Current State of Cross-Border Banking - Vrije Universiteit Amsterdam

Current State of Cross-Border Banking - Vrije Universiteit Amsterdam

Current State of Cross-Border Banking - Vrije Universiteit Amsterdam

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Earlier this year, Citigroup’s CEO stated that he would like to shift the mix <strong>of</strong> business from about 60%<br />

in the US and 40% abroad to around 50-50 over the next few years. 6 Our sensitivity analysis shows<br />

that Citigroup’s is on its way to becoming a global bank. In the Asian-Pacific region, National Australia<br />

Bank is added as a global bank up to 2001. Again the picture in Europe is different. 1 to 2 regional<br />

banks are added when relaxing the criteria. The new sequence ranges from 8 European banks in<br />

2000 to 12 in 2005. Based on the Lehmann-test, we find that the new sequence <strong>of</strong> European banks<br />

under the 10% relaxation remains significant at the 1% level (p = 0.0028). The results <strong>of</strong> the relaxation<br />

<strong>of</strong> the criteria suggest that our results are not overly sensitive to the choice <strong>of</strong> the criteria.<br />

4. Comparing <strong>Cross</strong>-<strong>Border</strong> <strong>Banking</strong> across the Continents<br />

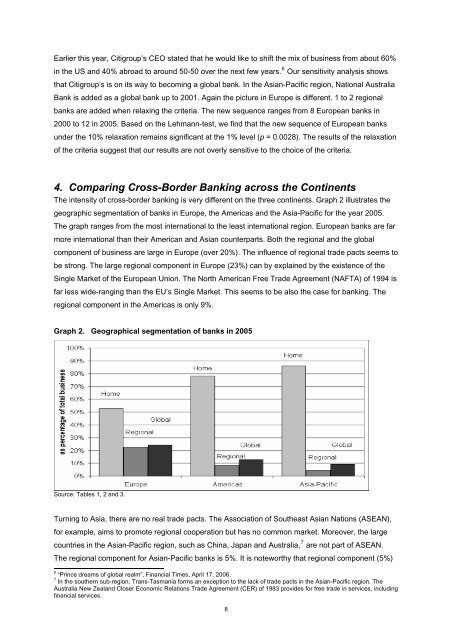

The intensity <strong>of</strong> cross-border banking is very different on the three continents. Graph 2 illustrates the<br />

geographic segmentation <strong>of</strong> banks in Europe, the Americas and the Asia-Pacific for the year 2005.<br />

The graph ranges from the most international to the least international region. European banks are far<br />

more international than their American and Asian counterparts. Both the regional and the global<br />

component <strong>of</strong> business are large in Europe (over 20%). The influence <strong>of</strong> regional trade pacts seems to<br />

be strong. The large regional component in Europe (23%) can by explained by the existence <strong>of</strong> the<br />

Single Market <strong>of</strong> the European Union. The North American Free Trade Agreement (NAFTA) <strong>of</strong> 1994 is<br />

far less wide-ranging than the EU’s Single Market. This seems to be also the case for banking. The<br />

regional component in the Americas is only 9%.<br />

Graph 2. Geographical segmentation <strong>of</strong> banks in 2005<br />

Source: Tables 1, 2 and 3.<br />

Turning to Asia, there are no real trade pacts. The Association <strong>of</strong> Southeast Asian Nations (ASEAN),<br />

for example, aims to promote regional cooperation but has no common market. Moreover, the large<br />

countries in the Asian-Pacific region, such as China, Japan and Australia, 7 are not part <strong>of</strong> ASEAN.<br />

The regional component for Asian-Pacific banks is 5%. It is noteworthy that regional component (5%)<br />

6 “Prince dreams <strong>of</strong> global realm”, Financial Times, April 17, 2006.<br />

7 In the southern sub-region, Trans-Tasmania forms an exception to the lack <strong>of</strong> trade pacts in the Asian-Pacific region. The<br />

Australia New Zealand Closer Economic Relations Trade Agreement (CER) <strong>of</strong> 1983 provides for free trade in services, including<br />

financial services.<br />

8