09.10 Registration and Coffee Room 206 CD (Mezzanine level)

09.10 Registration and Coffee Room 206 CD (Mezzanine level)

09.10 Registration and Coffee Room 206 CD (Mezzanine level)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

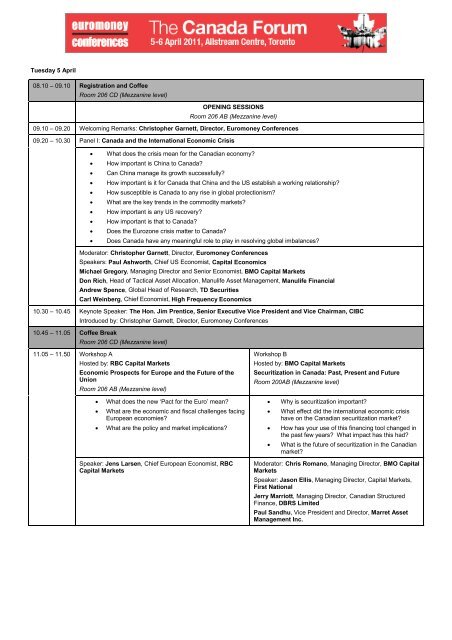

Tuesday 5 April<br />

08.10 – <strong>09.10</strong> <strong>Registration</strong> <strong>and</strong> <strong>Coffee</strong><br />

<strong>Room</strong> <strong>206</strong> <strong>CD</strong> (<strong>Mezzanine</strong> <strong>level</strong>)<br />

OPENING SESSIONS<br />

<strong>Room</strong> <strong>206</strong> AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

<strong>09.10</strong> – 09.20 Welcoming Remarks: Christopher Garnett, Director, Euromoney Conferences<br />

09.20 – 10.30 Panel I: Canada <strong>and</strong> the International Economic Crisis<br />

• What does the crisis mean for the Canadian economy?<br />

• How important is China to Canada?<br />

• Can China manage its growth successfully?<br />

• How important is it for Canada that China <strong>and</strong> the US establish a working relationship?<br />

• How susceptible is Canada to any rise in global protectionism?<br />

• What are the key trends in the commodity markets?<br />

• How important is any US recovery?<br />

• How important is that to Canada?<br />

• Does the Eurozone crisis matter to Canada?<br />

• Does Canada have any meaningful role to play in resolving global imbalances?<br />

Moderator: Christopher Garnett, Director, Euromoney Conferences<br />

Speakers: Paul Ashworth, Chief US Economist, Capital Economics<br />

Michael Gregory, Managing Director <strong>and</strong> Senior Economist, BMO Capital Markets<br />

Don Rich, Head of Tactical Asset Allocation, Manulife Asset Management, Manulife Financial<br />

Andrew Spence, Global Head of Research, TD Securities<br />

Carl Weinberg, Chief Economist, High Frequency Economics<br />

10.30 – 10.45 Keynote Speaker: The Hon. Jim Prentice, Senior Executive Vice President <strong>and</strong> Vice Chairman, CIBC<br />

10.45 – 11.05 <strong>Coffee</strong> Break<br />

11.05 – 11.50 Workshop A<br />

Introduced by: Christopher Garnett, Director, Euromoney Conferences<br />

<strong>Room</strong> <strong>206</strong> <strong>CD</strong> (<strong>Mezzanine</strong> <strong>level</strong>)<br />

Hosted by: RBC Capital Markets<br />

Economic Prospects for Europe <strong>and</strong> the Future of the<br />

Union<br />

<strong>Room</strong> <strong>206</strong> AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

• What does the new ‘Pact for the Euro’ mean?<br />

• What are the economic <strong>and</strong> fiscal challenges facing<br />

European economies?<br />

• What are the policy <strong>and</strong> market implications?<br />

Speaker: Jens Larsen, Chief European Economist, RBC<br />

Capital Markets<br />

Workshop B<br />

Hosted by: BMO Capital Markets<br />

Securitization in Canada: Past, Present <strong>and</strong> Future<br />

<strong>Room</strong> 200AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

• Why is securitization important?<br />

• What effect did the international economic crisis<br />

have on the Canadian securitization market?<br />

• How has your use of this financing tool changed in<br />

the past few years? What impact has this had?<br />

• What is the future of securitization in the Canadian<br />

market?<br />

Moderator: Chris Romano, Managing Director, BMO Capital<br />

Markets<br />

Speaker: Jason Ellis, Managing Director, Capital Markets,<br />

First National<br />

Jerry Marriott, Managing Director, Canadian Structured<br />

Finance, DBRS Limited<br />

Paul S<strong>and</strong>hu, Vice President <strong>and</strong> Director, Marret Asset<br />

Management Inc.

11.55 – 12.40 Workshop C<br />

Hosted by: TD Securities<br />

The Emergence of the Canadian High Yield Market – Why<br />

it Benefits Canadian Issuers <strong>and</strong> Investors<br />

<strong>Room</strong> <strong>206</strong> AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

• The role of high yield debt in an issuer’s capital<br />

structure<br />

• The risk-return proposition for investors<br />

• Comparison of Canadian <strong>and</strong> US markets<br />

Moderator: Michael Wolff, Managing Director, Head of<br />

Canadian High Yield, TD Securities<br />

Speakers: Barry Allan, Founder <strong>and</strong> Chief Executive Officer,<br />

Marret Asset Management Inc.<br />

Dan Bastasic, Senior Vice President, Investments, Co-Lead,<br />

Sentinel Investment Team, Mackenzie Financial<br />

Tom Peddie, Executive Vice President <strong>and</strong> Chief Financial<br />

Officer, Corus Entertainment Inc.<br />

Jean-François Pruneau, Chief Financial Officer, Quebecor<br />

Media Inc.<br />

Workshop D<br />

12.40 – 13.30 Panel II: Canada – Recasting the International Financial Architecture?<br />

13.30 – 14.40 Lunch<br />

<strong>Room</strong> <strong>206</strong> AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

Hosted by: Desjardins Securities<br />

The Impact of Basel III <strong>and</strong> OSFI Capital Pronouncements<br />

on the Canadian Capital Markets<br />

<strong>Room</strong> 200AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

• The Canadian banks are the largest<br />

participants/issuers in the Canadian capital markets;<br />

How will Basel III impact what is issued, how much<br />

is issued <strong>and</strong> where it is issued in the future?<br />

• How will the rules change the way in which banks<br />

do business?<br />

• OSFI has made its own pronouncements in the last<br />

year; What will be the new face of Canadian<br />

contingent capital?<br />

• What are the most important aspects?<br />

• How do we compare to the rest of the world in<br />

implementation?<br />

• How will the new pronouncements be applied?<br />

Moderator: Leon Dadoun, President, DSI Bodiam Financial<br />

Speakers: Michael Goldberg, Vice President <strong>and</strong> Director,<br />

Research, Banks <strong>and</strong> Diversified Financials/Insurance<br />

Analyst, Desjardins Capital Markets<br />

Julian Pope, Vice President <strong>and</strong> Director, Head of Credit<br />

Trading, Desjardins Capital Markets<br />

• What role can Canada play in the recasting of the international financial architecture?<br />

• Role model or bit-part player?<br />

• Where do Canada’s banks fit in the global capital adequacy regime?<br />

• How can Canada best leverage international relationships to achieve its goals?<br />

• What does Canada have to teach other countries – <strong>and</strong> multilateral organisations – about governance?<br />

• Does not having a single securities regulator damage Canada’s credibility?<br />

• How can Canada ensure that its banking system remains competitive in the face of international regulatory<br />

changes?<br />

Moderator: Janet Guttsman, Bureau Chief, Canada, Thomson Reuters<br />

Speakers: Andrew Fleming, Senior Partner, Ogilvy Renault<br />

Donald Hathaway, Interim Chief Executive Officer, Global Risk Institute (GRI)<br />

John Kirton, Director of G8 Research Group, Associate Professor of Political Science, Research Associate of the Centre for<br />

International Studies, <strong>and</strong> Fellow of Trinity College, University of Toronto<br />

Matthew Richardson, Charles Simon Professor, Applied Financial Economics, <strong>and</strong> Director, Salomon Center for the Study of<br />

Financial Institutions, NYU Stern School of Business<br />

The Lakeside <strong>Room</strong> (Main Floor)<br />

AFTERNOON SESSIONS<br />

<strong>Room</strong> <strong>206</strong> AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

14.40 – 15.05 Keynote Interview: The Hon. Dwight Duncan, Minister of Finance <strong>and</strong> Chair of the Management Board of the Cabinet,<br />

Government of Ontario<br />

Interviewed by: Andrew Lennon, Conference Director, Euromoney Conferences

15.10 – 16.15<br />

Panel III: Infrastructure<br />

16.15– 16.45 <strong>Coffee</strong> Break<br />

• What is the best method of financing the country’s infrastructure needs?<br />

• The use of the financial markets<br />

• The involvement of the government<br />

• The role of P3s<br />

• Best practice<br />

• Green infrastructure projects<br />

• A case study<br />

Moderator: Andrew Lennon, Conference Director, Euromoney Conferences<br />

Speakers: Simon Chapman, Executive Vice President, Infrastructure Development, Carillion Canada<br />

Bert Clark, Managing Director <strong>and</strong> Head US <strong>and</strong> Canada, Global Infrastructure Finance, Scotia Capital<br />

Cliff Inskip, Managing Director, Head of Infrastructure <strong>and</strong> Project Finance, Debt Capital Markets, CIBC<br />

John McBride, Chief Executive Officer, PPP Canada<br />

Martin Stickl<strong>and</strong>, Senior Vice President, Plenary Group<br />

<strong>Room</strong> <strong>206</strong> <strong>CD</strong> (<strong>Mezzanine</strong> <strong>level</strong>)<br />

16.45 – 17.35 Panel IV: Corporate Financing<br />

• What is the outlook for corporate Canada in the aftermath of the global economic crisis?<br />

• Where are the key funding requirements?<br />

Moderator: Christopher Garnett, Director, Euromoney Conferences<br />

Speakers: Andrew Baranowsky, Senior Director, Corporate Finance <strong>and</strong> Financial Risk Management, Bombardier<br />

Eric Castonguay, Managing Director, PricewaterhouseCoopers Corporate Finance<br />

Paul Stinis, Senior Vice President <strong>and</strong> Treasurer, BCE Inc <strong>and</strong> Bell Canada<br />

Ali Suleman, Vice President <strong>and</strong> Treasurer, Hydro One<br />

17.35 – 19.00 Cocktail Reception - All conference participants are invited to attend<br />

Wednesday 6 April<br />

<strong>Room</strong> <strong>206</strong><strong>CD</strong> (<strong>Mezzanine</strong> <strong>level</strong>)<br />

08.30 – <strong>09.10</strong> <strong>Registration</strong> <strong>and</strong> <strong>Coffee</strong><br />

<strong>Room</strong> <strong>206</strong> <strong>CD</strong> (<strong>Mezzanine</strong> <strong>level</strong>)<br />

OPENINGSESSION<br />

<strong>Room</strong> <strong>206</strong> AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

<strong>09.10</strong> – 09.20 Welcoming Remarks: Christopher Garnett, Director, Euromoney Conferences<br />

09.20 – 09.45 Keynote Interview: What about the Eurozone?<br />

Interview with Nicolas Véron, Senior Fellow, Bruegel, <strong>and</strong> Visiting Fellow, Peterson Institute for International<br />

Economics<br />

Interviewed by: Christopher Garnett, Director, Euromoney Conferences<br />

09.45 – 10.40 Panel V: Banking – The Example to Follow?<br />

• How will the Canadian banks take advantage of their strong position?<br />

• What are the funding needs of the Canadian banking sector?<br />

• How will Canada’s banks finance global growth?<br />

• How will Canadian banks <strong>and</strong> insurers manage liquidity?<br />

• What are the financing needs of the non-bank financial sector?<br />

• What are the specific funding, investment, risk <strong>and</strong> liability management needs of Canada’s insurers?<br />

Moderator: Peter Berezin, Managing Editor, The Bank Credit Analyst (BCA)<br />

Speakers: David Dickinson, Vice President, Treasury Financing, CIBC<br />

Michael Goldberg, Vice President <strong>and</strong> Director, Research, Banks <strong>and</strong> Diversified Financials/Insurance Analyst, Desjardins<br />

Capital Markets<br />

Chris Hughes, Vice President, Capital Management <strong>and</strong> Funding, BMO Financial Group<br />

Craig Lowery, Vice President, Treasury <strong>and</strong> Balance Sheet Management, TD Bank Financial Group<br />

David Power, Vice President, Market Strategy <strong>and</strong> Execution, Corporate Treasury, RBC<br />

Nicolas Véron, Senior Fellow, Bruegel, <strong>and</strong> Visiting Fellow, Peterson Institute for International Economics

10.45 – 11.30 Workshop E<br />

Hosted by: Deutsche Bank<br />

11.30 – 12.05 <strong>Coffee</strong> Break<br />

Piecing Together Global Derivatives Reform in 2011<br />

<strong>Room</strong> <strong>206</strong> AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

• Update on process <strong>and</strong> timing<br />

• Comparative review of global derivative reform<br />

efforts in the Americas, Europe <strong>and</strong> Asia<br />

• Focus on US derivatives regulatory proposals<br />

regarding the regulation of dealers, market<br />

participants, central clearing, exchange trading <strong>and</strong><br />

post-trade reporting<br />

• Review of key outst<strong>and</strong>ing questions still to be<br />

addressed<br />

Speaker: Robert Lee, Director, Global Markets, Deutsche<br />

Bank<br />

<strong>Room</strong> <strong>206</strong> <strong>CD</strong><br />

12.10 – 13.00 Panel VI: The Public Sector: Present <strong>and</strong> Future<br />

<strong>Room</strong> <strong>206</strong> AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

• Has the boom year for public sector debt continued?<br />

• Funding in the international market<br />

Workshop F<br />

Hosted by: Scotia Capital<br />

Canadian Dollar Leveraged Finance Workshop<br />

<strong>Room</strong> 200AB (<strong>Mezzanine</strong> <strong>level</strong>)<br />

• Bridge loans<br />

• Term B<br />

• Second lien notes<br />

• Public-private high yield notes<br />

• Covenants<br />

• What does the investor base look like now? What will it look like in 2015?<br />

• What are the key rating trends?<br />

• What fiscal challenges should governments be worried about?<br />

• How is the relationship between the provinces <strong>and</strong> the centre changing?<br />

• What is the plan for debt reduction for the year ahead?<br />

Moderator: Ralph Sinclair, Deputy Editor SSA Wire, EuroWeek<br />

Speakers: Grant Berry, Managing Director, Government Finance, RBC Capital Markets<br />

Gadi Mayman, Chief Executive Officer, Ontario Financing Authority<br />

Adrien De Naurois, Director, Deutsche Bank<br />

Bernard Turgeon, Associate Deputy Minister, Québec Ministry of Finance<br />

13.00 – 13.10 Closing Remarks: Andrew Lennon, Conference Director, Euromoney Conferences<br />

13.10 – 14.10 Lunch<br />

<strong>Room</strong> <strong>206</strong> <strong>CD</strong> (<strong>Mezzanine</strong> <strong>level</strong>)<br />

Moderator: Greg Woynarski, Managing Director <strong>and</strong> Co-<br />

Head, Global Capital Markets, Scotia Capital<br />

Speakers: Brian Dodd, Managing Director, Debt Capital<br />

Markets, Scotia Capital<br />

Nicholas Mann, Associate, Leveraged Finance - Canada,<br />

Scotia Capital<br />

Adam Mitchell, Director, High Yield Sales <strong>and</strong> Trading,<br />

Scotia Capital<br />

Euromoney Conferences reserve the right to amend the programme <strong>and</strong> is not responsible for cancellations due to unforeseen circumstances. Euromoney Conferences<br />

accepts no responsibility for statements made orally or in written material distributed by any of its speakers at its conferences. In addition, Euromoney Conferences is<br />

not responsible for any copying, republication or redistribution of such statements.