Declaration of Richard M. Pearl - LCD Class Action

Declaration of Richard M. Pearl - LCD Class Action

Declaration of Richard M. Pearl - LCD Class Action

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page1 <strong>of</strong> 19<br />

Francis O. Scarpulla (41059)<br />

Craig C. Corbitt (83251)<br />

Judith A. Zahid (215418)<br />

Patrick B. Clayton (240191)<br />

Qianwei Fu (242669)<br />

Heather T. Rankie (268002)<br />

ZELLE HOFMANN VOELBEL & MASON LLP<br />

44 Montgomery Street, Suite 3400<br />

San Francisco, CA 94104<br />

Telephone: (415) 693-0700<br />

Facsimile: (415) 693-0770<br />

fscarpulla@zelle.com<br />

ccorbitt@zelle.com<br />

Joseph M Alioto (42980)<br />

Theresa D. Moore (99978)<br />

Thomas P. Pier (235740)<br />

Jamie L. Miller (271452)<br />

Angelina Alioto-Grace (206899)<br />

THE ALIOTO FIRM<br />

225 Bush Street, 16th Floor<br />

San Francisco, CA 94111<br />

Telephone: (415) 434-8900<br />

Facsimile: (415) 434-9200<br />

jmalioto@aliotolaw.com<br />

Co-Lead <strong>Class</strong> Counsel for Indirect-Purchaser Plaintiffs<br />

IN RE TFT-<strong>LCD</strong> (FLAT PANEL)<br />

ANTITRUST LITIGATION<br />

This Document Relates to:<br />

All Indirect Purchaser <strong>Action</strong>s<br />

State <strong>of</strong> Missouri, et al. v. AU Optronics<br />

Corporation, et al.,<br />

Case No. 10-cv-03619 SI;<br />

State <strong>of</strong> Florida v. AU Optronics<br />

Corporation, et al.,<br />

Case No. 10-cv-3517 SI; and<br />

State <strong>of</strong> New York v. AU Optronics<br />

Corporation, et al.,<br />

Case No. 11-cv-0711 SI.<br />

UNITED STATES DISTRICT COURT<br />

NORTHERN DISTRICT OF CALIFORNIA<br />

SAN FRANCISCO DIVISION<br />

Case No. 3:07-md-1827 SI<br />

CLASS ACTION<br />

DECLARATION OF RICHARD M. PEARL<br />

Hearing Date: November 29, 2012<br />

Time: 3:30 p.m.<br />

Courtroom: 10, 19th Floor<br />

Judge: Honorable Susan Illston<br />

DECLARATION OF RICHARD M. PEARL<br />

MDL 3:07-md-1827 SI

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page2 <strong>of</strong> 19<br />

DECLARATION OF RICHARD M. PEARL<br />

I, <strong>Richard</strong> M. <strong>Pearl</strong>, declare:<br />

1. I am a member in good standing <strong>of</strong> the California State Bar. I am in<br />

private practice as the principal <strong>of</strong> my own law firm, the Law Offices <strong>of</strong> <strong>Richard</strong> M.<br />

<strong>Pearl</strong>, in Berkeley, California. I specialize in issues relating to court-awarded attorneys’<br />

fees, including the representation <strong>of</strong> parties in fee litigation and appeals, serving as an<br />

expert witness, and serving as a mediator and arbitrator in disputes concerning attorneys’<br />

fees and related issues. In this case, I have been asked by <strong>Class</strong> Counsel for the Indirect<br />

Purchaser Plaintiffs (“IPP <strong>Class</strong> Counsel” ) to render my opinion on the reasonableness<br />

<strong>of</strong> the lodestar-multiplier they have submitted to the Court as a cross-check against the<br />

percentage-based fee they are requesting from the common fund generated by the<br />

settlements in this matter.<br />

2. Briefly summarized, my background is as follows: I am a 1969 graduate<br />

<strong>of</strong> Boalt Hall School <strong>of</strong> Law, University <strong>of</strong> California, Berkeley, California. I took the<br />

California Bar Examination in August 1969 and passed it in November <strong>of</strong> that year, but<br />

because I was working as an attorney in Atlanta, Georgia for the Legal Aid Society <strong>of</strong><br />

Atlanta (LASA), I was not admitted to the California Bar until January 1970. I worked<br />

for LASA until summer <strong>of</strong> 1971, when I then went to work in California’s Central Valley<br />

for California Rural Legal Assistance, Inc., (CRLA), a statewide legal services program.<br />

From 1977 to 1982, I was CRLA’s Director <strong>of</strong> Litigation, supervising more than fifty<br />

attorneys. In 1982, I went into private practice, first in a small law firm, then as a sole<br />

practitioner. Martindale Hubbell rates my law firm “AV.” I also have been selected as a<br />

Northern California “Super Lawyer” in Appellate Law for 2005, 2006, 2007, 2008, 2010,<br />

2011, and 2012. A copy <strong>of</strong> my Resume is attached hereto as Exhibit A.<br />

3. Since 1982, my practice has been a general civil litigation and appellate<br />

practice, with an emphasis on cases and appeals involving court-awarded attorneys’ fees.<br />

1

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page3 <strong>of</strong> 19<br />

I have lectured and written extensively on court-awarded attorneys’ fees. I have been a<br />

member <strong>of</strong> the California State Bar’s Attorneys Fees Task Force and have testified before<br />

the State Bar Board <strong>of</strong> Governors and the California Legislature on attorneys’ fee issues.<br />

I am the author <strong>of</strong> California Attorney Fee Awards (3d ed Cal. CEB 2010) and its<br />

February 2011 and 2012 Supplements. I also was the author <strong>of</strong> California Attorney Fee<br />

Awards, 2d Ed. (Calif. Cont. Ed. <strong>of</strong> Bar 1994), and its 1995, 1996, 1997, 1998, 1999,<br />

2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007, and 2008 Supplements. This treatise<br />

has been cited by the California appellate courts on more than 35 occasions. See, e.g.,<br />

Lolley v. Campbell (2002) 28 Cal.4 th 367, 373; Chacon v. Litke (2010) 181 Cal.App.4 th<br />

1234, 1259. I also authored the 1984, 1985, 1987, 1988, 1990, 1991, 1992, and 1993<br />

Supplements to its predecessor, CEB’s California Attorney’s Fees Award Practice. In<br />

addition, I authored a federal manual on attorneys’ fees entitled Attorneys’ Fees: A<br />

Legal Services Practice Manual, published by the Legal Services Corporation. I also co-<br />

authored the chapter on “Attorney Fees” in Volume 2 <strong>of</strong> CEB’s Wrongful Employment<br />

Termination Practice, 2d Ed. (1997).<br />

4. More than 90% <strong>of</strong> my practice is devoted to issues involving court-<br />

awarded attorney’s fees. I have been counsel in over 180 attorneys’ fee applications in<br />

state and federal courts, primarily representing other attorneys. I also have briefed and<br />

argued more than 40 appeals, at least 25 <strong>of</strong> which have involved attorneys’ fees issues.<br />

In the past dozen or so years, I have successfully handled four cases in the California<br />

Supreme Court involving court-awarded attorneys’ fees: 1) Delaney v. Baker (1999) 20<br />

Cal.4th 23, which held that heightened remedies, including attorneys’ fees, are available<br />

in suits against nursing homes under California’s Elder Abuse Act; 2) Ketchum v. Moses<br />

(2001) 24 Cal.4th 1122, which held, inter alia, that contingent risk multipliers remain<br />

available under California attorney fee law, despite the United States Supreme Court’s<br />

contrary ruling on federal law (note that in Ketchum, I was primary appellate counsel in<br />

the Court <strong>of</strong> Appeal and “second chair” in the Supreme Court); 3) Flannery v. Prentice<br />

2

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page4 <strong>of</strong> 19<br />

(2001) 26 Cal.4th 572, which held that in the absence <strong>of</strong> an agreement to the contrary,<br />

statutory attorneys’ fees belong to the attorney whose services they are based upon; and<br />

4) Graham v. DaimlerChrysler Corp. (2004) 34 Cal.4th 553, which I handled, along with<br />

trial counsel, in both the Court <strong>of</strong> Appeal and Supreme Court. I also successfully<br />

represented the plaintiffs in a previous attorneys’ fee decision in the Supreme Court,<br />

Maria P. v. Riles (1987) 43 Cal.3d 1281, and represented amicus curiae, along with<br />

<strong>Richard</strong> Rothschild, in Vasquez v. State <strong>of</strong> California (2009) 45 Cal.4th 243. I also have<br />

handled numerous other appeals, including: Davis v. City & County <strong>of</strong> San Francisco<br />

(9th Cir. 1992) 976 F.2d 1536, Mangold v. CPUC (9th Cir. 1995) 67 F.3d 1470, Velez v.<br />

Wynne (9th Cir. 2007) 2007 U.S.App.LEXIS 2194; Camacho v. Bridgeport Financial,<br />

Inc. (9th Cir. 2008) 523 F.3d 973; Center for Biological Diversity v. County <strong>of</strong> San<br />

Bernardino (2010) 185 Cal.App.4 th 866; and Environmental Protection Information<br />

Center v. California Dept. <strong>of</strong> Forestry & Fire Protection et al (2010) 190 Cal.App.4 th<br />

217. For an expanded list <strong>of</strong> my reported decisions, see Exhibit A.<br />

5. I have been retained as an expert witness on attorneys’ fee issues on<br />

numerous occasions and have frequently been qualified as an expert on attorneys’ fees in<br />

judicial proceedings and arbitrations. My declarations on attorneys’ fee issues have<br />

been cited favorably by numerous courts, including: Prison Legal News v.<br />

Schwarzenegger, 608 F.3d 446, 455 (9 th Cir. 2010), in which the expert declaration<br />

referred to in that opinion is mine); Armstrong v. Brown (N.D. Cal. 2011) 2011<br />

U.S.Dist.LEXIS 87428; Californians for Disability Rights, Inc. v. California Dept. <strong>of</strong><br />

Transportation (N.D. Cal. 2010) 2010 U.S.Dist.LEXIS 141030; Prison Legal News v.<br />

Schwarzenegger, 561 F.Supp.2d 1095 (N.D. Cal. 2008) (an earlier motion); Oberfelder v.<br />

City <strong>of</strong> Petaluma, 2002 U.S.Dist. LEXIS 8635 (N.D. Cal. 2002), aff’d 2003<br />

U.S.App.LEXIS 11371 (9 th Cir. 2003); Bancr<strong>of</strong>t v. Trizechahn Corp., C.D. Cal. No. CV<br />

02-2373 SVW (FMOx), Order Granting Reasonable Attorneys’ Fees etc., filed Aug. 14,<br />

2006; Willoughby v. DT Credit Corp., C.D. Cal. No. CV 05-05907 MMM (Cwx), Order<br />

3

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page5 <strong>of</strong> 19<br />

Awarding Reasonable Attorneys’ Fees After Remand, filed July 17, 2006; A.D. v.<br />

California Highway Patrol, 2009 U.S.Dist.LEXIS 110743 (N.D.Cal. 2009) appeal<br />

pending; National Federation <strong>of</strong> the Blind v. Target Corp., 2009 U.S.Dist.LEXIS 67139<br />

(N.D.Cal. 2009); Church <strong>of</strong> Scientology v. Wollersheim, 42 Cal.App.4 th 628 (1996);<br />

Children’s Hospital & Medical Center v. Bonta, 97 Cal.App.4 th 740 (2002); Wilkinson v.<br />

South City Ford, 2010 Cal.App.Unpub. LEXIS 8680 (2010).<br />

6. I also have been retained by various governmental entities to consult with<br />

them regarding their affirmative attorney fee claims.<br />

7. I have been asked by IPP <strong>Class</strong> Counsel to express my opinion as to the<br />

reasonableness <strong>of</strong> the hourly rates and lodestar multiplier they have presented as a cross-<br />

check against their percentage-based fee. To form this opinion, I have reviewed<br />

numerous documents in the case, including the draft declarations <strong>of</strong> numerous IPP <strong>Class</strong><br />

counsel, the declaration <strong>of</strong> Pr<strong>of</strong>essor Brian T. Fitzpatrick, and the memorandum in<br />

support <strong>of</strong> IPP <strong>Class</strong> Plaintiffs’ Motion for Attorneys’ Fees and Incentive Awards. I also<br />

have discussed the case with several <strong>of</strong> Plaintiffs’ counsel, including Francis Scarpulla,<br />

Joe Alioto, Craig Corbitt, Alan Steyer, Josef Cooper, Tracy Kirkham, Patrick Clayton,<br />

Jack Lee, Derek Howard, and Theresa Moore.<br />

8. It is my understanding that <strong>Class</strong> Counsel request a common fund<br />

attorneys’ fee award, based on the percentage-<strong>of</strong>-fund method, <strong>of</strong> 28.5% <strong>of</strong> the<br />

$1,082,055,647 fund provided by the Settling Defendants pursuant to the Settlement in<br />

this matter. I also have been informed that IPP <strong>Class</strong> Counsel’s lodestar, using historical<br />

rates, is approximately $148 million; the fee requested equates to a multiplier <strong>of</strong> 2.08 on<br />

this lodestar. I also have been informed that IPP <strong>Class</strong> counsel have <strong>of</strong>fered an alternative<br />

lodestar for cross-check purposes, following the example <strong>of</strong> the DPPs, in which they have<br />

assumed a hypothetical 20% reduction <strong>of</strong> the reported lodestar to account for any<br />

arguably non-compensable time. This results in a lodestar <strong>of</strong> approximately $118 million,<br />

meaning that the requested fee equates to a multiplier <strong>of</strong> approximately 2.6. As a third<br />

4

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page6 <strong>of</strong> 19<br />

alternative, counsel have used current hourly rates instead <strong>of</strong> historical rates, as is<br />

commonly done in class action common fund cases, (and again following the example <strong>of</strong><br />

the DPPs). With current rates, the corresponding lodestar is approximately $159.4<br />

million, and the multipliers would be 1.93 as reported and 2.42 with an assumed 20%<br />

lodestar reduction.<br />

IPP CLASS COUNSEL’S LODESTAR/MULTIPLIER CROSS-CHECK<br />

9. In my opinion, based on my extensive experience with attorneys’ fee<br />

matters and the legal marketplace, the reasonableness <strong>of</strong> counsel’s percentage-based fee<br />

is confirmed by cross-checking it against a lodestar-based fee: (1) The hourly rates<br />

utilized in the lodestar cross-check are in line with those charged by comparably qualified<br />

attorneys for comparable work in the legal marketplace; and (2) the lodestar multipliers<br />

applied under any <strong>of</strong> the four scenarios set forth above are consistent with the legal<br />

marketplace and therefore reasonable. I base that opinion on the following:<br />

CLASS COUNSEL’S HOURLY RATES ARE REASONABLE<br />

10. I have been informed <strong>of</strong> the hourly rates utilized by several <strong>of</strong> IPP <strong>Class</strong><br />

Counsel in their lodestar cross-check. These include: Cooper & Kirkham, P.C.; Gary D.<br />

McAllister & Associates, LLC; Gray Plant Mooty; Green & Noblin; Gustafson Gluek,<br />

PLLC; Messina Law Firm, P.C.; The Saunders Law Firm and Thomas Doyle; Steyer<br />

Lowenthal Boodrookas Alvarez & Smith LLP; Straus & Boies, LLP; Zelle H<strong>of</strong>mann<br />

Voelbel & Mason LLP; MinamiTamaki LLP. In formulating my opinion, I have<br />

reviewed the qualifications, background, and experience <strong>of</strong> those attorneys. While I have<br />

not reviewed the rates and qualifications <strong>of</strong> the other attorneys, to the extent those rates<br />

are consistent with the rates I have reviewed, it is my opinion they are in line with the<br />

rates charged by comparably qualified attorneys for comparably complex work.<br />

11. Through my writing and practice, I have become familiar with the non-<br />

contingent market rates charged by attorneys in California and elsewhere. This<br />

familiarity has been obtained in several ways: (1) by handling attorneys’ fee litigation;<br />

5

(2) by discussing fees with other attorneys; (3) by obtaining declarations regarding<br />

prevailing market rates in cases in which I represent attorneys seeking fees; and (4) by<br />

reviewing attorneys’ fee applications and awards in other cases, as well as surveys and<br />

articles on attorney’s fees in the legal newspapers and treatises. The information I have<br />

gathered shows that the rates requested by IPP <strong>Class</strong> Counsel are in line with the non-<br />

contingent market rates charged by attorneys <strong>of</strong> reasonably comparable experience, skill,<br />

and reputation for reasonably comparable services. In fact, comparable hourly rates have<br />

been found reasonable by various courts for reasonably comparable services. These<br />

include<br />

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page7 <strong>of</strong> 19<br />

Holloway et. al. v. Best Buy Co., Inc. (N.D. Cal. 2011) No. 05-5056<br />

PJH (Order dated November 9, 2011), a class action alleging that Best<br />

Buy discriminated against female, African American and Latino<br />

employees by denying them promotions and lucrative sales positions,<br />

in which the court approved a lodestar award based rates <strong>of</strong> up to $825<br />

per hour;<br />

Californians for Disability Rights, Inc., et al. v. California Department<br />

<strong>of</strong> Transportation, et al. (N.D.Cal. 2010) 2010 U.S.Dist.LEXIS<br />

141030, adopted by Order Accepting Report and Recommendation<br />

filed February 2, 2011, a class action in which the court found<br />

reasonable 2010 hourly rates <strong>of</strong> up to $835 per hour;<br />

Credit/Debit Card Tying Cases, San Francisco County Superior Court,<br />

JCCP No. 4335, Order Granting Plaintiffs’ Motion for Attorneys’<br />

Fees, Expenses, and Incentive Awards, filed August 23, 2010, an<br />

antitrust class action, in which the court, before applying a 2.0 lodestar<br />

multiplier, found reasonable 2010 hourly rates <strong>of</strong> $975 for a 43-year<br />

attorney, $950 for a 46-year attorney, $850 for 32 and 38 year<br />

attorneys, $825 for a 35-year attorney, $740 for a 26-year attorney,<br />

6

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page8 <strong>of</strong> 19<br />

following:<br />

$610 for a 13-year attorney, and $600 for a 9-year attorney, and $485<br />

for a 5-year attorney;<br />

Savaglio, et al. v. WalMart, Alameda County Superior Court No. C-<br />

835687-7, Order Granting <strong>Class</strong> Counsel’s Motion for Attorneys’<br />

Fees, filed September 10, 2010, a wage and hour class action, in which<br />

the court found reasonable, before applying a 2.36 multiplier, rates <strong>of</strong><br />

up to $875 per hour for a 51-year attorney, $750 for a 39-year<br />

attorney, and $775 for a 33-year attorney.<br />

Qualcomm, Inc. v. Broadcom, Inc. Case No. 05-CV-1958-B, 2008 WL<br />

2705161 (S.D. Cal. 2008), in which the court found the 2007 hourly<br />

rates requested by Wilmer Cutler, Pickering, Hale & Dorr LLP<br />

reasonable; those rates ranged from $45 to $300 for staff and<br />

paralegals, from $275 to $505 for associates and counsel, and from<br />

$435 to $850 for partners.<br />

12. I also base my opinion on several surveys <strong>of</strong> legal rates, including the<br />

In an article published April 16, 2012, the Am Law Daily described<br />

the 2012 Real Rate Report, an analysis <strong>of</strong> $7.6 billion in legal bills<br />

paid by corporations over a five-year period ending in December 2011.<br />

A true and correct copy <strong>of</strong> that article is attached hereto as Exhibit B.<br />

That article confirms that the rates charged by experienced and well-<br />

qualified attorneys have continued to rise over this five-year period,<br />

particularly in large urban areas like San Francisco. It also shows, for<br />

example, that the top quartile <strong>of</strong> lawyer bill at an average <strong>of</strong> “just<br />

under $900 per hour.”<br />

Similarly, on February 25, 2011, the Wall Street Journal published an<br />

on-line article entitled “Top Billers.” A true and correct copy <strong>of</strong> that<br />

7

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page9 <strong>of</strong> 19<br />

article is attached hereto as Exhibit C. That article listed the 2010<br />

and/or 2009 hourly rates for more than 125 attorneys, in a variety <strong>of</strong><br />

practice areas and cases, who charged $1,000 per hour or more.<br />

On February 22, 2011, the ALM’s Daily Report listed the 2006-2009<br />

hourly rates <strong>of</strong> numerous San Francisco attorneys. A true and correct<br />

copy <strong>of</strong> that article is attached hereto as Exhibit D. Even though rates<br />

have increased significantly since that time (see Exhibit B), IPP <strong>Class</strong><br />

Counsel’s rates are well within the range <strong>of</strong> rates shown in this survey.<br />

The Westlaw CourtExpress Legal Billing Reports for May, August,<br />

and December 2009 (attached hereto as Exhibit E) show that attorneys<br />

with as little as 19 years’ experience are charging $800 per hour or<br />

more, and that the rates requested here are well within the range <strong>of</strong><br />

those reported. Again, current rates are significantly higher.<br />

The National Law Journal’s December 2010, nationwide sampling <strong>of</strong><br />

law firm billing rates (Exhibit F) lists 32 firms whose highest rate was<br />

$800 per hour or more, eleven firms whose highest rate was $900 per<br />

hour or more, and three firms whose highest rate was $1,000 per hour<br />

or more.<br />

On December 16, 2009, The American Lawyer published an online<br />

article entitled “Bankruptcy Rates Top $1,000 in 2008-2009. That<br />

article is attached hereto as Exhibit G. In addition to reporting that<br />

several attorneys had charged rates <strong>of</strong> $1,000 or more in bankruptcy<br />

filings in Delaware and the Southern District <strong>of</strong> New York, the article<br />

also listed 18 firms that charged median partner rates <strong>of</strong> from $625 to<br />

$980 per hour. Since by law, bankruptcy rates must be no higher than<br />

the rates charged for other types <strong>of</strong> similar work, these rates are<br />

probative here.<br />

8

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page10 <strong>of</strong> 19<br />

13. Lastly, the standard hourly rates for litigation stated in court filings,<br />

depositions, surveys, or other sources by numerous law firms or law firms with <strong>of</strong>fices or<br />

practices in California also support counsel’s rates. For example, numerous firms with<br />

<strong>of</strong>fices in San Francisco, including Altshuler Berzon LLP, Bingham McCutchen, Epstein<br />

Becker & Green LLP, Howard, Rice, Nemerovski, Canady, Falk & Rabkin, Manatt,<br />

Phelps & Philips Rosen, Bien & Galvan, LLP, and Sheppard, Mullin, Richter &<br />

Hampton, had senior attorneys charging rates over $800 per hour in the 2009-2011<br />

period. A number <strong>of</strong> other California and San Francisco firms, some <strong>of</strong> whom<br />

represented defendants in this litigation, including Gibson, Dunn & Crutcher LLP,<br />

Pillsbury Winthrop Shaw Puttman LLP, O’Melveny & Myers, Loeb & Loeb, Keker &<br />

Van Nest, LLP, Sidley Austin, Wilson Sonsini Goodrich & Rosati PC and Winston &<br />

Strawn, billed senior partners at rates in excess <strong>of</strong> $900 per hour during this period.<br />

14. In addition, the rates charged by counsel in Apple Inc. v. Samsung<br />

Electronics Co. Ltd., N.D. Cal. No. 11-cv—01846-LKK (PSG), support the rates<br />

requested here. In that case, according to the declaration filed by Diane C. Hutnyan on<br />

July 22, 2012 (Dkt. No. 1275), Quinn Emanuel Urquhart & Sullivan LLP, counsel for<br />

defendant Samsumg, charged median partner rates <strong>of</strong> $821 per hour and median<br />

associate rates <strong>of</strong> $448 per hour.<br />

15. Moreover, the hourly rates set forth above are those charged where full<br />

payment is expected promptly upon the rendition <strong>of</strong> the billing and without consideration<br />

<strong>of</strong> factors other than hours and rates. If any substantial part <strong>of</strong> the payment were to be<br />

contingent or deferred for any substantial period <strong>of</strong> time, for example, the fee<br />

arrangement would be adjusted accordingly to compensate the attorneys for those factors.<br />

THE LODESTAR/MULTIPLIER IS REASONABLE<br />

16. In my opinion, the lodestar-multiplier reflected in a 28.5% percentage-<br />

based fee also is consistent with the legal marketplace and eminently reasonable,<br />

especially considering, inter alia, the exceptional results obtained for the class, the high<br />

9

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page11 <strong>of</strong> 19<br />

risk and complex nature <strong>of</strong> this litigation, the difficulties and obstacles overcome, the<br />

delay in payment (when historical rates are used), a comparison to the lodestar multipliers<br />

applied in comparable cases, and the fees charged in the private marketplace. My<br />

opinion is based on the following factors:<br />

17. The Exceptional Results Obtained. In the legal marketplace, law firms<br />

that obtain excellent or exceptional results for their clients can and do expect that those<br />

exceptional results will be reflected in their fees. Here, the results obtained are<br />

exceptional: after six years <strong>of</strong> intensive litigation, counsel have achieved $1.1 billion in<br />

settlements, which, according to counsel, constitutes the largest indirect purchaser cash<br />

settlement recovery on record. These funds are non-reversionary and represent<br />

approximately half <strong>of</strong> the total <strong>of</strong> all class members potential damages. Since it can be<br />

reasonably predicted that not all class members will submit claims, even after the<br />

payment <strong>of</strong> attorneys’ fees, it appears extremely likely that those who submit claims will<br />

be highly compensated for their losses. In addition, class counsel have obtained<br />

injunctive relief that goes beyond the relief obtained by the government and provides<br />

significant protection for future purchasers. In my view, this factor provides strong<br />

support for the modest lodestar enhancements reflected in the lodestar cross-check.<br />

18. The Extraordinary Risk Taken by <strong>Class</strong> Counsel. In the legal<br />

marketplace, lawyers who assume a significant financial risk on behalf <strong>of</strong> their clients<br />

rightfully expect that their compensation will be significantly greater than it would be if<br />

no risk or delay was involved, i.e., under the traditional arrangement where the client is<br />

obligated to pay for costs and fees incurred on a monthly basis. In my experience,<br />

attorneys are willing to enter into such contingency fee arrangements only if they can<br />

expect to receive significantly higher effective hourly rates in successful cases,<br />

particularly in cases that are expected to be hard fought and where the result is uncertain.<br />

As the courts have recognized, such arrangements do not result in any “windfall” or<br />

undue “bonus” for the attorney; rather, they are earned compensation, reflecting the need<br />

10

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page12 <strong>of</strong> 19<br />

for the legal services market to compensate for the risk <strong>of</strong> non-payment for what can be<br />

thousands <strong>of</strong> hours <strong>of</strong> time spent and many thousands <strong>of</strong> dollars in costs and expenses<br />

advanced. Court-awarded fees that reflect that risk <strong>of</strong> loss simply make such<br />

representation competitive in the legal marketplace.<br />

19. Several factors made this case especially high risk:<br />

a) Over a six-year period, IPP <strong>Class</strong> Counsel have expended more than<br />

312,000 hours, all on a contingent fee basis. This is a tremendous commitment, much<br />

higher than most cases, and consequently, one that imposes an exceptionally high risk:<br />

assuming attorneys bill approximately 1800 hours a year, this is more than 172 years <strong>of</strong><br />

uncompensated work if this case had not been successful. Plaintiffs’ counsel also are<br />

out-<strong>of</strong>-pocket more than $8 million for costs and expenses; these funds also would have<br />

been unrecovered if the case had not been successfully resolved.<br />

b) The legal obstacles were formidable. As explained in IPP <strong>Class</strong><br />

Counsel’s memoranda and declarations, the difficulties and uncertainties <strong>of</strong><br />

winning cases like this, both in terms <strong>of</strong> unsettled antitrust law and unsettled class<br />

certification law, were significant.<br />

c) The Defendants had far more resources to resist suits <strong>of</strong> this nature than<br />

<strong>Class</strong> Counsel. Accordingly, they were able to employ highly competent lawyers from<br />

preeminent law firms to mount an aggressive defense.<br />

d) Settlement <strong>of</strong> the case came only after extensive, hard-fought<br />

litigation, including preparation for a lengthy trial. Contingent cases that must be<br />

tried or prepared for trial are always far riskier than cases that settle earlier in the<br />

process. That is why contingent fee agreements call for higher percentages in<br />

cases that must be tried or prepared for trial; the same principle applies here.<br />

All <strong>of</strong> these facts show the extraordinary risk taken by IPP <strong>Class</strong> Counsel,<br />

justifying the lodestar multiplier reflected in their percentage-based fee.<br />

11

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page13 <strong>of</strong> 19<br />

20. The Exceptional Novelty, Difficulty and Complexity <strong>of</strong> the Litigation.<br />

As the Court is aware, the legal issues here were quite novel, difficult, and complex.<br />

They are amply described in <strong>Class</strong> Counsel’s supporting memorandum, and will not be<br />

repeated here. Suffice it to say that they go beyond the complexities found in the vast<br />

majority <strong>of</strong> cases, a factor that in the legal marketplace justifies an enhanced lodestar.<br />

21. Encouraging Settlement. By settling this case prior to trial rather than<br />

continuing to litigate issues that remain somewhat unsettled, counsel have obtained<br />

exceptional results for the class at far less expense to the parties, their counsel, and the<br />

court. They also have obtained those results more quickly and surely than if the matter<br />

had been litigated to final resolution through the appellate process. This factor also<br />

supports the lodestar enhancement used in the cross-check. Cf. Lealao v. Beneficial<br />

California, Inc. (2000) 82 Cal.App.4 th 19, 51.<br />

22. The Public Service Performed by IPP <strong>Class</strong> Counsel. As Pr<strong>of</strong>essor<br />

Fitzpatrick notes, the public interest served by Plaintiffs’ lawsuit also supports the fee<br />

sought. See also State v. Meyer (1985) 174 Cal.App.3d 1061, 1073 (the “public service<br />

element ... and motivation to represent consumers and enforce laws” may justify lodestar<br />

enhancement). In this case, IPP <strong>Class</strong> Counsel have enforced our nation’s antitrust and<br />

consumer protection laws against some <strong>of</strong> the world’s largest corporations. The<br />

fundamental importance <strong>of</strong> these laws has been repeatedly recognized. An award <strong>of</strong> the<br />

requested fee will encourage other attorneys to take on similar cases and deter the<br />

Defendants and other manufacturers from engaging in similar practices.<br />

23. The Continuing Obligations <strong>of</strong> Counsel to the <strong>Class</strong>. The<br />

enhancement also is reasonable in light <strong>of</strong> the continuing obligations counsel will have to<br />

the class members, both in terms <strong>of</strong> overseeing the claims payment process and in terms<br />

<strong>of</strong> ensuring that the injunctive relief is properly implemented. In addition, since it is safe<br />

to predict that one or more <strong>of</strong> the objectors whose objections the court has overruled will<br />

12

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page14 <strong>of</strong> 19<br />

appeal, <strong>Class</strong> Counsel will likely be required to protect the classes’ interets before the<br />

Ninth Circuit Court <strong>of</strong> Appeals.<br />

24. The Lodestar Multipliers Applied in Other Cases. A comparison to the<br />

lodestar multipliers applied in other cases also shows that a 1.9 – 2.6 lodestar<br />

enhancement is well within the range <strong>of</strong> multipliers applied in comparable cases. See,<br />

e.g., Vizcaino v. Micros<strong>of</strong>t Corp. (9th Cir. 2002) 290 F.3d 1043, 1050 (looking to<br />

multipliers awarded in comparable cases as evidence <strong>of</strong> reasonableness). Indeed, it is<br />

quite modest: significantly greater multipliers -- 4.0 and above -- are commonly applied<br />

in fee awards from common funds. See, e.g., In re Rite Aid Corp. Secs. Litig. (3d Cir.<br />

2005) 396 F.3d 294, 298-99 (“Performing a lodestar cross-check to confirm the fees’<br />

reasonableness, the court found a ‘handsome,’ yet ‘fairly common’ lodestar multiplier <strong>of</strong><br />

4.07 based upon 12,906 hours billed since the fee application in Rite Aid I at an hourly<br />

rate <strong>of</strong> $605.”); Vizcaino v. Micros<strong>of</strong>t Corp. (9th Cir. 2002) 290 F.3d 1043, 1051 & n.6 &<br />

Appendix (index <strong>of</strong> common fund cases between 1996 and 2001, showing lodestar<br />

multipliers ranging from 0.6 to 19.6); In re WorldCom, Inc. Litig. (S.D.N.Y. 2005) 388<br />

F.Supp.2d 319 (common fund award equivalent to 4.0 multiplier); Maley v. Del Global<br />

Technologies Corp. (S.D.N.Y. 2002) 186 F.Supp.2d 358, 371 (“modest” multiplier <strong>of</strong><br />

4.65 “fair and reasonable”); In re Linerboard Antitrust Lit., 2004 WL 1221350 (E.D. Pa.<br />

June 2, 2004) at * 16 (noting that “during 2001-2003, the average multiplier approved in<br />

common fund class actions was 4.35 and during 30 year period from 1973-2003, average<br />

multiplier approved in common fund class actions was 3.89. Stuart J. Logan, et al.,<br />

Attorney Fee Awards in Common Fund <strong>Class</strong> <strong>Action</strong>s, 24 <strong>Class</strong> <strong>Action</strong> Reports 167<br />

(2003).”). As the court observed in In re Nasdaq Market-Makers Antitrust Litig.<br />

(S.D.N.Y. 1998) 187 F.R.D. 465, 489:<br />

The percentage fee award in this case represents a multiplier <strong>of</strong><br />

approximately 3.97 times <strong>Class</strong> Counsel's lodestar <strong>of</strong> $36,191,751. A<br />

multiplier <strong>of</strong> 3.97 is not unreasonable in this type <strong>of</strong> case. Indeed, as noted<br />

by the Honorable Leonard B. Sand, “In recent years multipliers <strong>of</strong><br />

13

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page15 <strong>of</strong> 19<br />

between 3 and 4.5 have become common.” Rabin v. Concord Assets<br />

Group, Inc., [1991-92 Transfer Binder] Fed. Sec. L. Rep. (CCH) 96,471<br />

(S.D.N.Y.1991) (applying a 4.4 multiplier), quoting O'Brien v. National<br />

Property Analysts, 88 Civ. 4153, Tr. p. 72 (S.D.N.Y. July 27, 1989). The<br />

fee award is well supported by precedent within this Circuit. See e.g.,<br />

Roberts v. Texaco, 979 F.Supp. 185 (1997) (5.5 multiplier); In re RJR<br />

Nabisco, Inc. Securities Litigation, [1992 Transfer Binder] Fed. Sec. L.<br />

Rep. (CCH) 96,984 (S.D.N.Y.1992) (awarding a percentage-based fee<br />

representing 6 times lodestar).<br />

See also Van Vranken v. Atlantic Richfield Co. (N.D. Cal. 1995) 901 F.Supp. 294, 298<br />

(“multipliers in the 3 – 4 range are common lodestar awards in lengthy and complex class<br />

action litigation”).<br />

25. The California federal courts have reached the same conclusion: common<br />

fund awards that result in lodestar multipliers <strong>of</strong> 4.0 or above are reasonable. As the<br />

Central District <strong>of</strong> California held in Craft v. County <strong>of</strong> San Bernardino (C.D. Cal. 2008)<br />

624 F.Supp.2d 1113, 1125:<br />

A 25% <strong>of</strong> the fund award will result in a multiplier <strong>of</strong> approximately 5.2.<br />

While this is a high end multiplier, there is ample authority for such<br />

awards resulting in multipliers in this range or higher. See, e.g., In Re<br />

Merry-Go-Round Enterprise, Inc. (Bankr.D.Md.2000) 244 B.R. 327 (40%<br />

award for $71 million fund awarded, resulting in a cross-check multiplier<br />

<strong>of</strong> 19.6); Stop & Shop Supermarket Co. v. SmithKline Beecham Corp.,<br />

2005 WL 1213926 (E.D.Pa.) ($100 Million class fund in antitrust case,<br />

with an award <strong>of</strong> 20% <strong>of</strong> the fund, which amounted to a multiplier <strong>of</strong><br />

15.6); In re Rite Aid Corp. Sec. Litig., 146 F.Supp.2d 706 (E.D.Pa.2001)<br />

(in $193 Million fund, class counsel awarded fee <strong>of</strong> 25% <strong>of</strong> fund, which<br />

amounted to $48 Million and represented a multiplier <strong>of</strong> 4.5-8.5, which the<br />

court described as “handsome but “unquestionably reasonable”); In re<br />

Cendant Corp. PRIDES Litigation, 243 F.3d 722, 732 (3rd Cir.2001)<br />

(5.7% <strong>of</strong> $341,500,000 settlement awarded, resulting in multiplier <strong>of</strong> 7); In<br />

re Rite Aid Corp. Sec. Litig, 362 F.Supp.2d 587 (E.D.Pa.2005) (25% <strong>of</strong><br />

$126,800,000 fund awarded; multiplier <strong>of</strong> 6.96); In Re IDB<br />

Communication Group, Inc., Sec. Litig., No. 94-3618 (C.D.Cal. Jan. 17,<br />

1997) (Hupp, J.), cited at 19 <strong>Class</strong> <strong>Action</strong> Reports 472-73 (1996) (16.5%<br />

<strong>of</strong> $83 Million fund awarded; multiplier <strong>of</strong> 6.2); In re RJR Nabisco, 1992<br />

WL 210138 (25% <strong>of</strong> $72.5 Million fee awarded; multiplier <strong>of</strong> 6); In re<br />

Charter Communications, Inc., Securities Litigation, 2005 WL 4045741,<br />

18 (E.D.Mo.2005) (20% <strong>of</strong> fund awarded in recovery <strong>of</strong> $146,250,000,<br />

multiplier <strong>of</strong> 5.61); Roberts v. Texaco, Inc., 979 F.Supp. 185, 197<br />

(S.D.N.Y.1997) (fee award <strong>of</strong> approximately 16.7% <strong>of</strong> the fund, multiplier<br />

14

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page16 <strong>of</strong> 19<br />

<strong>of</strong> 5.5, plus fund set aside to compensate for post-settlement work); Di<br />

Giacomo v. Plains All Am. Pipeline, Nos. H-99-4137, H-99-4212, 2001<br />

U.S. Dist. LEXIS 25532, at 31, 2001 WL 3463337 at 10 (S.D.Tex. Dec.<br />

18, 2001) (awarding 30% <strong>of</strong> $29.5 Million fund; multiplier <strong>of</strong> 5.3); In re<br />

Beverly Hills Fire Litigation, 639 F.Supp. 915 (E.D.Ky.1986) (fee <strong>of</strong><br />

$4,121,926 in settlement <strong>of</strong> $14 Million; multiplier <strong>of</strong> 5 for lead counsel);<br />

Kuhnlein v. Department <strong>of</strong> Revenue, 662 So.2d 309, 315 (Fla.1995) (class<br />

fund award <strong>of</strong> 10% <strong>of</strong> $188,100,000, resulting in multiplier <strong>of</strong><br />

approximately 15, reduced by Fla. Supreme Court to multiplier <strong>of</strong> 5 times<br />

lodestar, because lodestar was proper method under Florida law); In re<br />

Xcel Energy, Inc. Sec., Derivative & ERISA Litig., 364 F.Supp.2d 980<br />

(D.Minn.2005) (25% <strong>of</strong> $80M settlement; multiplier <strong>of</strong> 4.7); Wilson v.<br />

Bank <strong>of</strong> Am. Natl. Trust & Savs. Assn., No. 643872 (Cal.Sup.Ct.9/16/82)<br />

(multiplier <strong>of</strong> 10 times then hourly rate <strong>of</strong> $150), cited in Newberg, 14:6,<br />

p. 578, F3d 373, 378-379. The 25% is substantially below the average<br />

class fund fee fn.87; Cosgrove v. Sullivan, 759 F.Supp. 166, 167 n. 1<br />

(S.D.N.Y.1991) (1% <strong>of</strong> $100 Million right to Medicare reimbursement<br />

awarded, resulting in multiplier <strong>of</strong> 8.74).<br />

(Emphasis added.)<br />

26. The Percentage Fees Charged In The Legal Marketplace For<br />

Comparable Litigation. My opinion that IPP <strong>Class</strong> Counsel’s lodestar cross-check<br />

supports their percentage-based fee also is based in part on the fact that a 28.5% fee from<br />

a $1.082 billion fund is entirely consistent with the legal marketplace for attorneys’<br />

services in contingency fee cases like this one. One object <strong>of</strong> a common fund award is to<br />

set a fee that approximates the probable terms <strong>of</strong> a contingent fee contract negotiated by<br />

sophisticated lawyers and clients in comparable private litigation, as evidenced by the<br />

terms <strong>of</strong> such contingent fee contracts. See Silver, A Restitutionary Theory <strong>of</strong> Attorneys’<br />

Fees in <strong>Class</strong> <strong>Action</strong>s (1991) 76 Cornell L.Rev. 656, 702-703 (goal “is to pay attorneys<br />

on terms they would probably accept in an ex ante bargain, before the outcome <strong>of</strong><br />

litigation is known”). Here, it is beyond any reasonable dispute that that if <strong>Class</strong> Counsel<br />

had been able to negotiate a fee directly with the class members, the class would have<br />

found a 28.5% fee eminently reasonable for a case that would have to be prepared for a<br />

long trial. The particular risks and difficulties <strong>of</strong> this case have been previously discussed<br />

(19-20 ante). Given the prospective risks and difficulties <strong>of</strong> this case, as well as the<br />

15

legal obstacles this case encountered until it was finally settled, any class member would<br />

have been very grateful to obtain representation for his or her claim at no cost unless<br />

counsel was successful, and then at a cost <strong>of</strong> only 28.5% <strong>of</strong> the total fund recovered. This<br />

is especially true given IPP <strong>Class</strong> Counsel’s willingness to advance more than 312,000<br />

hours <strong>of</strong> time and $8 million in costs, with no hope <strong>of</strong> recovering those funds unless the<br />

case was successful. Private contingent fee agreements in personal injury and other types<br />

<strong>of</strong> cases usually provide for fees <strong>of</strong> 33-40%, with the higher percentages applied to cases<br />

resolved through litigation rather than early settlement. This case is well below that<br />

range.<br />

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page17 <strong>of</strong> 19<br />

27. Likewise, I have reviewed extensive evidence <strong>of</strong> the contingency fee<br />

percentages charged by law firms to sophisticated institutional clients in large damage<br />

cases. In my experience, when corporate or government clients hire law firms to litigate<br />

large claims on a contingent fee basis, the contracts provide for fees in a range between<br />

10 and 50 percent <strong>of</strong> the recovery. See Fisk, Corporate Firms Try Contingency, National<br />

Law Journal (Oct. 27, 1997) p. Al. Based on that knowledge and my experience in the<br />

attorneys’ fees field generally, it is my opinion that if competent and experienced<br />

attorneys and a sophisticated client were to negotiate a contingency fee agreement under<br />

the circumstances <strong>of</strong> this case, a sophisticated client would be more than willing to enter<br />

into a retainer agreement for a contingent fee under which: a) the client would owe no<br />

fees unless the case was successful; b) the attorneys would pay all litigation expenses;<br />

and c) the attorneys would recover, if successful, 28.5% <strong>of</strong> the total fund recovered.<br />

28. Percentage-Fees Approved in Other Cases. A 28.5% fee also is<br />

squarely in line with the range <strong>of</strong> reasonable attorneys’ fees awarded in other cases<br />

involving similar funds in California and across the nation. Fitzpatrick Decl. 20-24.<br />

29. Surveys <strong>of</strong> class action recoveries nationwide also confirm that the fee<br />

requested by Plaintiffs’ counsel is reasonable. For example, a 1999 analysis <strong>of</strong> 1,349<br />

shareholder class actions conducted by National Economic Research Associates<br />

16

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page18 <strong>of</strong> 19<br />

concluded that “[f]ee amounts average approximately 32 percent <strong>of</strong> the settlement<br />

award.” D. Martin, V. Juneja, T. Foster and F. Dunbar, Recent Trends IV: What<br />

Explains Filings and Settlements in Shareholder <strong>Class</strong> <strong>Action</strong>s, 5 Stan. J. L. Bus. & Fin.<br />

121. Likewise, a Federal Judicial Center report found a mean rate <strong>of</strong> 27% and a median<br />

rate <strong>of</strong> 29% for fee awards in class action settlements approved by the Northern District<br />

<strong>of</strong> California from 1992 to 1994. T. Willging, L. Hooper and R. Niemic, Emiprical Study<br />

<strong>of</strong> <strong>Class</strong> <strong>Action</strong>s in Four Federal District Courts: Final Report to the Advisory<br />

Committee on Civil Rules, 147 (1996).<br />

30. In summary, federal courts that have surveyed applicable reported fee<br />

decisions in California and throughout the United States, as well as studies <strong>of</strong> both<br />

reported and unreported decisions, have revealed that lodestar multipliers <strong>of</strong> 4.0 and<br />

above have become frequent if not commonplace. Placed within this broader context <strong>of</strong><br />

awards in California and the United States, the range <strong>of</strong> multipliers (depending on the<br />

lodestar calculation employed) represented in a fee <strong>of</strong> 28.5% <strong>of</strong> the fund for this long,<br />

heavily contested but highly successful matter is undoubtedly within the range <strong>of</strong><br />

marketplace compensation in California and in the United States more generally.<br />

31. Similarly, as discussed in paragraph 26 ante, the lodestar reported by<br />

<strong>Class</strong> Counsel is well below the percentage fees charged in the private marketplace. This<br />

factor also supports the lodestar enhancement represented in the percentage fee requested<br />

by <strong>Class</strong> Counsel. See Lealao; Fitzpatrick Decl. 25. Accordingly, the lodestar cross-<br />

check supports an upward adjustment <strong>of</strong> the Ninth Circuit’s 25% benchmark and the<br />

fairness and reasonableness <strong>of</strong> awarding IPP <strong>Class</strong> Counsel a fee <strong>of</strong> 28.5% <strong>of</strong> the<br />

settlement fund.<br />

17

Case3:07-md-01827-SI Document6662-6 Filed09/07/12 Page19 <strong>of</strong> 19

Case3:07-md-01827-SI Document6662-7 Filed09/07/12 Page1 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-7 Filed09/07/12 Page2 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-7 Filed09/07/12 Page3 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-7 Filed09/07/12 Page4 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-7 Filed09/07/12 Page5 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-7 Filed09/07/12 Page6 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-7 Filed09/07/12 Page7 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-7 Filed09/07/12 Page8 <strong>of</strong> 8

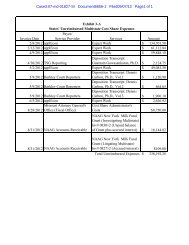

Case3:07-md-01827-SI Document6662-8 Filed09/07/12 Page1 <strong>of</strong> 5

Case3:07-md-01827-SI Document6662-8 Filed09/07/12 Page2 <strong>of</strong> 5

Case3:07-md-01827-SI Document6662-8 Filed09/07/12 Page3 <strong>of</strong> 5

Case3:07-md-01827-SI Document6662-8 Filed09/07/12 Page4 <strong>of</strong> 5

Case3:07-md-01827-SI Document6662-8 Filed09/07/12 Page5 <strong>of</strong> 5

Case3:07-md-01827-SI Document6662-9 Filed09/07/12 Page1 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-9 Filed09/07/12 Page2 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-9 Filed09/07/12 Page3 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-9 Filed09/07/12 Page4 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-9 Filed09/07/12 Page5 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-9 Filed09/07/12 Page6 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-9 Filed09/07/12 Page7 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-9 Filed09/07/12 Page8 <strong>of</strong> 8

Case3:07-md-01827-SI Document6662-10 Filed09/07/12 Page1 <strong>of</strong> 5

Case3:07-md-01827-SI Document6662-10 Filed09/07/12 Page2 <strong>of</strong> 5

Case3:07-md-01827-SI Document6662-10 Filed09/07/12 Page3 <strong>of</strong> 5

Case3:07-md-01827-SI Document6662-10 Filed09/07/12 Page4 <strong>of</strong> 5

Case3:07-md-01827-SI Document6662-10 Filed09/07/12 Page5 <strong>of</strong> 5

Case3:07-md-01827-SI Document6662-11 Filed09/07/12 Page1 <strong>of</strong> 10

Case3:07-md-01827-SI Document6662-11 Filed09/07/12 Page2 <strong>of</strong> 10

Case3:07-md-01827-SI Document6662-11 Filed09/07/12 Page3 <strong>of</strong> 10

Case3:07-md-01827-SI Document6662-11 Filed09/07/12 Page4 <strong>of</strong> 10

Case3:07-md-01827-SI Document6662-11 Filed09/07/12 Page5 <strong>of</strong> 10

Case3:07-md-01827-SI Document6662-11 Filed09/07/12 Page6 <strong>of</strong> 10

Case3:07-md-01827-SI Document6662-11 Filed09/07/12 Page7 <strong>of</strong> 10

Case3:07-md-01827-SI Document6662-11 Filed09/07/12 Page8 <strong>of</strong> 10

Case3:07-md-01827-SI Document6662-11 Filed09/07/12 Page9 <strong>of</strong> 10

Case3:07-md-01827-SI Document6662-11 Filed09/07/12 Page10 <strong>of</strong> 10

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page1 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page2 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page3 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page4 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page5 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page6 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page7 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page8 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page9 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page10 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page11 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page12 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page13 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page14 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-12 Filed09/07/12 Page15 <strong>of</strong> 15

Case3:07-md-01827-SI Document6662-13 Filed09/07/12 Page1 <strong>of</strong> 3

Case3:07-md-01827-SI Document6662-13 Filed09/07/12 Page2 <strong>of</strong> 3

Case3:07-md-01827-SI Document6662-13 Filed09/07/12 Page3 <strong>of</strong> 3