Kumasi, Ghana: Potential Opportunities for Investors - Millennium ...

Kumasi, Ghana: Potential Opportunities for Investors - Millennium ...

Kumasi, Ghana: Potential Opportunities for Investors - Millennium ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fruit processing market<br />

In addition to the<br />

<strong>Ghana</strong>ian market, there is<br />

the potential <strong>for</strong> <strong>Ghana</strong>based<br />

manufacturers to<br />

enter regional and<br />

international fruit<br />

juice markets<br />

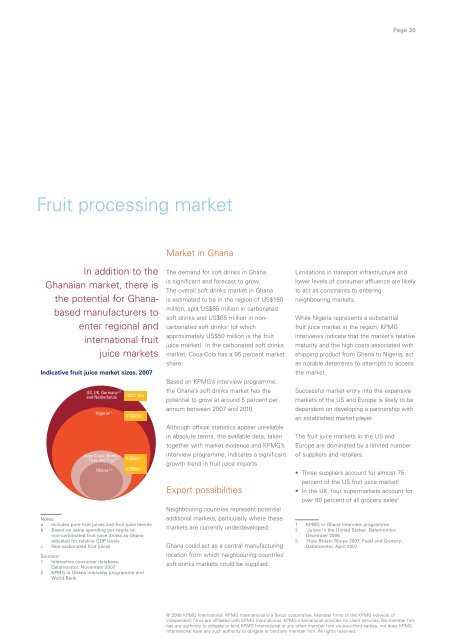

Indicative fruit juice market sizes, 2007<br />

a 1<br />

US, UK, Germany<br />

and Netherlands<br />

Nigeriaa 1<br />

Ivory Coast, Burkina<br />

b c<br />

Faso and Togo<br />

<strong>Ghana</strong> 2 c<br />

US$37.1bn<br />

US$320m<br />

US$50m<br />

US$50m<br />

Notes:<br />

a Includes pure fruit juices and fruit juice blends<br />

b Based on same spending per capita on<br />

non-carbonated fruit juice drinks as <strong>Ghana</strong><br />

adjusted <strong>for</strong> relative GDP levels<br />

c Non-carbonated fruit juices<br />

Sources:<br />

1 Interactive consumer database,<br />

Datamonitor, November 2007<br />

2 KPMG in <strong>Ghana</strong> interview programme and<br />

World Bank<br />

Market in <strong>Ghana</strong><br />

The demand <strong>for</strong> soft drinks in <strong>Ghana</strong><br />

is significant and <strong>for</strong>ecast to grow.<br />

The overall soft drinks market in <strong>Ghana</strong><br />

is estimated to be in the region of US$150<br />

million, split US$85 million in carbonated<br />

soft drinks and US$65 million in noncarbonated<br />

soft drinks1 (of which<br />

approximately US$50 million is the fruit<br />

juice market). In the carbonated soft drinks<br />

market, Coca-Cola has a 95 percent market<br />

share.<br />

Based on KPMG’s interview programme,<br />

the <strong>Ghana</strong>’s soft drinks market has the<br />

potential to grow at around 5 percent per<br />

annum between 2007 and 2010.<br />

Although official statistics appear unreliable<br />

in absolute terms, the available data, taken<br />

together with market evidence and KPMG’s<br />

interview programme, indicates a significant<br />

growth trend in fruit juice imports.<br />

Export possibilities<br />

Neighbouring countries represent potential<br />

additional markets, particularly where these<br />

markets are currently underdeveloped.<br />

<strong>Ghana</strong> could act as a central manufacturing<br />

location from which neighbouring countries’<br />

soft drinks markets could be supplied.<br />

Page 30<br />

Limitations in transport infrastructure and<br />

lower levels of consumer affluence are likely<br />

to act as constraints to entering<br />

neighbouring markets.<br />

While Nigeria represents a substantial<br />

fruit juice market in the region, KPMG<br />

interviews indicate that the market’s relative<br />

maturity and the high costs associated with<br />

shipping product from <strong>Ghana</strong> to Nigeria, act<br />

as notable deterrents to attempts to access<br />

the market.<br />

Successful market entry into the expansive<br />

markets of the US and Europe is likely to be<br />

dependent on developing a partnership with<br />

an established market player.<br />

The fruit juice markets in the US and<br />

Europe are dominated by a limited number<br />

of suppliers and retailers.<br />

• Three suppliers account <strong>for</strong> almost 75<br />

percent of the US fruit juice market 2<br />

• In the UK, four supermarkets account <strong>for</strong><br />

over 80 percent of all grocery sales 3<br />

1 KPMG in <strong>Ghana</strong> interview programme<br />

2 ‘Juices in the United States’, Datamonitor,<br />

December 2006<br />

3 ‘How Britain Shops 2007: Food and Grocery’,<br />

Datamonitor, April 2007<br />

© 2008 KPMG International. KPMG International is a Swiss cooperative. Member firms of the KPMG network of<br />

independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm<br />

has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG<br />

International have any such authority to obligate or bind any member firm. All rights reserved.