Abu Dhabi: The Gulf's Best Kept Secret - Euromoney Conferences

Abu Dhabi: The Gulf's Best Kept Secret - Euromoney Conferences

Abu Dhabi: The Gulf's Best Kept Secret - Euromoney Conferences

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

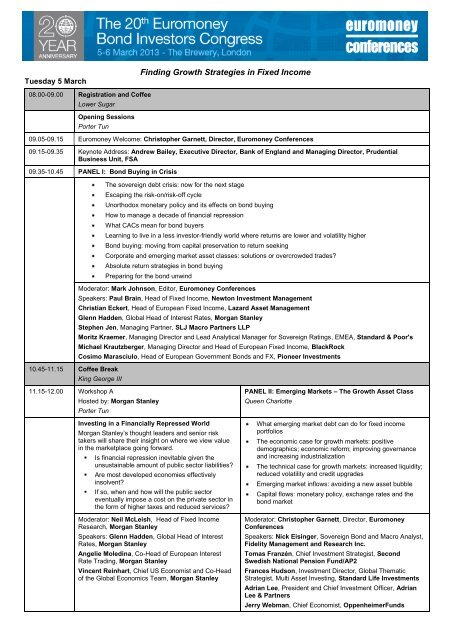

Tuesday 5 March<br />

08.00-09.00 Registration and Coffee<br />

Lower Sugar<br />

Opening Sessions<br />

Porter Tun<br />

Finding Growth Strategies in Fixed Income<br />

09.05-09.15 <strong>Euromoney</strong> Welcome: Christopher Garnett, Director, <strong>Euromoney</strong> <strong>Conferences</strong><br />

09.15-09.35 Keynote Address: Andrew Bailey, Executive Director, Bank of England and Managing Director, Prudential<br />

Business Unit, FSA<br />

09.35-10.45 PANEL I: Bond Buying in Crisis<br />

10.45-11.15 Coffee Break<br />

<strong>The</strong> sovereign debt crisis: now for the next stage<br />

Escaping the risk-on/risk-off cycle<br />

Unorthodox monetary policy and its effects on bond buying<br />

How to manage a decade of financial repression<br />

What CACs mean for bond buyers<br />

Learning to live in a less investor-friendly world where returns are lower and volatility higher<br />

Bond buying: moving from capital preservation to return seeking<br />

Corporate and emerging market asset classes: solutions or overcrowded trades?<br />

Absolute return strategies in bond buying<br />

Preparing for the bond unwind<br />

Moderator: Mark Johnson, Editor, <strong>Euromoney</strong> <strong>Conferences</strong><br />

Speakers: Paul Brain, Head of Fixed Income, Newton Investment Management<br />

Christian Eckert, Head of European Fixed Income, Lazard Asset Management<br />

Glenn Hadden, Global Head of Interest Rates, Morgan Stanley<br />

Stephen Jen, Managing Partner, SLJ Macro Partners LLP<br />

Moritz Kraemer, Managing Director and Lead Analytical Manager for Sovereign Ratings, EMEA, Standard & Poor's<br />

Michael Krautzberger, Managing Director and Head of European Fixed Income, BlackRock<br />

Cosimo Marasciulo, Head of European Government Bonds and FX, Pioneer Investments<br />

King George III<br />

11.15-12.00 Workshop A<br />

Hosted by: Morgan Stanley<br />

Porter Tun<br />

Investing in a Financially Repressed World<br />

Morgan Stanley’s thought leaders and senior risk<br />

takers will share their insight on where we view value<br />

in the marketplace going forward.<br />

Is financial repression inevitable given the<br />

unsustainable amount of public sector liabilities?<br />

Are most developed economies effectively<br />

insolvent?<br />

If so, when and how will the public sector<br />

eventually impose a cost on the private sector in<br />

the form of higher taxes and reduced services?<br />

Moderator: Neil McLeish, Head of Fixed Income<br />

Research, Morgan Stanley<br />

Speakers: Glenn Hadden, Global Head of Interest<br />

Rates, Morgan Stanley<br />

Angelie Moledina, Co-Head of European Interest<br />

Rate Trading, Morgan Stanley<br />

Vincent Reinhart, Chief US Economist and Co-Head<br />

of the Global Economics Team, Morgan Stanley<br />

PANEL II: Emerging Markets – <strong>The</strong> Growth Asset Class<br />

Queen Charlotte<br />

What emerging market debt can do for fixed income<br />

portfolios<br />

<strong>The</strong> economic case for growth markets: positive<br />

demographics; economic reform; improving governance<br />

and increasing industrialization<br />

<strong>The</strong> technical case for growth markets: increased liquidity;<br />

reduced volatility and credit upgrades<br />

Emerging market inflows: avoiding a new asset bubble<br />

Capital flows: monetary policy, exchange rates and the<br />

bond market<br />

Moderator: Christopher Garnett, Director, <strong>Euromoney</strong><br />

<strong>Conferences</strong><br />

Speakers: Nick Eisinger, Sovereign Bond and Macro Analyst,<br />

Fidelity Management and Research Inc.<br />

Tomas Franzén, Chief Investment Strategist, Second<br />

Swedish National Pension Fund/AP2<br />

Frances Hudson, Investment Director, Global <strong>The</strong>matic<br />

Strategist, Multi Asset Investing, Standard Life Investments<br />

Adrian Lee, President and Chief Investment Officer, Adrian<br />

Lee & Partners<br />

Jerry Webman, Chief Economist, OppenheimerFunds

12.05-12.50 Workshop B<br />

Hosted by: RBC Capital Markets<br />

Porter Tun<br />

12.50-13.50 Lunch<br />

Liquidity Enhanced Returns in a Changing<br />

Environment<br />

How can public debt be reduced if not by<br />

default and what is the impact for the investor?<br />

Which alternatives are there to obtain a decent<br />

total return in a low yield environment?<br />

What options are available for investors to get<br />

involved?<br />

Speakers: Keith McIntosh, Co-Head of European Rates<br />

Trading, RBC Capital Markets<br />

Priya Nair, Managing Director, Debt Capital Markets<br />

Origination, RBC Capital Markets<br />

Josep Santacana, Co-Head of European Rates<br />

Trading, RBC Capital Markets<br />

Peter Schaffrik, Head of European Rates Strategy,<br />

RBC Capital Markets<br />

King George III<br />

13.50-14.35 PANEL III: How to Invest in Emerging Market Debt<br />

Porter Tun<br />

14.35-15.00 Coffee Break<br />

How to incorporate emerging market debt into portfolios<br />

<strong>The</strong> rise of cross-over investing<br />

Correlation with more established bond markets<br />

Which indices to follow<br />

Workshop C<br />

Hosted by: Deutsche Bank<br />

Queen Charlotte<br />

Liquidity, settlement and clearing in local currency bond markets<br />

<strong>The</strong> development of credit products in emerging market debt<br />

Moderator: Katie Llanos-Small, Features Editor, LatinFinance<br />

CoCos, Capital and Crystal Balls<br />

Capital for financial institutions continues to spark intense<br />

discussion amongst issuers, investors and regulators.<br />

What is the outlook for capital issuance and<br />

regulatory certainty in Europe?<br />

Why are there more CoCos being issued and<br />

should they be viewed as an alternative source of<br />

capital?<br />

How should investors view "new style" or "bail-in"<br />

capital instruments<br />

What can we expect in terms of performance and<br />

liquidity of capital instruments?<br />

Moderator: Vinod Vasan, Head of Financial Institutions<br />

Group, Europe, Deutsche Bank<br />

Speakers: Adekunle Ademakinwa, Global Risk Syndicate,<br />

Deutsche Bank<br />

Nigel Howells, Director, Capital Solutions Group, Deutsche<br />

Bank<br />

Christian Leukers, Credit Trading, Deutsche Bank<br />

Speakers: Sam Finkelstein, Portfolio Manager, Head of Macro Strategies, Goldman Sachs Asset Management<br />

Ignacio E. Sosa, Executive Vice President, Emerging Markets Product Management, PIMCO<br />

Yerlan Syzdykov, Senior Portfolio Manager, Emerging Markets and High Yield Fixed Income, Pioneer Investments<br />

Helene Williamson, Head of Emerging Markets Debt, First State Investments<br />

King George III<br />

Afternoon Sessions<br />

Porter Tun<br />

15.00-15.55 PANEL IV: Regulation, Liquidity, Intelligent Indices: <strong>The</strong> New Shape of the Bond Market<br />

What regulation means for the fixed income markets<br />

Capital pressures, bank books and bond market liquidity<br />

New peer-to-peer trading systems<br />

Developing intelligent benchmarks: moving away from market-weighted indices<br />

Dealing with ratings migration<br />

Developing in-house rating systems<br />

<strong>The</strong> effects of central clearing<br />

Moderator: Andrew Capon, Writer on Markets, Investment, and Asset Management<br />

Speakers: Reiner Back, Head of Fixed Income and FX, MEAG<br />

Didier Haenecour, Head of Fixed Income Index, Europe, Vanguard Investments<br />

Ciaran O'Flynn, Co-Head of European Interest Rate Trading, Morgan Stanley

16.00-16.55 PANEL V: Bank Debt Refigured<br />

Wednesday 6 March<br />

<strong>The</strong> relationship between sovereign and bank debt<br />

What recapitalisation means for bank credit<br />

What bail-ins and bail-outs mean for bank debt markets<br />

Collateral shortages<br />

What Basle III means for bank debt<br />

<strong>The</strong> changing relationship between different parts of the capital structure<br />

What a European banking union means for bank debt<br />

Moderator: Will Caiger-Smith, Bank Finance Editor, EuroWeek<br />

Speakers: Peter Doherty, Partner and Chief Investment Officer, Tideway Investment Partners<br />

Georg Grodzki, Head of Credit Research, Legal & General Investment Management<br />

Simon Hills, Executive Director, British Bankers' Association<br />

Steve Hussey, Head of Financial Institutions Credit Research, AllianceBernstein<br />

John Raymond, Banking Analyst, CreditSights<br />

08.50-09.20 Registration and Coffee<br />

Lower Sugar<br />

Opening Sessions<br />

Porter Tun<br />

09.20-09.25 <strong>Euromoney</strong> Welcome: John Baskott, Director, Global Head of Sales, <strong>Euromoney</strong> <strong>Conferences</strong> and HedgeFund<br />

Intelligence <strong>Conferences</strong><br />

09.25-09.40 Keynote Address: James Clark, Deputy Assistant <strong>Secret</strong>ary for Federal Finance, US Treasury<br />

09.40-10.55 PANEL VI: Sovereign Borrowers<br />

10.55-11.15 Coffee Break<br />

What does the sovereign debt crisis mean for the Eurozone government bond market<br />

Credit trends in European sovereign borrowing<br />

<strong>The</strong> effect of the ESM<br />

Unorthodox monetary policy and sovereign debt markets<br />

Inflation-linked programmes<br />

Developing new sources of demand<br />

Moderator: Mark Johnson, Editor, <strong>Euromoney</strong> <strong>Conferences</strong><br />

Speakers: Maya Atig, Deputy Chief Executive, Agence France Trésor<br />

Maria Cannata, Director General, Public Debt Management, Italian Ministry of Economics and Finance<br />

James Clark, Deputy Assistant <strong>Secret</strong>ary for Federal Finance, US Treasury<br />

Ignacio Fernández-Palomero Morales, Deputy Head of the Treasury, Head of Funding and Debt Management,<br />

Ministry of Economy and Finance, Spain<br />

Gabriele Frediani, Head of Markets, MTS<br />

Robert Stheeman, Chief Executive, UK Debt Management Office<br />

Erik Wilders, Agent, Dutch State Treasury Agency<br />

King George III<br />

11.15-12.00 Workshop D<br />

Hosted by: J.P. Morgan<br />

Porter Tun<br />

12.00-13.00 Lunch<br />

Sovereign Inflation Linked Markets<br />

Current opportunities for global investors<br />

Is it the beginning of the end for inflation targeting?<br />

Inflation tail risks – what are the best hedges?<br />

Speakers: Francis Diamond, Executive Director, Fixed Income Research, J. P. Morgan<br />

Jasper Falk, Managing Director, Global Head of Inflation Linked Trading, J. P. Morgan<br />

King George III

Afternoon Sessions<br />

Porter Tun<br />

13.00-13.45 PANEL VII: Corporate Credit in a Changing World<br />

<strong>The</strong> corporate bond market: supply and demand<br />

Credit trends in the corporate bond market<br />

Incorporating credit in a fixed income portfolio<br />

Corporate bond indices<br />

Moderator: Duncan Kerr, Deputy Editor, <strong>Euromoney</strong><br />

Speakers: Maureen Baker, General Manager, Funding and Investor Relations, ArcelorMittal<br />

Andrea Cicione, Head of Credit and Rates Strategy, Lombard Street Research<br />

Martin Opfermann, Head of Credit, Allianz Investment Management SE<br />

Craig Veysey, Head of Fixed Income, Sanlam Private Investments<br />

Mark Wauton, Head of Credit, Aviva Investors<br />

13.45-14.30 PANEL VIII: Economists’ Debate: <strong>The</strong> Global Outlook<br />

What next for the Eurozone?<br />

<strong>The</strong> US: fiscal politics and the bond markets<br />

<strong>The</strong> US: monetary politics and the bond markets<br />

China: fighting slowdown<br />

China and the US<br />

Asia: growth strains<br />

<strong>The</strong> commodity cycle<br />

Where is inflation going? And what does this mean for bond markets?<br />

Moderator: Mark Johnson, Editor, <strong>Euromoney</strong> <strong>Conferences</strong><br />

Speakers: David Barker, Chief Economist, Moore Europe Capital Management<br />

Tim Bond, Head of Investment Strategy, Odey Asset Management<br />

Philip Shaw, Chief Economist, Investec<br />

Neil Williams, Chief Economist, Global Government and Inflation Bonds, Hermes Fund Managers<br />

14.30 Close of Conference<br />

<strong>Euromoney</strong> <strong>Conferences</strong> reserves the right to amend the programme and is not responsible for cancellations due to unforeseen circumstances. <strong>Euromoney</strong> <strong>Conferences</strong> accepts no<br />

responsibility for statements made verbally or in written material distributed by any of its speakers at its conferences. In addition, <strong>Euromoney</strong> <strong>Conferences</strong> is not responsible for any<br />

copying, republication or redistribution of such statements.