Historical Live Cattle/Feeder Cattle Report - gpvec

Historical Live Cattle/Feeder Cattle Report - gpvec

Historical Live Cattle/Feeder Cattle Report - gpvec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CONT<br />

YEAR<br />

ENTRY<br />

DATE<br />

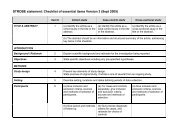

Buy Oct <strong>Live</strong> <strong>Cattle</strong>(CME) / Sell Apr <strong>Live</strong> <strong>Cattle</strong>(CME)<br />

Enter on approximately 08/25 - Exit on approximately 09/14<br />

ENTRY<br />

PRICE<br />

EXIT<br />

DATE<br />

EXIT<br />

PRICE PROFIT<br />

PROFIT<br />

AMOUNT<br />

BEST<br />

EQUITY<br />

DATE<br />

BEST<br />

EQUITY<br />

AMOUNT<br />

WORST<br />

EQUITY<br />

DATE<br />

WORST<br />

EQUITY<br />

AMOUNT<br />

2007 08/27/07 -2.87 09/14/07 -5.28 -2.40 -960.00 08/29/07 20.00 09/12/07 -1168.00<br />

2006 08/25/06 1.57 09/14/06 -0.71 -2.29 -916.00 09/05/06 552.00 09/14/06 -916.00<br />

2005 08/25/05 -3.53 09/14/05 -1.65 1.88 752.00 09/14/05 752.00 09/01/05 -268.00<br />

2004 08/25/04 -2.35 09/14/04 -1.23 1.12 448.00 09/14/04 448.00 09/09/04 -80.00<br />

2003 08/25/03 3.75 09/12/03 7.75 4.00 1600.00 09/11/03 1740.00<br />

2002 08/26/02 -5.23 09/13/02 -3.34 1.88 752.00 09/13/02 752.00<br />

2001 08/27/01 -4.67 09/14/01 -5.45 -0.78 -312.00 09/04/01 88.00 09/14/01 -312.00<br />

2000 08/25/00 -5.39 09/14/00 -5.14 0.25 100.00 09/14/00 100.00 09/06/00 -240.00<br />

1999 08/25/99 -3.59 09/14/99 -2.75 0.85 340.00 09/07/99 528.00<br />

1998 08/25/98 -4.96 09/14/98 -3.47 1.49 596.00 09/11/98 628.00 09/03/98 -52.00<br />

1997 08/25/97 -5.75 09/12/97 -5.39 0.35 140.00 09/12/97 140.00 08/28/97 -380.00<br />

1996 08/26/96 4.37 09/13/96 6.20 1.83 732.00 09/13/96 732.00 09/05/96 -16.00<br />

1995 08/25/95 -3.56 09/14/95 -1.53 2.04 816.00 09/08/95 1036.00<br />

1994 08/25/94 -0.21 09/14/94 0.69 0.92 368.00 09/01/94 676.00<br />

1993 08/25/93 -2.65 09/14/93 -1.66 0.98 392.00 09/03/93 780.00<br />

Percentage Correct 80<br />

Average Profit on Winning Trades 1.47 586.33 Winners 12<br />

Average Loss on Trades -1.82 -729.33 Losers 3<br />

Average Net Profit Per Trade 0.81 323.20 Total trades 15<br />

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE<br />

PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED<br />

BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION,<br />

HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE<br />

ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE<br />

ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF<br />

HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. RESULTS NOT ADJUSTED FOR COMMISSION AND SLIPPAGE.<br />

CONT<br />

YEAR<br />

BUY<br />

DATE<br />

Buy on approximately 08/30 - Exit on approximately 09/11<br />

BUY<br />

PRICE<br />

EXIT<br />

DATE<br />

<strong>Live</strong> <strong>Cattle</strong>(CME)—December<br />

EXIT<br />

PRICE PROFIT<br />

PROFIT<br />

AMOUNT<br />

BEST<br />

EQUITY<br />

DATE<br />

BEST<br />

EQUITY<br />

AMOUNT<br />

Contract Size: 40,000 lbs<br />

WORST<br />

EQUITY<br />

DATE<br />

WORST<br />

EQUITY<br />

AMOUNT<br />

2007 08/30/07 99.90 09/11/07 99.60 -0.30 -120.00 09/04/07 460.00 09/07/07 -180.00<br />

2006 08/30/06 92.90 09/11/06 91.75 -1.15 -460.00 09/05/06 380.00 09/11/06 -460.00<br />

2005 08/30/05 85.60 09/09/05 87.80 2.20 880.00 09/09/05 880.00 09/01/05 -480.00<br />

2004 08/30/04 87.30 09/10/04 88.10 0.80 320.00 09/10/04 320.00 09/07/04 -560.00<br />

2003 09/02/03 81.37 09/11/03 85.20 3.83 1532.00 09/11/03 1532.00<br />

2002 08/30/02 70.17 09/11/02 71.47 1.30 520.00 09/11/02 520.00 09/03/02 -120.00<br />

2001 08/30/01 74.20 09/10/01 74.27 0.07 28.00 09/04/01 240.00 09/06/01 -60.00<br />

2000 08/30/00 69.02 09/11/00 69.47 0.45 180.00 09/07/00 192.00 09/06/00 -208.00<br />

1999 08/30/99 67.25 09/10/99 69.27 2.02 808.00 09/10/99 808.00 09/01/99 -32.00<br />

1998 08/31/98 60.97 09/11/98 63.75 2.78 1112.00 09/11/98 1112.00 09/03/98 -240.00<br />

1997 09/02/97 69.25 09/11/97 69.92 0.67 268.00 09/11/97 268.00 09/04/97 -172.00<br />

1996 08/30/96 68.05 09/11/96 68.50 0.45 180.00 09/09/96 248.00 09/05/96 -140.00<br />

1995 08/30/95 64.37 09/11/95 66.72 2.35 940.00 09/08/95 1000.00<br />

1994 08/30/94 69.55 09/09/94 69.75 0.20 80.00 09/06/94 168.00 08/31/94 -192.00<br />

1993 08/30/93 75.32 09/10/93 75.82 0.50 200.00 09/02/93 272.00 08/31/93 -8.00<br />

Percentage Correct 87<br />

Average Profit on Winning Trades 1.36 542.15 Winners 13<br />

Average Loss on Trades -0.73 -290.00 Losers 2<br />

Average Net Profit Per Trade 1.08 431.20 Total trades 15<br />

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE<br />

PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED<br />

BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION,<br />

HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE<br />

ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE<br />

ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF<br />

HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. RESULTS NOT ADJUSTED FOR COMMISSION AND SLIPPAGE.<br />

MOORE RESEARCH CENTER, INC. 33<br />

<strong>Live</strong> <strong>Cattle</strong> Strategy Tables