Historical Live Cattle/Feeder Cattle Report - gpvec

Historical Live Cattle/Feeder Cattle Report - gpvec

Historical Live Cattle/Feeder Cattle Report - gpvec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

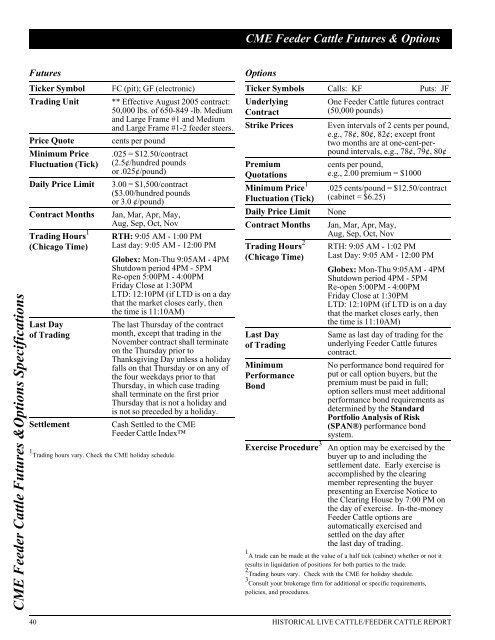

CME <strong>Feeder</strong> <strong>Cattle</strong> Futures &Options Specifications<br />

Futures<br />

Ticker Symbol FC (pit); GF (electronic)<br />

Trading Unit ** Effective August 2005 contract:<br />

50,000 lbs. of 650-849 -lb. Medium<br />

and Large Frame #1 and Medium<br />

and Large Frame #1-2 feeder steers.<br />

Price Quote cents per pound<br />

Minimum Price<br />

Fluctuation (Tick)<br />

.025 = $12.50/contract<br />

(2.5¢/hundred pounds<br />

or .025¢/pound)<br />

Daily Price Limit 3.00 = $1,500/contract<br />

($3.00/hundred pounds<br />

or 3.0 ¢/pound)<br />

Contract Months Jan, Mar, Apr, May,<br />

Aug, Sep, Oct, Nov<br />

Trading Hours 1<br />

(Chicago Time)<br />

Last Day<br />

of Trading<br />

RTH: 9:05 AM - 1:00 PM<br />

Last day: 9:05 AM - 12:00 PM<br />

Globex: Mon-Thu 9:05AM - 4PM<br />

Shutdown period 4PM - 5PM<br />

Re-open 5:00PM - 4:00PM<br />

Friday Close at 1:30PM<br />

LTD: 12:10PM (if LTD is on a day<br />

that the market closes early, then<br />

the time is 11:10AM)<br />

The last Thursday of the contract<br />

month, except that trading in the<br />

November contract shall terminate<br />

on the Thursday prior to<br />

Thanksgiving Day unless a holiday<br />

falls on that Thursday or on any of<br />

the four weekdays prior to that<br />

Thursday, in which case trading<br />

shall terminate on the first prior<br />

Thursday that is not a holiday and<br />

is not so preceded by a holiday.<br />

Settlement Cash Settled to the CME<br />

<strong>Feeder</strong> <strong>Cattle</strong> Index<br />

1 Trading hours vary. Check the CME holiday schedule.<br />

CME <strong>Feeder</strong> <strong>Cattle</strong> Futures & Options<br />

Options<br />

Ticker Symbols Calls: KF Puts: JF<br />

Underlying<br />

Contract<br />

One <strong>Feeder</strong> <strong>Cattle</strong> futures contract<br />

(50,000 pounds)<br />

Strike Prices Even intervals of 2 cents per pound,<br />

e.g., 78¢, 80¢, 82¢; except front<br />

two months are at one-cent-perpound<br />

intervals, e.g., 78¢, 79¢, 80¢<br />

Premium<br />

Quotations<br />

Minimum Price 1<br />

Fluctuation (Tick)<br />

Daily Price Limit None<br />

cents per pound,<br />

e.g., 2.00 premium = $1000<br />

.025 cents/pound = $12.50/contract<br />

(cabinet = $6.25)<br />

Contract Months Jan, Mar, Apr, May,<br />

Aug, Sep, Oct, Nov<br />

Trading Hours 2<br />

(Chicago Time)<br />

Last Day<br />

of Trading<br />

Minimum<br />

Performance<br />

Bond<br />

RTH: 9:05 AM - 1:02 PM<br />

Last Day: 9:05 AM - 12:00 PM<br />

Globex: Mon-Thu 9:05AM - 4PM<br />

Shutdown period 4PM - 5PM<br />

Re-open 5:00PM - 4:00PM<br />

Friday Close at 1:30PM<br />

LTD: 12:10PM (if LTD is on a day<br />

that the market closes early, then<br />

the time is 11:10AM)<br />

Same as last day of trading for the<br />

underlying <strong>Feeder</strong> <strong>Cattle</strong> futures<br />

contract.<br />

No performance bond required for<br />

put or call option buyers, but the<br />

premium must be paid in full;<br />

option sellers must meet additional<br />

performance bond requirements as<br />

determined by the Standard<br />

Portfolio Analysis of Risk<br />

(SPAN®) performance bond<br />

system.<br />

Exercise Procedure 3 An option may be exercised by the<br />

buyer up to and including the<br />

settlement date. Early exercise is<br />

accomplished by the clearing<br />

member representing the buyer<br />

presenting an Exercise Notice to<br />

the Clearing House by 7:00 PM on<br />

the day of exercise. In-the-money<br />

<strong>Feeder</strong> <strong>Cattle</strong> options are<br />

automatically exercised and<br />

settled on the day after<br />

the last day of trading.<br />

1 A trade can be made at the value of a half tick (cabinet) whether or not it<br />

results in liquidation of positions for both parties to the trade.<br />

2<br />

Trading hours vary. Check with the CME for holiday shedule.<br />

3<br />

Consult your brokerage firm for additional or specific requirements,<br />

policies, and procedures.<br />

40 HISTORICAL LIVE CATTLE/FEEDER CATTLE REPORT