Postal Bulletin 22217 - October 11, 2007 - USPS.com® - About

Postal Bulletin 22217 - October 11, 2007 - USPS.com® - About

Postal Bulletin 22217 - October 11, 2007 - USPS.com® - About

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INFORMATION DESK<br />

Finance<br />

Local Tax Code Information<br />

The <strong>Postal</strong> Service collects appropriate federal, state,<br />

and, in some cases, local taxes directly from the pay of our<br />

employees who are subject to these deductions. Based on<br />

agreements between individual local taxation authorities<br />

and the United States Treasury Department, the <strong>Postal</strong><br />

Service collects a number of occupational license taxes,<br />

city and/or county income taxes and license fees, revenue<br />

taxes, senior citizen taxes, mental health taxes, residence<br />

taxes, local service taxes or, in some locations, two of<br />

these taxes. This updated local tax code listing changes<br />

the title of one tax, adds one new tax collection location,<br />

and indicates the type(s) of taxes collected directly from<br />

our employees via payroll deduction procedures.<br />

Some of the taxes shown below are automatically<br />

deducted from the salaries of <strong>Postal</strong> Service employees<br />

who live or work within the geographic boundaries of specific<br />

taxing authorities. However, most of these taxes have<br />

not been established as automatic deductions. If you are<br />

subject to any of these local taxes, you must be proactive<br />

and complete and submit the proper taxation paperwork.<br />

Frequent contact between the <strong>Postal</strong> Service, Treasury, the<br />

Internal Revenue Service, and these taxing authorities indicates<br />

that many employees are not having the appropriate<br />

amounts withheld from their pay. You are reminded that, as<br />

POSTAL BULLETIN <strong>22217</strong> (10-<strong>11</strong>-07)<br />

51<br />

a <strong>Postal</strong> Service employee, you are personally responsible<br />

for ensuring that the correct local taxes are deducted from<br />

your pay.<br />

All <strong>Postal</strong> Service employees are reminded that they are<br />

bound by the materials contained within the Code of<br />

Ethics, Principles of Ethical Conduct for Government<br />

Officers and Employees. This includes Principle 12, which<br />

states: “An employee shall satisfy in good faith their obligations<br />

as citizens, including all just financial obligations,<br />

especially those — such as federal, state, or local taxes —<br />

that are imposed by law.”<br />

If you live or work in a locality that is subject to one (or<br />

more) of the taxes listed below and the correct deduction(s)<br />

is not being assessed from your pay, you should immediately<br />

complete a PS Form 4, Employee’s City or County<br />

Withholding Certificate. After completing this form, forward<br />

it to the following address:<br />

HR SHARED SERVICE CENTER<br />

PO BOX 970400<br />

GREENSBORO NC 27497-0400<br />

Direct all questions concerning these local taxes to the<br />

HR Shared Service Center in Greensboro. Call 877-477-<br />

3273, and select option 5.<br />

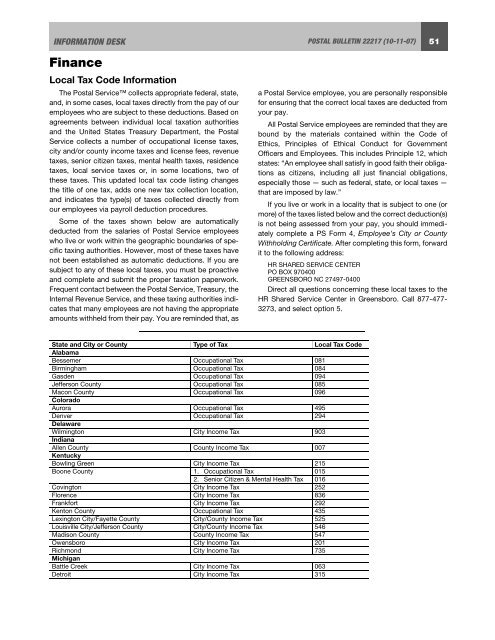

State and City or County Type of Tax Local Tax Code<br />

Alabama<br />

Bessemer Occupational Tax 081<br />

Birmingham Occupational Tax 084<br />

Gasden Occupational Tax 094<br />

Jefferson County Occupational Tax 085<br />

Macon County Occupational Tax 096<br />

Colorado<br />

Aurora Occupational Tax 495<br />

Denver Occupational Tax 294<br />

Delaware<br />

Wilmington City Income Tax 903<br />

Indiana<br />

Allen County County Income Tax 007<br />

Kentucky<br />

Bowling Green City Income Tax 215<br />

Boone County 1. Occupational Tax 015<br />

2. Senior Citizen & Mental Health Tax 016<br />

Covington City Income Tax 252<br />

Florence City Income Tax 836<br />

Frankfort City Income Tax 292<br />

Kenton County Occupational Tax 435<br />

Lexington City/Fayette County City/County Income Tax 525<br />

Louisville City/Jefferson County City/County Income Tax 546<br />

Madison County County Income Tax 547<br />

Owensboro City Income Tax 201<br />

Richmond City Income Tax 735<br />

Michigan<br />

Battle Creek City Income Tax 063<br />

Detroit City Income Tax 315