Abu Dhabi: The Gulf's Best Kept Secret - Euromoney Conferences

Abu Dhabi: The Gulf's Best Kept Secret - Euromoney Conferences

Abu Dhabi: The Gulf's Best Kept Secret - Euromoney Conferences

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

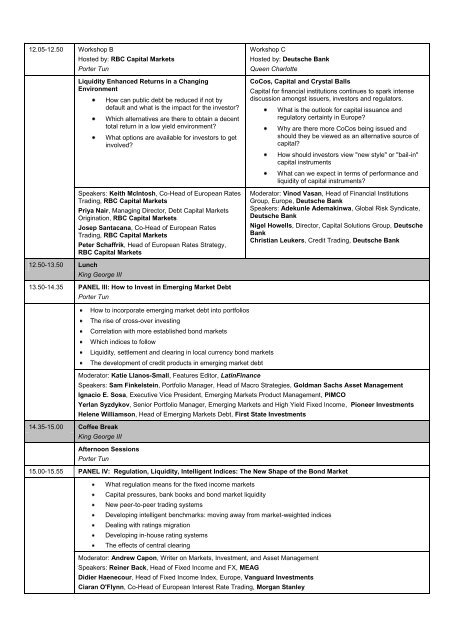

12.05-12.50 Workshop B<br />

Hosted by: RBC Capital Markets<br />

Porter Tun<br />

12.50-13.50 Lunch<br />

Liquidity Enhanced Returns in a Changing<br />

Environment<br />

How can public debt be reduced if not by<br />

default and what is the impact for the investor?<br />

Which alternatives are there to obtain a decent<br />

total return in a low yield environment?<br />

What options are available for investors to get<br />

involved?<br />

Speakers: Keith McIntosh, Co-Head of European Rates<br />

Trading, RBC Capital Markets<br />

Priya Nair, Managing Director, Debt Capital Markets<br />

Origination, RBC Capital Markets<br />

Josep Santacana, Co-Head of European Rates<br />

Trading, RBC Capital Markets<br />

Peter Schaffrik, Head of European Rates Strategy,<br />

RBC Capital Markets<br />

King George III<br />

13.50-14.35 PANEL III: How to Invest in Emerging Market Debt<br />

Porter Tun<br />

14.35-15.00 Coffee Break<br />

How to incorporate emerging market debt into portfolios<br />

<strong>The</strong> rise of cross-over investing<br />

Correlation with more established bond markets<br />

Which indices to follow<br />

Workshop C<br />

Hosted by: Deutsche Bank<br />

Queen Charlotte<br />

Liquidity, settlement and clearing in local currency bond markets<br />

<strong>The</strong> development of credit products in emerging market debt<br />

Moderator: Katie Llanos-Small, Features Editor, LatinFinance<br />

CoCos, Capital and Crystal Balls<br />

Capital for financial institutions continues to spark intense<br />

discussion amongst issuers, investors and regulators.<br />

What is the outlook for capital issuance and<br />

regulatory certainty in Europe?<br />

Why are there more CoCos being issued and<br />

should they be viewed as an alternative source of<br />

capital?<br />

How should investors view "new style" or "bail-in"<br />

capital instruments<br />

What can we expect in terms of performance and<br />

liquidity of capital instruments?<br />

Moderator: Vinod Vasan, Head of Financial Institutions<br />

Group, Europe, Deutsche Bank<br />

Speakers: Adekunle Ademakinwa, Global Risk Syndicate,<br />

Deutsche Bank<br />

Nigel Howells, Director, Capital Solutions Group, Deutsche<br />

Bank<br />

Christian Leukers, Credit Trading, Deutsche Bank<br />

Speakers: Sam Finkelstein, Portfolio Manager, Head of Macro Strategies, Goldman Sachs Asset Management<br />

Ignacio E. Sosa, Executive Vice President, Emerging Markets Product Management, PIMCO<br />

Yerlan Syzdykov, Senior Portfolio Manager, Emerging Markets and High Yield Fixed Income, Pioneer Investments<br />

Helene Williamson, Head of Emerging Markets Debt, First State Investments<br />

King George III<br />

Afternoon Sessions<br />

Porter Tun<br />

15.00-15.55 PANEL IV: Regulation, Liquidity, Intelligent Indices: <strong>The</strong> New Shape of the Bond Market<br />

What regulation means for the fixed income markets<br />

Capital pressures, bank books and bond market liquidity<br />

New peer-to-peer trading systems<br />

Developing intelligent benchmarks: moving away from market-weighted indices<br />

Dealing with ratings migration<br />

Developing in-house rating systems<br />

<strong>The</strong> effects of central clearing<br />

Moderator: Andrew Capon, Writer on Markets, Investment, and Asset Management<br />

Speakers: Reiner Back, Head of Fixed Income and FX, MEAG<br />

Didier Haenecour, Head of Fixed Income Index, Europe, Vanguard Investments<br />

Ciaran O'Flynn, Co-Head of European Interest Rate Trading, Morgan Stanley