Strategic Resources and Family Firm Performance - Windesheim

Strategic Resources and Family Firm Performance - Windesheim

Strategic Resources and Family Firm Performance - Windesheim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

emphasizes in this respect the need for a balance in the input <strong>and</strong> output of resources from the<br />

family to the business <strong>and</strong> vice versa.<br />

In general, the RBV emphasizes that the availability of appropriate resources is a necessary,<br />

but insufficient, condition for achieving a long-term competitive advantage. <strong>Resources</strong> must<br />

be managed in a way that leads to capabilities that make it possible to achieve a competitive<br />

advantage (Sirmon & Hitt, 2003). Therefore, the management of these strategic resources is<br />

discussed in the next section.<br />

1.3.3 Management of strategic resources<br />

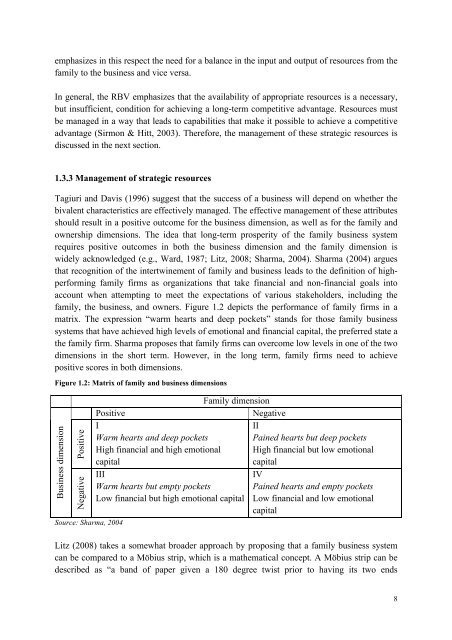

Tagiuri <strong>and</strong> Davis (1996) suggest that the success of a business will depend on whether the<br />

bivalent characteristics are effectively managed. The effective management of these attributes<br />

should result in a positive outcome for the business dimension, as well as for the family <strong>and</strong><br />

ownership dimensions. The idea that long-term prosperity of the family business system<br />

requires positive outcomes in both the business dimension <strong>and</strong> the family dimension is<br />

widely acknowledged (e.g., Ward, 1987; Litz, 2008; Sharma, 2004). Sharma (2004) argues<br />

that recognition of the intertwinement of family <strong>and</strong> business leads to the definition of highperforming<br />

family firms as organizations that take financial <strong>and</strong> non-financial goals into<br />

account when attempting to meet the expectations of various stakeholders, including the<br />

family, the business, <strong>and</strong> owners. Figure 1.2 depicts the performance of family firms in a<br />

matrix. The expression “warm hearts <strong>and</strong> deep pockets” st<strong>and</strong>s for those family business<br />

systems that have achieved high levels of emotional <strong>and</strong> financial capital, the preferred state a<br />

the family firm. Sharma proposes that family firms can overcome low levels in one of the two<br />

dimensions in the short term. However, in the long term, family firms need to achieve<br />

positive scores in both dimensions.<br />

Figure 1.2: Matrix of family <strong>and</strong> business dimensions<br />

Business dimension<br />

Positive<br />

Negative<br />

Source: Sharma, 2004<br />

Positive<br />

<strong>Family</strong> dimension<br />

Negative<br />

I<br />

II<br />

Warm hearts <strong>and</strong> deep pockets Pained hearts but deep pockets<br />

High financial <strong>and</strong> high emotional High financial but low emotional<br />

capital<br />

capital<br />

III<br />

IV<br />

Warm hearts but empty pockets Pained hearts <strong>and</strong> empty pockets<br />

Low financial but high emotional capital Low financial <strong>and</strong> low emotional<br />

capital<br />

Litz (2008) takes a somewhat broader approach by proposing that a family business system<br />

can be compared to a Möbius strip, which is a mathematical concept. A Möbius strip can be<br />

described as “a b<strong>and</strong> of paper given a 180 degree twist prior to having its two ends<br />

8