Insurance Risk Study - Aon

Insurance Risk Study - Aon

Insurance Risk Study - Aon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Insurance</strong> <strong>Risk</strong> <strong>Study</strong><br />

Evaluating Solvency II Factors<br />

Solvency II is scheduled to take effect no later than<br />

January 1, 2013. The fifth quantitative impact study<br />

(QIS 5) is in progress with a deadline of October<br />

2010 for individual insurers and mid-November 2010<br />

for groups.<br />

QIS 5 is likely the key test for most insurers across<br />

Europe. The Standard Formula factors were designed to<br />

be appropriate for the entire market — meaning a<br />

typical company of average size — so larger insurers<br />

with greater diversification will find the formula<br />

generates conservative capital requirements. Moreover,<br />

in QIS 5, the formula reflects added concerns that<br />

emerged from the 2008 financial crisis. Insurers now<br />

have heightened incentives to develop full or partial<br />

internal models as an alternative to the Solvency II<br />

Standard Formula.<br />

At this stage, the most important aspect of preparing<br />

for Solvency II is correct parameterization, driven by<br />

access to data. Insurers may face serious challenges to<br />

their IT systems. They will need some reference point as<br />

they undertake the various Solvency II tests: evaluating<br />

the statistical quality of the data, calibrating and<br />

validating the models they are using.<br />

The non-life Solvency Capital Requirement (SCR) is<br />

predominantly driven by premium risk, reserve risk and<br />

catastrophe risk. Since many companies with<br />

catastrophe exposure purchase excess of loss<br />

reinsurance, premium and reserve risk will be the key<br />

drivers of capital.<br />

Solvency II vs. <strong>Insurance</strong> <strong>Risk</strong> <strong>Study</strong><br />

There are four key differences between the Solvency II<br />

factors and those in the <strong>Insurance</strong> <strong>Risk</strong> <strong>Study</strong>.<br />

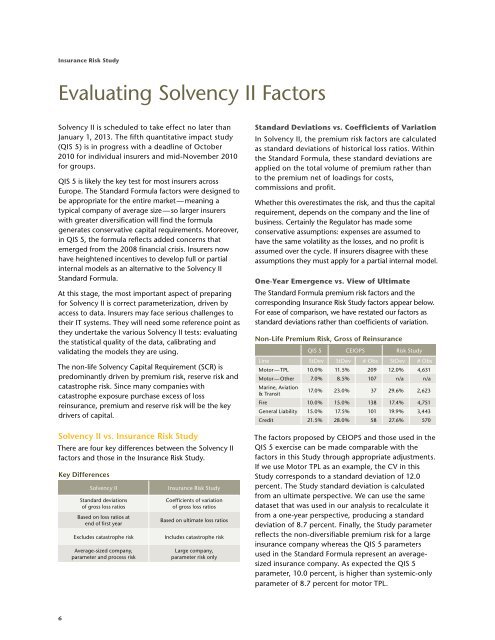

Key Differences<br />

6<br />

Solvency II <strong>Insurance</strong> <strong>Risk</strong> <strong>Study</strong><br />

Standard deviations<br />

of gross loss ratios<br />

Based on loss ratios at<br />

end of first year<br />

Coefficients of variation<br />

of gross loss ratios<br />

Based on ultimate loss ratios<br />

Excludes catastrophe risk Includes catastrophe risk<br />

Average-sized company,<br />

parameter and process risk<br />

Large company,<br />

parameter risk only<br />

Standard Deviations vs. Coefficients of Variation<br />

In Solvency II, the premium risk factors are calculated<br />

as standard deviations of historical loss ratios. Within<br />

the Standard Formula, these standard deviations are<br />

applied on the total volume of premium rather than<br />

to the premium net of loadings for costs,<br />

commissions and profit.<br />

Whether this overestimates the risk, and thus the capital<br />

requirement, depends on the company and the line of<br />

business. Certainly the Regulator has made some<br />

conservative assumptions: expenses are assumed to<br />

have the same volatility as the losses, and no profit is<br />

assumed over the cycle. If insurers disagree with these<br />

assumptions they must apply for a partial internal model.<br />

One-Year Emergence vs. View of Ultimate<br />

The Standard Formula premium risk factors and the<br />

corresponding <strong>Insurance</strong> <strong>Risk</strong> <strong>Study</strong> factors appear below.<br />

For ease of comparison, we have restated our factors as<br />

standard deviations rather than coefficients of variation.<br />

Non-Life Premium <strong>Risk</strong>, Gross of Reinsurance<br />

QIS 5 CEIOPS <strong>Risk</strong> <strong>Study</strong><br />

Line StDev StDev # Obs StDev # Obs<br />

Motor — TPL 10.0% 11.5% 209 12.0% 4,631<br />

Motor — Other 7.0% 8.5% 107 n/a n/a<br />

Marine, Aviation<br />

& Transit<br />

17.0% 23.0% 37 29.6% 2,623<br />

Fire 10.0% 15.0% 138 17.4% 4,751<br />

General Liability 15.0% 17.5% 101 19.9% 3,443<br />

Credit 21.5% 28.0% 58 27.6% 570<br />

The factors proposed by CEIOPS and those used in the<br />

QIS 5 exercise can be made comparable with the<br />

factors in this <strong>Study</strong> through appropriate adjustments.<br />

If we use Motor TPL as an example, the CV in this<br />

<strong>Study</strong> corresponds to a standard deviation of 12.0<br />

percent. The <strong>Study</strong> standard deviation is calculated<br />

from an ultimate perspective. We can use the same<br />

dataset that was used in our analysis to recalculate it<br />

from a one-year perspective, producing a standard<br />

deviation of 8.7 percent. Finally, the <strong>Study</strong> parameter<br />

reflects the non-diversifiable premium risk for a large<br />

insurance company whereas the QIS 5 parameters<br />

used in the Standard Formula represent an averagesized<br />

insurance company. As expected the QIS 5<br />

parameter, 10.0 percent, is higher than systemic-only<br />

parameter of 8.7 percent for motor TPL.