Current State of Cross-Border Banking - Vrije Universiteit Amsterdam

Current State of Cross-Border Banking - Vrije Universiteit Amsterdam

Current State of Cross-Border Banking - Vrije Universiteit Amsterdam

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

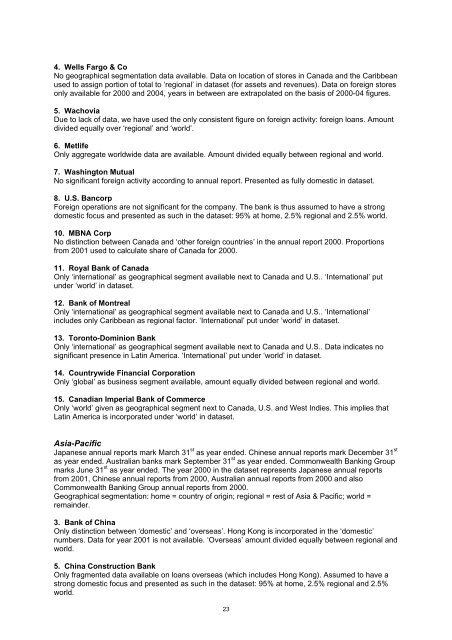

4. Wells Fargo & Co<br />

No geographical segmentation data available. Data on location <strong>of</strong> stores in Canada and the Caribbean<br />

used to assign portion <strong>of</strong> total to ‘regional’ in dataset (for assets and revenues). Data on foreign stores<br />

only available for 2000 and 2004, years in between are extrapolated on the basis <strong>of</strong> 2000-04 figures.<br />

5. Wachovia<br />

Due to lack <strong>of</strong> data, we have used the only consistent figure on foreign activity: foreign loans. Amount<br />

divided equally over ‘regional’ and ‘world’.<br />

6. Metlife<br />

Only aggregate worldwide data are available. Amount divided equally between regional and world.<br />

7. Washington Mutual<br />

No significant foreign activity according to annual report. Presented as fully domestic in dataset.<br />

8. U.S. Bancorp<br />

Foreign operations are not significant for the company. The bank is thus assumed to have a strong<br />

domestic focus and presented as such in the dataset: 95% at home, 2.5% regional and 2.5% world.<br />

10. MBNA Corp<br />

No distinction between Canada and ‘other foreign countries’ in the annual report 2000. Proportions<br />

from 2001 used to calculate share <strong>of</strong> Canada for 2000.<br />

11. Royal Bank <strong>of</strong> Canada<br />

Only ‘international’ as geographical segment available next to Canada and U.S.. ‘International’ put<br />

under ‘world’ in dataset.<br />

12. Bank <strong>of</strong> Montreal<br />

Only ‘international’ as geographical segment available next to Canada and U.S.. ‘International’<br />

includes only Caribbean as regional factor. ‘International’ put under ‘world’ in dataset.<br />

13. Toronto-Dominion Bank<br />

Only ‘international’ as geographical segment available next to Canada and U.S.. Data indicates no<br />

significant presence in Latin America. ‘International’ put under ‘world’ in dataset.<br />

14. Countrywide Financial Corporation<br />

Only ‘global’ as business segment available, amount equally divided between regional and world.<br />

15. Canadian Imperial Bank <strong>of</strong> Commerce<br />

Only ‘world’ given as geographical segment next to Canada, U.S. and West Indies. This implies that<br />

Latin America is incorporated under ‘world’ in dataset.<br />

Asia-Pacific<br />

Japanese annual reports mark March 31 st as year ended. Chinese annual reports mark December 31 st<br />

as year ended. Australian banks mark September 31 st as year ended. Commonwealth <strong>Banking</strong> Group<br />

marks June 31 st as year ended. The year 2000 in the dataset represents Japanese annual reports<br />

from 2001, Chinese annual reports from 2000, Australian annual reports from 2000 and also<br />

Commonwealth <strong>Banking</strong> Group annual reports from 2000.<br />

Geographical segmentation: home = country <strong>of</strong> origin; regional = rest <strong>of</strong> Asia & Pacific; world =<br />

remainder.<br />

3. Bank <strong>of</strong> China<br />

Only distinction between ‘domestic’ and ‘overseas’. Hong Kong is incorporated in the ‘domestic’<br />

numbers. Data for year 2001 is not available. ‘Overseas’ amount divided equally between regional and<br />

world.<br />

5. China Construction Bank<br />

Only fragmented data available on loans overseas (which includes Hong Kong). Assumed to have a<br />

strong domestic focus and presented as such in the dataset: 95% at home, 2.5% regional and 2.5%<br />

world.<br />

23