Determinants and effects of Venture Capital and Private Equity ...

Determinants and effects of Venture Capital and Private Equity ...

Determinants and effects of Venture Capital and Private Equity ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

debt 8 . A negative sign, in particular coupled with an increase <strong>of</strong> debt, would give clear evidence<br />

<strong>of</strong> better conditions applied to backed firms, in turns allowing for the presence <strong>of</strong> the<br />

certification effect.<br />

4.3 The econometric set‐up<br />

In order to test the hypothesis outlined we rely on econometric techniques applicable to<br />

panel data, allowing us: (1) to control for unobservable individual heterogeneity; (2) to use a<br />

large amount <strong>of</strong> information, including many companies <strong>and</strong> several years for each company,<br />

thus increasing the degrees <strong>of</strong> freedom <strong>and</strong> reducing colinearity between the explanatory<br />

variables; (3) to analyse the evolution over time <strong>of</strong> the variables in a group <strong>of</strong> companies.<br />

A logarithmic transformation has been applied to most <strong>of</strong> the variables. Applying this<br />

procedure we obtain beneficial <strong>effects</strong> such as: steadying the variance, reducing multiplicative<br />

<strong>effects</strong> into additive ones <strong>and</strong> normalizing the distributions. Since the transformation it is not<br />

feasible when there are null <strong>and</strong> negative values we first add 100 to each value <strong>and</strong> then<br />

calculate their logarithms. In particular, this was the case for variables obtained as variation<br />

between two subsequent periods such as Growth, Capex <strong>and</strong> ROE.<br />

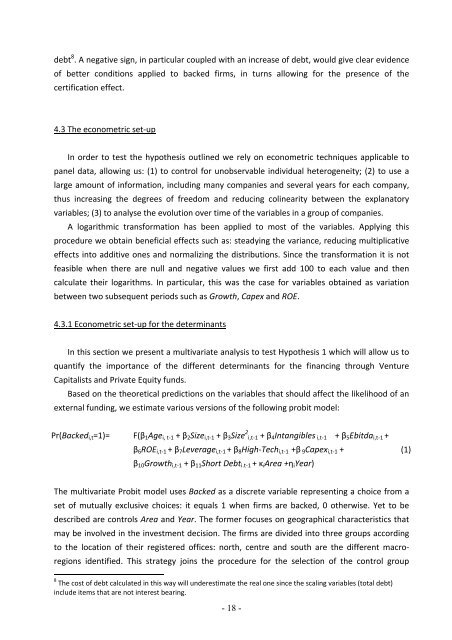

4.3.1 Econometric set‐up for the determinants<br />

In this section we present a multivariate analysis to test Hypothesis 1 which will allow us to<br />

quantify the importance <strong>of</strong> the different determinants for the financing through <strong>Venture</strong><br />

<strong>Capital</strong>ists <strong>and</strong> <strong>Private</strong> <strong>Equity</strong> funds.<br />

Based on the theoretical predictions on the variables that should affect the likelihood <strong>of</strong> an<br />

external funding, we estimate various versions <strong>of</strong> the following probit model:<br />

Pr(Backedi,t=1)= F(β1Agei, t‐1 + β2Sizei,t‐1 + β3Size 2 i,t‐1 + β4Intangibles i,t‐1 + β5Ebitdai,t‐1 +<br />

β6ROEi,t‐1 + β7Leveragei,t‐1 + β8High‐Techi,t‐1 +β 9Capexi,t‐1 +<br />

β10Growthi,t‐1 + β11Short Debti.t‐1 + κiArea +ηiYear)<br />

The multivariate Probit model uses Backed as a discrete variable representing a choice from a<br />

set <strong>of</strong> mutually exclusive choices: it equals 1 when firms are backed, 0 otherwise. Yet to be<br />

described are controls Area <strong>and</strong> Year. The former focuses on geographical characteristics that<br />

may be involved in the investment decision. The firms are divided into three groups according<br />

to the location <strong>of</strong> their registered <strong>of</strong>fices: north, centre <strong>and</strong> south are the different macro‐<br />

regions identified. This strategy joins the procedure for the selection <strong>of</strong> the control group<br />

8<br />

The cost <strong>of</strong> debt calculated in this way will underestimate the real one since the scaling variables (total debt)<br />

include items that are not interest bearing.<br />

- 18 -<br />

(1)