Alibaba.com Exceeds One million Paying Members in Q3 While VAS ...

Alibaba.com Exceeds One million Paying Members in Q3 While VAS ...

Alibaba.com Exceeds One million Paying Members in Q3 While VAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Alibaba</strong>.<strong>com</strong> <strong>Exceeds</strong> <strong>One</strong> <strong>million</strong> <strong>Pay<strong>in</strong>g</strong> <strong>Members</strong> <strong>in</strong> <strong>Q3</strong> <strong>While</strong> <strong>VAS</strong> Keep Driv<strong>in</strong>g Marg<strong>in</strong> Improvement<br />

Highlights<br />

Cont<strong>in</strong>u<strong>in</strong>g trust and safety efforts <strong>in</strong>crease value for customers<br />

Revenue <strong>in</strong> <strong>Q3</strong> 2010 up 40.4 percent y-o-y and 6.1 percent q-o-q<br />

Cont<strong>in</strong>ued strong growth <strong>in</strong> registered users with an addition of 11.4 <strong>million</strong> registered users y-o-y<br />

Number of overall pay<strong>in</strong>g members (<strong>in</strong>clud<strong>in</strong>g those of HiCh<strong>in</strong>a) surpassed 1 <strong>million</strong> <strong>in</strong> the quarter<br />

Net profit 1 grew 55.1 percent y-o-y<br />

EBITA marg<strong>in</strong> (before share-based <strong>com</strong>pensation expense) rema<strong>in</strong>ed strong at 35.8 percent due to operat<strong>in</strong>g<br />

leverage and the accelerated growth of revenue from value-added services<br />

Deferred revenue up 30.3 percent y-o-y to reach RMB3,868.9 <strong>million</strong> (US$571.5 <strong>million</strong>) due to strong<br />

customer acquisitions<br />

Strong cash and bank position of RMB8.4 billion (US$1.2 billion), with strong y-o-y <strong>in</strong>crease of 107.0 percent <strong>in</strong><br />

recurr<strong>in</strong>g free cash flow<br />

HONG KONG, November 11, 2010 – <strong>Alibaba</strong>.<strong>com</strong> Limited (HKSE:1688.HK) (1688.HK), the world‟s lead<strong>in</strong>g small<br />

bus<strong>in</strong>ess e-<strong>com</strong>merce <strong>com</strong>pany, today announced unaudited f<strong>in</strong>ancial results for the quarter ended September 30,<br />

2010, demonstrat<strong>in</strong>g solid f<strong>in</strong>ancial performance with improved marg<strong>in</strong>s three quarters <strong>in</strong> a row due to the growth of<br />

value-added services (“<strong>VAS</strong>”), despite cont<strong>in</strong>ued active <strong>in</strong>vestment <strong>in</strong> our operations. F<strong>in</strong>ancial contribution from<br />

<strong>VAS</strong> cont<strong>in</strong>ued to grow, demonstrat<strong>in</strong>g customer stick<strong>in</strong>ess to our platform.<br />

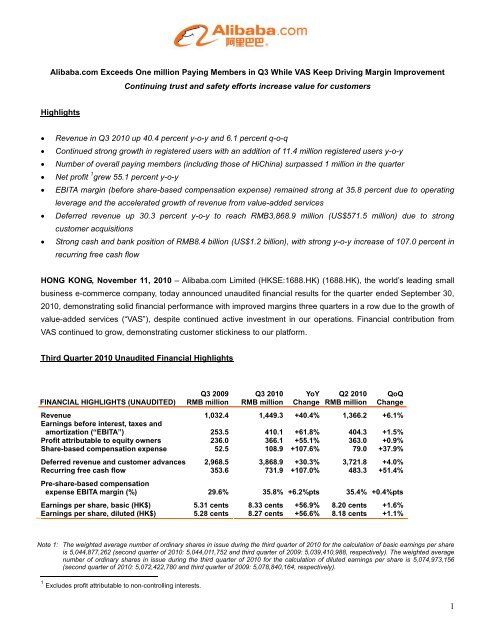

Third Quarter 2010 Unaudited F<strong>in</strong>ancial Highlights<br />

FINANCIAL HIGHLIGHTS (UNAUDITED)<br />

Note 1: The weighted average number of ord<strong>in</strong>ary shares <strong>in</strong> issue dur<strong>in</strong>g the third quarter of 2010 for the calculation of basic earn<strong>in</strong>gs per share<br />

is 5,044,877,262 (second quarter of 2010: 5,044,011,752 and third quarter of 2009: 5,039,410,988, respectively). The weighted average<br />

number of ord<strong>in</strong>ary shares <strong>in</strong> issue dur<strong>in</strong>g the third quarter of 2010 for the calculation of diluted earn<strong>in</strong>gs per share is 5,074,973,156<br />

(second quarter of 2010: 5,072,422,780 and third quarter of 2009: 5,078,840,164, respectively).<br />

1 Excludes profit attributable to non-controll<strong>in</strong>g <strong>in</strong>terests.<br />

<strong>Q3</strong> 2009<br />

RMB <strong>million</strong><br />

<strong>Q3</strong> 2010<br />

RMB <strong>million</strong><br />

YoY<br />

Change<br />

Q2 2010<br />

RMB <strong>million</strong><br />

QoQ<br />

Change<br />

Revenue<br />

Earn<strong>in</strong>gs before <strong>in</strong>terest, taxes and<br />

1,032.4 1,449.3 +40.4% 1,366.2 +6.1%<br />

amortization (“EBITA”) 253.5 410.1 +61.8% 404.3 +1.5%<br />

Profit attributable to equity owners 236.0 366.1 +55.1% 363.0 +0.9%<br />

Share-based <strong>com</strong>pensation expense 52.5 108.9 +107.6% 79.0 +37.9%<br />

Deferred revenue and customer advances 2,968.5 3,868.9 +30.3% 3,721.8 +4.0%<br />

Recurr<strong>in</strong>g free cash flow 353.6 731.9 +107.0% 483.3 +51.4%<br />

Pre-share-based <strong>com</strong>pensation<br />

expense EBITA marg<strong>in</strong> (%) 29.6% 35.8% +6.2%pts 35.4% +0.4%pts<br />

Earn<strong>in</strong>gs per share, basic (HK$) 5.31 cents 8.33 cents +56.9% 8.20 cents +1.6%<br />

Earn<strong>in</strong>gs per share, diluted (HK$) 5.28 cents 8.27 cents +56.6% 8.18 cents +1.1%<br />

1

OPERATIONAL HIGHLIGHTS<br />

Note 2: Includes pay<strong>in</strong>g members with active storefront list<strong>in</strong>gs on our <strong>in</strong>ternational and Ch<strong>in</strong>a marketplaces as well as pay<strong>in</strong>g members who<br />

have paid membership package subscription fees but whose storefronts have not been activated.<br />

Note 3: The number of Global Gold Supplier members has decreased s<strong>in</strong>ce we upgraded the product with more features and higher pric<strong>in</strong>g <strong>in</strong><br />

July 2009.<br />

“Despite the uncerta<strong>in</strong>ty and mixed signals <strong>in</strong> the global economic environment, we are gratified to see our f<strong>in</strong>ancial<br />

growth rema<strong>in</strong>ed strong <strong>in</strong> this quarter,” said David Wei, chief executive officer of <strong>Alibaba</strong>.<strong>com</strong>. “We believe our<br />

results are tied to our <strong>com</strong>mitment of mak<strong>in</strong>g 2010 a year of customer service. <strong>While</strong> we are delighted to announce<br />

the milestone of 1 <strong>million</strong> pay<strong>in</strong>g members, we specifically stepped up our efforts <strong>in</strong> enforc<strong>in</strong>g a trusted and safe<br />

environment <strong>in</strong> our marketplace by elim<strong>in</strong>at<strong>in</strong>g pay<strong>in</strong>g members who <strong>com</strong>mitted fraud as well as those who have<br />

high probability to <strong>com</strong>mit fraud. In this quarter, we term<strong>in</strong>ated about 1,200 Gold Supplier members. We believe this<br />

will help ma<strong>in</strong>ta<strong>in</strong> a high-quality e-<strong>com</strong>merce platform for buyers and suppliers, hence improv<strong>in</strong>g customer<br />

experience and foster<strong>in</strong>g <strong>VAS</strong> penetration <strong>in</strong> the long run.<br />

“Internationally, we made our first direct <strong>in</strong>vestment <strong>in</strong> India, demonstrat<strong>in</strong>g our confidence and <strong>com</strong>mitment <strong>in</strong> our<br />

bus<strong>in</strong>ess development there. We also <strong>com</strong>pleted the acquisitions of Vendio and Auctiva and connected these two<br />

platforms with our transaction-based wholesale site. This further <strong>in</strong>tegrates the e-<strong>com</strong>merce value cha<strong>in</strong> between<br />

B2B and B2C, fully realiz<strong>in</strong>g the B2B2C model. In the report<strong>in</strong>g period, these transactions furthered our goal of<br />

transform<strong>in</strong>g our platforms from „Meet at <strong>Alibaba</strong>‟ to „Work at <strong>Alibaba</strong>‟ by creat<strong>in</strong>g more values for our members<br />

through help<strong>in</strong>g them do bus<strong>in</strong>ess easier and better while <strong>in</strong>creas<strong>in</strong>g customer stick<strong>in</strong>ess to our platforms.”<br />

Outlook<br />

September 30,<br />

2009<br />

September 30,<br />

2010<br />

YoY<br />

Change<br />

“The current global economic situation rema<strong>in</strong>s <strong>com</strong>plex, and we expect Ch<strong>in</strong>a‟s export growth <strong>in</strong> the <strong>com</strong><strong>in</strong>g<br />

quarters may cont<strong>in</strong>ue to moderate, grow<strong>in</strong>g at a slower rate than what we saw <strong>in</strong> previous quarters. In Ch<strong>in</strong>a,<br />

however, we expect the growth <strong>in</strong> domestic consumption to ma<strong>in</strong>ta<strong>in</strong> momentum. Nonetheless, challenges like<br />

staff<strong>in</strong>g cost <strong>in</strong>creases, ris<strong>in</strong>g raw material costs, and Renm<strong>in</strong>bi appreciation are <strong>in</strong>tensify<strong>in</strong>g and may dampen the<br />

growth of small bus<strong>in</strong>esses. Hence, we will cont<strong>in</strong>ue to help our customers to do bus<strong>in</strong>ess <strong>in</strong> a holistic approach,<br />

look<strong>in</strong>g for ways to add value to their bus<strong>in</strong>ess, regardless of the economic climate. Forg<strong>in</strong>g ahead on our „Work at<br />

<strong>Alibaba</strong>‟ strategy, we believe there is ample room for further growth for our <strong>VAS</strong> as more of our customers migrate<br />

their bus<strong>in</strong>ess processes onl<strong>in</strong>e, mak<strong>in</strong>g them part of the e-<strong>com</strong>merce value cha<strong>in</strong>."<br />

June 30,<br />

2010<br />

QoQ<br />

Change<br />

<strong>Q3</strong> 2010<br />

Net adds<br />

Registered users 45,275,511 56,722,482 +25.3% 53,437,054 +6.1% 3,285,428<br />

International marketplace 10,480,421 14,921,668 +42.4% 13,643,361 +9.4% 1,278,307<br />

Ch<strong>in</strong>a marketplace 34,795,090 41,800,814 +20.1% 39,793,693 +5.0% 2,007,121<br />

Storefronts 6,066,900 8,199,384 +35.1% 7,812,354 +5.0% 387,030<br />

International marketplace 1,226,496 1,622,597 +32.3% 1,559,881 +4.0% 62,716<br />

Ch<strong>in</strong>a marketplace 4,840,404 6,576,787 +35.9% 6,252,473 +5.2% 324,314<br />

<strong>Pay<strong>in</strong>g</strong> members (Note 2) 578,901 750,937 +29.7% 712,867 +5.3% 38,070<br />

Ch<strong>in</strong>a Gold Supplier 84,868 108,572 +27.9% 105,810 +2.6% 2,762<br />

Global Gold Supplier (Note 3) 18,611 11,017 -40.8% 13,559 -18.7% -2,542<br />

Ch<strong>in</strong>a TrustPass 475,422 631,348 +32.8% 593,498 +6.4% 37,850<br />

2

Third Quarter 2010 F<strong>in</strong>ancial and Operational Results<br />

<strong>Pay<strong>in</strong>g</strong> <strong>Members</strong> and Revenue<br />

In the third quarter of 2010, we cont<strong>in</strong>ued healthy growth <strong>in</strong> the number of pay<strong>in</strong>g members. Overall, we<br />

surpassed the milestone of 1 <strong>million</strong> pay<strong>in</strong>g members on our marketplaces and HiCh<strong>in</strong>a. As of September 30, 2010,<br />

we had a total of 750,937 pay<strong>in</strong>g members on both <strong>in</strong>ternational and Ch<strong>in</strong>a marketplaces, represent<strong>in</strong>g a 29.7<br />

percent <strong>in</strong>crease y-o-y and a 5.3 percent <strong>in</strong>crease q-o-q. Additionally, we had 255,000 pay<strong>in</strong>g members from<br />

HiCh<strong>in</strong>a.<br />

Dur<strong>in</strong>g the quarter, we net added 2,762 Ch<strong>in</strong>a Gold Supplier members to total 108,572 as of the end of the third<br />

quarter despite the take-down of 1,200 pay<strong>in</strong>g members to ma<strong>in</strong>ta<strong>in</strong> a trusted and safe environment on our<br />

marketplace. Our Global Gold Supplier members slightly reduced to 11,017, which was expected and was well<br />

<strong>com</strong>pensated by the revenue growth. We achieved 37,850 net additions of Ch<strong>in</strong>a TrustPass pay<strong>in</strong>g members,<br />

br<strong>in</strong>g<strong>in</strong>g the total to 631,348 as of September 30, 2010.<br />

Deferred revenue and customer advances were RMB3,868.9 <strong>million</strong> (US$571.5 <strong>million</strong>) as of September 30,<br />

2010, represent<strong>in</strong>g a 30.3 percent <strong>in</strong>crease from RMB2,968.5 <strong>million</strong> (US$438.5 <strong>million</strong>) as of September 30, 2009<br />

and a 4.0 percent <strong>in</strong>crease from RMB3,721.8 <strong>million</strong> (US$549.7 <strong>million</strong>) as of June 30, 2010. The <strong>in</strong>crease was<br />

ma<strong>in</strong>ly due to the cont<strong>in</strong>ued growth of our pay<strong>in</strong>g customers and <strong>VAS</strong>. Total revenue was RMB1,449.3 <strong>million</strong><br />

(US$214.1 <strong>million</strong>) <strong>in</strong> the third quarter of 2010, represent<strong>in</strong>g a 40.4 percent <strong>in</strong>crease from the same period of 2009<br />

and a 6.1 percent <strong>in</strong>crease from the second quarter of 2010.<br />

International Marketplace<br />

Revenue from our <strong>in</strong>ternational marketplace <strong>in</strong>creased to RMB847.2 <strong>million</strong> (US$125.1 <strong>million</strong>) <strong>in</strong> the period, a<br />

32.5 percent <strong>in</strong>crease y-o-y and a 7.1 percent <strong>in</strong>crease q-o-q. The q-o-q growth was primarily due to the <strong>in</strong>crease <strong>in</strong><br />

revenue from our Ch<strong>in</strong>a Gold Supplier membership and <strong>VAS</strong> as well as the consolidation of revenue from newly<br />

acquired Vendio Services, Inc. (“Vendio”) and Auctiva Corporation (“Auctiva”).<br />

Dur<strong>in</strong>g the quarter, we recorded a quarterly net addition of 2,762 Ch<strong>in</strong>a Gold Supplier members, br<strong>in</strong>g<strong>in</strong>g the total<br />

number of Ch<strong>in</strong>a Gold Supplier members to 108,572 as of September 30, 2010, represent<strong>in</strong>g an <strong>in</strong>crease of 23,704<br />

from September 30, 2009, despite the clean-up of suspicious members. This voluntary clean-up of bad players is<br />

crucial to improv<strong>in</strong>g overall supplier quality despite the short-term impact on membership base. The quarter saw a<br />

steady development <strong>in</strong> <strong>VAS</strong> adoption by our members as the <strong>VAS</strong> revenue contribution to Ch<strong>in</strong>a Gold Supplier<br />

revenue cont<strong>in</strong>ued to surpass 25 percent.<br />

In September 2010, we announced an upgraded Ch<strong>in</strong>a Gold Supplier membership package (“CGS 2011 edition”)<br />

priced at RMB29,800 (US$4,401.8) per annum that will replace the exist<strong>in</strong>g Gold Supplier Starter Pack on January<br />

3

1, 2011. This upgrade is a key step toward our long-term vision of br<strong>in</strong>g<strong>in</strong>g e-<strong>com</strong>merce and our bus<strong>in</strong>ess to<br />

another level: help<strong>in</strong>g our customers move from “Meet at <strong>Alibaba</strong>” to “Work at <strong>Alibaba</strong>.” The new CGS 2011 edition<br />

<strong>in</strong>cludes an upgraded customer work<strong>in</strong>g platform on the marketplace and new services for promot<strong>in</strong>g trust and safe<br />

trad<strong>in</strong>g on the <strong>Alibaba</strong>.<strong>com</strong> platform. The upgrade aims to enhance user experience while steadily expand<strong>in</strong>g our<br />

customer base and strengthen<strong>in</strong>g our customer relationship.<br />

The number of Global Gold Supplier members reduced to 11,017 as of September 30, 2010, represent<strong>in</strong>g a<br />

decrease of 7,594 y-o-y and 2,542 q-o-q, which is primarily due to the expected impact from product upgrade and<br />

price <strong>in</strong>crease last year. Revenue from Global Gold Supplier rema<strong>in</strong>ed steady as <strong>com</strong>pared to the previous quarter.<br />

To further build on the membership growth achieved <strong>in</strong> India <strong>in</strong> the past two years, <strong>in</strong> the third quarter of 2010, we<br />

launched local operations <strong>in</strong> Mumbai, India to better serve the vast Indian small bus<strong>in</strong>ess <strong>com</strong>munity. Our Indian<br />

office handles all direct membership sales and provides hands-on support and customer tra<strong>in</strong><strong>in</strong>g programs.<br />

As of September 30, 2010, there were 14.9 <strong>million</strong> registered users and 1.6 <strong>million</strong> storefronts on our <strong>in</strong>ternational<br />

marketplace. In the third quarter, registered users <strong>in</strong>creased by 1.3 <strong>million</strong> and storefronts grew by 62,716.<br />

AliExpress<br />

Dur<strong>in</strong>g the period, we actively expanded our suppliers, buyers, product categories and product offer<strong>in</strong>gs on this<br />

transaction-based wholesale platform. At the same time, we stepped up our effort <strong>in</strong> improv<strong>in</strong>g its flow, <strong>in</strong>clud<strong>in</strong>g<br />

streaml<strong>in</strong><strong>in</strong>g the process of plac<strong>in</strong>g orders while ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g trust and safety on the platform, provid<strong>in</strong>g enhanced<br />

overall user experience.<br />

In July 2010, we <strong>com</strong>pleted the acquisition of Vendio, an e-<strong>com</strong>merce platform provid<strong>in</strong>g a one-stop solution for<br />

small bus<strong>in</strong>esses that are sell<strong>in</strong>g across multiple onl<strong>in</strong>e channels, <strong>in</strong>clud<strong>in</strong>g eBay and Amazon. In August 2010, we<br />

acquired Auctiva, the lead<strong>in</strong>g third-party developer of list<strong>in</strong>g, market<strong>in</strong>g and management tools for eBay sellers.<br />

Through these two acquisitions, <strong>Alibaba</strong>.<strong>com</strong> ga<strong>in</strong>ed access to more than 250,000 small onl<strong>in</strong>e retailers who have<br />

potential sourc<strong>in</strong>g needs from suppliers on our <strong>in</strong>ternational marketplace and AliExpress. The connection of these<br />

two platforms with our marketplaces will help <strong>in</strong>tegrate the e-<strong>com</strong>merce value cha<strong>in</strong> between B2B and B2C, fully<br />

realiz<strong>in</strong>g the B2B2C model. Bus<strong>in</strong>ess <strong>in</strong>tegration is underway as we are now work<strong>in</strong>g on further match<strong>in</strong>g criteria<br />

like product categories <strong>in</strong> demand, quality and scale of suppliers, etc. between the buyers and our AliExpress<br />

suppliers.<br />

Ch<strong>in</strong>a Marketplace<br />

Revenue from our Ch<strong>in</strong>a marketplace <strong>in</strong>creased to RMB492.2 <strong>million</strong> (US$72.7 <strong>million</strong>) <strong>in</strong> the period,<br />

represent<strong>in</strong>g a 30.1 percent <strong>in</strong>crease y-o-y and a 4.6 percent <strong>in</strong>crease q-o-q. Dur<strong>in</strong>g this period, registered users<br />

rose by 2.0 <strong>million</strong> to 41.8 <strong>million</strong> and storefronts grew by 324,314 to 6.6 <strong>million</strong>.<br />

<strong>Pay<strong>in</strong>g</strong> member growth was also well on track. As we have previously cautioned, the net addition of pay<strong>in</strong>g<br />

4

members has reverted to a more susta<strong>in</strong>able level <strong>in</strong> the third quarter, when the new product impact of Ch<strong>in</strong>a<br />

TrustPass Basic was absorbed. We achieved 37,850 net additions of Ch<strong>in</strong>a TrustPass pay<strong>in</strong>g members, br<strong>in</strong>g<strong>in</strong>g<br />

the total to 631,348 as of September 30, 2010, grow<strong>in</strong>g 32.8 percent y-o-y and 6.4 percent q-o-q. The strong<br />

growth <strong>in</strong> our base of pay<strong>in</strong>g members was ma<strong>in</strong>ly attributable to the positive effects of new bus<strong>in</strong>ess <strong>in</strong>itiatives<br />

<strong>in</strong>troduced <strong>in</strong> the beg<strong>in</strong>n<strong>in</strong>g of the year.<br />

In the third quarter of 2010, the contribution of <strong>VAS</strong> revenue to Ch<strong>in</strong>a TrustPass revenue exceeded 20 percent<br />

attributed ma<strong>in</strong>ly to the strong growth momentum <strong>in</strong> Ali-ADvance and Premium Placement. Further product and<br />

search feature modifications <strong>in</strong> Ali-ADvance helped us address customer needs <strong>in</strong> a more effective way and hence<br />

raised the return on <strong>in</strong>vestment for our members. We expect further penetration of <strong>VAS</strong> as more new features are<br />

be<strong>in</strong>g launched and our members further experience the power of these applications.<br />

HiCh<strong>in</strong>a<br />

HiCh<strong>in</strong>a had about 2.1 <strong>million</strong> doma<strong>in</strong> names <strong>in</strong> service, and the total number of pay<strong>in</strong>g members for its non-<br />

doma<strong>in</strong> name services was around 255,000 as of September 30, 2010. The growth <strong>in</strong> doma<strong>in</strong> names <strong>in</strong> service<br />

slowed down <strong>in</strong> the third quarter ma<strong>in</strong>ly due to the new government policy on the authentication process for users.<br />

Ali-Loan<br />

Ali-Loan cont<strong>in</strong>ued to demonstrate its value <strong>in</strong> solv<strong>in</strong>g small bus<strong>in</strong>esses‟ f<strong>in</strong>anc<strong>in</strong>g needs while <strong>in</strong>creas<strong>in</strong>g members‟<br />

stick<strong>in</strong>ess to <strong>Alibaba</strong>.<strong>com</strong>. As of September 30, 2010, the cumulative number of loans issued by our partner banks<br />

to our pay<strong>in</strong>g members was more than 8,000, with total loans exceed<strong>in</strong>g RMB20 billion (US$3.0 billion) s<strong>in</strong>ce the<br />

program was <strong>in</strong>troduced.<br />

Gross profit <strong>in</strong>creased to RMB1,207.2 <strong>million</strong> (US$178.3 <strong>million</strong>) <strong>in</strong> the period, up 35.0 percent y-o-y from<br />

RMB894.4 <strong>million</strong> (US$132.1 <strong>million</strong>) and up 6.0 percent q-o-q from RMB1,139.0 <strong>million</strong> (US$168.2 <strong>million</strong>). Gross<br />

profit marg<strong>in</strong> decl<strong>in</strong>ed slightly to 83.3 percent <strong>com</strong>pared with 86.6 percent <strong>in</strong> the same period last year and was flat<br />

from 83.4 percent <strong>in</strong> the second quarter of 2010. The decl<strong>in</strong>e was primarily due to a higher cost of revenue<br />

stemm<strong>in</strong>g from the <strong>in</strong>clusion of f<strong>in</strong>ancial results from HiCh<strong>in</strong>a and Vendio, which had relatively lower gross profit<br />

marg<strong>in</strong>s.<br />

Total operat<strong>in</strong>g expenses were RMB831.9 <strong>million</strong> (US$122.9 <strong>million</strong>) <strong>in</strong> the period, represent<strong>in</strong>g a 24.4 percent<br />

<strong>in</strong>crease y-o-y from RMB668.8 <strong>million</strong> (US$98.8 <strong>million</strong>) and a 10.5 percent <strong>in</strong>crease q-o-q from RMB752.9 <strong>million</strong><br />

(US$111.2 <strong>million</strong>). The <strong>in</strong>crease <strong>in</strong> operat<strong>in</strong>g expenses, for both y-o-y and q-o-q, was ma<strong>in</strong>ly due to the<br />

consolidation of expenses <strong>in</strong>curred by HiCh<strong>in</strong>a, Vendio and Auctiva, as well as our cont<strong>in</strong>u<strong>in</strong>g <strong>in</strong>vestments <strong>in</strong> our<br />

bus<strong>in</strong>ess as we expand. Total operat<strong>in</strong>g expenses as a percentage of revenue were 57.4 percent for the period,<br />

<strong>com</strong>pared with 64.8 percent <strong>in</strong> the same period last year and 55.1 percent <strong>in</strong> the second quarter of 2010. The y-o-y<br />

decrease was ma<strong>in</strong>ly due to the <strong>VAS</strong> growth as well as scale benefits that we realized while the q-o-q <strong>in</strong>crease was<br />

ma<strong>in</strong>ly due to higher share-based <strong>com</strong>pensation expense <strong>in</strong>curred <strong>in</strong> the third quarter of 2010. Profit from<br />

5

operations was RMB396.1 <strong>million</strong> (US$58.5 <strong>million</strong>), represent<strong>in</strong>g an <strong>in</strong>crease of 52.3 percent from the same<br />

period last year.<br />

Our profit marg<strong>in</strong> before <strong>in</strong>terest, taxes and amortization (“EBITA marg<strong>in</strong>”) (non-GAAP) was 28.3 percent for<br />

the period, an <strong>in</strong>crease from 24.6 percent <strong>in</strong> the same period of 2009 and a decrease from 29.6 percent <strong>in</strong> the<br />

second quarter of 2010. EBITA marg<strong>in</strong> before share-based <strong>com</strong>pensation expense (non-GAAP) was 35.8 percent<br />

for the period, an <strong>in</strong>crease from 29.6 percent <strong>in</strong> the same period last year and an <strong>in</strong>crease from 35.4 percent <strong>in</strong> the<br />

second quarter of 2010. The <strong>in</strong>crease <strong>in</strong> EBITA marg<strong>in</strong> before share-based <strong>com</strong>pensation expense y-o-y was<br />

ma<strong>in</strong>ly caused by lower sales and market<strong>in</strong>g expenses as a percentage of revenue as well as a higher marg<strong>in</strong><br />

contribution from <strong>VAS</strong> revenue, which was partially offset by the dilutive effect after the consolidation of results of<br />

the newly acquired <strong>com</strong>panies.<br />

Profit attributable to equity owners for the third quarter of 2010 was RMB366.1 <strong>million</strong> (US$54.1 <strong>million</strong>), an<br />

<strong>in</strong>crease of 55.1 percent from the same period <strong>in</strong> 2009 and 0.9 percent from the second quarter of 2010, was<br />

largely due to the <strong>in</strong>crease <strong>in</strong> revenue contributed by our larger pay<strong>in</strong>g customer base and strong growth of our<br />

<strong>VAS</strong> products.<br />

Earn<strong>in</strong>gs per share, basic and diluted were 8.33 Hong Kong cents (1.07 US cents) and 8.27 Hong Kong cents<br />

(1.06 US cents) respectively, <strong>com</strong>pared to 5.31 Hong Kong cents (0.68 US cents) and 5.28 Hong Kong cents (0.68<br />

US cents) (basic and diluted, respectively) <strong>in</strong> the third quarter of 2009 and 8.20 Hong Kong cents (1.05 US cents)<br />

and 8.18 Hong Kong cents (1.05 US cents) (basic and diluted, respectively) <strong>in</strong> the second quarter of 2010.<br />

Recurr<strong>in</strong>g free cash flow (non-GAAP) <strong>in</strong> the period was RMB731.9 <strong>million</strong> (US$108.1 <strong>million</strong>), represent<strong>in</strong>g a<br />

107.0 percent <strong>in</strong>crease y-o-y and a 51.4 percent <strong>in</strong>crease q-o-q. The y-o-y and q-o-q <strong>in</strong>crease was ma<strong>in</strong>ly<br />

attributable to the strong <strong>in</strong>crease <strong>in</strong> pay<strong>in</strong>g members and <strong>VAS</strong>, refund of overpaid 2009 enterprise <strong>in</strong><strong>com</strong>e tax<br />

ma<strong>in</strong>ly due to adjustment of tax rate from 15 percent to 10 percent and lower capital expenditure <strong>in</strong>curred <strong>in</strong> the<br />

period.<br />

Cash and bank balances as of September 30, 2010 were RMB8,361.1 <strong>million</strong> (US$1,235.0 <strong>million</strong>), represent<strong>in</strong>g<br />

a 30.9 percent <strong>in</strong>crease y-o-y and a 7.3 percent <strong>in</strong>crease q-o-q. Dur<strong>in</strong>g the third quarter of 2010, we paid a total of<br />

RMB233.2 <strong>million</strong> (US$34.4 <strong>million</strong>) <strong>in</strong> cash for the acquisition of Vendio and Auctiva.<br />

Note: All U.S. dollar conversions are based on an exchange rate of US$1.00=HK$7.80 and US$1.00=RMB6.77.<br />

-End-<br />

6

About <strong>Alibaba</strong>.<strong>com</strong> Limited<br />

<strong>Alibaba</strong>.<strong>com</strong> (HKSE: 1688) (1688.HK) is the global leader <strong>in</strong> e-<strong>com</strong>merce for small bus<strong>in</strong>esses and the flagship<br />

<strong>com</strong>pany of <strong>Alibaba</strong> Group. Founded <strong>in</strong> 1999 <strong>in</strong> Hangzhou, Ch<strong>in</strong>a, <strong>Alibaba</strong>.<strong>com</strong> makes it easy for <strong>million</strong>s of buyers<br />

and suppliers around the world to do bus<strong>in</strong>ess onl<strong>in</strong>e through three marketplaces: a global trade platform<br />

(www.alibaba.<strong>com</strong>) for importers and exporters; a Ch<strong>in</strong>ese platform (www.1688.<strong>com</strong>) for domestic trade <strong>in</strong> Ch<strong>in</strong>a;<br />

and, through an associated <strong>com</strong>pany, a Japanese platform (www.alibaba.co.jp) facilitat<strong>in</strong>g trade to and from Japan.<br />

In addition, <strong>Alibaba</strong>.<strong>com</strong> offers a transaction-based wholesale platform on the global site (www.aliexpress.<strong>com</strong>)<br />

geared for smaller buyers seek<strong>in</strong>g fast shipment of small quantities of goods. Together, these marketplaces form a<br />

<strong>com</strong>munity of more than 56 <strong>million</strong> registered users <strong>in</strong> more than 240 countries and regions. <strong>Alibaba</strong>.<strong>com</strong> also<br />

offers bus<strong>in</strong>ess management software and Internet <strong>in</strong>frastructure services target<strong>in</strong>g bus<strong>in</strong>esses across Ch<strong>in</strong>a, and<br />

provides educational services to <strong>in</strong>cubate enterprise management and e-<strong>com</strong>merce professionals. <strong>Alibaba</strong>.<strong>com</strong><br />

also owns Vendio and Auctiva, lead<strong>in</strong>g providers of third-party e-<strong>com</strong>merce solutions for onl<strong>in</strong>e merchants.<br />

<strong>Alibaba</strong>.<strong>com</strong> has offices <strong>in</strong> more than 60 cities across Greater Ch<strong>in</strong>a, India, Japan, Korea, Europe and the United<br />

States.<br />

For <strong>in</strong>vestor <strong>in</strong>quiries please contact:<br />

L<strong>in</strong>dy Lau<br />

Tel: +852 2215 5215<br />

Email: l<strong>in</strong>dylau@hk.alibaba-<strong>in</strong>c.<strong>com</strong><br />

For media <strong>in</strong>quiries please contact:<br />

L<strong>in</strong>da Kozlowski<br />

Tel: +852 9028 5150<br />

Email: lkozlowski@hk.alibaba-<strong>in</strong>c.<strong>com</strong><br />

For photos and broadcast-standard video support<strong>in</strong>g this press release, please visit<br />

www.thenewsmarket.<strong>com</strong>/alibaba. If you are a first-time user, please take a moment to register. If you have any<br />

questions, please email journalisthelp@thenewsmarket.<strong>com</strong>.<br />

7

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME<br />

FOR THE QUARTER ENDED SEPTEMBER 30, 2010<br />

<strong>Q3</strong> 2009 <strong>Q3</strong> 2010 Q2 2010 <strong>Q3</strong> 2010<br />

RMB’000 RMB’000 RMB’000 RMB’000<br />

Revenue<br />

International marketplace 639,339 847,153 791,038 847,153<br />

Ch<strong>in</strong>a marketplace 378,319 492,177 470,738 492,177<br />

Others 14,713 109,945 104,454 109,945<br />

Total revenue 1,032,371 1,449,275 1,366,230 1,449,275<br />

Cost of revenue (138,000) (242,050)<br />

Gross profit 894,371 1,207,225<br />

(227,208) (242,050)<br />

1,139,022 1,207,225<br />

Sales and market<strong>in</strong>g expenses (463,052) (526,212) (498,084) (526,212)<br />

Product development expenses (107,803) (160,258) (132,279) (160,258)<br />

General and adm<strong>in</strong>istrative expenses (97,962) (145,437) (122,542) (145,437)<br />

Other operat<strong>in</strong>g <strong>in</strong><strong>com</strong>e, net 34,475 20,783 7,789 20,783<br />

Profit from operations 260,029 396,101 393,906 396,101<br />

F<strong>in</strong>ance <strong>in</strong><strong>com</strong>e, net 33,415 48,392 43,102 48,392<br />

Share of losses, after tax of:<br />

Associated <strong>com</strong>panies (8,749) - - -<br />

Jo<strong>in</strong>t controlled entity - (1,740) - (1,740)<br />

Profit before <strong>in</strong><strong>com</strong>e taxes 284,695 442,753 437,008 442,753<br />

In<strong>com</strong>e tax charges (48,656) (77,036) (74,055) (77,036)<br />

Profit for the period 236,039 365,717 362,953 365,717<br />

Other <strong>com</strong>prehensive <strong>in</strong><strong>com</strong>e/(expense)<br />

Net fair value ga<strong>in</strong>s on available-for-sale <strong>in</strong>vestments 60 220 100 220<br />

Currency translation differences (629) (8,894) (3,162) (8,894)<br />

Total <strong>com</strong>prehensive <strong>in</strong><strong>com</strong>e for the period 235,470 357,043 359,891 357,043<br />

Profit/(loss) for the period attributable to<br />

Equity owners of our Company 236,039 366,066 362,959 366,066<br />

Non-controll<strong>in</strong>g <strong>in</strong>terest - (349) (6) (349)<br />

Profit for the period 236,039 365,717 362,953 365,717<br />

Total <strong>com</strong>prehensive <strong>in</strong><strong>com</strong>e/(expense) for the<br />

period attributable to<br />

Equity owners of our Company 235,470 357,392 359,897 357,392<br />

Non-controll<strong>in</strong>g <strong>in</strong>terest - (349) (6) (349)<br />

Total <strong>com</strong>prehensive <strong>in</strong><strong>com</strong>e for the period 235,470 357,043 359,891 357,043<br />

Dividends 888,261 - - -<br />

Earn<strong>in</strong>gs per share, basic (RMB) 4.68 cents 7.26 cents 7.19 cents 7.26 cents<br />

Earn<strong>in</strong>gs per share, diluted (RMB) 4.65 cents 7.21 cents 7.18 cents 7.21 cents<br />

Earn<strong>in</strong>gs per share, basic (HK$) (Note 4) 5.31 cents 8.33 cents 8.20 cents 8.33 cents<br />

Earn<strong>in</strong>gs per share, diluted (HK$) (Note 4) 5.28 cents 8.27 cents 8.18 cents 8.27 cents<br />

Note 4: The translation of Renm<strong>in</strong>bi amounts <strong>in</strong>to Hong Kong dollars has been made at the rate of RMB0.8713 to HK$1.0000 for the third<br />

quarter of 2010 (second quarter of 2010: RMB0.8771 to HK$1.0000 and third quarter of 2009: RMB0.8814 to HK$1.0000). No<br />

representation is made that the Renm<strong>in</strong>bi amounts have been, could have been or could be converted <strong>in</strong>to Hong Kong dollars or vice<br />

versa, at that rate, or at any rate or at all.<br />

8

ADDITIONAL QUARTERLY FINANCIAL INFORMATION (UNAUDITED)<br />

Revenue<br />

International marketplace<br />

<strong>Q3</strong> 2009 <strong>Q3</strong> 2010 Q2 2010 <strong>Q3</strong> 2010<br />

RMB’000 RMB’000 RMB’000 RMB’000<br />

Ch<strong>in</strong>a Gold Supplier 622,824 824,094 768,248 824,094<br />

Global Gold Supplier 16,515 23,059 22,790 23,059<br />

Ch<strong>in</strong>a marketplace<br />

639,339 847,153 791,038 847,153<br />

Ch<strong>in</strong>a TrustPass 358,877 472,303 444,420 472,303<br />

Other revenue (Note 5) 19,442 19,874 26,318 19,874<br />

378,319 492,177 470,738 492,177<br />

Others (Note 6) 14,713 109,945 104,454 109,945<br />

Total 1,032,371 1,449,275 1,366,230 1,449,275<br />

Recurr<strong>in</strong>g free cash flow (Non-<br />

GAAP)<br />

Net cash generated from operat<strong>in</strong>g<br />

activities 418,497 847,562 547,765 847,562<br />

Purchase of property and equipment,<br />

exclud<strong>in</strong>g payment for land use<br />

rights and construction costs of<br />

corporate campus project (64,902) (38,906) (64,476) (38,906)<br />

<strong>One</strong>-off tax refund (Note 7) - (76,766) - (76,766)<br />

Total 353,595 731,890 483,289 731,890<br />

Share-based <strong>com</strong>pensation expense 52,473 108,927 79,015 108,927<br />

Amortization of <strong>in</strong>tangible assets<br />

and lease prepayment 1,951 11,230<br />

As of<br />

September 30,<br />

2009<br />

As of<br />

September 30,<br />

2010<br />

Cash and bank balances 6,389,641 8,361,076<br />

Deferred revenue and customer<br />

advances 2,968,517 3,868,937<br />

8,401 11,230<br />

As of<br />

June 30,<br />

2010<br />

As of<br />

September 30,<br />

2010<br />

RMB’000 RMB’000 RMB’000 RMB’000<br />

7,790,635 8,361,076<br />

3,721,805 3,868,937<br />

Note 5: Other revenue earned with respect to our Ch<strong>in</strong>a marketplace ma<strong>in</strong>ly represents advertis<strong>in</strong>g fees paid by third-party advertisers.<br />

Note 6: Other revenue ma<strong>in</strong>ly represents revenue earned from the sale of Internet <strong>in</strong>frastructure and application services and certa<strong>in</strong><br />

software products.<br />

Note 7: <strong>One</strong>-off tax refund represents a cash refund of prepaid tax received. Pursuant to the New Enterprise In<strong>com</strong>e Tax Law and<br />

Guoshuihan [2008] No.875, taxable <strong>in</strong><strong>com</strong>e should be <strong>com</strong>puted on an accrual basis for Enterprise In<strong>com</strong>e Tax purpose. As a<br />

result, <strong>Alibaba</strong> (Ch<strong>in</strong>a) Technology Co., Ltd. changed its Enterprise In<strong>com</strong>e Tax fil<strong>in</strong>g basis from cash basis to accrual basis <strong>in</strong><br />

2009 and a cash refund of RMB76.8 <strong>million</strong>, be<strong>in</strong>g tax prepaid under cash basis, was received dur<strong>in</strong>g the period.<br />

9