International VAT Monitor Index 2009 - empcom.gov.in

International VAT Monitor Index 2009 - empcom.gov.in

International VAT Monitor Index 2009 - empcom.gov.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

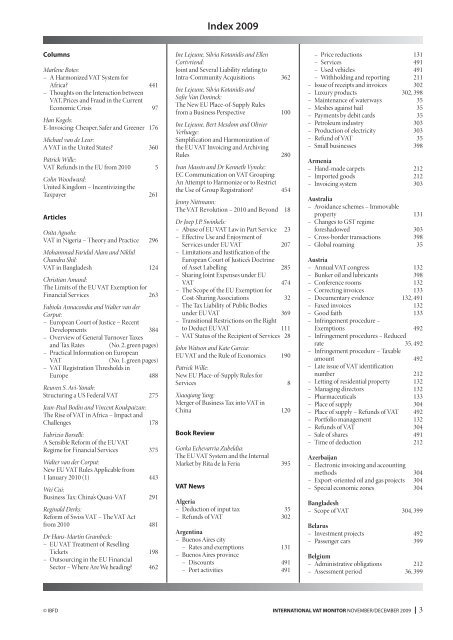

Columns<br />

Marlene Botes:<br />

– A Harmonized <strong>VAT</strong> System for<br />

Africa? 441<br />

– Thoughts on the Interaction between<br />

<strong>VAT</strong>, Prices and Fraud <strong>in</strong> the Current<br />

Economic Crisis 97<br />

Han Kogels:<br />

E-Invoic<strong>in</strong>g: Cheaper, Safer and Greener 176<br />

Michael van de Leur:<br />

A <strong>VAT</strong> <strong>in</strong> the United States? 360<br />

Patrick Wille:<br />

<strong>VAT</strong> Refunds <strong>in</strong> the EU from 2010 5<br />

Col<strong>in</strong> Woodward:<br />

United K<strong>in</strong>gdom – Incentiviz<strong>in</strong>g the<br />

Taxpayer 261<br />

Articles<br />

Osita Aguolu:<br />

<strong>VAT</strong> <strong>in</strong> Nigeria – Theory and Practice 296<br />

Mohammad Faridul Alam and Nikhil<br />

Chandra Shil:<br />

<strong>VAT</strong> <strong>in</strong> Bangladesh 124<br />

Christian Amand:<br />

The Limits of the EU <strong>VAT</strong> Exemption for<br />

F<strong>in</strong>ancial Services 263<br />

Fabiola Annacondia and Walter van der<br />

Corput:<br />

– European Court of Justice – Recent<br />

Developments 384<br />

– Overview of General Turnover Taxes<br />

and Tax Rates (No. 2, green pages)<br />

– Practical Information on European<br />

<strong>VAT</strong> (No. 1, green pages)<br />

– <strong>VAT</strong> Registration Thresholds <strong>in</strong><br />

Europe 488<br />

Reuven S. Avi-Yonah:<br />

Structur<strong>in</strong>g a US Federal <strong>VAT</strong> 275<br />

Jean-Paul Bod<strong>in</strong> and V<strong>in</strong>cent Koukpaizan:<br />

The Rise of <strong>VAT</strong> <strong>in</strong> Africa – Impact and<br />

Challenges 178<br />

Fabrizio Borselli:<br />

A Sensible Reform of the EU <strong>VAT</strong><br />

Regime for F<strong>in</strong>ancial Services 375<br />

Walter van der Corput:<br />

New EU <strong>VAT</strong> Rules Applicable from<br />

1 January 2010 (1) 443<br />

Wei Cui:<br />

Bus<strong>in</strong>ess Tax: Ch<strong>in</strong>a’s Quasi-<strong>VAT</strong> 291<br />

Reg<strong>in</strong>ald Derks:<br />

Reform of Swiss <strong>VAT</strong> – The <strong>VAT</strong> Act<br />

from 2010 481<br />

Dr Hans-Mart<strong>in</strong> Grambeck:<br />

– EU <strong>VAT</strong> Treatment of Resell<strong>in</strong>g<br />

Tickets 198<br />

– Outsourc<strong>in</strong>g <strong>in</strong> the EU F<strong>in</strong>ancial<br />

Sector – Where Are We head<strong>in</strong>g? 462<br />

<strong>Index</strong> <strong>2009</strong><br />

Ine Lejeune, Silvia Kotanidis and Ellen<br />

Cortvriend:<br />

Jo<strong>in</strong>t and Several Liability relat<strong>in</strong>g to<br />

Intra-Community Acquisitions 362<br />

Ine Lejeune, Silvia Kotanidis and<br />

Sofie Van Don<strong>in</strong>ck:<br />

The New EU Place-of-Supply Rules<br />

from a Bus<strong>in</strong>ess Perspective 100<br />

Ine Lejeune, Bert Mesdom and Olivier<br />

Verhaege:<br />

Simplification and Harmonization of<br />

the EU <strong>VAT</strong> Invoic<strong>in</strong>g and Archiv<strong>in</strong>g<br />

Rules 280<br />

Ivan Mass<strong>in</strong> and Dr Kenneth Vyncke:<br />

EC Communication on <strong>VAT</strong> Group<strong>in</strong>g:<br />

An Attempt to Harmonize or to Restrict<br />

the Use of Group Registration? 454<br />

Jenny Nittmann:<br />

The <strong>VAT</strong> Revolution – 2010 and Beyond 18<br />

Dr Joep J.P. Sw<strong>in</strong>kels:<br />

– Abuse of EU <strong>VAT</strong> Law <strong>in</strong> Part Service 23<br />

– Effective Use and Enjoyment of<br />

Services under EU <strong>VAT</strong> 207<br />

– Limitations and Justification of the<br />

European Court of Justice’s Doctr<strong>in</strong>e<br />

of Asset Labell<strong>in</strong>g 285<br />

– Shar<strong>in</strong>g Jo<strong>in</strong>t Expenses under EU<br />

<strong>VAT</strong> 474<br />

– The Scope of the EU Exemption for<br />

Cost-Shar<strong>in</strong>g Associations 32<br />

– The Tax Liability of Public Bodies<br />

under EU <strong>VAT</strong> 369<br />

– Transitional Restrictions on the Right<br />

to Deduct EU <strong>VAT</strong> 111<br />

– <strong>VAT</strong> Status of the Recipient of Services 28<br />

John Watson and Kate Garcia:<br />

EU <strong>VAT</strong> and the Rule of Economics 190<br />

Patrick Wille:<br />

New EU Place-of-Supply Rules for<br />

Services 8<br />

Xiaoqiang Yang:<br />

Merger of Bus<strong>in</strong>ess Tax <strong>in</strong>to <strong>VAT</strong> <strong>in</strong><br />

Ch<strong>in</strong>a 120<br />

Book Review<br />

Gorka Echevarría Zubeldia:<br />

The EU <strong>VAT</strong> System and the Internal<br />

Market by Rita de la Feria 395<br />

<strong>VAT</strong> News<br />

Algeria<br />

– Deduction of <strong>in</strong>put tax 35<br />

– Refunds of <strong>VAT</strong> 302<br />

Argent<strong>in</strong>a<br />

– Buenos Aires city<br />

– Rates and exemptions 131<br />

– Buenos Aires prov<strong>in</strong>ce<br />

– Discounts 491<br />

– Port activities 491<br />

– Price reductions 131<br />

– Services 491<br />

– Used vehicles 491<br />

– Withhold<strong>in</strong>g and report<strong>in</strong>g 211<br />

– Issue of receipts and <strong>in</strong>voices 302<br />

– Luxury products 302, 398<br />

– Ma<strong>in</strong>tenance of waterways 35<br />

– Meshes aga<strong>in</strong>st hail 35<br />

– Payments by debit cards 35<br />

– Petroleum <strong>in</strong>dustry 303<br />

– Production of electricity 303<br />

– Refund of <strong>VAT</strong> 35<br />

– Small bus<strong>in</strong>esses 398<br />

Armenia<br />

– Hand-made carpets 212<br />

– Imported goods 212<br />

– Invoic<strong>in</strong>g system 303<br />

Australia<br />

– Avoidance schemes – Immovable<br />

property 131<br />

– Changes to GST regime<br />

foreshadowed 303<br />

– Cross-border transactions 398<br />

– Global roam<strong>in</strong>g 35<br />

Austria<br />

– Annual <strong>VAT</strong> congress 132<br />

– Bunker oil and lubricants 398<br />

– Conference rooms 132<br />

– Correct<strong>in</strong>g <strong>in</strong>voices 133<br />

– Documentary evidence 132, 491<br />

– Faxed <strong>in</strong>voices 132<br />

– Good faith 133<br />

– Infr<strong>in</strong>gement procedure –<br />

Exemptions 492<br />

– Infr<strong>in</strong>gement procedures – Reduced<br />

rate 35, 492<br />

– Infr<strong>in</strong>gement procedure – Taxable<br />

amount 492<br />

– Late issue of <strong>VAT</strong> identification<br />

number 212<br />

– Lett<strong>in</strong>g of residential property 132<br />

– Manag<strong>in</strong>g directors 132<br />

– Pharmaceuticals 133<br />

– Place of supply 304<br />

– Place of supply – Refunds of <strong>VAT</strong> 492<br />

– Portfolio management 132<br />

– Refunds of <strong>VAT</strong> 304<br />

– Sale of shares 491<br />

– Time of deduction 212<br />

Azerbaijan<br />

– Electronic <strong>in</strong>voic<strong>in</strong>g and account<strong>in</strong>g<br />

methods 304<br />

– Export-oriented oil and gas projects 304<br />

– Special economic zones 304<br />

Bangladesh<br />

– Scope of <strong>VAT</strong> 304, 399<br />

Belarus<br />

– Investment projects 492<br />

– Passenger cars 399<br />

Belgium<br />

– Adm<strong>in</strong>istrative obligations 212<br />

– Assessment period 36, 399<br />

© IBFD INTERNATIONAL <strong>VAT</strong> MONITOR NOVEMBER/DECEMBER <strong>2009</strong><br />

3