Entropy Coherent and Entropy Convex Measures of Risk - Eurandom

Entropy Coherent and Entropy Convex Measures of Risk - Eurandom

Entropy Coherent and Entropy Convex Measures of Risk - Eurandom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

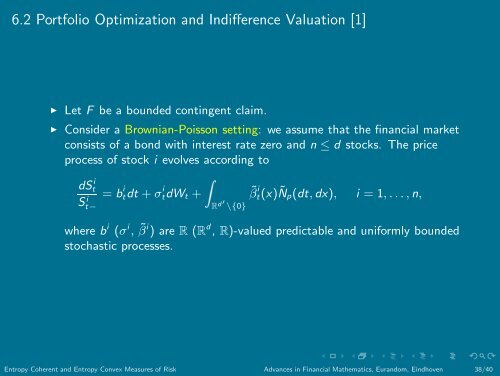

6.2 Portfolio Optimization <strong>and</strong> Indifference Valuation [1]<br />

◮ Let F be a bounded contingent claim.<br />

◮ Consider a Brownian-Poisson setting: we assume that the financial market<br />

consists <strong>of</strong> a bond with interest rate zero <strong>and</strong> n ≤ d stocks. The price<br />

process <strong>of</strong> stock i evolves according to<br />

dS i t<br />

Si = b<br />

t−<br />

i tdt + σ i tdWt +Rd′ ˜β<br />

\{0}<br />

i t(x) Ñp(dt,dx), i = 1, . . . , n,<br />

where b i (σ i , ˜ β i ) are R (R d , R)-valued predictable <strong>and</strong> uniformly bounded<br />

stochastic processes.<br />

<strong>Entropy</strong> <strong>Coherent</strong> <strong>and</strong> <strong>Entropy</strong> <strong>Convex</strong> <strong>Measures</strong> <strong>of</strong> <strong>Risk</strong> Advances in Financial Mathematics, Eur<strong>and</strong>om, Eindhoven 38/40

![The Contraction Method on C([0,1]) and Donsker's ... - Eurandom](https://img.yumpu.com/19554492/1/190x143/the-contraction-method-on-c01-and-donskers-eurandom.jpg?quality=85)