International VAT Monitor Index 2009 - empcom.gov.in

International VAT Monitor Index 2009 - empcom.gov.in

International VAT Monitor Index 2009 - empcom.gov.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

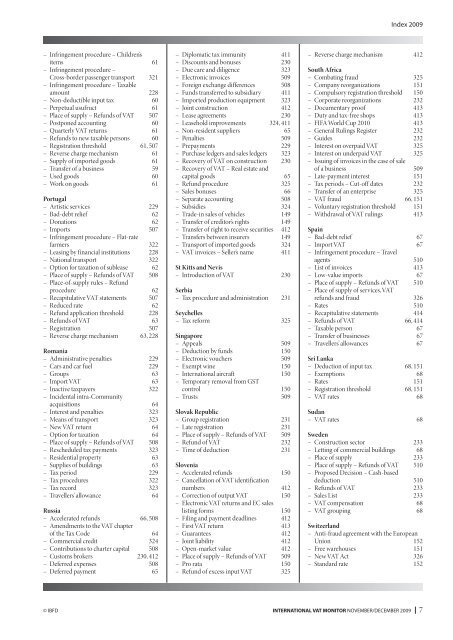

– Infr<strong>in</strong>gement procedure – Children’s<br />

items 61<br />

– Infr<strong>in</strong>gement procedure –<br />

Cross-border passenger transport 321<br />

– Infr<strong>in</strong>gement procedure – Taxable<br />

amount 228<br />

– Non-deductible <strong>in</strong>put tax 60<br />

– Perpetual usufruct 61<br />

– Place of supply – Refunds of <strong>VAT</strong> 507<br />

– Postponed account<strong>in</strong>g 60<br />

– Quarterly <strong>VAT</strong> returns 61<br />

– Refunds to new taxable persons 60<br />

– Registration threshold 61, 507<br />

– Reverse charge mechanism 61<br />

– Supply of imported goods 61<br />

– Transfer of a bus<strong>in</strong>ess 59<br />

– Used goods 60<br />

– Work on goods 61<br />

Portugal<br />

– Artistic services 229<br />

– Bad-debt relief 62<br />

– Donations 62<br />

– Imports 507<br />

– Infr<strong>in</strong>gement procedure – Flat-rate<br />

farmers 322<br />

– Leas<strong>in</strong>g by f<strong>in</strong>ancial <strong>in</strong>stitutions 228<br />

– National transport 322<br />

– Option for taxation of sublease 62<br />

– Place of supply – Refunds of <strong>VAT</strong> 508<br />

– Place-of-supply rules – Refund<br />

procedure 62<br />

– Recapitulative <strong>VAT</strong> statements 507<br />

– Reduced rate 62<br />

– Refund application threshold 228<br />

– Refunds of <strong>VAT</strong> 63<br />

– Registration 507<br />

– Reverse charge mechanism 63, 228<br />

Romania<br />

– Adm<strong>in</strong>istrative penalties 229<br />

– Cars and car fuel 229<br />

– Groups 63<br />

– Import <strong>VAT</strong> 63<br />

– Inactive taxpayers 322<br />

– Incidental <strong>in</strong>tra-Community<br />

acquisitions 64<br />

– Interest and penalties 323<br />

– Means of transport 323<br />

– New <strong>VAT</strong> return 64<br />

– Option for taxation 64<br />

– Place of supply – Refunds of <strong>VAT</strong> 508<br />

– Rescheduled tax payments 323<br />

– Residential property 63<br />

– Supplies of build<strong>in</strong>gs 63<br />

– Tax period 229<br />

– Tax procedures 322<br />

– Tax record 323<br />

– Travellers’ allowance 64<br />

Russia<br />

– Accelerated refunds 66, 508<br />

– Amendments to the <strong>VAT</strong> chapter<br />

of the Tax Code 64<br />

– Commercial credit 324<br />

– Contributions to charter capital 508<br />

– Customs brokers 230, 412<br />

– Deferred expenses 508<br />

– Deferred payment 65<br />

– Diplomatic tax immunity 411<br />

– Discounts and bonuses 230<br />

– Due care and diligence 323<br />

– Electronic <strong>in</strong>voices 509<br />

– Foreign exchange differences 508<br />

– Funds transferred to subsidiary 411<br />

– Imported production equipment 323<br />

– Jo<strong>in</strong>t construction 412<br />

– Lease agreements 230<br />

– Leasehold improvements 324, 411<br />

– Non-resident suppliers 65<br />

– Penalties 509<br />

– Prepayments 229<br />

– Purchase ledgers and sales ledgers 323<br />

– Recovery of <strong>VAT</strong> on construction 230<br />

– Recovery of <strong>VAT</strong> – Real estate and<br />

capital goods 65<br />

– Refund procedure 325<br />

– Sales bonuses 66<br />

– Separate account<strong>in</strong>g 508<br />

– Subsidies 324<br />

– Trade-<strong>in</strong> sales of vehicles 149<br />

– Transfer of creditor’s rights 149<br />

– Transfer of right to receive securities 412<br />

– Transfers between <strong>in</strong>surers 149<br />

– Transport of imported goods 324<br />

– <strong>VAT</strong> <strong>in</strong>voices – Seller’s name 411<br />

St Kitts and Nevis<br />

– Introduction of <strong>VAT</strong> 230<br />

Serbia<br />

– Tax procedure and adm<strong>in</strong>istration 231<br />

Seychelles<br />

– Tax reform 325<br />

S<strong>in</strong>gapore<br />

– Appeals 509<br />

– Deduction by funds 150<br />

– Electronic vouchers 509<br />

– Exempt w<strong>in</strong>e 150<br />

– <strong>International</strong> aircraft 150<br />

– Temporary removal from GST<br />

control 150<br />

– Trusts 509<br />

Slovak Republic<br />

– Group registration 231<br />

– Late registration 231<br />

– Place of supply – Refunds of <strong>VAT</strong> 509<br />

– Refund of <strong>VAT</strong> 232<br />

– Time of deduction 231<br />

Slovenia<br />

– Accelerated refunds 150<br />

– Cancellation of <strong>VAT</strong> identification<br />

numbers 412<br />

– Correction of output <strong>VAT</strong> 150<br />

– Electronic <strong>VAT</strong> returns and EC sales<br />

list<strong>in</strong>g forms 150<br />

– Fil<strong>in</strong>g and payment deadl<strong>in</strong>es 412<br />

– First <strong>VAT</strong> return 413<br />

– Guarantees 412<br />

– Jo<strong>in</strong>t liability 412<br />

– Open-market value 412<br />

– Place of supply – Refunds of <strong>VAT</strong> 509<br />

– Pro rata 150<br />

– Refund of excess <strong>in</strong>put <strong>VAT</strong> 325<br />

<strong>Index</strong> <strong>2009</strong><br />

– Reverse charge mechanism 412<br />

South Africa<br />

– Combat<strong>in</strong>g fraud 325<br />

– Company reorganizations 151<br />

– Compulsory registration threshold 150<br />

– Corporate reorganizations 232<br />

– Documentary proof 413<br />

– Duty and tax-free shops 413<br />

– FIFA World Cup 2010 413<br />

– General Rul<strong>in</strong>gs Register 232<br />

– Guides 232<br />

– Interest on overpaid <strong>VAT</strong> 325<br />

– Interest on underpaid <strong>VAT</strong> 325<br />

– Issu<strong>in</strong>g of <strong>in</strong>voices <strong>in</strong> the case of sale<br />

of a bus<strong>in</strong>ess 509<br />

– Late-payment <strong>in</strong>terest 151<br />

– Tax periods – Cut-off dates 232<br />

– Transfer of an enterprise 325<br />

– <strong>VAT</strong> fraud 66, 151<br />

– Voluntary registration threshold 151<br />

– Withdrawal of <strong>VAT</strong> rul<strong>in</strong>gs 413<br />

Spa<strong>in</strong><br />

– Bad-debt relief 67<br />

– Import <strong>VAT</strong> 67<br />

– Infr<strong>in</strong>gement procedure – Travel<br />

agents 510<br />

– List of <strong>in</strong>voices 413<br />

– Low-value imports 67<br />

– Place of supply – Refunds of <strong>VAT</strong> 510<br />

– Place of supply of services, <strong>VAT</strong><br />

refunds and fraud 326<br />

– Rates 510<br />

– Recapitulative statements 414<br />

– Refunds of <strong>VAT</strong> 66, 414<br />

– Taxable person 67<br />

– Transfer of bus<strong>in</strong>esses 67<br />

– Travellers’ allowances 67<br />

Sri Lanka<br />

– Deduction of <strong>in</strong>put tax 68, 151<br />

– Exemptions 68<br />

– Rates 151<br />

– Registration threshold 68, 151<br />

– <strong>VAT</strong> rates 68<br />

Sudan<br />

– <strong>VAT</strong> rates 68<br />

Sweden<br />

– Construction sector 233<br />

– Lett<strong>in</strong>g of commercial build<strong>in</strong>gs 68<br />

– Place of supply 233<br />

– Place of supply – Refunds of <strong>VAT</strong> 510<br />

– Proposed Decision – Cash-based<br />

deduction 510<br />

– Refunds of <strong>VAT</strong> 233<br />

– Sales List 233<br />

– <strong>VAT</strong> compensation 68<br />

– <strong>VAT</strong> group<strong>in</strong>g 68<br />

Switzerland<br />

– Anti-fraud agreement with the European<br />

Union 152<br />

– Free warehouses 151<br />

– New <strong>VAT</strong> Act 326<br />

– Standard rate 152<br />

© IBFD INTERNATIONAL <strong>VAT</strong> MONITOR NOVEMBER/DECEMBER <strong>2009</strong><br />

7