Cordlife Group Ltd - Phillip Securities Pte Ltd

Cordlife Group Ltd - Phillip Securities Pte Ltd

Cordlife Group Ltd - Phillip Securities Pte Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Strong FCF generation at a reasonable price<br />

Bloomberg │ Reuters │ POEMS<br />

CLGL SP │ CORD.SI │ CLGL.SG<br />

Industry: Medical & Healthcare<br />

Report type: Initiation<br />

Company Overview<br />

<strong>Cordlife</strong> <strong>Group</strong> (<strong>Cordlife</strong>) is a provider of cord blood and<br />

tissue banking services. <strong>Cordlife</strong> operates primarily in<br />

Singapore and Hong Kong, but offers indirect exposure to<br />

China with a 10% stake in China Cord Blood Corporation.<br />

Core earnings to increase at CAGR of 8.5%.<br />

Strong FCF generation to sustain high dividend payout<br />

to shareholders.<br />

Potential venture into complementary products.<br />

Acquisition of assets from CBB would drive<br />

geographical diversification into emerging markets.<br />

Undemanding valuations for a defensive stock.<br />

Initiate with Buy, TP of S$0.84.<br />

We initiate coverage on <strong>Cordlife</strong> with a Buy<br />

recommendation and TP of S$0.84. The key reasons for our<br />

positive view are as follow:<br />

#1: Expect core earnings to increase at CAGR of 8.5%<br />

over the next 3yrs.<br />

With increasing awareness of cord blood banking, we<br />

expect market penetration of Singapore and Hong Kong to<br />

improve materially over the next 3yrs. <strong>Cordlife</strong> is well<br />

positioned to benefit from this positive trend as one of the<br />

few private cord blood banking service providers in these<br />

markets. Furthermore, we believe that the Singapore<br />

government would keep policies accommodative to<br />

stimulate the current low level of birth rates (TFR target: 1.4-<br />

1.5 vs 2012E: 1.28-1.30) in the country. This is evident by a<br />

recently announced S$2bn package to promote marriage<br />

and parenthood.<br />

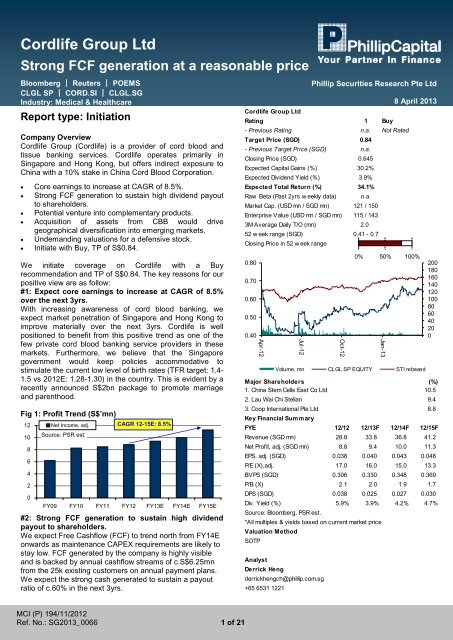

Fig 1: Profit Trend (S$’mn)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Net Income, adj.<br />

Source: PSR est.<br />

CAGR 12-15E: 8.5%<br />

FY09 FY10 FY11 FY12 FY13E FY14E FY15E<br />

#2: Strong FCF generation to sustain high dividend<br />

payout to shareholders.<br />

We expect Free Cashflow (FCF) to trend north from FY14E<br />

onwards as maintenance CAPEX requirements are likely to<br />

stay low. FCF generated by the company is highly visible<br />

and is backed by annual cashflow streams of c.S$6.25mn<br />

from the 25k existing customers on annual payment plans.<br />

We expect the strong cash generated to sustain a payout<br />

ratio of c.60% in the next 3yrs.<br />

MCI (P) 194/11/2012<br />

Ref. No.: SG2013_0066 1 of 21<br />

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Raw Beta (Past 2yrs w eekly data) n.a.<br />

<strong>Phillip</strong> <strong>Securities</strong> Research <strong>Pte</strong> <strong>Ltd</strong><br />

Rating 1 Buy<br />

- Previous Rating n.a. Not Rated<br />

Target Price (SGD) 0.84<br />

- Previous Target Price (SGD) n.a.<br />

Closing Price (SGD) 0.645<br />

Expected Capital Gains (%) 30.2%<br />

Expected Dividend Yield (%) 3.9%<br />

Expected Total Return (%) 34.1%<br />

Market Cap. (USD mn / SGD mn) 121 / 150<br />

Enterprise Value (USD mn / SGD mn) 115 / 143<br />

3M Average Daily T/O (mn) 2.0<br />

52 w eek range (SGD) 0.41 - 0.7<br />

Closing Price in 52 w eek range<br />

0.80<br />

0.70<br />

0.60<br />

0.50<br />

0.40<br />

Apr-12<br />

8 April 2013<br />

Major Shareholders (%)<br />

1. China Stem Cells East Co <strong>Ltd</strong><br />

10.5<br />

2. Lau Wai Chi Stellan<br />

Jul-12<br />

Oct-12<br />

0% 50% 100%<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

3. Coop International <strong>Pte</strong> <strong>Ltd</strong> 8.8<br />

Jan-13<br />

Volume, mn CLGL SP EQUITY STI rebased<br />

Key Financial Summary<br />

FYE 12/12 12/13F 12/14F 12/15F<br />

Revenue (SGD mn) 28.8 33.8 36.8 41.2<br />

Net Profit, adj. (SGD mn) 8.8 9.4 10.0 11.3<br />

EPS, adj. (SGD) 0.038 0.040 0.043 0.048<br />

P/E (X),adj. 17.0 16.0 15.0 13.3<br />

BVPS (SGD) 0.306 0.330 0.348 0.369<br />

P/B (X) 2.1 2.0 1.9 1.7<br />

DPS (SGD) 0.038 0.025 0.027 0.030<br />

Div. Yield (%) 5.9% 3.9% 4.2% 4.7%<br />

Source: Bloomberg, PSR est.<br />

*All multiples & yields based on current market price<br />

Valuation Method<br />

SOTP<br />

Analyst<br />

Derrick Heng<br />

derrickhengch@phillip.com.sg<br />

+65 6531 1221<br />

9.4

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Fig 2: Free Cashflow (S$’mn)<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Free Cashflow<br />

Source: PSR est.<br />

FY09 FY10 FY11 FY12 FY13E FY14E FY15E<br />

#3: Potential venture into complementary products.<br />

<strong>Cordlife</strong> announced a strategic alliance with Cordlabs Asia<br />

to offer umbilical cord tissue banking services beyond its<br />

current market in Hong Kong. The alliance would allow<br />

<strong>Cordlife</strong> to provide the services in India, Indonesia, Malaysia,<br />

Philippines, Singapore and Hong Kong on an exclusive<br />

basis and in Thailand on a non-exclusive basis. We believe<br />

that this alliance would leverage on the company’s existing<br />

network and open up new growth markets for the group.<br />

#4: Acquisition of assets from CBB would drive<br />

geographical diversification into emerging markets.<br />

<strong>Cordlife</strong> has a Right of First Refusal (ROFR) for the<br />

acquisition of various operating assets in Philippines,<br />

Indonesia & India from <strong>Cordlife</strong> <strong>Ltd</strong> (CBB), the Australia<br />

listed entity that owned <strong>Cordlife</strong> <strong>Group</strong> prior to its demerger<br />

in June 2011, should the company decide to divest.<br />

Acquisition of these entities would provide <strong>Cordlife</strong> with<br />

geographical diversification into emerging markets that have<br />

higher birth rates and lower market penetration. The recent<br />

results of CBB suggest that its operations in the emerging<br />

markets could start turning profitable soon. As long as they<br />

do not overpay for these emerging assets, we view any<br />

potential acquisition as a positive catalyst for the stock.<br />

#5: Undemanding valuations for a defensive stock.<br />

Lastly, we find the valuations for the stock of <strong>Cordlife</strong> as<br />

undemanding on various matrices. Despite the defensive<br />

nature of its business, the stock of <strong>Cordlife</strong> trades at a<br />

forward P/E of only 15X. Adjusting for the cash, liquid<br />

investments and market value of <strong>Cordlife</strong>’s stake in China<br />

Cord Blood Banking Corp, the core business of the company<br />

would offer a market leading FCF yield of c.7% in FY14E<br />

and beyond. With the stock trading at our bear case<br />

valuation level, we see limited downside at this entry point.<br />

2 of 21<br />

Fig 3: Forward P/E of 15X<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

Feb-12<br />

Mar-12<br />

Apr-12<br />

Forward P/E (X)<br />

May-12<br />

Jun-12<br />

Fig 4: High levels of FCF yield (%)<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Adjusted FCF yield (%)<br />

Source: PSR est.<br />

3.5%<br />

Jul-12<br />

Aug-12<br />

4.0%<br />

Sep-12<br />

Oct-12<br />

Nov-12<br />

Dec-12<br />

7.0%<br />

Source: Bloomberg, PSR<br />

Jan-13<br />

Feb-13<br />

Mar-13<br />

15.2<br />

Apr-13<br />

7.6%<br />

FY12 FY13E FY14E FY15E<br />

May-13<br />

Jun-13

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Financial Summary<br />

Deeper market penetration in Singapore to drive<br />

revenue growth<br />

After building in increased client deliveries from deeper<br />

market penetration in Singapore, we expect revenue to<br />

increase by 13% p.a. till FY15E. Our revenue growth<br />

forecasts are conservative and already lower than the 18%<br />

y-y revenue growth in 1HFY13 that is driven by 550 more<br />

deliveries.<br />

Hong Kong market to contract, mitigated by price hikes<br />

We expect <strong>Cordlife</strong>’s business in Hong Kong to contract in<br />

CY13 due to the negative impact of policy restrictions on<br />

deliveries by mainland women in Hong Kong. While the<br />

policy measures are negative for <strong>Cordlife</strong>, we opine that the<br />

impact would be softened by a price hike of c.7-9% (PSR<br />

est.) over the past yr. As its business in Singapore had been<br />

the main earnings driver, we believe that the impact of a<br />

contraction in the Hong Kong would not be material to the<br />

group.<br />

Fig 5: Forecasting CAGR growth of 13% to FY13E<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Revenue CAGR 12-15E: 13%<br />

Source: PSR est.<br />

FY09 FY10 FY11 FY12 FY13E FY14E FY15E<br />

Cost components<br />

We estimate that 35% of the company’s cost structure is in<br />

items that are variable in nature (mainly expenses<br />

associated with the conduct of the procedure). As the<br />

company had effectively locked in longer term overheads<br />

after moving into the new facility in Yishun, we expect<br />

administrative expenses to stabilize at S$8-10mn p.a. in the<br />

next 3yrs. While marketing expenses could continue<br />

trending higher, we believe that it should stabilize at c.23%<br />

of sales.<br />

Fig 6: Cost Structure<br />

Cost of Sales<br />

35%<br />

Source: PSR est.<br />

Selling and<br />

marketing<br />

expenses<br />

28%<br />

Administrative<br />

expenses<br />

37%<br />

3 of 21<br />

EBITDA margins to expand on better product mix and<br />

economies of scale<br />

EBITDA margins have contracted over the past 4 yrs as the<br />

company stepped up its marketing efforts and incurred<br />

higher variable costs to comply with a change in the AABB<br />

(an association involved in the field of transfusion medicine<br />

and cellular therapies, formerly known as American<br />

Association of Blood Banks) standards. However, we expect<br />

profitability to improve over the next 3yrs due to economies<br />

of scale and bigger contributions from the higher margin<br />

business in Singapore.<br />

Fig 7: Margins should expand on economies of scale<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Source: PSR est.<br />

EBITDA<br />

EBITDA margin (%)<br />

FY09 FY10 FY11 FY12 FY13E FY14E FY15E<br />

38%<br />

36%<br />

34%<br />

32%<br />

30%<br />

28%<br />

26%<br />

Profit contribution by geography<br />

After stripping out contributions from its mainland associates,<br />

<strong>Cordlife</strong>’s business in North Asia (mainly Hong Kong) had<br />

not been a meaningful profit contributor. South Asia (mainly<br />

from Singapore) remains a key profit driver with PBT<br />

contributions of c.S$7-9mn a year. With positive underlying<br />

business trends, we believe that its operations in South Asia<br />

will continue to be a driver of profits for the group.<br />

Fig 8: Revenue by geography (S$’mn)<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

South Asia<br />

North Asia<br />

16.9<br />

5.7<br />

20.3<br />

Source: <strong>Cordlife</strong><br />

19.2<br />

21.7<br />

7.9 6.5 7.1<br />

FY09 FY10 FY11 FY12<br />

Fig 9: Profit by geography (S$’mn)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

(2)<br />

Source: <strong>Cordlife</strong>, PSR est.<br />

6.9<br />

9.0<br />

0.8 0.2<br />

8.3 7.5<br />

(0.1)<br />

South Asia<br />

North Asia<br />

(0.0)<br />

FY09 FY10 FY11 FY12<br />

*Profit contributions adjusted to remove contributions from<br />

associates and added IPO expenses to South Asia for FY12.

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Stable FCF to sustain dividend payout to shareholders<br />

We expect CAPEX to decline significantly in FY14E onwards<br />

as we estimate that its existing facilities in Singapore &<br />

Hong Kong would only have a blended utilization of 10% by<br />

the end of FY15E (based on facility space). Consequently,<br />

we have forecasted increasing Free Cashflows (FCF) of<br />

more than S$7mn/yr from FY14E onwards. FCF generated<br />

by the company is highly visible and is backed by annual<br />

cashflow streams of c.S$6.25mn from the 25k existing<br />

customers on annual payment plans. Furthermore, we<br />

expect recurring income stream to grow over time as the<br />

number of units stored at the company increases. Hence,<br />

we explicitly modeled in payout ratios of c.60% till FY15E,<br />

which would use up c.S$6mn/yr of cash inflow (c.80% of<br />

FCF). Our payout ratio assumption of 60% is higher than<br />

management guidance of at least 25% in its IPO prospectus<br />

as we believe that the strong cash generation and low<br />

gearing of its balance sheet should allow them to sustain a<br />

higher level of payout to shareholders.<br />

Fig 10: FCF to sustain at >S$8mn/yr after FY15E<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

(2)<br />

(4)<br />

(6)<br />

Source: PSR est.<br />

FY09 FY10 FY11 FY12 FY13E FY14E FY15E<br />

Fig 11: DPS (S$)<br />

0.050<br />

0.040<br />

0.030<br />

0.020<br />

0.010<br />

0.000<br />

CFO CAPEX, net FCF<br />

100%<br />

DPS Payout Ratio (%)<br />

Source: PSR est.<br />

62% 63% 62%<br />

0.038 0.025 0.027 0.030<br />

FY12 FY13E FY14E FY15E<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

4 of 21

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Valuation<br />

With strong cash generation from its matured business units,<br />

we believe that it is most appropriate to value the core<br />

business using a DCF approach. <strong>Cordlife</strong> also holds a<br />

significant 10% stake in China Cord Blood Corp that forms<br />

c.13% of our valuation of the stock. Due to its unique<br />

business model, we opine that <strong>Cordlife</strong> is not comparable to<br />

other healthcare stocks listed on the SGX on a relative<br />

valuation basis. As the cord blood banking business is highly<br />

dependent on local market conditions, we believe that<br />

comparing companies that operate in different countries is<br />

far from meaningful. There are no comparable global peers<br />

that operate in similar geography to <strong>Cordlife</strong>.<br />

Fig 12: 34% upside to our target price of S$0.84<br />

Sum of the parts Value Percent Per shr Remarks<br />

(Base case valuation) S$'mn S$<br />

Core Value of Company, DCF 145.3 74% 0.62 DCF (WACC: 9.0%, terminal g: 1%)<br />

Stake in China Cord Blood Corp. 26.2 13% 0.11 Market Value (US$2.87/shr)<br />

Enterprise Value 171.6 88% 0.74 Basis: FY14E<br />

Add: Investments 19.9 10% 0.09<br />

Add: Cash 10.1 5% 0.04<br />

Less: Debt (5.5) -3% (0.02)<br />

Equity Value 196.0 100% 0.84<br />

Outstanding no. of shares ('mn) 232.7<br />

Target Price (S$') 0.84<br />

Current Market Price (S$) 0.645<br />

F12M DPS (S$) 0.025<br />

Price upside (%) 30.2%<br />

Dividend yield (%) 3.9%<br />

Total return (%)<br />

Source: PSR est.<br />

34.1%<br />

Undemanding at P/E of 15X<br />

Given the defensive nature and positive growth outlook, we<br />

believe that the current P/E multiple of 15X undervalues the<br />

stock of <strong>Cordlife</strong>. Furthermore, the company has a very<br />

visible stream of future cashflows from its long term<br />

contracts with customers. At our target price of S$0.84, the<br />

stock would trade at a FY14/15E P/E of 19.6/17.4X<br />

respectively.<br />

Fig 13: Forward P/E of 15X<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

Feb-12<br />

Mar-12<br />

Apr-12<br />

Forward P/E (X)<br />

May-12<br />

Jun-12<br />

Jul-12<br />

Aug-12<br />

Sep-12<br />

Oct-12<br />

Nov-12<br />

Dec-12<br />

Source: Bloomberg, PSR<br />

Jan-13<br />

Feb-13<br />

Mar-13<br />

15.2<br />

Apr-13<br />

May-13<br />

Jun-13<br />

5 of 21

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

SWOT Analysis<br />

Strength<br />

Brand awareness and goodwill in matured market<br />

With significant operating history in Singapore and Hong<br />

Kong, we believe that <strong>Cordlife</strong> has a well established brand<br />

name in these core markets. Marketing efforts over the<br />

years have led to strong brand recognition and significant<br />

amount of goodwill in the countries.<br />

Strong cash generative business<br />

After incurring significant CAPEX from moving into its new<br />

facility in Yishun, we expect minimal CAPEX needs for its<br />

business in Singapore over the next few years. Hence, we<br />

expect high levels of free cashflows to be generated by its<br />

business in Singapore, which should allow <strong>Cordlife</strong> to<br />

provide a stable stream of dividends to shareholders and<br />

supply the cash for investments into other areas of growth.<br />

Opportunities<br />

Leveraging on rich database of client information<br />

With its existing pool of cord blood under storage, <strong>Cordlife</strong><br />

holds a rich database of client information. Hence, we<br />

believe that the company would be able to engage them as<br />

repeat customers for their subsequent babies or offer<br />

complementary products to them in the future.<br />

Expansion into emerging markets<br />

If <strong>Cordlife</strong> successfully acquires the operating assets from<br />

CBB, the company would be able to gain an exposure to the<br />

fast growing emerging markets. These emerging markets<br />

have lower levels of penetration and higher birth rates.<br />

Umbilical cord tissue banking<br />

Currently, <strong>Cordlife</strong> only offers umbilical cord tissue banking<br />

services in Hong Kong. However, the company recently<br />

announced a partnership with Cordlab Asia to offer umbilical<br />

cord banking services in Singapore, Hong Kong, Malaysia,<br />

Indonesia, Philippines and India on an exclusive basis and<br />

in Thailand on a non-exclusive basis. If successfully<br />

executed, this new business would open up a new source of<br />

income for the group.<br />

Revenue streams beyond existing contractual period<br />

Existing contracts for cord blood banking are for 21yrs and<br />

18yrs in Singapore and Hong Kong respectively. Hence, we<br />

believe that upon contract expiry, there is the opportunity for<br />

contract renewal with the children of its existing clients.<br />

6 of 21<br />

Weakness<br />

Key markets have been experiencing low fertility rates<br />

As discussed below, the core markets of Singapore and<br />

Hong Kong had been experiencing fairly low fertility rates.<br />

Hence, growth in market size would likely be limited if this<br />

trend continues.<br />

Dependent on discretionary spending<br />

While there are merits associated with storing one’s cord<br />

blood, cord blood banking remains a discretionary form of<br />

spending. Hence, we expect the market size to shrink in<br />

times of weak economic conditions, when discretionary<br />

spending is scaled back.<br />

Threats<br />

Threat of substitute from public cord blood banks<br />

Cord blood units from public banks could be used for<br />

treatment as well. We believe that a significant increase in<br />

funding to administer public banks would increase the<br />

availability of samples and reduce the need for private<br />

storage of cord blood.<br />

Obsolescence of cord blood as a source of stem cells<br />

The cord blood banking business exists as cord blood is a<br />

rich source of stem cells. However, if advances in medical<br />

technology allow alternatives to develop, the business model<br />

could be under threat.<br />

Entrance of new players<br />

There are currently very few players providing private cord<br />

blood banking services in the countries that <strong>Cordlife</strong><br />

operates in. Hence, competition is less aggressive in the<br />

oligopolistic market structure. Entrance of new players could<br />

disrupt the competitive landscape.

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Porter’s Five Forces<br />

On the whole, we believe that <strong>Cordlife</strong> has a fairly strong<br />

competitive business position. While supplier power is<br />

generally strong as <strong>Cordlife</strong> is a price taker of fees charged<br />

by hospitals and doctors, we believe that the company has<br />

the ability to pass on any price hikes to its customers. Entry<br />

barriers are fairly high as marketing efforts over the years<br />

have built significant amount of goodwill and brand<br />

recognition in the core markets. We believe that this makes<br />

it prohibitively costly for new entrants to penetrate their<br />

markets.<br />

7 of 21

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Board of Directors and Senior Management<br />

Name Position Remarks<br />

Board of Directors<br />

Dr. Ho Choon Hou Chairman, Non-Executive<br />

Director<br />

- Appointed in June 2011.<br />

- Director at Southern Capital <strong>Group</strong> <strong>Ltd</strong>, Private Equity Firm.<br />

- Bachelor of Medicine & Bachelor of Surgery (The University of<br />

Sheffield), Masters in Medicine (Surgery) (National University of<br />

Singapore), MBA (Honours) (The University of Chicago)<br />

Ms. Jin Lu Non-Executive Director - Appointed in July 2011.<br />

- Executive Director of Golden Meditech Holdings (2000-2012)<br />

- Bachelor in Foreign Language (Beijing International Studies University),<br />

Executive MBA (Peking University).<br />

Mr. Ho Sheng Lead Independent Director - Appointed in July 2011.<br />

- Partner at Banamai Capital.<br />

- Bachelor of Economics (University of Tasmania), Master of Applied<br />

Finance (Macquarie University), an associate of the Institute of Chartered<br />

Secretaries and Administrators (UK), senior associate of the Australian<br />

Institute of Finance and Banking.<br />

Dr. Goh Jin Hian Independent Director - Appointed in July 2011.<br />

- Executive Consultant of Parkw ayHealth, Singapore.<br />

- <strong>Group</strong> Executive Director of IAG Heathsciences <strong>Pte</strong> <strong>Ltd</strong>.<br />

- Bachelor of Medicine and Bachelor of Surgery (National University of<br />

Singapore), MBA (University of Hull), The Wharton Advanced<br />

Management Program.<br />

Mr. Ng Tiak Soon<br />

Senior Management<br />

Independent Director - Appointed in November 2011.<br />

- Self employed consultant<br />

- Non-practicing member of the Institute of Certified Public Accountants,<br />

member of Association of Chartered Certified Accountants (UK), member<br />

of the Singapore Institute of Directors.<br />

Mr. Yee Pinh Jeremy CEO, Execuitive Director - Appointed CEO in June 2011, Executive Director since Jan 2004.<br />

- CFO of CBB prior to demerger in June 2011.<br />

- Bachelor of Arts in Economic and Social Studies (Victoria University of<br />

Manchester), Bachelor of Commerce (Murdoch University), Master of<br />

Commerce (University of Sydney), MBA (Nanyang Technological<br />

University), MBA (University of Chicago Booth School of Business).<br />

Ms. Gw endolene Yeo<br />

Teck Geok<br />

Ms. Cheung Wai Yee,<br />

Emily<br />

General Manager,<br />

Singapore<br />

General Manager, Hong<br />

Kong<br />

- Joined the group in Dec 2002.<br />

- Diploma in Mass Communication (Ngee Ann Polytechnic), Bachelor of<br />

Arts (Royal Melbourne Institute of Technology).<br />

- Joined the group in 2005.<br />

- Graduate Certificate in Business Administration, MBA (University of<br />

South Australia).<br />

Ms. Thet Hnin Yi Financial Controller - Joined group in June 2011.<br />

- Joined CBB as Senior Finance Manager in Dec 2007.<br />

- Diploma in Accountancy (Ngee Ann Polytechnic), a fellow of The<br />

Association of Chartered Certified Accountants (UK), non-practising<br />

member of the Institute of Certified Public Accountants of Singapore.<br />

Source: <strong>Cordlife</strong><br />

8 of 21

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Company Overview<br />

<strong>Cordlife</strong> <strong>Group</strong> (<strong>Cordlife</strong>) is a provider of cord blood and<br />

tissue banking services. <strong>Cordlife</strong> operates primarily in<br />

Singapore and Hong Kong, but offers indirect exposure to<br />

China with a 10% stake in China Cord Blood Corporation.<br />

The stock was listed on the mainboard of the Singapore<br />

Exchange on 29 th March 2012.<br />

Business Segments<br />

<strong>Cordlife</strong> generates approximately 75% and 25% of its group<br />

revenue from businesses in South Asia (mainly Singapore)<br />

and North Asia (mainly Hong Kong) respectively. South Asia<br />

contributes almost all the profits for the group with its<br />

business in North Asia only marginally profitable. Majority of<br />

its existing revenue is attributable to the cord blood banking<br />

services as the umbilical cord tissue banking services was<br />

only started recently (launched in Hong Kong: Mar 2011).<br />

This makes <strong>Cordlife</strong> a single product company that is highly<br />

dependent on the cord blood banking industry.<br />

Fig 14: Revenue by geography (S$’mn)<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

South Asia<br />

North Asia<br />

16.9<br />

5.7<br />

20.3<br />

Source: <strong>Cordlife</strong><br />

19.2<br />

21.7<br />

7.9 6.5 7.1<br />

FY09 FY10 FY11 FY12<br />

Fig 15: Profit by geography (S$’mn)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

(2)<br />

Source: <strong>Cordlife</strong>, PSR est.<br />

6.9<br />

9.0<br />

0.8 0.2<br />

8.3 7.5<br />

(0.1)<br />

South Asia<br />

North Asia<br />

(0.0)<br />

FY09 FY10 FY11 FY12<br />

*Profit contributions adjusted to remove contributions from<br />

associates and added IPO expenses to South Asia for FY12.<br />

What is cord blood banking?<br />

Cord blood is the blood that is removed from a baby’s<br />

umbilical cord at birth and is a rich source of stem cells. This<br />

provides an alternative to bone marrow as a source of stem<br />

cells that can be used for the treatment of various diseases.<br />

The risk free extraction is the main advantage of using cord<br />

blood, as compared to using bone marrow that requires a<br />

surgery. The process of collecting cord blood can be found<br />

on the company’s website: collection process.<br />

Subsequently, the cord blood that is extracted would need to<br />

be stored at very low temperatures for retrieval at a later<br />

date.<br />

9 of 21<br />

The cord blood that is stored is a perfect match for the baby,<br />

but it also has a high chance being compatible for the family<br />

members. Conceptually, we see it as similar to purchasing<br />

insurance for the baby and his/her family members.<br />

Public vs private cord blood banks<br />

Apart from private cord blood banking, such as services<br />

provided by <strong>Cordlife</strong>, public cord blood banks are also a<br />

source of cord blood. Cord blood samples that are stored at<br />

public banks are usually donated and could be used to<br />

support requirements from around the world. As such, unlike<br />

storing the person’s own cord blood at birth, a patient who<br />

requires cord blood for treatment may not be able to find a<br />

perfect match from public banks in the future.<br />

Singapore<br />

Singapore currently has 1 public and 2 private cord blood<br />

banking service providers. Singapore Cord Blood Bank<br />

(SCBB), the public cord blood bank in the country, holds<br />

inventories of 8,943 samples with diversity similar to the<br />

profile of Singapore’s ethnic groups. The samples held by<br />

the public bank are approximately 0.23% of the resident<br />

population (c.3.8mn) and 0.17% of the total population<br />

(c.5.3mn) in Singapore. <strong>Cordlife</strong> is the only AABB accredited<br />

private cord blood bank in Singapore.<br />

Fig 16: SCBB Cord Blood Inventory, as of 30 Sep 2012<br />

(‘k)<br />

Indian, 0.7 ,<br />

8%<br />

Others, 1.0 ,<br />

11%<br />

Malay, 1.7 ,<br />

19%<br />

Chinese, 5.5 ,<br />

62%<br />

Source: SCBB, PSR est.<br />

Fig 17: Singapore Resident Pop., as of 30 June 2012 (‘k)<br />

Others, 126 ,<br />

3%<br />

Indian, 351 ,<br />

9%<br />

Malay, 510 ,<br />

13%<br />

Chinese,<br />

2,832 , 75%<br />

Source: Singstat, PSR est.

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Population trends<br />

As with many developed nations, Singapore is currently<br />

experiencing a low level of fertility rate. At 2012’s Total<br />

Fertility Rate (TFR) of 1.28-1.30, Singapore is significantly<br />

below the replacement rate of 2.1. Consequently,<br />

Singapore’s government recently set a target to move the<br />

country’s TFR to 1.4-1.5 and had introduced an enhanced<br />

S$2bn “Marriage and Parenthood packages” to support this<br />

objective. Parents would receive a cash gift of S$6-8k for<br />

their newborn (1 st /2 nd : S$6k; 3 rd /4 th : S$8k) from the<br />

government and savings to a Child Development Account<br />

(CDA) would be matched dollar-for-dollar by S$6-18k (1 st /2 nd :<br />

S$6k; 3 rd /4 th : S$12k; >5 th : S$18k). This significantly<br />

subsidizes the cost of child rearing and benefits the private<br />

cord blood banking industry by supplementing the cost of<br />

using their services.<br />

Fig 18: Birth rates in Singapore<br />

55<br />

50<br />

45<br />

40<br />

35<br />

CY12<br />

CY11<br />

CY10<br />

CY09<br />

CY08<br />

CY07<br />

CY06<br />

CY05<br />

CY04<br />

CY03<br />

CY02<br />

CY01<br />

CY00<br />

CY99<br />

CY98<br />

CY97<br />

CY96<br />

CY95<br />

CY94<br />

CY93<br />

CY92<br />

CY91<br />

CY90<br />

Live birth in Singapore ('k), LHS<br />

TFR, RHS<br />

Source: SingStat<br />

42.6<br />

2.0<br />

1.9<br />

1.8<br />

1.7<br />

1.6<br />

1.5<br />

1.4<br />

1.3<br />

1.2<br />

1.1<br />

1.0<br />

Market share<br />

There is currently 2 private cord blood banking service<br />

providers in Singapore. While both <strong>Cordlife</strong> & StemCord do<br />

not breakdown the exact number of samples held in the<br />

country, <strong>Cordlife</strong> was estimated to have a market share of<br />

62% by deliveries in 2010. According to the company’s<br />

website StemCord stored more than 30k samples since<br />

2002, which is marginally lower than the > 40k samples held<br />

between Singapore and Hong Kong for <strong>Cordlife</strong>.<br />

Fig 19: Market share of private cord blood banks by<br />

deliveries in 2010 (‘k)<br />

Stemcord, 3.5<br />

, 38%<br />

<strong>Cordlife</strong>, 5.8 ,<br />

62%<br />

Source: <strong>Cordlife</strong>, PSR (for CY2010)<br />

10 of 21<br />

Hong Kong<br />

Hong Kong has 1 public and 5 private cord blood banking<br />

service providers. There is very limited information on Hong<br />

Kong Red Cross, the only public cord blood bank in the<br />

country. However, according to a news article on the South<br />

China Morning Post, dated 18 th Sep 2012, the bank stored<br />

about 3,600 samples and had been in operation since 1998.<br />

The number of samples held by the public bank is<br />

approximately 0.05% of the total population of Hong Kong<br />

(c.7.2mn).<br />

Population trends<br />

Similar to Singapore’s population trend, TFR in Hong Kong<br />

remained below replacement levels at 1.25 in 2012. The<br />

birth rates in Hong Kong have improved significantly due to<br />

the influx of mainland women giving birth in Hong Kong.<br />

Within this group, babies born in Hong Kong, due to<br />

mainland women whose spouses are not Hong Kong’s<br />

permanent residence, increased significantly over the years<br />

(2011: 35.7k vs 2001: 0.6k). This was due to a court ruling in<br />

2001 stating that babies born in Hong Kong to mainland<br />

nationals have a right of abode in the country. However, this<br />

trend of increasing birth rates in Hong Kong had put a<br />

significant strain on the resources in the country.<br />

Consequently, a policy to restrict mainland women from<br />

giving birth in Hong Kong was imposed (2012 quota: private<br />

hosp. - 31.0k; public hosp. - 3.4k). This restriction is<br />

probably the reason for a decline in birth rates in 2012,<br />

despite the seasonally stronger birth rates in the dragon<br />

year. The Hong Kong government tightened this regulation<br />

further in mid 2012 and imposed a “zero delivery quota”<br />

policy for mainland women whose spouse are not Hong<br />

Kong resident from 2013 onwards.<br />

Fig 20: Birth rates in Hong Kong<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

CY12<br />

CY11<br />

CY10<br />

CY09<br />

CY08<br />

CY07<br />

CY06<br />

CY05<br />

CY04<br />

CY03<br />

CY02<br />

CY01<br />

CY00<br />

CY99<br />

CY98<br />

CY97<br />

CY96<br />

CY95<br />

CY94<br />

CY93<br />

CY92<br />

CY91<br />

CY90<br />

Live birth in Hong Kong ('k), LHS<br />

TFR, RHS<br />

Source: HK Census & Statistics Dept<br />

Fig 21: Composition of live birth in Hong Kong<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Live birth due to Mainland women ('k)<br />

Live birth ex-Mainland woman ('k)<br />

% Mainland women<br />

Source: HK Census & Statistics Dept<br />

CY01<br />

CY02<br />

CY03<br />

CY04<br />

CY05<br />

91.3<br />

*Detailed breakdown of composition is not available for CY12.<br />

CY06<br />

CY07<br />

CY08<br />

CY09<br />

CY10<br />

CY11<br />

1.5<br />

1.4<br />

1.3<br />

1.2<br />

1.1<br />

1.0<br />

0.9<br />

0.8<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Market share<br />

There is currently 5 private cord blood banking service<br />

providers in Hong Kong. Based on 2010 figures, <strong>Cordlife</strong><br />

has a market share of 28% by deliveries in the year. Among<br />

these players, only the 3 largest players, Cryolife, <strong>Cordlife</strong><br />

and Healthbaby have attained AABB accreditation.<br />

Fig 22: Market share of private cord blood banks by<br />

deliveries in 2010 (‘k)<br />

Smart Cells &<br />

Asia Pacific<br />

Stem Cells,<br />

0.2 , 4%<br />

Cryolife, 1.2 ,<br />

23%<br />

Healthbaby,<br />

2.3 , 45%<br />

<strong>Cordlife</strong>, 1.5 ,<br />

28%<br />

Source: <strong>Cordlife</strong>, PSR (for CY2010)<br />

Low fertility rate in core markets<br />

According to data from Central Intelligence Agency (CIA),<br />

Hong Kong and Singapore have among the lowest fertility<br />

rates in the world. However, these countries tend to have a<br />

higher level of wealth and disposable income, which we<br />

opine is a more important gauge of cord blood banking<br />

adoption levels. According to data from World Bank,<br />

Singapore has the highest level of healthcare expenditure<br />

per capita in the markets relevant to <strong>Cordlife</strong>.<br />

Fig 23: Fertility rate<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

Philippines<br />

53 78 81 104 175 184 221 223 224<br />

3.10<br />

Malaysia<br />

2.61 2.55<br />

India<br />

Indonesia<br />

2.20<br />

Thailand<br />

1.66 1.55<br />

China<br />

Children Born per Woman<br />

Ranking<br />

Hong Kong^<br />

Source: CIA<br />

1.11 0.93 0.79<br />

Macao^<br />

Singapore<br />

*CIA’s measure of fertility rates could differ from national standards<br />

as a result of factors including data availability, assessment, and<br />

methods and protocols.<br />

11 of 21<br />

Fig 24: Healthcare exp. & GDP per capita, 2010 (US$)<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

Philippines<br />

Healthcare exp. per capita (US$), LHS<br />

GDP per capita (US$'k), RHS<br />

Source: World Bank, PSR<br />

77<br />

368<br />

Malaysia<br />

India<br />

54<br />

Indonesia<br />

77<br />

Thailand<br />

179 221<br />

China<br />

1,563<br />

Hong Kong^<br />

Macao^<br />

1,733<br />

Singapore<br />

^Healthcare expenditure data for Hong Kong estimated from HK<br />

DOH & data for Macao not available.<br />

Insurance penetration rate as a gauge<br />

We believe that cord blood banking is conceptually similar to<br />

life insurance policies. The “insured” pays a premium to<br />

receive a “payout” when a situation arose. However, there<br />

are two distinct differences. While insurance policies can be<br />

bought at anytime in a person’s life, the decision to adopt<br />

cord blood banking can only be made once in a person’s life<br />

(i.e. at birth). Hence, the decision to bank one’s cord blood is<br />

highly time sensitive. The second difference is that while the<br />

“payout” for insurance policies is money; the “payout” for<br />

cord blood banking is the opportunity to utilize one’s stem<br />

cell to save his/her life. Due to the conceptual similarity, we<br />

believe that one can use insurance penetration history as a<br />

guide to the potential for cord blood banking. As compared<br />

to a population of 5.3mn, 4.9mn lives were insured in<br />

Singapore at the end of 2012. The no. of lives insured as a<br />

proportion of population in Singapore trended higher over<br />

the years at a rate of 3.2% p.a. from 25% in 1991 to 92% in<br />

2012. Hence, if the adoption of private cord blood banking<br />

takes a similar path as that of insurance penetration, there<br />

would be significant upside to the 24% market penetration<br />

rate for Singapore in 2010.<br />

Fig 25: Lives Insured vs Population in Singapore<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

2012<br />

2011<br />

2010<br />

2009<br />

2008<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

2000<br />

1999<br />

1998<br />

1997<br />

1996<br />

1995<br />

1994<br />

1993<br />

1992<br />

1991<br />

No. of Lives Insured ('k)<br />

as % of Population<br />

Source: CEIC, PSR<br />

0%<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

We believe that our target price of S$0.84 is<br />

conservative for the following reasons:<br />

1) Market penetration assumed to stagnate from CY15E.<br />

As shown in the discussion of our modeling assumptions,<br />

we have conservatively assumed stagnant market<br />

penetration after CY15E (Singapore: 38%; Hong Kong: 21%)<br />

and prefer to leave further penetration beyond CY15E as an<br />

upside risk to our valuation of the stock.<br />

2) Potential introduction of Umbilical Cord Tissue<br />

Banking in Singapore, yet to be built in. Currently,<br />

<strong>Cordlife</strong> only offers umbilical cord tissue banking services in<br />

Hong Kong. In Feb 2013, the company announced that it<br />

has entered into a strategic alliance agreement with<br />

CordLabs Asia to co-operate on providing similar services<br />

across various countries. With management currently<br />

exploring the possibility of introducing this service in<br />

Singapore, we believe that this could open up an additional<br />

revenue stream in the near future. However, until there is<br />

greater clarity on adoption of this new product, we prefer to<br />

leave this future revenue stream out of our model.<br />

3) Conservative valuation of its stake in CCBC. We were<br />

conservative in using the market price of CCBC as our<br />

valuation inputs. Our valuation of <strong>Cordlife</strong> would have<br />

increased by S$0.10 to S$0.94, if we had used consensus<br />

target price of US$5.50 as our valuation input.<br />

Fig 26: Market Price of CCBC<br />

3.40<br />

3.20<br />

3.00<br />

2.80<br />

2.60<br />

2.40<br />

2.20<br />

2.00<br />

Mar-12<br />

Apr-12<br />

May-12<br />

3.20<br />

Jun-12<br />

Jul-12<br />

2.41<br />

Aug-12<br />

Source: Bloomberg<br />

Sep-12<br />

Oct-12<br />

Nov-12<br />

Dec-12<br />

Jan-13<br />

Feb-13<br />

Stock Price (US$)<br />

4) Potential acquisition of fast growing emerging assets<br />

from CBB not factored in. <strong>Cordlife</strong> has a Right of First<br />

Refusal (ROFR) for the acquisition of various operating<br />

assets in Philippines, Indonesia & India from CBB, should<br />

the company decide to divest. Acquisition of these entities<br />

would provide <strong>Cordlife</strong> with geographical diversification into<br />

emerging markets that have higher birth rates and lower<br />

market penetration. As observed from the recent results of<br />

CBB, the Philippines portfolio had turned profitable with its<br />

sales in 1HFY13 (A$1.3mn) almost matching that of FY12<br />

(A$1.4mn). This implies that cash burn rate in the emerging<br />

markets could slow as its units start to turn profitable. So,<br />

what price to pay these assets? We believe that a reference<br />

point for these assets would be CBB’s market value of<br />

c.S$11.6mn (A$8.6mn based on market price of A$0.050),<br />

which could be fully funded with less than 2yrs of operating<br />

cashflow.<br />

Mar-13<br />

Apr-13<br />

May-13<br />

Jun-13<br />

12 of 21<br />

Fig 27: Revenue of emerging market in CBB (A$’mn)<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

Philippines<br />

India<br />

Indonesia<br />

0.1<br />

0.5<br />

1.2<br />

1.7<br />

1.4<br />

3.4<br />

1.3 1.0 1.0 0.7<br />

Source: CBB<br />

1.3<br />

2.2<br />

FY10 FY11 FY12 HY13<br />

Fig 28: Profits of emerging market in CBB (A$’mn)<br />

0.5<br />

0.0<br />

(0.5)<br />

(1.0)<br />

(1.5)<br />

(2.0)<br />

(2.5)<br />

(3.0)<br />

(3.5)<br />

Source: CBB<br />

(0.7)<br />

(0.8)<br />

(0.6)<br />

(1.5)<br />

(0.9)<br />

(0.6)<br />

(1.0)<br />

(0.8)<br />

(0.4)<br />

FY10 FY11 FY12 HY13<br />

Fig 29: Market Price of CBB<br />

0.10<br />

0.08<br />

0.06<br />

0.04<br />

0.02<br />

0.00<br />

Mar-12<br />

Apr-12<br />

0.080<br />

May-12<br />

Jun-12<br />

Jul-12<br />

Aug-12<br />

Source: Bloomberg<br />

Sep-12<br />

Oct-12<br />

Nov-12<br />

Dec-12<br />

Jan-13<br />

0.030<br />

Feb-13<br />

Mar-13<br />

0.3<br />

(0.1)<br />

(0.2)<br />

Philippines<br />

India<br />

Indonesia<br />

Market Price (A$)<br />

Apr-13<br />

May-13<br />

Jun-13

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Key Drivers:<br />

We expect the number of live births in Singapore to<br />

moderate in CY13E to 38.0k, as we build in moderation after<br />

the seasonally stronger dragon year of 42.6k live births in<br />

CY12. In line with the long term population growth of<br />

Singapore, live births are assumed to increase at 1% a year.<br />

We modeled higher penetration rates and a 62% market<br />

share for <strong>Cordlife</strong> over the next few years and assumed that<br />

penetration rate sustain at 38% in CY15E and beyond.<br />

For the Hong Kong market, we expect live births at private<br />

hospitals to decline to 20.0k in CY13E due to restrictions on<br />

deliveries by mainland women as explained earlier. Similar<br />

to Singapore, live births are assumed to increase at 1% a<br />

year. We modeled a 28% market share and higher<br />

penetration rates over the next few years to a sustained<br />

level of 21% in CY15E and beyond.<br />

Our assumptions on the market penetration in Singapore<br />

and Hong Kong are in line with the market research report in<br />

<strong>Cordlife</strong>’s IPO prospectus by Deloitte & Touche Financial<br />

Advisory Services Limited.<br />

Fig 30: Key Model Assumptions<br />

13 of 21<br />

Key risks to our view:<br />

Market Penetration - While market penetration is<br />

expected to deepen for <strong>Cordlife</strong>’s core markets of<br />

Singapore and Hong Kong, actual increase in<br />

penetration rate may slow or not take place.<br />

Overpaying for emerging assets held by CBB - While<br />

acquisition of emerging assets held by CBB could<br />

provide growth beyond the matured markets, we believe<br />

that there is a risk of overpaying for them as it depends<br />

on the negotiation between the two parties.<br />

Regulatory - We believe that a change in regulatory<br />

regimes would have a significant impact on the business<br />

of <strong>Cordlife</strong>. For example, recent measures by the Hong<br />

Kong government to ban mainland women, who are not<br />

spouses of Hong Kong residents, from delivering in the<br />

country have effectively shrunk the number of live births<br />

and market size for the cord blood banking players.<br />

Model Build:<br />

Key assumptions CY13E CY14E CY15E CY16E CY17E CY18E CY19E CY20E CY21E CY22E CY23E CY24E<br />

Singapore<br />

Live Birth ('k) 38.0 38.4 38.8 39.2 39.5 39.9 40.3 40.7 41.1 41.6 42.0 42.4<br />

y-y (%) 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0%<br />

Penetration (%) 32.0% 35.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0%<br />

Cordblood bank deliveries ('k) 12.2 13.4 14.7 14.9 15.0 15.2 15.3 15.5 15.6 15.8 16.0 16.1<br />

<strong>Cordlife</strong> Market share (%) 62% 62% 62% 62% 62% 62% 62% 62% 62% 62% 62% 62%<br />

Hong Kong<br />

Live Birth ('k) 20.0 20.2 20.4 20.6 20.8 21.0 21.2 21.4 21.7 21.9 22.1 22.3<br />

y-y (%) 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0%<br />

Penetration (%) 16.9% 18.7% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0%<br />

Cordblood bank deliveries ('k) 3.4 3.8 4.3 4.3 4.4 4.4 4.5 4.5 4.5 4.6 4.6 4.7<br />

<strong>Cordlife</strong> Market share (%) 28% 28% 28% 28% 28% 28% 28% 28% 28% 28% 28% 28%<br />

Key model inputs FY13E FY14E FY15E FY16E FY17E FY18E FY19E FY20E FY21E FY22E FY23E FY24E<br />

Client delivery ('k) 8.4 8.9 9.9 10.4 10.5 10.6 10.7 10.8 10.9 11.0 11.1 11.2<br />

Units stored ('k) 49.3 58.2 68.1 78.5 89.0 99.6 110.3 121.1 132.0 143.0 154.1 165.4<br />

Utilisation (%) 6.9% 8.2% 9.6% 11.1% 12.5% 14.0% 15.5% 17.1% 18.6% 20.1% 21.7% 23.3%<br />

Revenue (S$'mn) 33.8 36.8 41.2 44.4 46.2 48.1 50.0 51.9 53.8 55.8 57.7 59.7<br />

y-y (%) 17.6% 8.9% 11.8% 7.7% 4.2% 4.0% 3.9% 3.8% 3.7% 3.6% 3.5% 3.4%<br />

Gross Margin (%) 70.0% 70.5% 71.0% 71.0% 71.0% 71.0% 71.0% 71.0% 71.0% 71.0% 71.0% 71.0%<br />

Gross Profit (S$'mn) 23.7 26.0 29.3 31.5 32.8 34.1 35.5 36.8 38.2 39.6 41.0 42.4<br />

FCF (S$'mn) 7.9 9.6 9.6 10.2 10.6 11.2 11.7 12.3 12.8 13.4 13.9<br />

Terminal Value (S$'mn) 169.3<br />

WACC (%) 9.0%<br />

Terminal g (%) 1.0%<br />

Discounted FCF (S$'mn) 7.5 8.4 7.7 7.5 7.2 7.0 6.7 6.4 6.2 80.6<br />

Sum of Discounted FCF (S$'mn) 145.3<br />

Source: PSR est.

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Scenarios<br />

Bullish view - Dreaming of the upside… What if cord<br />

blood banking continues to gain popularity? As with every<br />

trend, there are always tipping points that could result in<br />

mass adoption. For example, during initial introduction of<br />

mobile phones, not many would have imagined a market<br />

penetration of >100% in Singapore. In crafting our bullish<br />

view on the stock, we assumed that market penetration<br />

would continue to deepen over the next decade and sustain<br />

at 60% in Singapore and 40% in Hong Kong by 2022. We<br />

also used consensus TP of US$5.50/shr to value <strong>Cordlife</strong>’s<br />

stake in China Cord Blood. This valuation method would<br />

drive a target price of S$1.12.<br />

Fig 31: Bullish Valuation presents significant upside<br />

Sum of the parts Value Percent Per shr Remarks<br />

(Bullish view ) S$'mn S$<br />

Core Value of Company, DCF 185.2 71% 0.80 DCF (WACC: 9.0%, terminal g: 1%)<br />

Stake in China Cord Blood Corp. 50.3 19% 0.22 Consensus TP (US$5.50/shr)<br />

Enterprise Value 235.5 91% 1.01 Basis: FY14E<br />

Add: Investments 19.9 8% 0.09<br />

Add: Cash 10.1 4% 0.04<br />

Less: Debt (5.5) -2% (0.02)<br />

Equity Value 260.0 100% 1.12<br />

Outstanding no. of shares ('mn) 232.7<br />

Target Price (S$') 1.12<br />

Current Market Price (S$) 0.645<br />

F12M DPS (S$) 0.025<br />

Price upside (%) 73.6%<br />

Dividend yield (%) 3.9%<br />

Total return (%)<br />

Source: PSR est.<br />

77.5%<br />

Fig 32: Bearish Valuation close to current market price<br />

Sum of the parts Value Percent Per shr Remarks<br />

(Bearish view ) S$'mn S$<br />

Core Value of Company, DCF 100.5 67% 0.43 DCF (WACC: 9.0%, terminal g: 1%)<br />

Stake in China Cord Blood Corp. 22.0 15% 0.09 Low est price in 1yr (US$2.41/shr)<br />

Enterprise Value 122.6 82% 0.53 Basis: FY14E<br />

Add: Investments 19.9 13% 0.09<br />

Add: Cash 12.9 9% 0.06<br />

Less: Debt (5.5) -4% (0.02)<br />

Equity Value 149.9 100% 0.64<br />

Outstanding no. of shares ('mn) 232.7<br />

Target Price (S$') 0.64<br />

Current Market Price (S$) 0.645<br />

F12M DPS (S$) 0.025<br />

Price upside (%) -0.8%<br />

Dividend yield (%) 3.9%<br />

Total return (%)<br />

Source: PSR est.<br />

3.1%<br />

14 of 21<br />

Bearish view- What if the forecasted penetration did not<br />

materialize? We should also exercise caution and think<br />

about the downside. In this scenario, we assume that all the<br />

bullish views about increasing market penetration did not<br />

materialize and penetration levels stays at that of CY10<br />

(Singapore: 24.0%; Hong Kong 11.5%). We have also used<br />

the 1 year low of China Cord Blood of US$2.41/shr in this<br />

valuation model. This would lead to a valuation that is close<br />

to the current market price of S$0.64.

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

FYE June FY11 FY12 FY13F FY14F FY15F<br />

Valuation Ratios<br />

P/E (X), adj. 17.7 17.0 16.0 15.0 13.3<br />

P/B (X) n.m. 2.1 2.0 1.9 1.7<br />

EV/EBITDA (X), adj. 16.2 17.6 15.0 13.4 11.5<br />

Dividend Yield (%) n.m. 5.9% 3.9% 4.2% 4.7%<br />

Per share data (SGD)<br />

EPS, reported n.m. 0.030 0.052 0.043 0.048<br />

EPS, adj. 0.036 0.038 0.040 0.043 0.048<br />

DPS n.m. 0.038 0.025 0.027 0.030<br />

BVPS n.m. 0.306 0.330 0.348 0.369<br />

Grow th & Margins (%)<br />

Grow th<br />

Revenue -8.8% 12.1% 17.6% 8.9% 11.8%<br />

EBITDA -9.5% -7.7% 17.0% 11.9% 16.9%<br />

EBIT -11.5% -9.4% 15.1% 12.0% 19.3%<br />

Net Income, adj. 2.5% 4.2% 6.5% 6.2% 13.0%<br />

Margins<br />

EBITDA margin 34.3% 28.2% 28.1% 28.8% 30.2%<br />

EBIT margin 32.0% 25.8% 25.3% 26.0% 27.8%<br />

Net Profit Margin 33.0% 24.1% 35.7% 27.1% 27.4%<br />

Key Ratios<br />

ROE (%) 23.0% 12.4% 16.3% 12.7% 13.5%<br />

ROA (%) 14.8% 9.5% 12.5% 9.4% 10.0%<br />

Net Debt/(Cash) (3) (10) (3) (5) (8)<br />

Net Gearing (X) Net Cash Net Cash Net Cash Net Cash Net Cash<br />

Income Statement (SGD mn)<br />

Revenue 25.7 28.8 33.8 36.8 41.2<br />

EBITDA 8.8 8.1 9.5 10.6 12.4<br />

Depreciation & Amortisation (0.6) (0.7) (0.9) (1.0) (1.0)<br />

EBIT 8.2 7.4 8.6 9.6 11.4<br />

Net Finance (Expense)/Income 0.0 0.2 0.5 0.4 0.1<br />

Other items 0.0 (1.9) 2.7 0.0 0.0<br />

Associates & JVs 1.7 2.1 2.0 2.0 2.1<br />

Profit Before Tax 9.9 7.8 13.7 12.0 13.6<br />

Taxation (1.5) (0.9) (1.6) (2.0) (2.3)<br />

Profit After Tax 8.5 6.9 12.1 10.0 11.3<br />

Non-controlling Interest 0.0 0.0 0.0 0.0 0.0<br />

Net Income, reported 8.5 6.9 12.1 10.0 11.3<br />

Net Income, adj. 8.5 8.8 9.4 10.0 11.3<br />

Source: PSR<br />

15 of 21

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

FYE June FY11 FY12 FY13F FY14F FY15F<br />

Balance Sheet (SGD mn)<br />

PPE 4.3 6.1 10.1 9.6 9.4<br />

Intangibles 0.0 0.0 0.0 0.0 0.0<br />

Associates & JVs 15.1 17.7 27.4 29.4 31.5<br />

Investments 0.2 13.2 13.6 13.9 11.7<br />

Others 22.9 24.3 26.0 28.3 31.6<br />

Total non-current assets 42.5 61.2 77.1 81.3 84.2<br />

Inventories 0.2 0.4 0.4 0.4 0.4<br />

Accounts Receivables 7.1 9.2 10.0 10.9 12.2<br />

Investments 1.3 6.0 6.0 6.0 6.0<br />

Cash 4.0 12.9 8.5 10.1 14.0<br />

Others 0.3 0.5 0.5 0.5 0.5<br />

Total current assets 12.9 29.1 25.5 27.9 33.1<br />

Total Assets 55.4 90.4 102.6 109.2 117.4<br />

Short term loans 0.1 0.1 0.2 0.2 0.2<br />

Accounts Payables 4.3 3.9 5.5 5.9 6.5<br />

Others 3.7 4.3 4.3 4.3 4.3<br />

Total current liabilities 8.0 8.3 9.9 10.4 10.9<br />

Long term loans 0.8 2.5 5.3 5.3 5.3<br />

Others 6.0 8.5 10.7 12.6 15.2<br />

Total non-current liabilities 6.8 10.9 16.0 17.9 20.5<br />

Non-controlling interest 0.0 0.0 0.0 0.0 0.0<br />

Shareholder Equity 40.6 71.2 76.7 80.9 85.9<br />

Cashflow Statements (SGD mn)<br />

CFO<br />

PBT 9.9 7.8 13.7 12.0 13.6<br />

Adjustments (1.2) 0.5 (4.2) (1.4) (1.2)<br />

Cash from ops before WC changes 8.7 8.3 9.5 10.6 12.4<br />

WC changes 0.6 (0.6) 1.3 (0.8) (1.4)<br />

Cash generated from ops 9.4 7.7 10.8 9.8 11.0<br />

Taxes paid, net (1.4) (1.7) (1.6) (2.0) (2.3)<br />

Interest paid (0.0) (0.0) (0.1) (0.2) (0.2)<br />

Cashflow from ops 7.9 6.0 9.0 7.6 8.5<br />

CFI<br />

CAPEX, net (3.1) (2.4) (5.0) (0.5) (0.8)<br />

Dividends from associates & JVs 0.0 0.0 0.0 0.0 0.0<br />

Dividends/Interest from Investments 0.1 0.1 0.3 0.3 0.3<br />

Purchase/sale of investments (1.3) (17.7) (0.0) (0.0) 2.2<br />

Investments in subs & associates 0.0 0.0 (5.1) 0.0 0.0<br />

Others 0.0 0.0 0.0 0.0 0.0<br />

Cashflow from investments (4.3) (20.0) (9.9) (0.3) 1.7<br />

CFF<br />

Share issuance 0.0 26.0 0.0 0.0 0.0<br />

Purchase of treasury shares 0.0 0.0 0.0 0.0 0.0<br />

Loans, net of repayments 0.8 1.7 2.9 0.0 0.0<br />

Dividends to minority interests 0.0 0.0 0.0 0.0 0.0<br />

Dividends to shareholders & capital reduction 0.0 (4.7) (6.5) (5.8) (6.3)<br />

Others (8.1) 0.0 0.0 0.0 0.0<br />

Cashflow from financing (7.3) 23.0 (3.6) (5.8) (6.3)<br />

Net change in cash (3.6) 9.0 (4.4) 1.5 3.9<br />

Effects of exchange rates 0.3 (0.0) 0.0 0.0 0.0<br />

CCE, end 4.0 12.9 8.5 10.1 14.0<br />

Source: PSR<br />

16 of 21

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Ratings History<br />

0.90<br />

0.80<br />

0.70<br />

0.60<br />

0.50<br />

0.40<br />

1<br />

2<br />

3<br />

4<br />

5<br />

Mar-12<br />

Market Price<br />

Target Price<br />

Jun-12<br />

Sep-12<br />

Source: Bloomberg, PSR<br />

PSR Rating System<br />

Total Returns Recommendation Rating<br />

> +20% Buy 1<br />

+5% to +20% Accumulate 2<br />

-5% to +5% Neutral 3<br />

-5% to -20% Reduce 4<br />

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Important Information<br />

This publication is prepared by <strong>Phillip</strong> <strong>Securities</strong> Research <strong>Pte</strong> <strong>Ltd</strong>., 250 North Bridge Road, #06-00, Raffles City<br />

Tower, Singapore 179101 (Registration Number: 198803136N), which is regulated by the Monetary Authority of<br />

Singapore (“<strong>Phillip</strong> <strong>Securities</strong> Research”). By receiving or reading this publication, you agree to be bound by the terms<br />

and limitations set out below.<br />

This publication has been provided to you for personal use only and shall not be reproduced, distributed or published<br />

by you in whole or in part, for any purpose. If you have received this document by mistake, please delete or destroy it,<br />

and notify the sender immediately. <strong>Phillip</strong> <strong>Securities</strong> Research shall not be liable for any direct or consequential loss<br />

arising from any use of material contained in this publication.<br />

The information contained in this publication has been obtained from public sources, which <strong>Phillip</strong> <strong>Securities</strong> Research<br />

has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions<br />

(collectively, the “Research”) contained in this publication are based on such information and are expressions of belief<br />

of the individual author or the indicated source (as applicable) only. <strong>Phillip</strong> <strong>Securities</strong> Research has not verified this<br />

information and no representation or warranty, express or implied, is made that such information or Research is<br />

accurate, complete, appropriate or verified or should be relied upon as such. Any such information or Research<br />

contained in this publication is subject to change, and <strong>Phillip</strong> <strong>Securities</strong> Research shall not have any responsibility to<br />

maintain or update the information or Research made available or to supply any corrections, updates or releases in<br />

connection therewith. In no event will <strong>Phillip</strong> <strong>Securities</strong> Research or persons associated with or connected to <strong>Phillip</strong><br />

<strong>Securities</strong> Research, including but not limited its officers, directors, employees or persons involved in the preparation<br />

or issuance of this report, (i) be liable in any manner whatsoever for any consequences (including but not limited to<br />

any special, direct, indirect, incidental or consequential losses, loss of profits and damages) of any reliance or usage<br />

of this publication or (ii) accept any legal responsibility from any person who receives this publication, even if it has<br />

been advised of the possibility of such damages. You must make the final investment decision and accept all<br />

responsibility for your investment decision, including, but not limited to your reliance on the information, data and/or<br />

other materials presented in this publication.<br />

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this material are as of the date<br />

indicated and are subject to change at any time without prior notice.<br />

Past performance of any product referred to in this publication is not indicative of future results.<br />

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This<br />

publication should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own<br />

independent verification and exercise of judgment. The fact that this publication has been made available constitutes<br />

neither a recommendation to enter into a particular transaction, nor a representation that any product described in this<br />

material is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may<br />

be described in this publication involve significant risks and may not be suitable for all investors, and that any decision<br />

to enter into transactions involving such products should not be made, unless all such risks are understood and an<br />

independent determination has been made that such transactions would be appropriate. Any discussion of the risks<br />

contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete<br />

discussion of such risks.<br />

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any<br />

decision to purchase any product mentioned in this research should take into account existing public information,<br />

including any registered prospectus in respect of such product.<br />

<strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or connected to <strong>Phillip</strong> <strong>Securities</strong> Research, including but not<br />

limited to its officers, directors, employees or persons involved in the preparation or issuance of this report, may<br />

provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not<br />

limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting<br />

activities), brokerage or securities trading activities. <strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or<br />

connected to <strong>Phillip</strong> <strong>Securities</strong> Research, including but not limited to its officers, directors, employees or persons<br />

involved in the preparation or issuance of this report, may have participated in or invested in transactions with the<br />

issuer(s) of the securities mentioned in this publication, and may have performed services for or solicited business<br />

from such issuers. Additionally, <strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or connected to <strong>Phillip</strong><br />

<strong>Securities</strong> Research, including but not limited to its officers, directors, employees or persons involved in the<br />

18 of 21

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

preparation or issuance of this report, may have provided advice or investment services to such companies and<br />

investments or related investments, as may be mentioned in this publication.<br />

<strong>Phillip</strong> <strong>Securities</strong> Research or persons associated with or connected to <strong>Phillip</strong> <strong>Securities</strong> Research, including but not<br />

limited to its officers, directors, employees or persons involved in the preparation or issuance of this report may, from<br />

time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase<br />

or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other<br />

compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars<br />

and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign<br />

currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price<br />

or income return of the investment.<br />

To the extent permitted by law, <strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or connected to <strong>Phillip</strong><br />

<strong>Securities</strong> Research, including but not limited to its officers, directors, employees or persons involved in the<br />

preparation or issuance of this report, may at any time engage in any of the above activities as set out above or<br />

otherwise hold a interest, whether material or not, in respect of companies and investments or related investments,<br />

which may be mentioned in this publication. Accordingly, information may be available to <strong>Phillip</strong> <strong>Securities</strong> Research,<br />

or persons associated with or connected to <strong>Phillip</strong> <strong>Securities</strong> Research, including but not limited to its officers,<br />

directors, employees or persons involved in the preparation or issuance of this report, which is not reflected in this<br />

material, and <strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or connected to <strong>Phillip</strong> <strong>Securities</strong> Research,<br />

including but not limited to its officers, directors, employees or persons involved in the preparation or issuance of this<br />

report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following<br />

its publication. <strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or connected to <strong>Phillip</strong> <strong>Securities</strong> Research,<br />

including but not limited its officers, directors, employees or persons involved in the preparation or issuance of this<br />

report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of<br />

this material.<br />

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person<br />

or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the<br />

applicable law or regulation or which would subject <strong>Phillip</strong> <strong>Securities</strong> Research to any registration or licensing or other<br />

requirement, or penalty for contravention of such requirements within such jurisdiction.<br />

Section 27 of the Financial Advisers Act (Cap. 110) of Singapore and the MAS Notice on Recommendations on<br />

Investment Products (FAA-N01) do not apply in respect of this publication.<br />

This material is intended for general circulation only and does not take into account the specific investment objectives,<br />

financial situation or particular needs of any particular person. The products mentioned in this material may not be<br />

suitable for all investors and a person receiving or reading this material should seek advice from a professional and<br />

financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such<br />

products, taking into account the specific investment objectives, financial situation or particular needs of that person,<br />

before making a commitment to invest in any of such products.<br />

Please contact <strong>Phillip</strong> <strong>Securities</strong> Research at [65 65311240] in respect of any matters arising from, or in connection<br />

with, this document.<br />

This report is only for the purpose of distribution in Singapore.<br />

19 of 21

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Contact Information (Singapore Research Team)<br />

Chan Wai Chee Joshua Tan Derrick Heng<br />

CEO, Research Head of Research Deputy Head of Research<br />

Special Opportunities Global Macro, Asset Strategy<br />

SG Equity Strategist &<br />

Transport<br />

+65 6531 1231 +65 6531 1249 +65 6531 1221<br />

yebo@phillip.com.sg joshuatan@phillip.com.sg derrickhengch@phillip.com.sg<br />

Go Choon Koay, Bryan Ken Ang Ng Weiwen<br />

Investment Analyst Investment Analyst Macro Analyst<br />

Property Financials, Telecoms Global Macro, Asset Strategy<br />

+65 6531 1792 +65 6531 1793 +65 6531 1735<br />

gock@phillip.com.sg kenangwy@phillip.com.sg ngww@phillip.com.sg<br />

Roy Chen Nicholas Ong Research Assistant<br />

Macro Analyst Investment Analyst General Enquiries<br />

Global Macro, Asset Strategy Commodities, Offshore & Marine +65 6531 1240 (Phone)<br />

+65 6531 1535 +65 6531 5440 research@phillip.com.sg<br />

roychencz@phillip.com.sg nicholasonghg@phillip.com.sg<br />

20 of 21

<strong>Cordlife</strong> <strong>Group</strong> <strong>Ltd</strong><br />

Singapore Equities Research<br />

8 April 2013<br />

Contact Information (Regional Member Companies)<br />

SINGAPORE<br />

<strong>Phillip</strong> <strong>Securities</strong> <strong>Pte</strong> <strong>Ltd</strong><br />

Raffles City Tower<br />

250, North Bridge Road #06-00<br />

Singapore 179101<br />

Tel +65 6533 6001<br />

Fax +65 6535 6631<br />

Website: www.poems.com.sg<br />

HONG KONG<br />

<strong>Phillip</strong> <strong>Securities</strong> (HK) <strong>Ltd</strong><br />

Exchange Participant of the Stock Exchange of Hong Kong<br />

11/F United Centre 95 Queensway<br />

Hong Kong<br />

Tel +852 2277 6600<br />

Fax +852 2868 5307<br />

Websites: www.phillip.com.hk<br />

INDONESIA<br />

PT <strong>Phillip</strong> <strong>Securities</strong> Indonesia<br />

ANZ Tower Level 23B,<br />

Jl Jend Sudirman Kav 33A<br />

Jakarta 10220 – Indonesia<br />

Tel +62-21 5790 0800<br />

Fax +62-21 5790 0809<br />

Website: www.phillip.co.id<br />

THAILAND<br />

<strong>Phillip</strong> <strong>Securities</strong> (Thailand) Public Co. <strong>Ltd</strong><br />

15th Floor, Vorawat Building,<br />

849 Silom Road, Silom, Bangrak,<br />

Bangkok 10500 Thailand<br />

Tel +66-2 6351700 / 22680999<br />

Fax +66-2 22680921<br />

Website www.phillip.co.th<br />