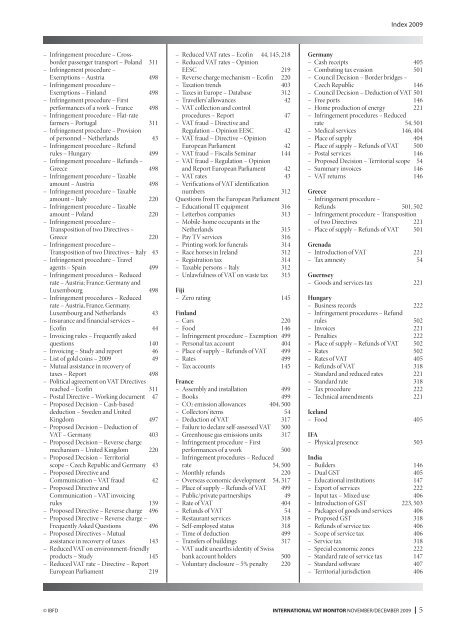

International VAT Monitor Index 2009 - empcom.gov.in

International VAT Monitor Index 2009 - empcom.gov.in

International VAT Monitor Index 2009 - empcom.gov.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

– Infr<strong>in</strong>gement procedure – Crossborder<br />

passenger transport – Poland 311<br />

– Infr<strong>in</strong>gement procedure –<br />

Exemptions – Austria 498<br />

– Infr<strong>in</strong>gement procedure –<br />

Exemptions – F<strong>in</strong>land 498<br />

– Infr<strong>in</strong>gement procedure – First<br />

performances of a work – France 498<br />

– Infr<strong>in</strong>gement procedure – Flat-rate<br />

farmers – Portugal 311<br />

– Infr<strong>in</strong>gement procedure – Provision<br />

of personnel – Netherlands 43<br />

– Infr<strong>in</strong>gement procedure – Refund<br />

rules – Hungary 499<br />

– Infr<strong>in</strong>gement procedure – Refunds –<br />

Greece 498<br />

– Infr<strong>in</strong>gement procedure – Taxable<br />

amount – Austria 498<br />

– Infr<strong>in</strong>gement procedure – Taxable<br />

amount – Italy 220<br />

– Infr<strong>in</strong>gement procedure – Taxable<br />

amount – Poland 220<br />

– Infr<strong>in</strong>gement procedure –<br />

Transposition of two Directives –<br />

Greece 220<br />

– Infr<strong>in</strong>gement procedure –<br />

Transposition of two Directives – Italy 43<br />

– Infr<strong>in</strong>gement procedure – Travel<br />

agents – Spa<strong>in</strong> 499<br />

– Infr<strong>in</strong>gement procedures – Reduced<br />

rate – Austria; France; Germany and<br />

Luxembourg 498<br />

– Infr<strong>in</strong>gement procedures – Reduced<br />

rate – Austria, France, Germany,<br />

Luxembourg and Netherlands 43<br />

– Insurance and f<strong>in</strong>ancial services –<br />

Ecof<strong>in</strong> 44<br />

– Invoic<strong>in</strong>g rules – Frequently asked<br />

questions 140<br />

– Invoic<strong>in</strong>g – Study and report 46<br />

– List of gold co<strong>in</strong>s – <strong>2009</strong> 49<br />

– Mutual assistance <strong>in</strong> recovery of<br />

taxes – Report 498<br />

– Political agreement on <strong>VAT</strong> Directives<br />

reached – Ecof<strong>in</strong> 311<br />

– Postal Directive – Work<strong>in</strong>g document 47<br />

– Proposed Decision – Cash-based<br />

deduction – Sweden and United<br />

K<strong>in</strong>gdom 497<br />

– Proposed Decision – Deduction of<br />

<strong>VAT</strong> – Germany 403<br />

– Proposed Decision – Reverse charge<br />

mechanism – United K<strong>in</strong>gdom 220<br />

– Proposed Decision – Territorial<br />

scope – Czech Republic and Germany 43<br />

– Proposed Directive and<br />

Communication – <strong>VAT</strong> fraud 42<br />

– Proposed Directive and<br />

Communication – <strong>VAT</strong> <strong>in</strong>voic<strong>in</strong>g<br />

rules 139<br />

– Proposed Directive – Reverse charge 496<br />

– Proposed Directive – Reverse charge –<br />

Frequently Asked Questions 496<br />

– Proposed Directives – Mutual<br />

assistance <strong>in</strong> recovery of taxes 143<br />

– Reduced <strong>VAT</strong> on environment-friendly<br />

products – Study 145<br />

– Reduced <strong>VAT</strong> rate – Directive – Report<br />

European Parliament 219<br />

– Reduced <strong>VAT</strong> rates – Ecof<strong>in</strong> 44, 145, 218<br />

– Reduced <strong>VAT</strong> rates – Op<strong>in</strong>ion<br />

EESC 219<br />

– Reverse charge mechanism – Ecof<strong>in</strong> 220<br />

– Taxation trends 403<br />

– Taxes <strong>in</strong> Europe – Database 312<br />

– Travellers’ allowances 42<br />

– <strong>VAT</strong> collection and control<br />

procedures – Report 47<br />

– <strong>VAT</strong> fraud – Directive and<br />

Regulation – Op<strong>in</strong>ion EESC 42<br />

– <strong>VAT</strong> fraud – Directive – Op<strong>in</strong>ion<br />

European Parliament 42<br />

– <strong>VAT</strong> fraud – Fiscalis Sem<strong>in</strong>ar 144<br />

– <strong>VAT</strong> fraud – Regulation – Op<strong>in</strong>ion<br />

and Report European Parliament 42<br />

– <strong>VAT</strong> rates 43<br />

– Verifications of <strong>VAT</strong> identification<br />

numbers 312<br />

Questions from the European Parliament<br />

– Educational IT equipment 316<br />

– Letterbox companies 313<br />

– Mobile-home occupants <strong>in</strong> the<br />

Netherlands 315<br />

– Pay TV services 316<br />

– Pr<strong>in</strong>t<strong>in</strong>g work for funerals 314<br />

– Race horses <strong>in</strong> Ireland 312<br />

– Registration tax 314<br />

– Taxable persons – Italy 312<br />

– Unlawfulness of <strong>VAT</strong> on waste tax 315<br />

Fiji<br />

– Zero rat<strong>in</strong>g 145<br />

F<strong>in</strong>land<br />

– Cars 220<br />

– Food 146<br />

– Infr<strong>in</strong>gement procedure – Exemption 499<br />

– Personal tax account 404<br />

– Place of supply – Refunds of <strong>VAT</strong> 499<br />

– Rates 499<br />

– Tax accounts 145<br />

France<br />

– Assembly and <strong>in</strong>stallation 499<br />

– Books 499<br />

– CO2 emission allowances 404, 500<br />

– Collectors’ items 54<br />

– Deduction of <strong>VAT</strong> 317<br />

– Failure to declare self-assessed <strong>VAT</strong> 500<br />

– Greenhouse gas emissions units 317<br />

– Infr<strong>in</strong>gement procedure – First<br />

performances of a work 500<br />

– Infr<strong>in</strong>gement procedures – Reduced<br />

rate 54, 500<br />

– Monthly refunds 220<br />

– Overseas economic development 54, 317<br />

– Place of supply – Refunds of <strong>VAT</strong> 499<br />

– Public/private partnerships 49<br />

– Rate of <strong>VAT</strong> 404<br />

– Refunds of <strong>VAT</strong> 54<br />

– Restaurant services 318<br />

– Self-employed status 318<br />

– Time of deduction 499<br />

– Transfers of build<strong>in</strong>gs 317<br />

– <strong>VAT</strong> audit unearths identity of Swiss<br />

bank account holders 500<br />

– Voluntary disclosure – 5% penalty 220<br />

<strong>Index</strong> <strong>2009</strong><br />

Germany<br />

– Cash receipts 405<br />

– Combat<strong>in</strong>g tax evasion 501<br />

– Council Decision – Border bridges –<br />

Czech Republic 146<br />

– Council Decision – Deduction of <strong>VAT</strong> 501<br />

– Free ports 146<br />

– Home production of energy 221<br />

– Infr<strong>in</strong>gement procedures – Reduced<br />

rate 54, 501<br />

– Medical services 146, 404<br />

– Place of supply 404<br />

– Place of supply – Refunds of <strong>VAT</strong> 500<br />

– Postal services 146<br />

– Proposed Decision – Territorial scope 54<br />

– Summary <strong>in</strong>voices 146<br />

– <strong>VAT</strong> returns 146<br />

Greece<br />

– Infr<strong>in</strong>gement procedure –<br />

Refunds 501, 502<br />

– Infr<strong>in</strong>gement procedure – Transposition<br />

of two Directives 221<br />

– Place of supply – Refunds of <strong>VAT</strong> 501<br />

Grenada<br />

– Introduction of <strong>VAT</strong> 221<br />

– Tax amnesty 54<br />

Guernsey<br />

– Goods and services tax 221<br />

Hungary<br />

– Bus<strong>in</strong>ess records 222<br />

– Infr<strong>in</strong>gement procedures – Refund<br />

rules 502<br />

– Invoices 221<br />

– Penalties 222<br />

– Place of supply – Refunds of <strong>VAT</strong> 502<br />

– Rates 502<br />

– Rates of <strong>VAT</strong> 405<br />

– Refunds of <strong>VAT</strong> 318<br />

– Standard and reduced rates 221<br />

– Standard rate 318<br />

– Tax procedure 222<br />

– Technical amendments 221<br />

Iceland<br />

– Food 405<br />

IFA<br />

– Physical presence 503<br />

India<br />

– Builders 146<br />

– Dual GST 405<br />

– Educational <strong>in</strong>stitutions 147<br />

– Export of services 222<br />

– Input tax – Mixed use 406<br />

– Introduction of GST 223, 503<br />

– Packages of goods and services 406<br />

– Proposed GST 318<br />

– Refunds of service tax 406<br />

– Scope of service tax 406<br />

– Service tax 318<br />

– Special economic zones 222<br />

– Standard rate of service tax 147<br />

– Standard software 407<br />

– Territorial jurisdiction 406<br />

© IBFD INTERNATIONAL <strong>VAT</strong> MONITOR NOVEMBER/DECEMBER <strong>2009</strong><br />

5