PUBLIC FINANCE - BoardDocs

PUBLIC FINANCE - BoardDocs

PUBLIC FINANCE - BoardDocs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

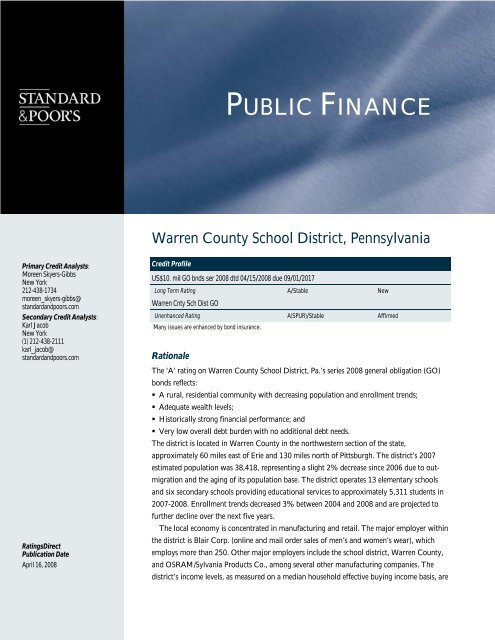

Primary Credit Analysts:<br />

Moreen Skyers-Gibbs<br />

New York<br />

212-438-1734<br />

moreen_skyers-gibbs@<br />

standardandpoors.com<br />

Secondary Credit Analysts:<br />

Karl Jacob<br />

New York<br />

(1) 212-438-2111<br />

karl_jacob@<br />

standardandpoors.com<br />

RatingsDirect<br />

Publication Date<br />

April 16, 2008<br />

<strong>PUBLIC</strong> <strong>FINANCE</strong><br />

Warren County School District, Pennsylvania<br />

Credit Profile<br />

US$10. mil GO bnds ser 2008 dtd 04/15/2008 due 09/01/2017<br />

Long Term Rating A/Stable New<br />

Warren Cnty Sch Dist GO<br />

Unenhanced Rating A(SPUR)/Stable Affirmed<br />

Many issues are enhanced by bond insurance.<br />

Rationale<br />

The ‘A’ rating on Warren County School District, Pa.’s series 2008 general obligation (GO)<br />

bonds reflects:<br />

A rural, residential community with decreasing population and enrollment trends;<br />

Adequate wealth levels;<br />

Historically strong financial performance; and<br />

Very low overall debt burden with no additional debt needs.<br />

The district is located in Warren County in the northwestern section of the state,<br />

approximately 60 miles east of Erie and 130 miles north of Pittsburgh. The district’s 2007<br />

estimated population was 38,418, representing a slight 2% decrease since 2006 due to outmigration<br />

and the aging of its population base. The district operates 13 elementary schools<br />

and six secondary schools providing educational services to approximately 5,311 students in<br />

2007-2008. Enrollment trends decreased 3% between 2004 and 2008 and are projected to<br />

further decline over the next five years.<br />

The local economy is concentrated in manufacturing and retail. The major employer within<br />

the district is Blair Corp. (online and mail order sales of men’s and women’s wear), which<br />

employs more than 250. Other major employers include the school district, Warren County,<br />

and OSRAM/Sylvania Products Co., among several other manufacturing companies. The<br />

district’s income levels, as measured on a median household effective buying income basis, are

Warren County School District, Pennsylvania<br />

adequate at 87% and 83% of state and national averages, respectively. Land use inside the district is<br />

designated 63% for residential purposes, 15% commercial, and 13% agricultural. In 2007, market<br />

value increased substantially, by 22%, bringing the total to $1.2 billion, or a low $33,129 per capita.<br />

Leading taxpayers account for a very diverse 8% of total assessed valuation.<br />

The district’s financial position has been strong over time. Management has maintained an<br />

unreserved designated and undesignated fund balance of 10% over the past three years. It has achieved<br />

five surpluses over a six-year period. Fiscal 2007 ended with huge surplus of $1.3 million, bringing the<br />

unreserved designated and undesignated fund balance to $7 million, a strong 12% of expenditures.<br />

State aid and local sources accounted for 55% and 40%, respectively, of fiscal 2007 operating revenue.<br />

Standard & Poor’s Ratings Services considers Warren County School District’s financial<br />

management practices “standard” under our Financial Management Assessment (FMA), indicating<br />

that practices exist in most areas, although not all may be formalized or regularly monitored by<br />

governance officials. The district’s budget monitoring is sound, with monthly budget reports presented<br />

to the school board. Investment holdings are monitored monthly and reported to the board when<br />

matured. Management aims at maintaining an unreserved fund balance at $5 million, which it has<br />

achieved over the past three consecutive years. The district makes a five-year facilities plan that it<br />

updates annually. There are no formal debt management policies.<br />

The district’s overall debt burden is very low at $746 on a per capita basis and low at 2% of market<br />

value. The district expects debt service as a percent of expenditures to be a low 5% in the fiscal 2008<br />

budget. Debt amortization is above average, with approximately 80% being retired in 10 years and<br />

95% in 20 years. The purpose of this bond issuance is to refund the district’s outstanding GO bonds<br />

series 2001 and 2002. The district has no additional debt needs.<br />

Outlook<br />

The stable outlook reflects Standard & Poor’s expectation that the district will maintain good financial<br />

performance and a stable fund balance. It also reflects that the district has no need for additional debt.<br />

Standard & Poor’s | ANALYSIS 2

Warren County School District, Pennsylvania<br />

Published by Standard & Poor's, a Division of The McGraw-Hill Companies, Inc. Executive offices: 1221 Avenue of the Americas, New York, NY 10020.<br />

Editorial offices: 55 Water Street, New York, NY 10041. Subscriber services: (1) 212-438-7280. Copyright 2008 by The McGraw-Hill Companies, Inc.<br />

Reproduction in whole or in part prohibited except by permission. All rights reserved. Information has been obtained by Standard & Poor's from sources<br />

believed to be reliable. However, because of the possibility of human or mechanical error by our sources, Standard & Poor's or others, Standard & Poor's<br />

does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or the result obtained<br />

from the use of such information. Ratings are statements of opinion, not statements of fact or recommendations to buy, hold, or sell any securities.<br />

Standard & Poor's uses billing and contact data collected from subscribers for billing and order fulfillment purposes, and occasionally to inform subscribers<br />

about products or services from Standard & Poor's, our parent, The McGraw-Hill Companies, and reputable third parties that may be of interest to them. All<br />

subscriber billing and contact data collected is stored in a secure database in the U.S. and access is limited to authorized persons. If you would prefer not to<br />

have your information used as outlined in this notice, if you wish to review your information for accuracy, or for more information on our privacy practices,<br />

please call us at (1) 800-852-1641 or write us at: privacy@standardandpoors.com. For more information about The McGraw-Hill Companies Privacy Policy<br />

please visit www.mcgraw-hill.com/privacy.html.<br />

Analytic services provided by Standard & Poor's Ratings Services ("Ratings Services") are the result of separate activities designed to<br />

preserve the independence and objectivity of ratings opinions. Credit ratings issued by Ratings Services are solely statements of opinion<br />

and not statements of fact or recommendations to purchase, hold, or sell any securities or make any other investment decisions.<br />

Accordingly, any user of credit ratings issued by Ratings Services should not rely on any such ratings or other opinion issued by Ratings<br />

Services in making any investment decision. Ratings are based on information received by Ratings Services. Other divisions of Standard<br />

& Poor's may have information that is not available to Ratings Services. Standard & Poor's has established policies and procedures to<br />

maintain the confidentiality of non-public information received during the ratings process.<br />

Ratings Services receives compensation for its ratings. Such compensation is normally paid either by the issuers of such securities or by<br />

the underwriters participating in the distribution thereof. The fees generally vary from US$2,000 to over US$1,500,000. While Standard<br />

& Poor's reserves the right to disseminate the rating, it receives no payment for doing so, except for subscriptions to its publications.<br />

Permissions: To reprint, translate, or quote Standard & Poor's publications, contact: Client Services, 55 Water Street, New York, NY<br />

10041; (1) 212-438-7280; or by e-mail to: research_request@standardandpoors.com.<br />

www.standardandpoors.com 3