- Page 1 and 2:

The Single Income Tax Final report

- Page 3 and 4:

The Single Income Tax Final report

- Page 5:

Prologue To create the conditions f

- Page 8 and 9:

Contents 6 Contents Prologue 3 Fore

- Page 10 and 11:

8 Contents 3.1.2. Under a range of

- Page 12 and 13:

10 Contents 4.3.5. Family formation

- Page 14 and 15:

12 Contents 8.1.2. Fiscal decentral

- Page 16 and 17:

14 Contents Rao, M.G., Tax System R

- Page 18 and 19:

16 Forewords Allister Heath Editor

- Page 20 and 21:

18 Matthew Elliott Co-founder and C

- Page 22 and 23:

Biographies of the Commissioners Al

- Page 24 and 25:

22 Graeme Leach, Chief Economist an

- Page 26 and 27:

Marginal tax rates should not excee

- Page 28 and 29:

26 Those proposals would result in

- Page 30 and 31:

28 so the elasticities are central

- Page 32 and 33:

30 As Table 1.1 shows, the impact o

- Page 35 and 36:

Chapter two Taxes in Britain are to

- Page 37 and 38:

it is today and did not exceed the

- Page 39 and 40:

Table 2.2: Ratios of total tax rece

- Page 41 and 42:

Average workers would have to work

- Page 43 and 44:

General government expenditure Priv

- Page 45 and 46:

Government final current expenditur

- Page 47 and 48:

Table 2.7: Chartered Institute of T

- Page 49 and 50:

Pages with cases Pages without case

- Page 51 and 52:

“The last decade has also seen an

- Page 53 and 54:

“I sought to abolish a tax at eve

- Page 55 and 56:

There are many ethical questions th

- Page 57 and 58:

for a society to function, but an e

- Page 59 and 60:

The use of tax reliefs in ways that

- Page 61 and 62:

“It is said one of Emperor Nero

- Page 63:

tions by people who, in some cases,

- Page 66 and 67:

64 3. Taxes should be cut to 33 per

- Page 68 and 69:

The old HM Treasury rule-of-thumb,

- Page 70 and 71:

68 A tax on success UK celebrities

- Page 72 and 73:

The more high-skilled the labour, t

- Page 74 and 75:

72 rise from the 40p top marginal r

- Page 76 and 77:

74 everyone to have a decent life,

- Page 78 and 79:

76 Deciding what we want Peter and

- Page 80 and 81:

78 made most strongly in Nozick’s

- Page 82 and 83:

80 example. That is simply choosing

- Page 84 and 85:

82 should support a state-funded in

- Page 86 and 87:

84 while continuing to fund these s

- Page 88 and 89:

“The more money that the governme

- Page 90 and 91:

Matt Ridley is the awardwinning aut

- Page 92 and 93:

“Whereas private extravagance is

- Page 94 and 95:

92 So here is a question: is it bet

- Page 96 and 97:

“Artificial light was an unimagin

- Page 98 and 99:

“Free markets allow you to cooper

- Page 100 and 101:

“The concept of the tithe is also

- Page 102 and 103:

100 state comes before the individu

- Page 104 and 105:

“The aim of zakat is not to satis

- Page 106 and 107:

104 of people: tax payers and tax c

- Page 108 and 109:

106 Author Title (year) Country Bra

- Page 110 and 111:

Politicians making decisions can an

- Page 112 and 113:

110 It is reasonable to argue that

- Page 114 and 115:

112 make inadequate returns. There

- Page 116 and 117:

114 A system of taxation and govern

- Page 118 and 119:

116 the individual rather than soci

- Page 120 and 121:

Putting the case for spending on ed

- Page 122 and 123:

120 Activity: author Unit/organisat

- Page 124 and 125:

122 Activity: author Unit/organisat

- Page 126 and 127:

124 1997 to 2007, it would have sav

- Page 128 and 129:

As a result of the logic of collect

- Page 130 and 131:

Brennan and Buchanan’s Leviathan

- Page 132 and 133:

130 The UK actually scores highly,

- Page 134 and 135:

132 errors that resulted from overe

- Page 136 and 137:

134 Author Data coverage Main expla

- Page 138 and 139:

136 Compounded total growth, potent

- Page 140 and 141:

138 the tax structure rather than t

- Page 142 and 143:

At its peak in 1993, spending in Sw

- Page 144 and 145:

142 UK non-oil GDP Time trend pre 2

- Page 146 and 147:

144 Leadership is key and not just

- Page 148 and 149:

69 per cent agree that “if the go

- Page 150 and 151:

When asked if ‘people like me’

- Page 152 and 153:

150 Figure 3.13: In the current eco

- Page 154 and 155:

“We shall cut income tax at all l

- Page 156 and 157:

154 3.5.3.1.3. The 1988 Budget Prob

- Page 158 and 159:

For most voters the Poll Tax repres

- Page 160 and 161:

“… the soundest way to raise th

- Page 162 and 163:

160 was the Democratic nominee. The

- Page 164 and 165:

162 In 1983, when Labor entered off

- Page 166 and 167:

164 have survived. This in part pro

- Page 168 and 169:

166 Those substantial disparities a

- Page 170 and 171:

168 appropriately to local conditio

- Page 172 and 173:

There is an independent negative cr

- Page 174 and 175:

172 The IMF staffers found that the

- Page 176 and 177:

Public sector pay is 7.8 per cent h

- Page 178 and 179:

176 intensity of intergenerational

- Page 180 and 181: 178 Real PDE Real GDP Figure 3.17:

- Page 182 and 183: 180 Figure 3.19: Ratio of Smoothed

- Page 184 and 185: The consolidations that turned out

- Page 186 and 187: 184 - The value added under the var

- Page 188 and 189: 186 revised version in 1987 succeed

- Page 190 and 191: 188 That statement must give at lea

- Page 192 and 193: 190 4. Marginal tax rates should no

- Page 194 and 195: 192 2001-02 2011-12 2012-13 2013-14

- Page 196 and 197: “The number of people who pay no

- Page 198 and 199: 196 Production and Consumption Effi

- Page 200 and 201: 198 offers, the latter effect (i.e.

- Page 202 and 203: “Corporate income taxes can affec

- Page 204 and 205: 202 the two is not tax evasion (alt

- Page 206 and 207: “Higher tax burdens raise the pri

- Page 208 and 209: There are numerous economic studies

- Page 210 and 211: 208 Table 4.2: Countries and jurisd

- Page 212 and 213: 210 made about the engine of growth

- Page 214 and 215: 212 Larger businesses have differen

- Page 216 and 217: 214 79 per cent agreed that Nationa

- Page 218 and 219: 216 0.35 TIE 0.45 TIE 0.55 TIE “N

- Page 220 and 221: 218 Feldstein and Feenberg looked a

- Page 222 and 223: 220 Personal income tax and employe

- Page 224 and 225: 222 As a result, at the time that t

- Page 226 and 227: 224 Table 4.5: Revenue raised by th

- Page 228 and 229: 226 open economies have lower maxim

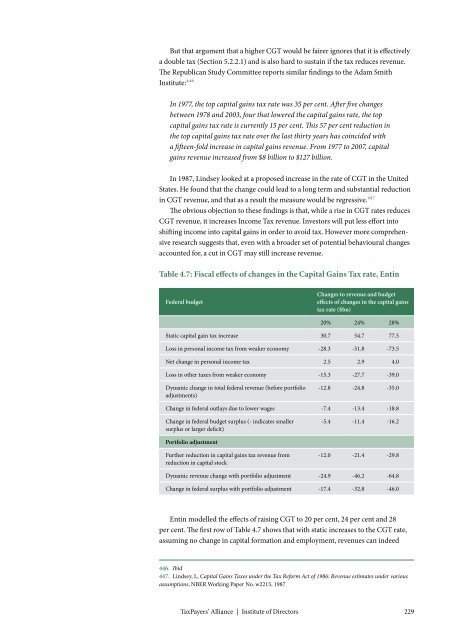

- Page 232 and 233: 230 increase. And a higher CGT will

- Page 234 and 235: 232 The argument that there is a so

- Page 236 and 237: 234 High earners will, thanks to th

- Page 238 and 239: 236 Percentages of disposable incom

- Page 240 and 241: The critical test should be whether

- Page 242 and 243: Other researchers had already come

- Page 244 and 245: 242 preposterous to argue, as Wilki

- Page 246 and 247: 244 This was puzzling, since the wo

- Page 248 and 249: 246 Other scholars have attempted t

- Page 250 and 251: Many studies of optimal taxation as

- Page 252 and 253: 250 amount of tax a single person o

- Page 254 and 255: 252 4.3.6. There is not a credible

- Page 256 and 257: 254 Incentives, behaviour and justi

- Page 258 and 259: 256 have less, and it is not at all

- Page 261 and 262: Chapter five Taxes on capital and l

- Page 263 and 264: Numerous empirical studies show tha

- Page 265 and 266: 5.1.3. Financial Transaction Taxes

- Page 267 and 268: There is a stamp duty on shares in

- Page 269 and 270: The Economist recently showed the t

- Page 271 and 272: Corporation Tax lacks public legiti

- Page 273 and 274: Table 5.1: Corporate flows of funds

- Page 275 and 276: would be created for them to acquir

- Page 277 and 278: dividends who were UK companies wou

- Page 279 and 280: ■ Original Company agrees to cove

- Page 281 and 282:

of removing distortions and an obvi

- Page 283 and 284:

Figure 5.3: Landlord with a propert

- Page 285 and 286:

And the fact that they do not gener

- Page 287 and 288:

capital gains by selling assets to

- Page 289 and 290:

Income from capital should be taxed

- Page 291 and 292:

UK Government. Capital payments sho

- Page 293 and 294:

as neutral between different taxpay

- Page 295 and 296:

If companies do not pay dividends o

- Page 297 and 298:

[M]any participants were resistant

- Page 299 and 300:

for jobs on the basis of experience

- Page 301 and 302:

Despite these technicalities the Fu

- Page 303 and 304:

■ Married Couples Allowance: Civi

- Page 305 and 306:

5.2.3.1.8. Interaction with benefit

- Page 307 and 308:

By splitting up employees’ tax bi

- Page 309 and 310:

5.2.4. There is an ethical responsi

- Page 311 and 312:

■ Amending remuneration advice no

- Page 313 and 314:

Table 5.13: Typical Second Phase pa

- Page 315 and 316:

■ 2004, British Chambers of Comme

- Page 317 and 318:

Chapter six Transaction, wealth and

- Page 319 and 320:

usinesses and other assets from bei

- Page 321 and 322:

Table 6.1: Cost of capital for alte

- Page 323 and 324:

There are a number of ways in which

- Page 325 and 326:

6.2. Wealth taxes lead to capital f

- Page 327 and 328:

“I found it impossible to draft o

- Page 329 and 330:

ather than on returns. Over time an

- Page 331 and 332:

2011-12 2012-13 If a mansion tax is

- Page 333 and 334:

Many high value properties were bou

- Page 335 and 336:

There are many ways in which people

- Page 337 and 338:

Real PDE Real GDP Figure 6.3: Annua

- Page 339 and 340:

Chapter seven Other consumption tax

- Page 341 and 342:

VAT is a substantial stealth tax wh

- Page 343 and 344:

Table 7.3: Tax gap estimates, cigar

- Page 345 and 346:

Higher taxes on goods that have rea

- Page 347 and 348:

to the senspropertiese that it is a

- Page 349 and 350:

More recently, Amazon agreed to sta

- Page 351 and 352:

■ The increase in high value/low

- Page 353 and 354:

The critical difference seems to be

- Page 355 and 356:

could improve it substantially, it

- Page 357 and 358:

Widening the base of VAT may improv

- Page 359 and 360:

Tobacco taxes are justified on the

- Page 361 and 362:

An estimate of that kind is reprodu

- Page 363 and 364:

Costs of smoking Lower margin Middl

- Page 365 and 366:

Duty on hydrocarbon oils & Vehicle

- Page 367 and 368:

Chapter eight Local authorities sho

- Page 369 and 370:

By pursuing a low tax and value-ori

- Page 371 and 372:

is vital to make corresponding chan

- Page 373 and 374:

The study tells us that the worst o

- Page 375 and 376:

But if councils are to be properly

- Page 377 and 378:

for revaluations or higher tax rate

- Page 379 and 380:

easons outlined below, the power wo

- Page 381:

Pages Test’ to the government of

- Page 384 and 385:

The Single Income Tax could deliver

- Page 386 and 387:

384 Appendix - earlier tax reviews

- Page 388 and 389:

386 the tax system is critically ex

- Page 390 and 391:

388 finances. A “growth-friendly

- Page 392 and 393:

390 special treatment for special i

- Page 394 and 395:

392 A Tax System for New Zealand’

- Page 396 and 397:

394 Evaluation of the 2006 Tax Refo

- Page 398 and 399:

396 local state taxes on consumptio

- Page 400 and 401:

398 the issue of the tax wedge, the

- Page 402 and 403:

400 Heath surveys the academic lite

- Page 404 and 405:

402 for the report was personal inc

- Page 406 and 407:

404 to add around 35 per cent to th

- Page 408 and 409:

406 HM Treasury Report on Flat Taxe

- Page 410 and 411:

408 Final Report of the Tax Policy

- Page 412 and 413:

410 overreliance on business and pe

- Page 414 and 415:

412 and consumption taxes correspon

- Page 416 and 417:

414 for poverty is to be found”.7

- Page 418 and 419:

416 gradually and not through a gig

- Page 420 and 421:

Acknowledgements The Commissioners