Kumasi, Ghana: Potential Opportunities for Investors - Millennium ...

Kumasi, Ghana: Potential Opportunities for Investors - Millennium ...

Kumasi, Ghana: Potential Opportunities for Investors - Millennium ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

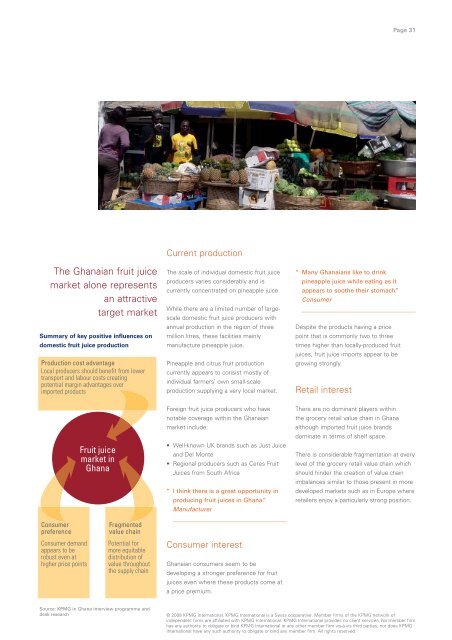

The <strong>Ghana</strong>ian fruit juice<br />

market alone represents<br />

an attractive<br />

target market<br />

Summary of key positive influences on<br />

domestic fruit juice production<br />

Production cost advantage<br />

Local producers should benefit from lower<br />

transport and labour costs creating<br />

potential margin advantages over<br />

imported products<br />

Consumer<br />

preference<br />

Consumer demand<br />

appears to be<br />

robust even at<br />

higher price points<br />

Fruit juice<br />

market in<br />

<strong>Ghana</strong><br />

Fragmented<br />

value chain<br />

<strong>Potential</strong> <strong>for</strong><br />

more equitable<br />

distribution of<br />

value throughout<br />

the supply chain<br />

Source: KPMG in <strong>Ghana</strong> interview programme and<br />

desk research<br />

Current production<br />

The scale of individual domestic fruit juice<br />

producers varies considerably and is<br />

currently concentrated on pineapple juice.<br />

While there are a limited number of largescale<br />

domestic fruit juice producers with<br />

annual production in the region of three<br />

million litres, these facilities mainly<br />

manufacture pineapple juice.<br />

Pineapple and citrus fruit production<br />

currently appears to consist mostly of<br />

individual farmers’ own small-scale<br />

production supplying a very local market.<br />

Foreign fruit juice producers who have<br />

notable coverage within the <strong>Ghana</strong>ian<br />

market include:<br />

• Well-known UK brands such as Just Juice<br />

and Del Monte<br />

• Regional producers such as Ceres Fruit<br />

Juices from South Africa<br />

“ I think there is a great opportunity in<br />

producing fruit juices in <strong>Ghana</strong>.”<br />

Manufacturer<br />

Consumer interest<br />

<strong>Ghana</strong>ian consumers seem to be<br />

developing a stronger preference <strong>for</strong> fruit<br />

juices even where these products come at<br />

a price premium.<br />

“ Many <strong>Ghana</strong>ians like to drink<br />

pineapple juice while eating as it<br />

appears to soothe their stomach.”<br />

Consumer<br />

Despite the products having a price<br />

point that is commonly two to three<br />

times higher than locally-produced fruit<br />

juices, fruit juice imports appear to be<br />

growing strongly.<br />

Retail interest<br />

There are no dominant players within<br />

the grocery retail value chain in <strong>Ghana</strong><br />

although imported fruit juice brands<br />

dominate in terms of shelf space.<br />

Page 31<br />

There is considerable fragmentation at every<br />

level of the grocery retail value chain which<br />

should hinder the creation of value chain<br />

imbalances similar to those present in more<br />

developed markets such as in Europe where<br />

retailers enjoy a particularly strong position.<br />

© 2008 KPMG International. KPMG International is a Swiss cooperative. Member firms of the KPMG network of<br />

independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm<br />

has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG<br />

International have any such authority to obligate or bind any member firm. All rights reserved.