Insurance Risk Study - Aon

Insurance Risk Study - Aon

Insurance Risk Study - Aon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Insurance</strong> <strong>Risk</strong> <strong>Study</strong><br />

Modeling Dependence<br />

Dependence is a core component of economic capital<br />

modeling. <strong>Risk</strong> managers frequently discuss correlation,<br />

and this <strong>Study</strong> includes numerous correlation matrices.<br />

But correlation alone does not fully describe<br />

dependence. There are many ways to combine two<br />

variables to have the same linear correlation coefficient.<br />

For example, the familiar symmetric, elliptical contours<br />

of the normal copula can have the same linear<br />

correlation as a more pinched distribution, and<br />

pinching can occur either on the left, the right or both<br />

sides. The impact of dependence is most clearly seen in<br />

the distribution of the sum (or portfolio return) of the<br />

two variables, with extreme tail correlation producing<br />

an aggregate distribution with much fatter tails.<br />

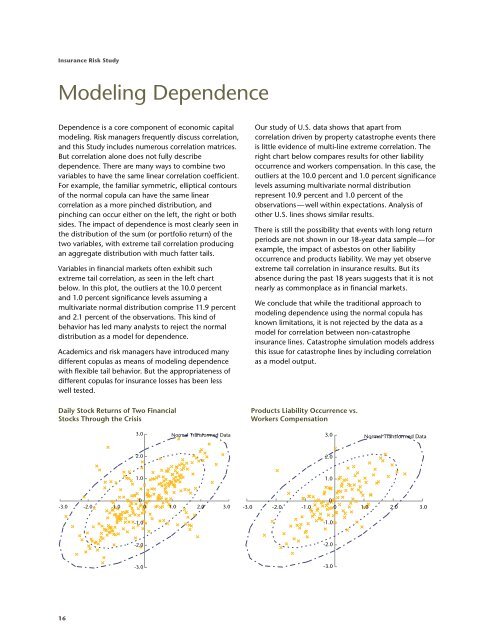

Variables in financial markets often exhibit such<br />

extreme tail correlation, as seen in the left chart<br />

below. In this plot, the outliers at the 10.0 percent<br />

and 1.0 percent significance levels assuming a<br />

multivariate normal distribution comprise 11.9 percent<br />

and 2.1 percent of the observations. This kind of<br />

behavior has led many analysts to reject the normal<br />

distribution as a model for dependence.<br />

Academics and risk managers have introduced many<br />

different copulas as means of modeling dependence<br />

with flexible tail behavior. But the appropriateness of<br />

different copulas for insurance losses has been less<br />

well tested.<br />

Daily Stock Returns of Two Financial<br />

Stocks Through the Crisis<br />

16<br />

3.0<br />

2.0<br />

1.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

Normal Transformed Data<br />

0<br />

-3.0 -2.0 -1.0 0 1.0 2.0 3.0<br />

Our study of U.S. data shows that apart from<br />

correlation driven by property catastrophe events there<br />

is little evidence of multi-line extreme correlation. The<br />

right chart below compares results for other liability<br />

occurrence and workers compensation. In this case, the<br />

outliers at the 10.0 percent and 1.0 percent significance<br />

levels assuming multivariate normal distribution<br />

represent 10.9 percent and 1.0 percent of the<br />

observations — well within expectations. Analysis of<br />

other U.S. lines shows similar results.<br />

There is still the possibility that events with long return<br />

periods are not shown in our 18-year data sample — for<br />

example, the impact of asbestos on other liability<br />

occurrence and products liability. We may yet observe<br />

extreme tail correlation in insurance results. But its<br />

absence during the past 18 years suggests that it is not<br />

nearly as commonplace as in financial markets.<br />

We conclude that while the traditional approach to<br />

modeling dependence using the normal copula has<br />

known limitations, it is not rejected by the data as a<br />

model for correlation between non-catastrophe<br />

insurance lines. Catastrophe simulation models address<br />

this issue for catastrophe lines by including correlation<br />

as a model output.<br />

Products Liability Occurrence vs.<br />

Workers Compensation<br />

3.0<br />

2.0<br />

1.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

Normal Transformed Data<br />

0<br />

-3.0 -2.0 -1.0 0 1.0 2.0 3.0