Comparative Analysis of Indian Stock Market with ... - Great Lakes

Comparative Analysis of Indian Stock Market with ... - Great Lakes

Comparative Analysis of Indian Stock Market with ... - Great Lakes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

important happenings on the <strong>Indian</strong> <strong>Stock</strong> exchange. This is especially relevant in the current<br />

scenario when the financial markets across the globe are getting integrated into one big<br />

market and the impact <strong>of</strong> one exchange on the other exchanges. In other words, the intention<br />

is to test the hypothesis, ‘whether various stock exchanges globally have any impact on each<br />

other’ or they are correlated in any way <strong>with</strong> regard to their movements and, if so, to what<br />

extent. Arising out <strong>of</strong> the main hypothesis is the question - given the above context: What<br />

impact would the result have on the understanding that international diversification <strong>of</strong><br />

investment is desirable and pr<strong>of</strong>itable <strong>with</strong> regard to both risk and return?<br />

5. Methodology<br />

43<br />

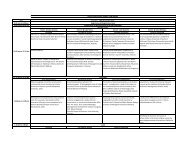

For the comparative analysis <strong>of</strong> the different stock exchanges, the period chosen is from<br />

1st January 1995 to 31st July, 2006. This period is divided into different sets <strong>of</strong> years, like<br />

1995-97, 1999-01, 2001-03, and 2003-06, in order to capture the effect and movement <strong>of</strong> stock<br />

exchanges <strong>with</strong> each other during different periods. The economic situation changes during<br />

different times. 1995-1997 period represents the East Asian miracle and crisis period, 1999-<br />

2001 represents technology boom and tech bubble bursting period, 2001-2003 represents the<br />

slow global recovery from the recession, 2003-2006 period represents the investment boom<br />

period especially in the developing and emerging markets. The world is divided into four main<br />

regions, namely, the US, Euro region, India and Asian region. <strong>Stock</strong> exchanges representing<br />

various regions used in this study include NSE (India), NYSE (USA), Hang Seng (South East Asia),<br />

Russian <strong>Stock</strong> Exchange (Russia), Korea (Asia). The number <strong>of</strong> sample units for this study is five.<br />

<strong>Comparative</strong> <strong>Analysis</strong><br />

This is the main part <strong>of</strong> the study wherein the various stock exchanges <strong>of</strong> the sample have<br />

been compared on certain parameters, both qualitatively and quantitatively.<br />

Qualitative <strong>Analysis</strong><br />

In this section the various stock exchanges have been compared on the following<br />

parameters;<br />

1. <strong>Market</strong> Capitalization<br />

2. number <strong>of</strong> listed securities<br />

3. listing agreements<br />

4. circuit filters<br />

5. settlement<br />

These parameters are used to look at selected important aspects <strong>of</strong> any stock exchange, viz.,<br />

the market capitalization gives an idea about the size <strong>of</strong> the respective exchanges; whereas<br />

©<strong>Great</strong> <strong>Lakes</strong> Herald – April 2007 Volume 1, Issue 1 by <strong>Great</strong> <strong>Lakes</strong> Institute <strong>of</strong> Management, Chennai