Singapore Banking Sector - Phillip Securities Pte Ltd

Singapore Banking Sector - Phillip Securities Pte Ltd

Singapore Banking Sector - Phillip Securities Pte Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

Results Season Takeaways<br />

Report type: Update<br />

<strong>Sector</strong> Overview<br />

The <strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong> provides traditional lending<br />

and depository functions, as well as other services in the<br />

areas of commercial banking, financial advisory, asst<br />

management, insurance broking and capital market<br />

services.<br />

Post Results Highlight<br />

Non Interest income<br />

Non Interest Income beat expectations due to strong<br />

performance of net trading income<br />

Net trading income likely due to strong performances in<br />

indices in 1Q12 leading higher valuation gains<br />

Strong performances unlikely to be repeated in 2Q12 or<br />

FY12, given currently macroeconomic uncertainties.<br />

Net Interest Margins<br />

NIMs improved 1-4bps in 1Q12, with OCBC’s NIMs<br />

growth weakest at 1bps and DBS strongest at 4bps<br />

DBS and OCBC guides possible upside potentials while<br />

UOB guides that NIMs may have peaked<br />

We expect NIMs to remain around current range<br />

Loans growth outlook<br />

Loans growth have slowed as guided by Managements<br />

General Commerce loans slow due to decrease in RMB<br />

appreciation driven trades, but expected to remain<br />

relatively strong for the rest of FY2012<br />

Strong growth of USD deposits to benefit growth of trade<br />

finance business for UOB and DBS<br />

We expect loans to SMEs to drive loans growth for<br />

FY2012, and contributing to growth of non-interest<br />

income<br />

Investment actions<br />

Based on 5 year historical price to book, all three banks are<br />

below historical mean PB ratio, possibly indicating cheap<br />

pricing based on valuations. While uncertainties in the<br />

current macroeconomic conditions continue to suppress<br />

prices, we think that DBS will outperform its local peers with<br />

continued growth and strong performance. We rate DBS as<br />

“Accumulate” while maintaining our “Neutral” call on UOB<br />

and OCBC.<br />

MICA (P) 012/01/2012<br />

Ref. No.: SG2012_0136 1 of 10<br />

<strong>Phillip</strong> <strong>Securities</strong> Research <strong>Pte</strong> <strong>Ltd</strong><br />

18 May 2012<br />

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

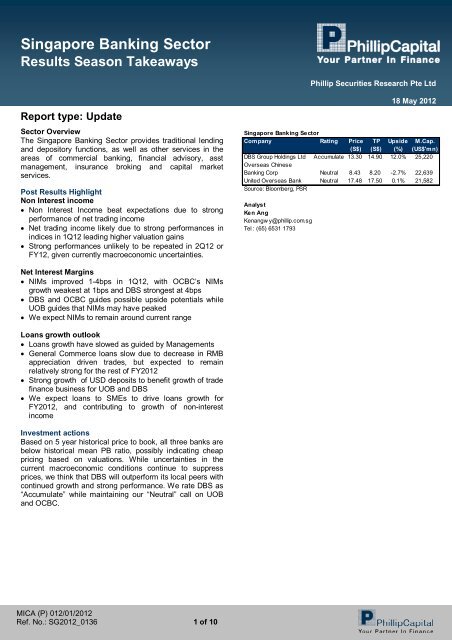

Company Rating Price TP Upside M.Cap.<br />

(S$) (S$) (%) (US$'mn)<br />

DBS Group Holdings <strong>Ltd</strong> Accumulate 13.30 14.90 12.0% 25,220<br />

Overseas Chinese<br />

<strong>Banking</strong> Corp Neutral 8.43 8.20 -2.7% 22,639<br />

United Overseas Bank Neutral 17.48 17.50 0.1% 21,582<br />

Source: Bloomberg, PSR<br />

Analyst<br />

Ken Ang<br />

Kenangw y@phillip.com.sg<br />

Tel : (65) 6531 1793

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

<strong>Singapore</strong> Equities Research<br />

18 May 2012<br />

Earnings surprise largely attributed to likely nonrecurring<br />

strong performance of net trading income<br />

Fig 1: Strong performance of Indices supported net<br />

trading income in 1Q12, but largely flat since then<br />

FTSE Straits Times Index – trending downwards since<br />

1Q12, expected to be relatively flat for rest of FY2012<br />

FTSE Bursa Malaysia KLCI – Growth may be further<br />

stimulated with possible policy rate cuts<br />

Indonesia Sharia Stock Index – higher highs since 1Q12,<br />

expected to perform relatively stronger than the STI<br />

Thailand SET Index– higher highs since 1Q12, expected to<br />

perform relatively stronger than the STI<br />

Source: bigcharts.marketwatch.com, <strong>Phillip</strong> <strong>Securities</strong> Research<br />

2 of 10<br />

Higher trading income contributed largely to the positive<br />

earnings surprise. Trading income generally refers to<br />

income from customer flow of treasury products, and from<br />

trading activities including realized gains from sale of AFS<br />

securities, and unrealized valuation gains on other products<br />

such as FVTPL. The strong performances of the indices in<br />

the Asean region may have supported the stronger net<br />

trading income through higher equity valuation gains, and<br />

greater opportunities to realize gains on AFS.<br />

Moving forward, our strategist believes that while the market<br />

outlook for export dependant countries such as <strong>Singapore</strong><br />

and Taiwan would be rather flat, countries such as Malaysia,<br />

Indonesia and Thailand are expected to experience<br />

relatively better economic growth. For Malaysia, given the<br />

lower and more stable inflation rate, growth may be further<br />

stimulated with policy rate cuts. This may benefit bonds due<br />

to their inverse correlations with interest rates, while equity<br />

securities perform in tandem with the Malaysian market.<br />

However, as observed from the graphs in Fig 1, it is unlikely<br />

for 1Q12’s strong net trading income to be repeated in 2Q12<br />

and likely for the rest of FY2012, other than realizing current<br />

valuation gains on AFS. Downward potentials to net trading<br />

income may arise from further slowdown in the global<br />

economy or from adverse developments on the debt crisis in<br />

Europe. We are unable to do a comparison between the<br />

three banks due to lack of disclosure by the banks.<br />

NIMs improved in 1Q12 from better loans pricing – likely<br />

to be stable and remain within current range for FY2012<br />

Fig 2: NIMS have been trending downwards but<br />

seems to have bottomed in 3Q11<br />

2.25<br />

2.15<br />

2.05<br />

1.95<br />

1.85<br />

1.75<br />

1.65<br />

OCBC DBS<br />

UOB<br />

2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12<br />

Source: Company data, <strong>Phillip</strong> <strong>Securities</strong> Research<br />

NIMs have expanded across the three banks in 1Q12, with<br />

DBS the strongest at 4bps, and OCBC weakest at 1bp.<br />

UOB continued its strong rebound, increasing 3bps to<br />

register a commendable 9bps increase since hitting lows in<br />

3Q11. As previously highlighted in our 4Q11 results season<br />

takeaway report, UOB’s increase in NIMS is likely due to the<br />

offering of higher maturity loans, therefore commanding a<br />

liquidity premium. However, longer maturity loans also pose<br />

higher interest rate risks (for fixed rate loans) and credit risks.<br />

DBS and OCBC has commented that there may be potential<br />

for further NIMs expansion, while UOB guided that NIMs<br />

may have peaked. With UOB’s main overseas markets<br />

being in countries with relatively better market outlooks such<br />

as Malaysia, Indonesia and Thailand, we prefer UOB for its<br />

current high NIMs ability to increase NIMs significantly.

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

<strong>Singapore</strong> Equities Research<br />

18 May 2012<br />

Loans growth expected to gather momentum from<br />

slower 1Q12<br />

Fig 3: Q-Q Loans growth momentum slows in 1Q12<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

-2%<br />

OCBC DBS<br />

UOB Total<br />

2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12<br />

Fig 4: Q-Q Total loans growth among local banks<br />

negative in a few industries, but remain relatively<br />

strong in housing, FIs, Professional & private loans<br />

Total loans q-q grow th 2Q11 3Q11 4Q11 1Q12<br />

Agriculture<br />

-4.0% 9.1% 18.2% 1.3%<br />

Manufacturing<br />

12.0% 5.0% 7.2% 2.4%<br />

Building and construction 3.8% 8.4% 8.0% 1.8%<br />

General commerce<br />

24.0% 20.9% 1.9% -1.2%<br />

Transport<br />

6.1% 4.7% 4.4% -2.5%<br />

Financial institutions<br />

3.2% 9.3% 1.0% 4.9%<br />

Professional and private (business) 7.0% 3.0% 7.5% 2.1%<br />

Others<br />

10.6% 5.3% 0.3% -4.8%<br />

Housing<br />

3.0% 4.8% 3.6% 3.1%<br />

Total loans<br />

7.6% 8.0% 4.2% 1.3%<br />

Source: Company data, <strong>Phillip</strong> <strong>Securities</strong> Research<br />

Loans growth momentum has slowed, but remains positive<br />

for all three banks on an average loan balance basis. With<br />

similar guidance of low teens loans growth, we expect<br />

growth to increase for the next few quarters. We note that<br />

current gross balances were likely reduced due to the<br />

appreciation of the <strong>Singapore</strong> Dollar in 1Q12 against the<br />

Asian currencies.<br />

Fig 5: General Commerce loans VS Total Loans<br />

Growth – growth may continue in FY2012<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

OCBC DBS<br />

UOB Total<br />

2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12<br />

Source: Company data, <strong>Phillip</strong> <strong>Securities</strong> Research<br />

General Commerce (GC) loans have slowed, registering its<br />

first negative q-q growth since 3Q09, based on the total GC<br />

loans across the three banks. OCBC’s CEO Samuel Tsien<br />

has guided that the drop was due to a decrease in demand<br />

from the RMB appreciation driven trade financing by<br />

customers from China, as written in our OCBC 1Q12 results<br />

report dd 11 May 2012.<br />

3 of 10<br />

We expect GC loans to continue its growth in FY2012 as 1)<br />

New opportunities have risen from the deleveraging of<br />

global banks as highlighted in our <strong>Sector</strong> reports. 2)<br />

Success of <strong>Singapore</strong>’s Global Trader Program in increasing<br />

trading activities with <strong>Singapore</strong> as companies’ regional<br />

base. 3) An increase in intra Asia trade volumes.<br />

Due to the attractive returns, short term commitments and<br />

safe quality of assets as these loans are typically fully<br />

collateralized, we expect General Commerce to continue<br />

healthy loans growth in FY12. The three banks have also<br />

built up a larger funding base of USD deposits and<br />

wholesale funding, giving them the liquidity required to<br />

increase USD denominated lending.<br />

Fig 6: USD LDR continues to decrease as banks<br />

boost USD liquidity through higher deposits (UOB<br />

figs. not available)<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

0<br />

OCBC US$ DBS US$<br />

OCBC LDR DBS LDR<br />

2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12<br />

Source: Company data, <strong>Phillip</strong> <strong>Securities</strong> Research<br />

180%<br />

170%<br />

160%<br />

150%<br />

140%<br />

130%<br />

120%<br />

110%<br />

100%<br />

DBS continues to enjoy an advantage in General commerce<br />

loans due to a larger and more established presence, while<br />

UOB may perform better than OCBC due to better liquidity<br />

management based on the LDR ratios.<br />

Rise of the SMEs – <strong>Singapore</strong> and Abroad<br />

Based on SPRING <strong>Singapore</strong>, 99% of all enterprises in<br />

<strong>Singapore</strong> are SMEs, contributing over 50% of <strong>Singapore</strong>’s<br />

GDP. Growth is likely further spurred by the low interest rate<br />

environment, and increase in intra Asian trades as the<br />

neighboring Asian countries continue to grow, although at a<br />

slower pace. The local banks have stepped in, increasing<br />

efforts to provide loans and transaction banking services,<br />

including trade financing and cash management services.<br />

While competition remains stiff for MNCs and larger SMEs,<br />

the relatively smaller sized SMEs are relatively underserved<br />

and provide opportunities for banks. Transaction <strong>Banking</strong> is<br />

especially lucrative given the potential fees and<br />

commissions and lower capital requirements.<br />

Key risks for the <strong>Sector</strong><br />

A worsening global economy may result in rise of NPLs and<br />

credit costs, as affected customers, especially SMEs and<br />

unsecured consumer loans, default on loan repayments.<br />

This may result in reduced net profits.<br />

The return of US banks flushed with USD liquidity, as<br />

suggested by OCBC’s CEO, re-entering the Asian markets<br />

may provide competition to the <strong>Singapore</strong> banks and<br />

increase NIMS pressure in the region.<br />

90%

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

<strong>Singapore</strong> Equities Research<br />

18 May 2012<br />

Com pany Rating FYE Price TP Upside Market Ent. Market Ent.<br />

Equity Multiple (X) Dividend Yield (%)<br />

Market price as of:<br />

Cap. Value Cap. Value Net Incom e Book Value<br />

18-May-12 (%) (S$'m n) (S$'m n) (US$'mn)(US$'mn) FY10 FY11 FY12E FY10 FY11 FY12E FY10 FY11 FY12E<br />

DBS Group Holdings <strong>Ltd</strong> Accumulate Dec 13.30 14.90 12.0% 32,140 38,494 25,220 30,277 19.7 10.6 9.3 1.2 1.1 1.0 4.2% 4.2% 4.3%<br />

Overseas Chinese <strong>Banking</strong> Corp Neutral Dec 8.43 8.20 -2.7% 28,850 19,710 22,639 15,366 12.8 12.5 11.0 1.5 1.4 1.3 3.6% 3.6% 3.6%<br />

United Overseas Bank<br />

Source: Bloomberg, PSR est.<br />

Neutral Dec 17.48 17.50 0.1% 27,503 26,169 21,582 20,521 10.2 11.8 10.5 1.4 1.3 1.2 4.0% 3.4% 3.4%<br />

4 of 10

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

<strong>Singapore</strong> Equities Research<br />

18 May 2012<br />

Oversea-Chinese <strong>Banking</strong> Corp – Insurance “wildcard”<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12<br />

DBS Group Holdings – Most stable Non II earnings<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12<br />

United Overseas Bank <strong>Ltd</strong><br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

2.8<br />

2.6<br />

2.4<br />

2.2<br />

2.0<br />

1.8<br />

1.6<br />

1.4<br />

1.2<br />

1.0<br />

0.8<br />

2.0<br />

1.8<br />

1.6<br />

1.4<br />

1.2<br />

1.0<br />

0.8<br />

0.6<br />

0.4<br />

0<br />

2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12<br />

OCBC - PB ratio<br />

SD+1<br />

SD-1<br />

May-07 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12<br />

DBS - PB ratio<br />

SD+1<br />

SD-1<br />

May-07 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12<br />

Source: Company data, Bloomberg, <strong>Phillip</strong> <strong>Securities</strong> Research<br />

1.83<br />

1.51<br />

1.23 1.20<br />

1.49<br />

1.23<br />

1.08<br />

0.98<br />

5 of 10<br />

- Net profit y-y growth slower than Total revenue growth<br />

8,000<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

FY2009 FY2010 FY2011 FY2012<br />

Non Int Inc<br />

Fees and<br />

Comm<br />

NII<br />

Net Profit<br />

PPOP<br />

- Increasing y-y earnings from Non II, High net profit growth<br />

8,000<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

FY2009 FY2010 FY2011 FY2012<br />

- Minimal y-y growth in total revenue<br />

8,000<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

2.4<br />

2.2<br />

2.0<br />

1.8<br />

1.6<br />

1.4<br />

1.2<br />

1.0<br />

0.8<br />

19.0<br />

17.0<br />

15.0<br />

13.0<br />

11.0<br />

9.0<br />

7.0<br />

0<br />

FY2009 FY2010 FY2011 FY2012<br />

UOB - PB ratio<br />

SD+1<br />

SD-1<br />

OCBC - PE ratio<br />

SD+1<br />

SD-1<br />

Non Int Inc<br />

Fees and<br />

Comm<br />

NII<br />

Net Profit<br />

PPOP<br />

Non Int Inc<br />

Fees and<br />

Comm<br />

NII<br />

Net Profit<br />

PPOP<br />

May-07 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12<br />

May-07 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12<br />

Source: Company data, Bloomberg, <strong>Phillip</strong> <strong>Securities</strong> Research<br />

1.83<br />

1.57<br />

1.27 1.31<br />

15.33<br />

13.64<br />

11.94

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

<strong>Singapore</strong> Equities Research<br />

18 May 2012<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

DBS - PE ratio<br />

SD+1<br />

SD-1<br />

-<br />

May-07 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12<br />

6<br />

4<br />

2<br />

0<br />

-4<br />

-6<br />

-8<br />

25 April 12 rebased<br />

-2<br />

4/25/2012 5/1/2012 5/7/2012 5/13/2012<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-4<br />

-6<br />

-8<br />

OCB C<br />

DBS<br />

UOB<br />

STI<br />

1 month rebased<br />

4/17/2012 -2<br />

4/25/2012 5/3/2012 5/11/2012<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

OCBC<br />

DBS<br />

UOB<br />

STI<br />

OCBC<br />

DB S<br />

UOB<br />

STI<br />

3 months rebased<br />

2/17/2012 3/8/2012 3/28/2012 4/17/2012 5/7/2012<br />

Source: Company data, Bloomberg, <strong>Phillip</strong> <strong>Securities</strong> Research<br />

15.37<br />

12.47<br />

9.56<br />

6 of 10<br />

20.0<br />

18.0<br />

16.0<br />

14.0<br />

12.0<br />

10.0<br />

8.0<br />

6.0<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-10<br />

-15<br />

10<br />

5<br />

0<br />

-10<br />

-15<br />

-20<br />

-25<br />

-30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

-25<br />

-30<br />

UOB - PE ratio<br />

SD+1<br />

SD-1<br />

May-07 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12<br />

OCBC<br />

DBS<br />

UOB<br />

STI<br />

2 Year rebased<br />

5/19/2010 10/19/2010 3/19/2011 8/19/2011 1/19/2012<br />

OCB C<br />

DBS<br />

UOB<br />

STI<br />

1 Year rebased<br />

5/19/2011 -5 7/19/2011 9/19/201111/19/20111/19/2012 3/19/2012<br />

OCB C<br />

DBS<br />

UOB<br />

STI<br />

6 months rebased<br />

15.17<br />

13.02<br />

10.87<br />

11/18/201 -5 12/18/20111/18/2012 2/18/20123/18/2012 4/18/2012 5/18/2012<br />

Source: Company data, Bloomberg, <strong>Phillip</strong> <strong>Securities</strong> Research

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

<strong>Singapore</strong> Equities Research<br />

18 May 2012<br />

Important Information<br />

This publication is prepared by <strong>Phillip</strong> <strong>Securities</strong> Research <strong>Pte</strong> <strong>Ltd</strong>., 250 North Bridge Road, #06-00, Raffles City<br />

Tower, <strong>Singapore</strong> 179101 (Registration Number: 198803136N), which is regulated by the Monetary Authority of<br />

<strong>Singapore</strong> (“<strong>Phillip</strong> <strong>Securities</strong> Research”). By receiving or reading this publication, you agree to be bound by the terms<br />

and limitations set out below.<br />

This publication has been provided to you for personal use only and shall not be reproduced, distributed or published<br />

by you in whole or in part, for any purpose. If you have received this document by mistake, please delete or destroy it,<br />

and notify the sender immediately. <strong>Phillip</strong> <strong>Securities</strong> Research shall not be liable for any direct or consequential loss<br />

arising from any use of material contained in this publication.<br />

The information contained in this publication has been obtained from public sources, which <strong>Phillip</strong> <strong>Securities</strong> Research<br />

has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions<br />

(collectively, the “Research”) contained in this publication are based on such information and are expressions of belief<br />

of the individual author or the indicated source (as applicable) only. <strong>Phillip</strong> <strong>Securities</strong> Research has not verified this<br />

information and no representation or warranty, express or implied, is made that such information or Research is<br />

accurate, complete, appropriate or verified or should be relied upon as such. Any such information or Research<br />

contained in this publication is subject to change, and <strong>Phillip</strong> <strong>Securities</strong> Research shall not have any responsibility to<br />

maintain or update the information or Research made available or to supply any corrections, updates or releases in<br />

connection therewith. In no event will <strong>Phillip</strong> <strong>Securities</strong> Research or persons associated with or connected to <strong>Phillip</strong><br />

<strong>Securities</strong> Research, including but not limited its officers, directors, employees or persons involved in the preparation<br />

or issuance of this report, (i) be liable in any manner whatsoever for any consequences (including but not limited to<br />

any special, direct, indirect, incidental or consequential losses, loss of profits and damages) of any reliance or usage<br />

of this publication or (ii) accept any legal responsibility from any person who receives this publication, even if it has<br />

been advised of the possibility of such damages. You must make the final investment decision and accept all<br />

responsibility for your investment decision, including, but not limited to your reliance on the information, data and/or<br />

other materials presented in this publication.<br />

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this material are as of the date<br />

indicated and are subject to change at any time without prior notice.<br />

Past performance of any product referred to in this publication is not indicative of future results.<br />

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This<br />

publication should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own<br />

independent verification and exercise of judgment. The fact that this publication has been made available constitutes<br />

neither a recommendation to enter into a particular transaction, nor a representation that any product described in this<br />

material is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may<br />

be described in this publication involve significant risks and may not be suitable for all investors, and that any decision<br />

to enter into transactions involving such products should not be made, unless all such risks are understood and an<br />

independent determination has been made that such transactions would be appropriate. Any discussion of the risks<br />

contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete<br />

discussion of such risks.<br />

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any<br />

decision to purchase any product mentioned in this research should take into account existing public information,<br />

including any registered prospectus in respect of such product.<br />

<strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or connected to <strong>Phillip</strong> <strong>Securities</strong> Research, including but not<br />

limited to its officers, directors, employees or persons involved in the preparation or issuance of this report, may<br />

provide an array of financial services to a large number of corporations in <strong>Singapore</strong> and worldwide, including but not<br />

limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting<br />

activities), brokerage or securities trading activities. <strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or<br />

connected to <strong>Phillip</strong> <strong>Securities</strong> Research, including but not limited to its officers, directors, employees or persons<br />

involved in the preparation or issuance of this report, may have participated in or invested in transactions with the<br />

issuer(s) of the securities mentioned in this publication, and may have performed services for or solicited business<br />

from such issuers. Additionally, <strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or connected to <strong>Phillip</strong><br />

<strong>Securities</strong> Research, including but not limited to its officers, directors, employees or persons involved in the<br />

7 of 10

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

<strong>Singapore</strong> Equities Research<br />

18 May 2012<br />

preparation or issuance of this report, may have provided advice or investment services to such companies and<br />

investments or related investments, as may be mentioned in this publication.<br />

<strong>Phillip</strong> <strong>Securities</strong> Research or persons associated with or connected to <strong>Phillip</strong> <strong>Securities</strong> Research, including but not<br />

limited to its officers, directors, employees or persons involved in the preparation or issuance of this report may, from<br />

time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase<br />

or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other<br />

compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars<br />

and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign<br />

currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price<br />

or income return of the investment.<br />

To the extent permitted by law, <strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or connected to <strong>Phillip</strong><br />

<strong>Securities</strong> Research, including but not limited to its officers, directors, employees or persons involved in the<br />

preparation or issuance of this report, may at any time engage in any of the above activities as set out above or<br />

otherwise hold a interest, whether material or not, in respect of companies and investments or related investments,<br />

which may be mentioned in this publication. Accordingly, information may be available to <strong>Phillip</strong> <strong>Securities</strong> Research,<br />

or persons associated with or connected to <strong>Phillip</strong> <strong>Securities</strong> Research, including but not limited to its officers,<br />

directors, employees or persons involved in the preparation or issuance of this report, which is not reflected in this<br />

material, and <strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or connected to <strong>Phillip</strong> <strong>Securities</strong> Research,<br />

including but not limited to its officers, directors, employees or persons involved in the preparation or issuance of this<br />

report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following<br />

its publication. <strong>Phillip</strong> <strong>Securities</strong> Research, or persons associated with or connected to <strong>Phillip</strong> <strong>Securities</strong> Research,<br />

including but not limited its officers, directors, employees or persons involved in the preparation or issuance of this<br />

report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of<br />

this material.<br />

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person<br />

or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the<br />

applicable law or regulation or which would subject <strong>Phillip</strong> <strong>Securities</strong> Research to any registration or licensing or other<br />

requirement, or penalty for contravention of such requirements within such jurisdiction.<br />

Section 27 of the Financial Advisers Act (Cap. 110) of <strong>Singapore</strong> and the MAS Notice on Recommendations on<br />

Investment Products (FAA-N01) do not apply in respect of this publication.<br />

This material is intended for general circulation only and does not take into account the specific investment objectives,<br />

financial situation or particular needs of any particular person. The products mentioned in this material may not be<br />

suitable for all investors and a person receiving or reading this material should seek advice from a professional and<br />

financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such<br />

products, taking into account the specific investment objectives, financial situation or particular needs of that person,<br />

before making a commitment to invest in any of such products.<br />

Please contact <strong>Phillip</strong> <strong>Securities</strong> Research at [65 65311240] in respect of any matters arising from, or in connection<br />

with, this document.<br />

This report is only for the purpose of distribution in <strong>Singapore</strong>.<br />

8 of 10

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

<strong>Singapore</strong> Equities Research<br />

18 May 2012<br />

Contact Information (<strong>Singapore</strong> Research Team)<br />

Chan Wai Chee Lee Kok Joo, CFA Joshua Tan<br />

CEO, Research Head of Research Strategist<br />

Special Opportunities S-Chips, Strategy +65 6531 1249<br />

+65 6531 1231 +65 6531 1685 joshuatan@phillip.com.sg<br />

yebo@phillip.com.sg leekj@phillip.com.sg<br />

Magdalene Choong Go Choon Koay, Bryan Derrick Heng<br />

Investment Analyst Investment Analyst Investment Analyst<br />

SG & US Financials, Gaming Property Transportation, Telecom.<br />

+65 6531 1791 +65 6531 1792 +65 6531 1221<br />

magdalenechoongss@phillip.com.sg gock@phillip.com.sg derrickhengch@phillip.com.sg<br />

Travis Seah Ken Ang Peter Lee<br />

Investment Analyst Investment Analyst Research Assistant<br />

REITS Financials General Enquiries<br />

+65 6531 1229 +65 6531 1793 +65 6531 1240 (Phone)<br />

travisseahhk@phillip.com.sg kenangwy@phillip.com.sg +65 6336 7607 (Fax)<br />

research@phillip.com.sg<br />

9 of 10

<strong>Singapore</strong> <strong>Banking</strong> <strong>Sector</strong><br />

<strong>Singapore</strong> Equities Research<br />

18 May 2012<br />

Contact Information (Regional Member Companies)<br />

SINGAPORE<br />

<strong>Phillip</strong> <strong>Securities</strong> <strong>Pte</strong> <strong>Ltd</strong><br />

Raffles City Tower<br />

250, North Bridge Road #06-00<br />

<strong>Singapore</strong> 179101<br />

Tel : (65) 6533 6001<br />

Fax : (65) 6535 6631<br />

Website: www.poems.com.sg<br />

HONG KONG<br />

<strong>Phillip</strong> <strong>Securities</strong> (HK) <strong>Ltd</strong><br />

Exchange Participant of the Stock Exchange of Hong Kong<br />

11/F United Centre 95 Queensway<br />

Hong Kong<br />

Tel (852) 22776600<br />

Fax (852) 28685307<br />

Websites: www.phillip.com.hk<br />

INDONESIA<br />

PT <strong>Phillip</strong> <strong>Securities</strong> Indonesia<br />

ANZ Tower Level 23B,<br />

Jl Jend Sudirman Kav 33A<br />

Jakarta 10220 – Indonesia<br />

Tel (62-21) 57900800<br />

Fax (62-21) 57900809<br />

Website: www.phillip.co.id<br />

THAILAND<br />

<strong>Phillip</strong> <strong>Securities</strong> (Thailand) Public Co. <strong>Ltd</strong><br />

15th Floor, Vorawat Building,<br />

849 Silom Road, Silom, Bangrak,<br />

Bangkok 10500 Thailand<br />

Tel (66-2) 6351700 / 22680999<br />

Fax (66-2) 22680921<br />

Website www.phillip.co.th<br />

UNITED KINGDOM<br />

King & Shaxson Capital Limited<br />

6th Floor, Candlewick House,<br />

120 Cannon Street,<br />

London, EC4N 6AS<br />

Tel (44-20) 7426 5950<br />

Fax (44-20) 7626 1757<br />

Website: www.kingandshaxson.com<br />

AUSTRALIA<br />

<strong>Phillip</strong>Capital Australia<br />

Level 37, 530 Collins Street,<br />

Melbourne, Victoria 3000, Australia<br />

Tel (613) 96298380<br />

Fax (613) 96148309<br />

Website: www.phillipcapital.com.au<br />

10 of 10<br />

MALAYSIA<br />

<strong>Phillip</strong> Capital Management Sdn Bhd<br />

B-3-6 Block B Level 3 Megan Avenue II,<br />

No. 12, Jalan Yap Kwan Seng, 50450<br />

Kuala Lumpur<br />

Tel (603) 21628841<br />

Fax (603) 21665099<br />

Website: www.poems.com.my<br />

JAPAN<br />

<strong>Phillip</strong> <strong>Securities</strong> Japan, <strong>Ltd</strong>.<br />

4-2 Nihonbashi Kabuto-cho<br />

Chuo-ku, Tokyo 103-0026<br />

Tel (81-3) 36662101<br />

Fax (81-3) 36666090<br />

Website:www.phillip.co.jp<br />

CHINA<br />

<strong>Phillip</strong> Financial Advisory (Shanghai) Co. <strong>Ltd</strong><br />

No 550 Yan An East Road,<br />

Ocean Tower Unit 2318,<br />

Postal code 200001<br />

Tel (86-21) 51699200<br />

Fax (86-21) 63512940<br />

Website: www.phillip.com.cn<br />

FRANCE<br />

King & Shaxson Capital Limited<br />

3rd Floor, 35 Rue de la Bienfaisance 75008<br />

Paris France<br />

Tel (33-1) 45633100<br />

Fax (33-1) 45636017<br />

Website: www.kingandshaxson.com<br />

UNITED STATES<br />

<strong>Phillip</strong> Futures Inc<br />

141 W Jackson Blvd Ste 3050<br />

The Chicago Board of Trade Building<br />

Chicago, IL 60604 USA<br />

Tel +1.312.356.9000<br />

Fax +1.312.356.9005