Current State of Cross-Border Banking - Vrije Universiteit Amsterdam

Current State of Cross-Border Banking - Vrije Universiteit Amsterdam

Current State of Cross-Border Banking - Vrije Universiteit Amsterdam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

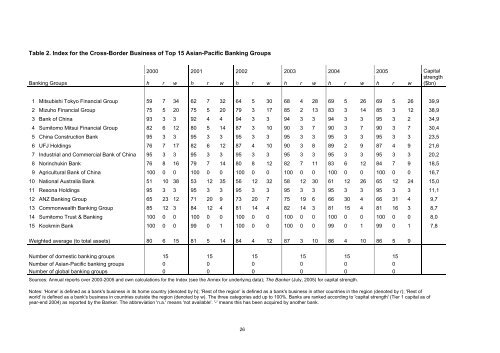

Table 2. Index for the <strong>Cross</strong>-<strong>Border</strong> Business <strong>of</strong> Top 15 Asian-Pacific <strong>Banking</strong> Groups<br />

2000 2001 2002 2003 2004 2005<br />

<strong>Banking</strong> Groups h r w h r w h r w h r w h r w h r w<br />

1 Mitsubishi Tokyo Financial Group 59 7 34 62 7 32 64 5 30 68 4 28 69 5 26 69 5 26 39,9<br />

2 Mizuho Financial Group 75 5 20 75 5 20 79 3 17 85 2 13 83 3 14 85 3 12 38,9<br />

3 Bank <strong>of</strong> China 93 3 3 92 4 4 94 3 3 94 3 3 94 3 3 95 3 2 34,9<br />

4 Sumitomo Mitsui Financial Group 82 6 12 80 5 14 87 3 10 90 3 7 90 3 7 90 3 7 30,4<br />

5 China Construction Bank 95 3 3 95 3 3 95 3 3 95 3 3 95 3 3 95 3 3 23,5<br />

6 UFJ Holdings 76 7 17 82 6 12 87 4 10 90 3 8 89 2 9 87 4 9 21,6<br />

7 Industrial and Commercial Bank <strong>of</strong> China 95 3 3 95 3 3 95 3 3 95 3 3 95 3 3 95 3 3 20,2<br />

8 Norinchukin Bank 76 8 16 79 7 14 80 8 12 82 7 11 83 6 12 84 7 9 18,5<br />

9 Agricultural Bank <strong>of</strong> China 100 0 0 100 0 0 100 0 0 100 0 0 100 0 0 100 0 0 16,7<br />

10 National Australia Bank 51 10 38 53 12 35 56 12 32 58 12 30 61 12 26 65 12 24 15,0<br />

11 Resona Holdings 95 3 3 95 3 3 95 3 3 95 3 3 95 3 3 95 3 3 11,1<br />

12 ANZ <strong>Banking</strong> Group 65 23 12 71 20 9 73 20 7 75 19 6 66 30 4 66 31 4 9,7<br />

13 Commonwealth <strong>Banking</strong> Group 85 12 3 84 12 4 81 14 4 82 14 3 81 15 4 81 16 3 8,7<br />

14 Sumitomo Trust & <strong>Banking</strong> 100 0 0 100 0 0 100 0 0 100 0 0 100 0 0 100 0 0 8,0<br />

15 Kookmin Bank 100 0 0 99 0 1 100 0 0 100 0 0 99 0 1 99 0 1 7,8<br />

Weighted average (to total assets) 80 6 15 81 5 14 84 4 12 87 3 10 86 4 10 86 5 9<br />

Number <strong>of</strong> domestic banking groups 15 15 15 15 15 15<br />

Number <strong>of</strong> Asian-Pacific banking groups 0 0 0 0 0 0<br />

Number <strong>of</strong> global banking groups 0 0 0 0 0 0<br />

Sources: Annual reports over 2000-2005 and own calculations for the Index (see the Annex for underlying data); The Banker (July, 2005) for capital strength.<br />

Notes: 'Home' is defined as a bank's business in its home country (denoted by h); 'Rest <strong>of</strong> the region' is defined as a bank's business in other countries in the region (denoted by r); 'Rest <strong>of</strong><br />

world' is defined as a bank's business in countries outside the region (denoted by w). The three categories add up to 100%. Banks are ranked according to 'capital strength' (Tier 1 capital as <strong>of</strong><br />

year-end 2004) as reported by the Banker. The abbreviation 'n.a.' means 'not available'. '-' means this has been acquired by another bank.<br />

26<br />

Capital<br />

strength<br />

($bn)