Comparative Analysis of Indian Stock Market with ... - Great Lakes

Comparative Analysis of Indian Stock Market with ... - Great Lakes

Comparative Analysis of Indian Stock Market with ... - Great Lakes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

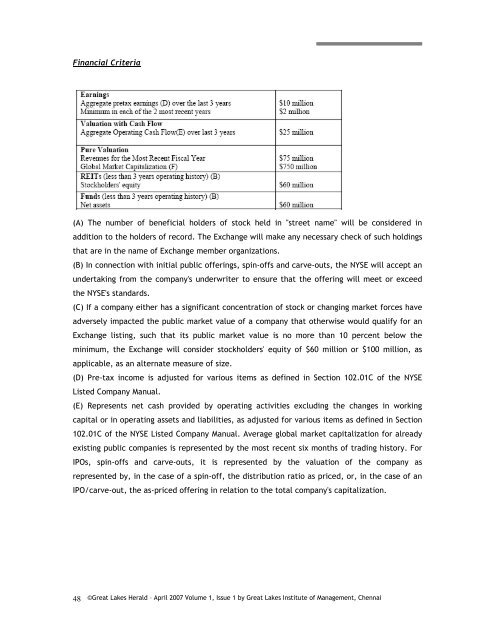

Financial Criteria<br />

(A) The number <strong>of</strong> beneficial holders <strong>of</strong> stock held in "street name" will be considered in<br />

addition to the holders <strong>of</strong> record. The Exchange will make any necessary check <strong>of</strong> such holdings<br />

that are in the name <strong>of</strong> Exchange member organizations.<br />

(B) In connection <strong>with</strong> initial public <strong>of</strong>ferings, spin-<strong>of</strong>fs and carve-outs, the NYSE will accept an<br />

undertaking from the company's underwriter to ensure that the <strong>of</strong>fering will meet or exceed<br />

the NYSE's standards.<br />

(C) If a company either has a significant concentration <strong>of</strong> stock or changing market forces have<br />

adversely impacted the public market value <strong>of</strong> a company that otherwise would qualify for an<br />

Exchange listing, such that its public market value is no more than 10 percent below the<br />

minimum, the Exchange will consider stockholders' equity <strong>of</strong> $60 million or $100 million, as<br />

applicable, as an alternate measure <strong>of</strong> size.<br />

(D) Pre-tax income is adjusted for various items as defined in Section 102.01C <strong>of</strong> the NYSE<br />

Listed Company Manual.<br />

(E) Represents net cash provided by operating activities excluding the changes in working<br />

capital or in operating assets and liabilities, as adjusted for various items as defined in Section<br />

102.01C <strong>of</strong> the NYSE Listed Company Manual. Average global market capitalization for already<br />

existing public companies is represented by the most recent six months <strong>of</strong> trading history. For<br />

IPOs, spin-<strong>of</strong>fs and carve-outs, it is represented by the valuation <strong>of</strong> the company as<br />

represented by, in the case <strong>of</strong> a spin-<strong>of</strong>f, the distribution ratio as priced, or, in the case <strong>of</strong> an<br />

IPO/carve-out, the as-priced <strong>of</strong>fering in relation to the total company's capitalization.<br />

48<br />

©<strong>Great</strong> <strong>Lakes</strong> Herald – April 2007 Volume 1, Issue 1 by <strong>Great</strong> <strong>Lakes</strong> Institute <strong>of</strong> Management, Chennai