Pre-Conference Primer - Euromoney Conferences

Pre-Conference Primer - Euromoney Conferences

Pre-Conference Primer - Euromoney Conferences

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

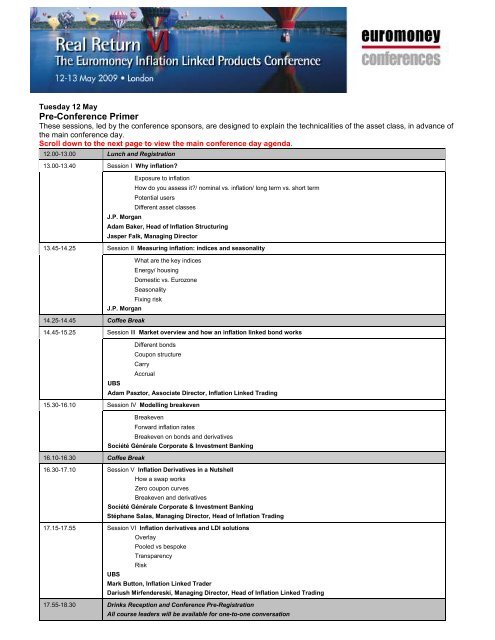

Tuesday 12 May<br />

<strong>Pre</strong>-<strong>Conference</strong> <strong>Primer</strong><br />

These sessions, led by the conference sponsors, are designed to explain the technicalities of the asset class, in advance of<br />

the main conference day.<br />

Scroll down to the next page to view the main conference day agenda.<br />

12.00-13.00 Lunch and Registration<br />

13.00-13.40<br />

13.45-14.25<br />

Session I Why inflation?<br />

J.P. Morgan<br />

Exposure to inflation<br />

How do you assess it?/ nominal vs. inflation/ long term vs. short term<br />

Potential users<br />

Different asset classes<br />

Adam Baker, Head of Inflation Structuring<br />

Jasper Falk, Managing Director<br />

Session II Measuring inflation: indices and seasonality<br />

J.P. Morgan<br />

14.25-14.45 Coffee Break<br />

14.45-15.25<br />

15.30-16.10<br />

What are the key indices<br />

Energy/ housing<br />

Domestic vs. Eurozone<br />

Seasonality<br />

Fixing risk<br />

Session III Market overview and how an inflation linked bond works<br />

UBS<br />

Different bonds<br />

Coupon structure<br />

Carry<br />

16.10-16.30 Coffee Break<br />

Accrual<br />

Adam Pasztor, Associate Director, Inflation Linked Trading<br />

Session IV Modelling breakeven<br />

Breakeven<br />

Forward inflation rates<br />

Breakeven on bonds and derivatives<br />

Société Générale Corporate & Investment Banking<br />

16.30-17.10 Session V Inflation Derivatives in a Nutshell<br />

How a swap works<br />

Zero coupon curves<br />

Breakeven and derivatives<br />

Société Générale Corporate & Investment Banking<br />

Stéphane Salas, Managing Director, Head of Inflation Trading<br />

17.15-17.55 Session VI Inflation derivatives and LDI solutions<br />

UBS<br />

Overlay<br />

Pooled vs bespoke<br />

Transparency<br />

Risk<br />

Mark Button, Inflation Linked Trader<br />

Dariush Mirfendereski, Managing Director, Head of Inflation Linked Trading<br />

17.55-18.30 Drinks Reception and <strong>Conference</strong> <strong>Pre</strong>-Registration<br />

All course leaders will be available for one-to-one conversation

Wednesday 13 May<br />

Main <strong>Conference</strong> Day<br />

08.00-08.45 Coffee and Registration<br />

Ballrooms 2 & 3<br />

ALL SESSIONS<br />

Ballroom 1<br />

08.45-08.50 <strong>Euromoney</strong> Welcome: John Baskott, Director - Inflation-Linked <strong>Conference</strong>s, <strong>Euromoney</strong> <strong>Conference</strong>s<br />

08.50-09.20 Head to Head Debate: Inflation or Deflation: Which Should We Worry About?<br />

Charles Dumas, Director and Head of the World Service, Lombard Street Research<br />

Liam Halligan, Chief Economist, Prosperity Capital Management, Economics Correspondent, The Sunday<br />

Telegraph and formerly Channel 4 News Economics Editor<br />

09.20-10.20 Panel I: Inflation and the Markets<br />

• What does the end of the Great Moderation mean for inflation?<br />

• Is central bank credibility fatally wounded?<br />

• Policy responses and the path of inflation<br />

• How real is deflation and what does it mean for inflation markets?<br />

• Or should we worry about stagflation?<br />

• Quantitative Easing<br />

• Inflation markets<br />

• How wrong are breakevens?<br />

• Inflation and the commodity cycle<br />

• Has the relationship between growth and inflation changed?<br />

• And between employment and wage expectations?<br />

• How quickly will policymakers move against renewed inflationary outbreaks?<br />

Moderator: Mark Johnson, Editor, <strong>Euromoney</strong> <strong>Conference</strong>s<br />

Speakers:<br />

10.20-10.50 Coffee Break<br />

10.50-11.35<br />

11.40-12.25<br />

Samer Helou, Fund Manager Inflation, Global Rates Team, AXA Investment Managers<br />

David Mackie, European Chief Economist, J.P. Morgan<br />

Stéphane Salas, Managing Director, Head of Inflation Trading, Société Générale Corporate & Investment Banking<br />

Mihir Worah, Managing Director, Head of the Real Return Portfolio Management Team, PIMCO<br />

Paul Wynn, Senior Portfolio Manager, Western Asset Management<br />

Ballrooms 2 & 3<br />

Workshop A<br />

Hosted by: UBS<br />

• US TIPS into deflation<br />

• Market dislocation<br />

Speakers:<br />

Mark Button, Executive Director, UBS<br />

Chris Lupoli, Executive Director, Global Inflation-Linked Strategist, UBS<br />

Dariush Mirfendereski, Managing Director, Head of Inflation Linked Trading, UBS<br />

Workshop B<br />

Hosted by: Société Générale Corporate & Investment Banking

Eurozone Inflation Derivatives and their Use in Hedging Extreme Inflation Scenarios<br />

• Opportunities in a volatile Eurozone inflation market<br />

• Pros and cons of investing in inflation derivatives<br />

• Case study: the year-on-year versus zero coupon options market<br />

Speaker:<br />

Stéphane Salas, Managing Director, Head of Inflation Trading, Société Générale Corporate & Investment Banking<br />

12.30-13.30 Panel II: The UK Inflation-Linked Market<br />

• What is the likely path of future UK inflation?<br />

• What does rapid fiscal expansion mean for inflation and the inflation market?<br />

• What will quantitative easing mean for the market?<br />

• And for UK debt management policy?<br />

• How captive is the domestic bid?<br />

• Does it skew value in the market?<br />

• Should the DMO continue to hit the linkers bid whenever possible?<br />

• Does the UK market need new sources of payers?<br />

• Is there any chance of finding them?<br />

Moderator: Mark Johnson, Editor, <strong>Euromoney</strong> <strong>Conference</strong>s<br />

Speakers:<br />

13.30-14.30 Lunch<br />

14.30-15.15<br />

David Dyer, Investment Manager, AXA Investment Managers<br />

David Hooker, Senior Portfolio Manager, Insight Investment Management<br />

Dariush Mirfendereski, Managing Director, Head of Inflation Linked Trading, UBS<br />

Samantha Pitt, Deputy Group Treasurer, Network Rail<br />

Paul Wynn, Senior Portfolio Manager, Western Asset Management<br />

Workshop C<br />

Hosted by: J.P. Morgan<br />

The Future of the Inflation linked Markets<br />

• How have the inflation markets changed<br />

• New approaches to the market<br />

• Trading strategies to take advantage<br />

Speakers:<br />

Adam Baker, Head of Inflation Structuring, J.P. Morgan<br />

Jasper Falk, Managing Director, J.P. Morgan<br />

Jorge Garayo, J.P. Morgan<br />

Kari Hallgrimsson, J.P. Morgan<br />

15.15-15.55 Panel III: Inflation-linked Programmes: An Issuers’ Roundtable

• What does quantitative easing mean for central bank independence?<br />

• For monetary policy independence?<br />

• And for debt management programmes?<br />

• How can linkers programmes best be maintained in current inflationary/deflationary environments?<br />

• Where does a linker programme sit in the overall debt management programme?<br />

• Should investor bases be domestic or international?<br />

• How can you ensure liquidity in your linker programmes?<br />

• The role of broker-dealers in a world of reduced liquidity<br />

• Should you use a domestic or a cross-border index?<br />

• How have current events affected the credibility of the various inflation indices?<br />

Moderators: Mark Johnson, Editor, <strong>Euromoney</strong> <strong>Conference</strong>s<br />

Speakers:<br />

15.55-16.25 Coffee Break<br />

Mark Deacon, Senior Quantitative Analyst, UK Debt Management Office<br />

Davide Iacovoni, Head of Euro-denominated Medium-long Term Liquid Funding Division, Public Debt Directorate,<br />

Department of the Treasury, Ministry of Economy and Finance, Italy<br />

Nathan Struemph, Financial Economist, Office of Debt Management, US Treasury Department<br />

Ballrooms 2 & 3<br />

16.25-17.15 Panel IV: Looking to the Future: What Demographics, Savings and Public Sector Balance Sheets Mean for<br />

Inflation-linked Markets<br />

• What do fiscal stimulus packages mean for future inflation patterns?<br />

• And inter-generational savings patterns?<br />

• How can savings rates be revived in a low policy rate/ high inflation environment?<br />

• Can the wholesale inflation markets protect retail investors?<br />

• Will governments inflate their debt burdens away?<br />

• If so, what does that mean for linkers markets?<br />

• How should government use of linkers markets reflect those patterns: tactically or strategically?<br />

• Has the current world economic crisis obscured longer term problems such as ageing?<br />

Moderator: Mark Johnson, Editor, <strong>Euromoney</strong> <strong>Conference</strong>s<br />

Speakers:<br />

Philip Booth, Editorial and Programme Director, Institute of Economic Affairs and Professor of Insurance and Risk<br />

Management, Cass Business School<br />

Con Keating, Head of Research, BrightonRock Group<br />

Dominic Pegler, Head of Fixed Income Strategy Europe, Barclays Global Investors<br />

17.15-17.20 <strong>Euromoney</strong> Closing Remarks: Mark Johnson, Editor, <strong>Euromoney</strong> <strong>Conference</strong>s<br />

17.20-18.30 Cocktail Reception<br />

NB: <strong>Euromoney</strong> <strong>Conference</strong>s reserve the right to amend the programme and is not responsible for cancellations due to unforeseen circumstances.<br />

<strong>Euromoney</strong> <strong>Conference</strong>s accepts no responsibility for statements made orally or in written material distributed by any of its speakers at its conferences. In<br />

addition, <strong>Euromoney</strong> <strong>Conference</strong>s is not responsible for any copying, republication or redistribution of such statements.