GLOBAL REACH. LEADlNG TECHNOLOGY. - Zonebourse.com

GLOBAL REACH. LEADlNG TECHNOLOGY. - Zonebourse.com

GLOBAL REACH. LEADlNG TECHNOLOGY. - Zonebourse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Joy Global Inc.<br />

Notes to Consolidated Financial Statements<br />

October 31, 2008<br />

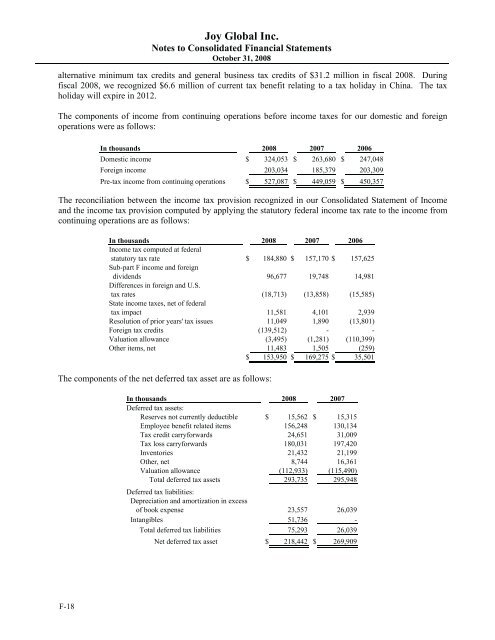

iscal 2008. During alternative minimum tax credits and general business tax credits of $31.2 million in fiscal 2008. During<br />

in China. The fiscal tax 2008, we recognized $6.6 million of current tax benefit relating to a tax holiday in China. The tax<br />

holiday will expire in 2012.<br />

omestic and foreign The <strong>com</strong>ponents of in<strong>com</strong>e from continuing operations before in<strong>com</strong>e taxes for our domestic and foreign<br />

operations were as follows:<br />

48<br />

09<br />

57<br />

In thousands 2008 2007 2006<br />

Domestic in<strong>com</strong>e $ 324,053 $ 263,680 $ 247,048<br />

Foreign in<strong>com</strong>e 203,034 185,379 203,309<br />

Pre-tax in<strong>com</strong>e from continuing operations $ 527,087 $ 449,059 $ 450,357<br />

tatement of In<strong>com</strong>e The reconciliation between the in<strong>com</strong>e tax provision recognized in our Consolidated Statement of In<strong>com</strong>e<br />

to the in<strong>com</strong>e from<br />

and the in<strong>com</strong>e tax provision <strong>com</strong>puted by applying the statutory federal in<strong>com</strong>e tax rate to the in<strong>com</strong>e from<br />

continuing operations are as follows:<br />

In thousands 2008 2007 2006<br />

In<strong>com</strong>e tax <strong>com</strong>puted at federal<br />

statutory tax rate $ 184,880 $ 157,170 $ 157,625<br />

Sub-part F in<strong>com</strong>e and foreign<br />

dividends 96,677 19,748 14,981<br />

Differences in foreign and U.S.<br />

tax rates (18,713) (13,858) (15,585)<br />

State in<strong>com</strong>e taxes, net of federal<br />

tax impact 11,581 4,101 2,939<br />

Resolution of prior years' tax issues 11,049 1,890 (13,801)<br />

Foreign tax credits (139,512) - -<br />

Valuation allowance (3,495) (1,281) (110,399)<br />

Other items, net 11,483 1,505 (259)<br />

$ 153,950 $ 169,275 $ 35,501<br />

The <strong>com</strong>ponents of the net deferred tax asset are as follows:<br />

F-18<br />

In thousands 2008 2007<br />

Deferred tax assets:<br />

Reserves not currently deductible $ 15,562 $ 15,315<br />

Employee benefit related items 156,248 130,134<br />

Tax credit carryforwards 24,651 31,009<br />

Tax loss carryforwards 180,031 197,420<br />

Inventories 21,432 21,199<br />

Other, net 8,744 16,361<br />

Valuation allowance (112,933) (115,490)<br />

Total deferred tax assets 293,735 295,948<br />

Deferred tax liabilities:<br />

Depreciation and amortization in excess<br />

of book expense 23,557 26,039<br />

Intangibles 51,736 -<br />

Total deferred tax liabilities 75,293 26,039<br />

Net deferred tax asset $ 218,442 $ 269,909<br />

F-18