GLOBAL REACH. LEADlNG TECHNOLOGY. - Zonebourse.com

GLOBAL REACH. LEADlNG TECHNOLOGY. - Zonebourse.com

GLOBAL REACH. LEADlNG TECHNOLOGY. - Zonebourse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Joy Global Inc.<br />

Notes to Consolidated Financial Statements<br />

October 31, 2008<br />

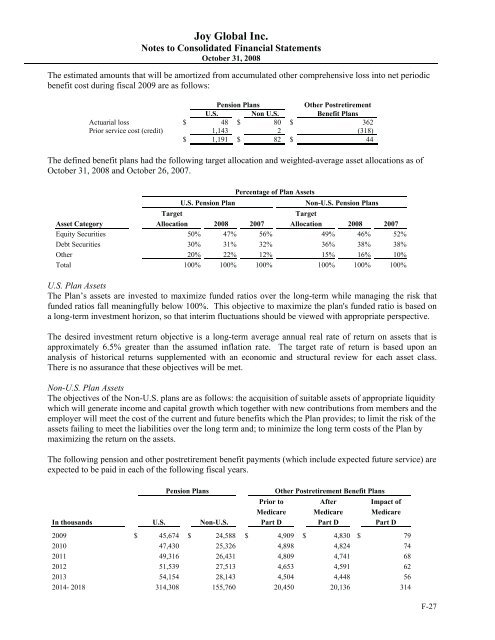

The estimated amounts that will be amortized from accumulated other <strong>com</strong>prehensive loss into net periodic<br />

benefit cost during fiscal 2009 are as follows:<br />

Pension Plans Other Postretirement<br />

U.S. Non U.S. Benefit Plans<br />

Actuarial loss $ 48 $ 80 $ 362<br />

Prior service cost (credit) 1,143 2 (318)<br />

$ 1,191 $ 82 $ 44<br />

The defined benefit plans had the following target allocation and weighted-average asset allocations as of<br />

October 31, 2008 and October 26, 2007.<br />

Percentage of Plan Assets<br />

U.S. Pension Plan Non-U.S. Pension Plans<br />

Target Target<br />

Asset Category Allocation 2008 2007 Allocation 2008 2007<br />

Equity Securities 50% 47% 56% 49% 46% 52%<br />

Debt Securities 30% 31% 32% 36% 38% 38%<br />

Other 20% 22% 12% 15% 16% 10%<br />

Total 100% 100% 100% 100% 100% 100%<br />

U.S. Plan Assets<br />

The Plan’s assets are invested to maximize funded ratios over the long-term while managing the risk that<br />

funded ratios fall meaningfully below 100%. This objective to maximize the plan's funded ratio is based on<br />

a long-term investment horizon, so that interim fluctuations should be viewed with appropriate perspective.<br />

The desired investment return objective is a long-term average annual real rate of return on assets that is<br />

approximately 6.5% greater than the assumed inflation rate. The target rate of return is based upon an<br />

analysis of historical returns supplemented with an economic and structural review for each asset class.<br />

There is no assurance that these objectives will be met.<br />

Non-U.S. Plan Assets<br />

The objectives of the Non-U.S. plans are as follows: the acquisition of suitable assets of appropriate liquidity<br />

which will generate in<strong>com</strong>e and capital growth which together with new contributions from members and the<br />

employer will meet the cost of the current and future benefits which the Plan provides; to limit the risk of the<br />

assets failing to meet the liabilities over the long term and; to minimize the long term costs of the Plan by<br />

maximizing the return on the assets.<br />

The following pension and other postretirement benefit payments (which include expected future service) are<br />

expected to be paid in each of the following fiscal years.<br />

Pension Plans Other Postretirement Benefit Plans<br />

Prior to After Impact of<br />

Medicare Medicare Medicare<br />

In thousands U.S. Non-U.S. Part D Part D Part D<br />

2009 $ 45,674 $ 24,588 $ 4,909 $ 4,830 $ 79<br />

2010 47,430 25,326 4,898 4,824 74<br />

2011 49,316 26,431 4,809 4,741 68<br />

2012 51,539 27,513 4,653 4,591 62<br />

2013 54,154 28,143 4,504 4,448 56<br />

2014- 2018 314,308 155,760 20,450 20,136 314<br />

F-27