Report for the Academic Years 1987-1988 and 1988-1989

Report for the Academic Years 1987-1988 and 1988-1989

Report for the Academic Years 1987-1988 and 1988-1989

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F •<br />

G •<br />

FUNDS<br />

CHANGES<br />

Institute <strong>for</strong> advanced study<br />

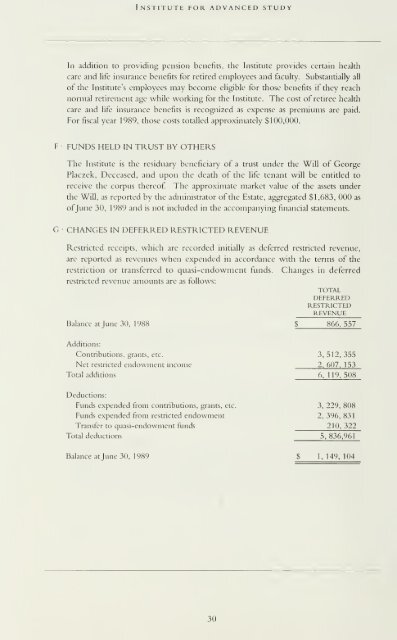

In addition to providing pension benefits, <strong>the</strong> Institute provides certain health<br />

care <strong>and</strong> life insurance benefits <strong>for</strong> retired employees <strong>and</strong> faculty. Substantially all<br />

of <strong>the</strong> Institute's employees may become eligible <strong>for</strong> those benefits if <strong>the</strong>y reach<br />

nonnal retirement age while working <strong>for</strong> <strong>the</strong> Institute. The cost of retiree health<br />

care <strong>and</strong> life insurance benefits is recognized as expense as premiums are paid.<br />

For fiscal year <strong>1989</strong>, those costs totalled approximately $100,000.<br />

HELD IN TRUST BY OTHERS<br />

The Institute is <strong>the</strong> residuary beneficiary of a trust under <strong>the</strong> Will of George<br />

Placzek, Deceased, <strong>and</strong> upon <strong>the</strong> death of <strong>the</strong> life tenant will be entitled to<br />

receive <strong>the</strong> corpus <strong>the</strong>reof The approximate market value of <strong>the</strong> assets under<br />

<strong>the</strong> Will, as reported by <strong>the</strong> administrator of <strong>the</strong> Estate, aggregated $1,683, 000 as<br />

ofJune 30, 1 989 <strong>and</strong> is not included in <strong>the</strong> accompanying financial statements.<br />

IN DEFERRED RESTRICTED REVENUE<br />

Restricted receipts, which are recorded initially as deferred restricted revenue,<br />

are reported as revenues when expended in accordance with <strong>the</strong> terms of <strong>the</strong><br />

restriction or transferred to quasi-endowment funds. Changes in deferred<br />

restricted revenue amounts are as follows:<br />

TOTAL<br />

DEFERRED<br />

RESTRICTED<br />

REVENUE<br />

Balance at June 30, <strong>1988</strong> $ 866, 557<br />

Additions:<br />

Contributions, grants, etc.<br />

Net restricted endowment income<br />

Total additions<br />

Deducrions:<br />

Funds expended from contributions, grants, etc.<br />

Funds expended from restricted endowment<br />

Transfer to quasi-endowment funds<br />

Total deductions<br />

3,512,355<br />

2, 607, 153<br />

6, 119,508<br />

3, 229, 808<br />

2, 396, 831<br />

210, 322<br />

5, 836,961<br />

Balance at June 30, <strong>1989</strong> 149, 104<br />

30