Entropy Coherent and Entropy Convex Measures of Risk - Eurandom

Entropy Coherent and Entropy Convex Measures of Risk - Eurandom

Entropy Coherent and Entropy Convex Measures of Risk - Eurandom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

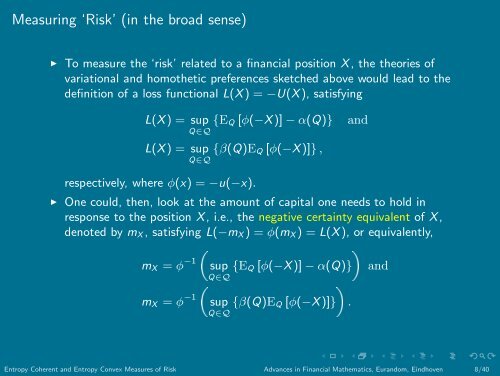

Measuring ‘<strong>Risk</strong>’ (in the broad sense)<br />

◮ To measure the ‘risk’ related to a financial position X, the theories <strong>of</strong><br />

variational <strong>and</strong> homothetic preferences sketched above would lead to the<br />

definition <strong>of</strong> a loss functional L(X) = −U(X), satisfying<br />

L(X) = sup {EQ [φ(−X)] − α(Q)} <strong>and</strong><br />

Q∈Q<br />

L(X) = sup {β(Q)EQ [φ(−X)]} ,<br />

Q∈Q<br />

respectively, where φ(x) = −u(−x).<br />

◮ One could, then, look at the amount <strong>of</strong> capital one needs to hold in<br />

response to the position X, i.e., the negative certainty equivalent <strong>of</strong> X,<br />

denoted by mX, satisfying L(−mX) = φ(mX) = L(X), or equivalently,<br />

mX = φ −1sup {EQ [φ(−X)] − α(Q)}<strong>and</strong><br />

Q∈Q<br />

mX = φ −1sup {β(Q)EQ [φ(−X)]}.<br />

Q∈Q<br />

<strong>Entropy</strong> <strong>Coherent</strong> <strong>and</strong> <strong>Entropy</strong> <strong>Convex</strong> <strong>Measures</strong> <strong>of</strong> <strong>Risk</strong> Advances in Financial Mathematics, Eur<strong>and</strong>om, Eindhoven 8/40

![The Contraction Method on C([0,1]) and Donsker's ... - Eurandom](https://img.yumpu.com/19554492/1/190x143/the-contraction-method-on-c01-and-donskers-eurandom.jpg?quality=85)