

been reduced.<br />

These tables show the tax before and after reduction. The crossed-out part <strong>of</strong> the table<br />

shows the tax before reduction. The amount shown in the shaded area is the tax after reduction.<br />

Use the shaded part <strong>of</strong> the tables to determine your 1998 <strong>Ohio</strong> income taxes.<br />

If your <strong>Ohio</strong> taxable<br />

income is:<br />

At But <strong>Ohio</strong> tax Tax<br />

least: less is: After<br />

than: Reduction<br />

Use these tax tables for 1998 <strong>Ohio</strong> taxes only.<br />

If your <strong>Ohio</strong> taxable<br />

income is:<br />

At But <strong>Ohio</strong> tax Tax<br />

least: less is: After<br />

than: Reduction<br />

If your <strong>Ohio</strong> taxable<br />

income is:<br />

At But <strong>Ohio</strong> tax Tax<br />

least: less is: After<br />

than: Reduction<br />

$20,000 $22,000 $24,000 $26,000<br />

$20,000 $20,050 $ 447 $ 405<br />

20,050 20,100 449 407<br />

20,100 20,150 451 409<br />

20,150 20,200 454 411<br />

20,200 20,250 456 413<br />

20,250 20,300 458 415<br />

20,300 20,350 460 417<br />

20,350 20,400 463 419<br />

20,400 20,450 465 421<br />

20,450 20,500 467 423<br />

20,500 20,550 469 425<br />

20,550 20,600 471 427<br />

20,600 20,650 474 429<br />

20,650 20,700 476 431<br />

20,700 20,750 478 433<br />

20,750 20,800 480 435<br />

20,800 20,850 483 437<br />

20,850 20,900 485 439<br />

20,900 20,950 487 441<br />

20,950 21,000 489 443<br />

$21,000 $21,050 $ 491 $ 446<br />

21,050 21,100 494 448<br />

21,100 21,150 496 450<br />

21,150 21,200 498 452<br />

21,200 21,250 500 454<br />

21,250 21,300 503 456<br />

21,300 21,350 505 458<br />

21,350 21,400 507 460<br />

21,400 21,450 509 462<br />

21,450 21,500 512 464<br />

21,500 21,550 514 466<br />

21,550 21,600 516 468<br />

21,600 21,650 518 470<br />

21,650 21,700 520 472<br />

21,700 21,750 523 474<br />

21,750 21,800 525 476<br />

21,800 21,850 527 478<br />

21,850 21,900 529 480<br />

21,900 21,950 532 482<br />

21,950 22,000 534 484<br />

$22,000 $22,050 $ 536 $ 486<br />

22,050 22,100 538 488<br />

22,100 22,150 541 490<br />

22,150 22,200 543 492<br />

22,200 22,250 545 494<br />

22,250 22,300 547 496<br />

22,300 22,350 549 498<br />

22,350 22,400 552 500<br />

22,400 22,450 554 502<br />

22,450 22,500 556 504<br />

22,500 22,550 558 506<br />

22,550 22,600 561 508<br />

22,600 22,650 563 510<br />

22,650 22,700 565 512<br />

22,700 22,750 567 514<br />

22,750 22,800 569 516<br />

22,800 22,850 572 518<br />

22,850 22,900 574 520<br />

22,900 22,950 576 522<br />

22,950 23,000 578 524<br />

$23,000 $23,050 $ 581 $ 526<br />

23,050 23,100 583 528<br />

23,100 23,150 585 530<br />

23,150 23,200 587 532<br />

23,200 23,250 590 534<br />

23,250 23,300 592 536<br />

23,300 23,350 594 538<br />

23,350 23,400 596 540<br />

23,400 23,450 598 542<br />

23,450 23,500 601 544<br />

23,500 23,550 603 547<br />

23,550 23,600 605 549<br />

23,600 23,650 607 551<br />

23,650 23,700 610 553<br />

23,700 23,750 612 555<br />

23,750 23,800 614 557<br />

23,800 23,850 616 559<br />

23,850 23,900 619 561<br />

23,900 23,950 621 563<br />

23,950 24,000 623 565<br />

24<br />

$24,000 $24,050 $ 625 $ 567<br />

24,050 24,100 627 569<br />

24,100 24,150 630 571<br />

24,150 24,200 632 573<br />

24,200 24,250 634 575<br />

24,250 24,300 636 577<br />

24,300 24,350 639 579<br />

24,350 24,400 641 581<br />

24,400 24,450 643 583<br />

24,450 24,500 645 585<br />

24,500 24,550 647 587<br />

24,550 24,600 650 589<br />

24,600 24,650 652 591<br />

24,650 24,700 654 593<br />

24,700 24,750 656 595<br />

24,750 24,800 659 597<br />

24,800 24,850 661 599<br />

24,850 24,900 663 601<br />

24,900 24,950 665 603<br />

24,950 25,000 668 605<br />

$25,000 $25,050 $ 670 $ 607<br />

25,050 25,100 672 609<br />

25,100 25,150 674 611<br />

25,150 25,200 676 613<br />

25,200 25,250 679 615<br />

25,250 25,300 681 617<br />

25,300 25,350 683 619<br />

25,350 25,400 685 621<br />

25,400 25,450 688 623<br />

25,450 25,500 690 625<br />

25,500 25,550 692 627<br />

25,550 25,600 694 629<br />

25,600 25,650 697 631<br />

25,650 25,700 699 633<br />

25,700 25,750 701 635<br />

25,750 25,800 703 637<br />

25,800 25,850 705 639<br />

25,850 25,900 708 641<br />

25,900 25,950 710 643<br />

25,950 26,000 712 645<br />

If your <strong>Ohio</strong> taxable<br />

income is:<br />

At But <strong>Ohio</strong> tax Tax<br />

least: less is: After<br />

than: Reduction<br />

$26,000 $26,050 $ 714 $ 648<br />

26,050 26,100 717 650<br />

26,100 26,150 719 652<br />

26,150 26,200 721 654<br />

26,200 26,250 723 656<br />

26,250 26,300 725 658<br />

26,300 26,350 728 660<br />

26,350 26,400 730 662<br />

26,400 26,450 732 664<br />

26,450 26,500 734 666<br />

26,500 26,550 737 668<br />

26,550 26,600 739 670<br />

26,600 26,650 741 672<br />

26,650 26,700 743 674<br />

26,700 26,750 746 676<br />

26,750 26,800 748 678<br />

26,800 26,850 750 680<br />

26,850 26,900 752 682<br />

26,900 26,950 754 684<br />

26,950 27,000 757 686<br />

$21,000 $23,000 $25,000 $27,000<br />

OHIO <strong>TAX</strong> TABLES FOR 1998 ONLY<br />

$27,000 $27,050 $ 759 $ 688<br />

27,050 27,100 761 690<br />

27,100 27,150 763 692<br />

27,150 27,200 766 694<br />

27,200 27,250 768 696<br />

27,250 27,300 770 698<br />

27,300 27,350 772 700<br />

27,350 27,400 775 702<br />

27,400 27,450 777 704<br />

27,450 27,500 779 706<br />

27,500 27,550 781 708<br />

27,550 27,600 783 710<br />

27,600 27,650 786 712<br />

27,650 27,700 788 714<br />

27,700 27,750 790 716<br />

27,750 27,800 792 718<br />

27,800 27,850 795 720<br />

27,850 27,900 797 722<br />

27,900 27,950 799 724<br />

27,950 28,000 801 726