Financial Ratios as Predictors of Failure: Evidence from ... - ERIM

Financial Ratios as Predictors of Failure: Evidence from ... - ERIM

Financial Ratios as Predictors of Failure: Evidence from ... - ERIM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

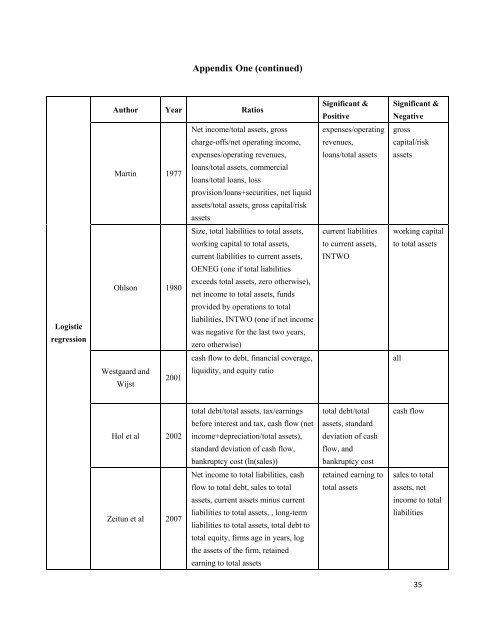

Logistic<br />

regression<br />

Appendix One (continued)<br />

Author Year <strong>Ratios</strong><br />

Martin 1977<br />

Ohlson 1980<br />

Westgaard and<br />

Wijst<br />

2001<br />

Hol et al 2002<br />

Zeitun et al 2007<br />

Net income/total <strong>as</strong>sets, gross<br />

charge-<strong>of</strong>fs/net operating income,<br />

expenses/operating revenues,<br />

loans/total <strong>as</strong>sets, commercial<br />

loans/total loans, loss<br />

provision/loans+securities, net liquid<br />

<strong>as</strong>sets/total <strong>as</strong>sets, gross capital/risk<br />

<strong>as</strong>sets<br />

Size, total liabilities to total <strong>as</strong>sets,<br />

working capital to total <strong>as</strong>sets,<br />

current liabilities to current <strong>as</strong>sets,<br />

OENEG (one if total liabilities<br />

exceeds total <strong>as</strong>sets, zero otherwise),<br />

net income to total <strong>as</strong>sets, funds<br />

provided by operations to total<br />

liabilities, INTWO (one if net income<br />

w<strong>as</strong> negative for the l<strong>as</strong>t two years,<br />

zero otherwise)<br />

c<strong>as</strong>h flow to debt, financial coverage,<br />

liquidity, and equity ratio<br />

total debt/total <strong>as</strong>sets, tax/earnings<br />

before interest and tax, c<strong>as</strong>h flow (net<br />

income+depreciation/total <strong>as</strong>sets),<br />

standard deviation <strong>of</strong> c<strong>as</strong>h flow,<br />

bankruptcy cost (ln(sales))<br />

Net income to total liabilities, c<strong>as</strong>h<br />

flow to total debt, sales to total<br />

<strong>as</strong>sets, current <strong>as</strong>sets minus current<br />

liabilities to total <strong>as</strong>sets, , long-term<br />

liabilities to total <strong>as</strong>sets, total debt to<br />

total equity, firms age in years, log<br />

the <strong>as</strong>sets <strong>of</strong> the firm, retained<br />

earning to total <strong>as</strong>sets<br />

Significant &<br />

Positive<br />

expenses/operating<br />

revenues,<br />

loans/total <strong>as</strong>sets<br />

current liabilities<br />

to current <strong>as</strong>sets,<br />

INTWO<br />

total debt/total<br />

<strong>as</strong>sets, standard<br />

deviation <strong>of</strong> c<strong>as</strong>h<br />

flow, and<br />

bankruptcy cost<br />

retained earning to<br />

total <strong>as</strong>sets<br />

Significant &<br />

Negative<br />

gross<br />

capital/risk<br />

<strong>as</strong>sets<br />

working capital<br />

to total <strong>as</strong>sets<br />

all<br />

c<strong>as</strong>h flow<br />

sales to total<br />

<strong>as</strong>sets, net<br />

income to total<br />

liabilities<br />

35