Download PDF - Sky Deutschland AG

Download PDF - Sky Deutschland AG

Download PDF - Sky Deutschland AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Share<br />

The initial public offering of Premiere <strong>AG</strong> on<br />

9 March 2005 was a great success. During the<br />

bookbuilding phase that lasted from 23 February<br />

to 8 March 2005, investors subscribed for<br />

525 million shares in the overall value of EUR<br />

14.5 billion. The issue was more than 12.3 times<br />

oversubscribed. At EUR 28.00, the issuing price<br />

for Premiere stock was at the upper end of the<br />

pricing range. 42.1 million stocks were placed.<br />

24.6 million stocks plus a green shoe of<br />

5.5 million came from the existing shareholders,<br />

12 million stocks from a capital increase. The<br />

issue volume was EUR 1.179 billion. Premiere<br />

<strong>AG</strong>'s initial public offering was the largest new<br />

issue by a German media company to date. After<br />

the initial public offering and capital increase,<br />

Premiere <strong>AG</strong> has a total stock of 82 million<br />

shares.<br />

In assigning shares, Premiere treated private investors<br />

preferentially. 30 per cent of all offered shares<br />

(12.6 million) were allocated to private investors.<br />

70 per cent of the offered shares went to<br />

institutional investors. 39 per cent of the offered<br />

shares were placed with domestic stockholders,<br />

32 per cent to stockholders in Great Britain, 15<br />

per cent in remaining Europe, and 14 per cent in<br />

the US.<br />

The first trading price for Premiere stock was EUR<br />

30.50, 9 per cent above the issuing price of EUR<br />

28.00. The positive and stable price development<br />

of Premiere's shares resulted primarily from<br />

purchases by institutional investors in the first<br />

days of trading. In a relatively stable market environment,<br />

Premiere's stock developed in line with<br />

the DAX and MDAX, at an overall high level. On 31<br />

March 2005, Premiere closed at a price of EUR<br />

31.95, so that the market price exceeds the<br />

issuing price by 14 per cent.<br />

On the basis of the closing price on 31 March<br />

2005 of EUR 31.95, market capitalization is EUR<br />

2.6 billion, and the free-float market capitalization<br />

is EUR 1.3 billion.<br />

With its high free-float market capitalization and a<br />

high average trading volume, Premiere <strong>AG</strong> satisfies<br />

important criteria for being admitted into the MDAX<br />

segment.<br />

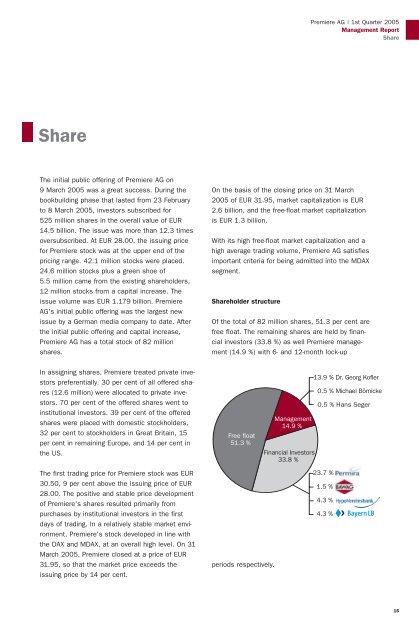

Shareholder structure<br />

Of the total of 82 million shares, 51.3 per cent are<br />

free float. The remaining shares are held by financial<br />

investors (33.8 %) as well Premiere management<br />

(14.9 %) with 6- and 12-month lock-up<br />

Free float<br />

51.3 %<br />

periods respectively.<br />

Management<br />

14.9 %<br />

Financial Investors<br />

33.8 %<br />

Premiere <strong>AG</strong> | 1st Quarter 2005<br />

Management Report<br />

Share<br />

13.9 % Dr. Georg Kofler<br />

0.5 % Michael Börnicke<br />

0.5 % Hans Seger<br />

23.7 %<br />

1.5 %<br />

4.3 %<br />

4.3 %<br />

16