GLOBAL REACH. LEADlNG TECHNOLOGY. - Zonebourse.com

GLOBAL REACH. LEADlNG TECHNOLOGY. - Zonebourse.com

GLOBAL REACH. LEADlNG TECHNOLOGY. - Zonebourse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Joy Global Inc.<br />

Notes to Consolidated Financial Statements<br />

October 31, 2008<br />

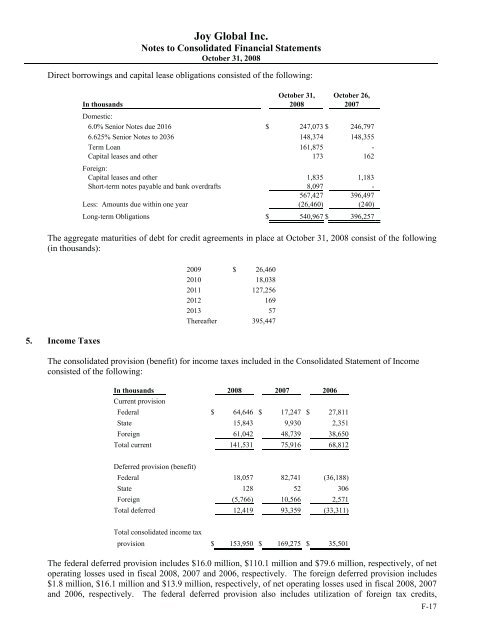

Direct borrowings and capital lease obligations consisted of the following:<br />

October 31, October 26,<br />

In thousands 2008 2007<br />

Domestic:<br />

6.0% Senior Notes due 2016 $ 247,073 $ 246,797<br />

6.625% Senior Notes to 2036 148,374 148,355<br />

Term Loan 161,875 -<br />

Capital leases and other 173 162<br />

Foreign:<br />

Capital leases and other 1,835 1,183<br />

Short-term notes payable and bank overdrafts 8,097 -<br />

567,427 396,497<br />

Less: Amounts due within one year (26,460) (240)<br />

Long-term Obligations $ 540,967 $ 396,257<br />

The aggregate maturities of debt for credit agreements in place at October 31, 2008 consist of the following<br />

(in thousands):<br />

5. In<strong>com</strong>e Taxes<br />

2009 $ 26,460<br />

2010 18,038<br />

2011 127,256<br />

2012 169<br />

2013 57<br />

Thereafter 395,447<br />

The consolidated provision (benefit) for in<strong>com</strong>e taxes included in the Consolidated Statement of In<strong>com</strong>e<br />

consisted of the following:<br />

In thousands 2008 2007 2006<br />

Current provision<br />

Federal $ 64,646 $ 17,247 $ 27,811<br />

State 15,843 9,930 2,351<br />

Foreign 61,042 48,739 38,650<br />

Total current 141,531 75,916 68,812<br />

Deferred provision (benefit)<br />

Federal 18,057 82,741 (36,188)<br />

State 128 52 306<br />

Foreign (5,766) 10,566 2,571<br />

Total deferred 12,419 93,359 (33,311)<br />

Total consolidated in<strong>com</strong>e tax<br />

provision $ 153,950 $ 169,275 $ 35,501<br />

The federal deferred provision includes $16.0 million, $110.1 million and $79.6 million, respectively, of net<br />

operating losses used in fiscal 2008, 2007 and 2006, respectively. The foreign deferred provision includes<br />

$1.8 million, $16.1 million and $13.9 million, respectively, of net operating losses used in fiscal 2008, 2007<br />

and 2006, respectively. The federal deferred provision also includes utilization of foreign tax credits,<br />

F-17