Strategic Resources and Family Firm Performance - Windesheim

Strategic Resources and Family Firm Performance - Windesheim

Strategic Resources and Family Firm Performance - Windesheim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Strategic</strong> <strong>Resources</strong><br />

<strong>and</strong> <strong>Family</strong> <strong>Firm</strong> <strong>Performance</strong><br />

Ilse Anje Matser

<strong>Strategic</strong> <strong>Resources</strong> <strong>and</strong> <strong>Family</strong> <strong>Firm</strong> <strong>Performance</strong><br />

Strategische resources en de prestaties van familiebedrijven<br />

(met een samenvatting in het Nederl<strong>and</strong>s)<br />

Proefschrift<br />

ter verkrijging van de graad van doctor aan de Universiteit Utrecht op gezag van de rector<br />

magnificus, prof.dr. G.J. van der Zwaan, ingevolge het besluit van het college voor<br />

promoties in het openbaar te verdedigen op vrijdag 18 januari 2013<br />

des middags te 2.30 uur<br />

door<br />

Ilse Anje Matser<br />

geboren op 28 september 1969<br />

te Veenendaal

Promotoren: Prof.dr. A. Buijs<br />

Prof.dr. R.H. Flören<br />

Ontwerp omslag: Steven Koelemeijer<br />

Realisatie: Kerckebosch Media, Zeist<br />

ISBN: 978-90-807379-0-7<br />

© 2012, Ilse A. Matser<br />

Alle rechten voorbehouden. Niets uit deze uitgave mag worden verveelvoudigd, opgeslagen in een<br />

geautomatiseerd gegevensbest<strong>and</strong>, of openbaar gemaakt, in enige vorm of op enige wijze, hetzij<br />

elektronisch, mechanisch, door fotokopieën, opname of enige <strong>and</strong>ere manier, zonder voorafga<strong>and</strong>e<br />

schriftelijke toestemming van de uitgever.<br />

Voor zover het maken van kopieën uit deze uitgave is toegestaan op grond van artikel 16b<br />

Auteurswet 1912 juncto het Besluit van 20 juni 1974, Stb. 351, zoals gewijzigd bij Besluit van 23<br />

augustus 1985, Stb. 471 en artikel 17 Auteurswet 1912, dient men de daarvoor wettelijk<br />

verschuldigde vergoedingen te voldoen aan de Publicatie- en Reproductierechten Organisatie<br />

(Postbus 3060, 2130 KB Hoofddorp). Voor het overnemen van (een) gedeelte(n) uit deze uitgave<br />

in bloemlezingen, readers en <strong>and</strong>ere compilatiewerken (artikel 16 Auteurswet 1912) dient men<br />

zich tot de uitgever te wenden.

Voor mijn ouders Anje en Piet Matser

Acknowledgments<br />

Welcome to the world of family business! In 2011, the <strong>Family</strong> <strong>Firm</strong> Institute (FFI), an<br />

international organization for family business advisors <strong>and</strong> researchers, celebrated its twentyfifth<br />

anniversary. Its short history illustrates the fact that family business research is a<br />

relatively new field of research. For many years, the general opinion among scholars has been<br />

that family involvement is limited to a temporary phase in the life cycle of a business. In<br />

general, it has been assumed that as firms grow, the need for external capital <strong>and</strong> professional<br />

management leads to changes in management <strong>and</strong> ownership, resulting in a more dispersed<br />

group of owners <strong>and</strong> an external CEO (Flören, 2004).<br />

However, the growing number of centers <strong>and</strong> programs devoted to the study of family<br />

business at universities worldwide <strong>and</strong> the wide variety of international academic conferences<br />

on the topic (Astrachan, 2010) attest to the importance of family business as a separate field<br />

of research. Other evidence suggests this as well. In 2011, the <strong>Family</strong> Business Review<br />

ranked among the top 20 business journals in Thomas Reuters’ Journal Citation Report (FFI,<br />

2011). Furthermore, the number of submissions to <strong>Family</strong> Business Review grew from 32 in<br />

2004 to 232 in 2010 (FFI, 2011). In 2010, two new academic journals were launched in this<br />

field: the Journal of <strong>Family</strong> Business Strategy <strong>and</strong> the Journal of <strong>Family</strong> Business<br />

Management. In addition, Astrachan (2010) identifies a significant increase in the number of<br />

articles dealing with family businesses in mainstream journals. Public authorities have also<br />

shown an increasing interest in the topic. For instance, the European Commission has<br />

formulated in an official statement that family firms differ from SMEs <strong>and</strong> that they deserve<br />

more specific attention (European Commission, 2009).<br />

Despite the growing acknowledgement of the importance of family business research, many<br />

business management students do not appear to come into contact with the peculiarities of<br />

family business management during their studies. When I studied business administration at<br />

Vrije Universiteit in the early 1990s, the topic of family businesses was not mentioned at all.<br />

As a result, certain courses, such as “strategic management,” “leadership,” <strong>and</strong><br />

“organizational development” hardly connected with my own experience <strong>and</strong> background in<br />

a second-generation family business active in the designer furniture sector. When I was a<br />

child, my family <strong>and</strong> I lived in an apartment above our store. We often discussed customers at<br />

the dinner table <strong>and</strong> the family business has always been an integral part of our lives, in good<br />

<strong>and</strong> in bad times. I worked for our family company for a short period at the start of my career.<br />

Recently, my brother has taken over the business from my parents. My personal background,<br />

in fact, has inspired me to initiate the research that has resulted in the dissertation presented<br />

here.<br />

My position as a lecturer in business management at Utrecht University combined with my<br />

experience in the family business led me to the conviction that the topic of family businesses<br />

deserves a more prominent place in business curricula. As a visiting professor at Nelson<br />

i

M<strong>and</strong>ela Metropolitan University, South Africa, I became acquainted with Elmarie Venter<br />

<strong>and</strong> Shelley Farrington, both of whom are family business scholars. That exchange stay<br />

motivated me to take my first steps towards research with regard to family businesses.<br />

When I started reviewing articles <strong>and</strong> books in this field, I began to notice the plentitude of<br />

research topics to explore. What interested me most is the notion that family firms have<br />

specific characteristics that can make them very successful in what they do, while other<br />

factors can have a negative or even devastating effect on their performance. This is<br />

particularly important if the firms’ owner-managers are ignorant of the existence of these<br />

positive or negative characteristics, or if they neglect to manage them. I am confident that<br />

new insights stemming from an increase in research related to family businesses will prove a<br />

welcome contribution to current theoretical <strong>and</strong> practical underst<strong>and</strong>ing of business<br />

management. There is a need to increase our underst<strong>and</strong>ing of the drivers that influence<br />

family firms, which in turn will help owners of family businesses to optimally manage the<br />

influence of the family effect. Ideally, the positive effects could be leveraged <strong>and</strong> the negative<br />

effects should be minimized in such a way that the positive effects can dominate.<br />

Writing this dissertation has been a challenging journey with many ups <strong>and</strong> downs. It has<br />

brought me into contact with many interesting people <strong>and</strong> places, I learned a lot about doing<br />

research <strong>and</strong> the subject itself proved to be a source of motivation to continue.<br />

The biggest challenge I faced during this journey is the lack of time to perform in my role as<br />

the managing director of the Dutch Centre for <strong>Family</strong> <strong>Firm</strong>s (CFB) <strong>and</strong> professor at<br />

<strong>Windesheim</strong>, while trying to make my deadlines with regard to this dissertation. The support<br />

I received from family, friends <strong>and</strong> colleagues has been of great help to keep making<br />

progress, however small, <strong>and</strong> make it to the end.<br />

First, I wish to thank my supervisors Arie Buijs <strong>and</strong> Roberto Flören. Arie, since that ‘braai’ at<br />

the guest house of the Mountain Zebra National Park in South Africa where we decided that I<br />

should write this dissertation you have been a great support for me. Besides being a great<br />

supervisor for the past years you gave me the confidence I needed, the most valuable thing to<br />

succeed. Roberto, as the expert of family business in the Netherl<strong>and</strong>s, I am very thankful for<br />

your guidance, feedback <strong>and</strong> support. You have the ability to give ‘small notes of advice’ that<br />

are very true <strong>and</strong> very helpful.<br />

Second, I am grateful to the members of the reading committee, Tineke Bahlmann, Johan<br />

Lambrecht, Sascha Kraus, Enno Masurel <strong>and</strong> Elmarie Venter, for reading <strong>and</strong> commenting on<br />

this thesis.<br />

Third, doing research meant making long hours in my study but also working together with<br />

fellow researchers <strong>and</strong> colleagues. Working together with Lorraine Uhlaner, Marta Berent,<br />

Judith van Helvert, Shelley Farrington, Elmarie Venter, Sascha Kraus, Stefan Mark <strong>and</strong> Coen<br />

Rigtering has not only improved the content of this dissertation but we have also had a great<br />

deal of fun. I’m looking forward to continue to work together with you.<br />

ii

I would also like to thank the support I got from the CFB, its board members <strong>and</strong> its partners.<br />

As managing director of a centre that has a mission to increase the knowledge on family<br />

firms, the centre has given me a lot of opportunities that were beneficial for this dissertation.<br />

I am indebted to many colleagues who supported me during this journey. I am indebted to my<br />

colleagues at UCEME in Utrecht during the start of my dissertation <strong>and</strong> later those at<br />

<strong>Windesheim</strong> in Zwolle. Especially in this final year, my colleagues in Zwolle helped me out<br />

so I had more time to finish my dissertation. Thank you for this.<br />

Judith van Helvert <strong>and</strong> Evelyn Groot Bruinderink, thank you for being willing to act as my<br />

‘paranimphs’, assisting me in the defense. Judith at work <strong>and</strong> Evelyn at home helped me were<br />

they could. Evelyn, you contributed also by making sure that there was also time for having<br />

fun. Judith, we were colleagues in Utrecht <strong>and</strong> now at Zwolle <strong>and</strong> at the centre. It’s always<br />

great to work with you, I think we are the best team ever.<br />

Finally, I would like to thank my parents, Anje <strong>and</strong> Piet, my children Louise <strong>and</strong> Hugo <strong>and</strong><br />

my husb<strong>and</strong> Steven. Thank you for all your love.<br />

iii

Table of contents<br />

Acknowledgments………………………………………………………………………..<br />

List of Tables…………………………………………………………………………….<br />

List of Figures ……………………………………………………………………………<br />

1: <strong>Family</strong> involvement, strategic resources, <strong>and</strong> firm performance: An introduction…...<br />

1.1 Introduction.............................................………………………………………….....<br />

1.2 The three-circle model: family firms as a subgroup of privately owned firms……...<br />

1.3 The family factor’s influence on the business: theoretical concepts………………..<br />

1.3.1 Bivalent characteristics …………………………………………………….<br />

1.3.2 Familiness………………………………………………………………….<br />

1.3.3 Management of strategic resources………………………………………..<br />

1.4 Existing research findings……………………………………………………………<br />

1.5 Research question, framework, definitions <strong>and</strong> Dutch context……………………..<br />

1.5.1 Research question <strong>and</strong> research framework……………………………….<br />

1.5.2 Defining the family firm…………………………………………………...<br />

1.5.3 <strong>Family</strong> firms in the Netherl<strong>and</strong>s…………………………………..............<br />

1.6 Dissertation overview.....................................................................................<br />

2: Ownership social capital in privately held firms: the role of family involvement........<br />

2.1 Introduction................................................................................................................<br />

2.2 Background on ownership social capital ...................................................................<br />

2.3 Research framework <strong>and</strong> hypotheses.........................................................................<br />

2.3.1 Direct relations among components of ownership social capital................<br />

2.3.2 Complex relations among components of ownership social capital............<br />

2.4 Method........................................................................................................................<br />

2.5 Results.........................................................................................................................<br />

2.6 Discussion <strong>and</strong> conclusion..........................................................................................<br />

3: The relationship between ownership social capital <strong>and</strong> product innovation: The<br />

moderating role of family involvement..............................................................................<br />

3.1 Introduction..................................................................................................................<br />

3.2 Background on product innovation <strong>and</strong> the role of (family) owners...........................<br />

3.3 Research framework <strong>and</strong> hypotheses...........................................................................<br />

3.4 Method.........................................................................................................................<br />

3.5 Results..........................................................................................................................<br />

3.6 Discussion <strong>and</strong> conclusion..........................................................................................<br />

4: The relationship between spousal social capital in copreneurial firms <strong>and</strong> firm<br />

performance......................................................................................................................<br />

4.1 Introduction.................................................................................................................<br />

4.2 Spousal social capital: background <strong>and</strong> hypotheses....................................................<br />

4.2.1 The copreneurial relationship as a strategic resource...................................<br />

4.2.2 Three dimensions of spousal social capital..................................................<br />

4.3 Method........................................................................................................................<br />

4.3.1 Sample <strong>and</strong> data collection...........................................................................<br />

i<br />

vi<br />

vi<br />

1<br />

1<br />

2<br />

4<br />

4<br />

6<br />

8<br />

9<br />

17<br />

17<br />

19<br />

21<br />

23<br />

25<br />

25<br />

27<br />

29<br />

29<br />

32<br />

33<br />

36<br />

44<br />

47<br />

47<br />

48<br />

50<br />

56<br />

57<br />

64<br />

69<br />

69<br />

71<br />

71<br />

72<br />

78<br />

78<br />

iv

4.3.2 Variables.......................................................................................................<br />

4.4 Results.........................................................................................................................<br />

4.4.1 Factor analysis..............................................................................................<br />

4.4.2 Descriptive statistics <strong>and</strong> correlations..........................................................<br />

4.4.4 Structural model............................................................................................<br />

4.5 Discussion <strong>and</strong> conclusion...........................................................................................<br />

5: Securing post-succession continuity in family firms through knowledge transfer........<br />

5.1 Introduction..................................................................................................................<br />

5.2 Research framework <strong>and</strong> hypotheses...........................................................................<br />

5.2.1 Post-succession continuity............................................................................<br />

5.2.2 The knowledge transfer climate....................................................................<br />

5.2.3 Moderator: Is the successor a family member?............................................<br />

5.3 Method.........................................................................................................................<br />

5.4 Results..........................................................................................................................<br />

5.5 Discussion <strong>and</strong> conclusion...........................................................................................<br />

6: Conclusions <strong>and</strong> implications........................................................................................<br />

6.1 Research findings.........................................................................................................<br />

6.2 Overall conclusions......................................................................................................<br />

6.3 Theoretical implications..............................................................................................<br />

6.4 Limitations <strong>and</strong> directions for future research.............................................................<br />

6.5 Practical implications...................................................................................................<br />

Summary.............................................................................................................................<br />

Samenvatting (in Dutch)....................................................................................................<br />

References.........................................................................................................................<br />

Curriculum Vitae.............................................................................................................<br />

80<br />

82<br />

82<br />

83<br />

84<br />

85<br />

89<br />

89<br />

90<br />

90<br />

92<br />

96<br />

97<br />

99<br />

102<br />

105<br />

105<br />

107<br />

110<br />

114<br />

116<br />

119<br />

125<br />

133<br />

149<br />

v

List of Tables<br />

Table 1.1: Social capital research in major management <strong>and</strong> family business journals….<br />

Table 1.2: Empirical trends in social capital studies of private firms……………………<br />

Table 1.3: <strong>Family</strong> business in relation to all businesses in the Netherl<strong>and</strong>s……………..<br />

Table 1.4: Representation in business sectors……………………………………………<br />

Table 1.5: Number of owners per business in the Netherl<strong>and</strong>s………………………….<br />

Table 1.6: Dissertation overview…………………………………………………………<br />

Table 2.1: Factor analysis of multi-item variables included in the study………………...<br />

Table 2.2: Correlations between variables used in the study……………………………..<br />

Table 2.3: Prediction of ownership social capital………………………………………...<br />

Table 3.1: Factor analysis of multi-item variables included in the study………………...<br />

Table 3.2: Correlations between variables used in the study…………………………….<br />

Table 3.3: Prediction of product innovation……………………………………………...<br />

Table 4.1: Overview of sample characteristics…………………………………………...<br />

Table 4.2: Average variance extracted <strong>and</strong> shared variance estimates…………………...<br />

Table 4.3: Means, st<strong>and</strong>ard deviations, <strong>and</strong> zero-order correlations ……………………..<br />

Table 5.1: Possible factors influencing the knowledge-management process…………...<br />

Table 5.2: Descriptive statistics <strong>and</strong> correlation matrix………………………………….<br />

Table 5.3: Predicting profit growth………………………………………………………<br />

Table 6.1: Summary of research findings……………………………………………….<br />

List of Figures<br />

Figure 1.1:The three-circle model……………………………………………………….<br />

Figure 1.2: Matrix of family <strong>and</strong> business dimensions………………………………….<br />

Figure 1.3: Möbius strip………………………………………………………………….<br />

Figure 1.4: Research framework…………………………………………………………<br />

Figure 2.1: Research framework including direct effects………………………………..<br />

Figure 2.2: Interaction term shared vision <strong>and</strong> quality of relationships…………………<br />

Figure 2.3: Interaction term shared vision <strong>and</strong> family involvement......…………………<br />

Figure 3.1: Model of ownership social capital <strong>and</strong> product innovation…………………<br />

Figure 3.2 Interaction term family involvement <strong>and</strong> network mobilization …………….<br />

Figure 4.1 Research framework…………………………………………………………<br />

Figure 4.2 Structural model……………………………………………………………..<br />

Figure 5.1 Interaction term family succession <strong>and</strong> knowledge transfer climate………..<br />

Figure 6.1 Research framework…………………………………………………………<br />

Figure 6.2 Adjusted research framework………………………………………………..<br />

12<br />

13<br />

21<br />

22<br />

22<br />

24<br />

38<br />

39<br />

41<br />

59<br />

60<br />

61<br />

80<br />

83<br />

84<br />

94<br />

99<br />

100<br />

106<br />

3<br />

8<br />

9<br />

18<br />

29<br />

42<br />

43<br />

56<br />

62<br />

78<br />

85<br />

101<br />

105<br />

109<br />

vi

1: <strong>Family</strong> involvement, strategic resources, <strong>and</strong> firm<br />

performance: An introduction<br />

1.1 Introduction<br />

Past research has raised many interesting questions regarding the effect of family<br />

involvement on businesses. With the resource-based view as the primary theoretical<br />

framework, this dissertation looks at strategic resources in private firms <strong>and</strong> how those<br />

resources are influenced by family involvement. Furthermore, the research investigates to<br />

what extent the development of these strategic resources have an impact on firm<br />

performance. The focus is on the development of tacit knowledge <strong>and</strong> social capital, as these<br />

components of strategic resources have been identified in the literature as elements for which<br />

family involvement may have a strong, positive influence.<br />

In this chapter, the outline of this dissertation <strong>and</strong> underlying themes are presented. Section<br />

1.2 introduces the distinctive characteristics of family firms, making use of the core concept<br />

of family business research: the three-circle model. Section 1.3 explores the distinctive<br />

characteristics of family firms using the concept of bivalent characteristics. Resource-based<br />

theory is introduced as a theoretical framework that may be appropriate for the dynamics of<br />

family businesses. Furthermore, the unique challenge that family businesses face is<br />

introduced – the need to manage the interests of the family <strong>and</strong> the business in such a way<br />

that their overlap results in synergies. Section 1.4 highlights several gaps in the existing<br />

empirical research. This leads to the main research question <strong>and</strong> research framework, which<br />

are formulated in section 1.5, where the quest for finding suitable definitions for family<br />

businesses is explored <strong>and</strong> an overview of the prevalence of family firms in the Dutch<br />

economy is provided. The final section provides an outline of this thesis.<br />

1

1.2 The three-circle model: family firms as a subgroup of privately owned<br />

firms<br />

The business l<strong>and</strong>scape in the Netherl<strong>and</strong>s consists of a rich mixture of firms with an<br />

emerging focus on entrepreneurship (EIM, 2011). Most companies are privately held: the<br />

owner or owners are private persons whose shares are not traded on a public stock exchange.<br />

The objectives of privately held firms are to remain viable <strong>and</strong> healthy, <strong>and</strong>, if possible,<br />

create growth. From the owners’ perspective, the firm’s main priority is to meet the owners’<br />

values, goals, <strong>and</strong> needs. Key for an underst<strong>and</strong>ing of the dynamics of privately owned firms<br />

is recognition of the fact that the interests of owners <strong>and</strong> the firm are not always compatible.<br />

When business owners <strong>and</strong> the managers who run the business are not the same, the two<br />

parties might face a conflict of interest (Tutelman & Hause, 2008). However, even if the<br />

business is managed by a sole owner, a distinction can be made between interests as an owner<br />

<strong>and</strong> those as a manager. Tutelman <strong>and</strong> Hause (2008) stress that it is important to balance<br />

these various interests to ensure the long-term continuity of the business.<br />

<strong>Family</strong> firms are a subgroup of privately owned firms. Within the entrepreneurship literature<br />

there is a growing interest for the unique challenges this subgroup is facing (Kraus, Craig,<br />

Dibrell <strong>and</strong> Märk, 2012). The family system is as relevant as the business <strong>and</strong> the ownership<br />

systems. In family firms, these three systems interact with each other, making the balancing<br />

act even more complex. The family firm can be regarded as an open-system model<br />

comprising three overlapping, interacting, <strong>and</strong> interdependent subsystems of owners, family,<br />

<strong>and</strong> managers (Moores, 2008). This view builds on the “systems approach” to organization<br />

(Morgan, 1986): The main principle of the system approach is that organizations, like<br />

organisms, are open to their environment <strong>and</strong> in order to survive must achieve an appropriate<br />

relation with that environment. A focus of the open-systems approach is that organizations<br />

can be defined in terms of interrelated subsystems. The notion of family firms as<br />

organizations consisting of three subsystems, was introduced by Tagiuri <strong>and</strong> Davis in 1982<br />

(reprinted in 1996) <strong>and</strong> is known as the three-circle model (see Figure 1.1). This view has<br />

largely been accepted by the community of family business scholars as the key symbolic<br />

generalization of the prevailing family business paradigm (Moores, 2008).<br />

In the three-circle model, the overlap of the three systems indicates that individuals have up<br />

to three roles simultaneously. A family member who st<strong>and</strong>s at the “core” of the system is a<br />

family member, an owner, <strong>and</strong> a manager of the business. With each role comes different<br />

obligations, interests, <strong>and</strong> goals. As a family member, the prime concern is the welfare <strong>and</strong><br />

the harmony of the family. As an owner, the focus is on ensuring stable returns on<br />

investments <strong>and</strong> the continuity of the firm. As a manager, the primary interest is the firms<br />

“operational effectiveness” (Tagiuri & Davis, 1996). These varying interests explain the<br />

potential conflicts among roles in family businesses.<br />

2

Figure 1.1: The three-circle model<br />

Ownership<br />

Source: Tagiuri & Davis, 1996<br />

3<br />

4<br />

1<br />

<strong>Family</strong><br />

7<br />

6<br />

5<br />

Business<br />

2<br />

Each individual directly involved in the business can be placed<br />

in one of seven sectors:<br />

1- a family member who is neither an owner nor an employee;<br />

2- an employee who is neither a family member nor an owner;<br />

3- an owner who is neither a family member nor an employee;<br />

4- a family member who is also an owner but not an employee;<br />

5- a family member who is also an employee but not an owner;<br />

6- an owner who is also an employee but not a family member;<br />

7- a family member who is also an owner <strong>and</strong> an employee.<br />

Flören (2004) highlights the difference between family <strong>and</strong> non-family firms in terms of the<br />

openness of the systems. In non-family firms, conflicts at home or at work typically remain in<br />

their own environments, while the same is not true for family firms. If, for example, two<br />

sisters who co-own <strong>and</strong> run a family firm argue about the strategic course for the firm, the<br />

dispute will have consequences in the family sphere. Such spillover effects can be found in<br />

various dimensions of family firms, including finances, work-life balance, <strong>and</strong> risk<br />

perceptions.<br />

Another aspect incorporated into the three-circle model is the dynamic nature of the family<br />

business system. Individuals’ roles <strong>and</strong> positions may change during the life cycle stages of<br />

the individuals, the family, <strong>and</strong> the business as a whole (Hoy & Sharma, 2010). One such<br />

change could be the spouse of the founder joining the business when the workload increases<br />

(Steier, 2007). At a later stage, children may join the family firm, first as employees <strong>and</strong> later<br />

as owners. In the succession phase, parents <strong>and</strong> their children may work together. Later, when<br />

parents retire as managers, they might stay involved in the firm as owners. If this<br />

evolutionary succession path is followed, family business systems can become increasingly<br />

large <strong>and</strong> complex in later generations. A family business can evolve, for example, from a<br />

founder-managed company to a sibling partnership in the second generation <strong>and</strong> to a cousinlinked<br />

consortium in the third generation (e.g., Gersick, Lansberg, Desjardins & Dunn, 1999).<br />

This evolutionary path may prove impossible or undesirable for many family firms, for<br />

instance when the business does not have the growth potential to financially support a<br />

growing number of family members; undesirable when owners’ visions diverge, family<br />

members are uninterested or incompetent, or family members or family branches begin to<br />

compete (Lambrecht & Lievens, 2008). These signals can be interpreted as indications that it<br />

is time to “prune” the family tree, which ensures that the remaining family owners <strong>and</strong><br />

managers are the same people, or that the shareholders are concentrated in a single family<br />

branch. Lambrecht <strong>and</strong> Lievens (2008) discuss the principle of keeping the management or<br />

ownership of a business within a small group of family members. They argue that pruning the<br />

family tree can potentially enhance family business continuity <strong>and</strong> family harmony. One<br />

3

example of where this process has been successful is the Van Bommel shoe factory, where<br />

recently a pruning process has been completed. The ninth generation currently runs the<br />

business as a sibling partnership.<br />

1.3 The family factor’s influence on the business: theoretical concepts<br />

The previous section introduced the family firm as a subgroup of privately owned firms with<br />

the three-circle model as the key symbolic generalization. In this section, the effects arising<br />

from the interrelationships among the family, the business, <strong>and</strong> its owners are introduced. In<br />

this regard, the notion that the family effect on the business can lead to both positive <strong>and</strong><br />

negative outcomes is highly relevant.<br />

1.3.1 Bivalent characteristics<br />

In order to study family businesses as a st<strong>and</strong>-alone discipline, it is necessary to identify<br />

theoretically founded, empirical evidence of the distinctiveness of family firms. A milestone<br />

in this regard is the research done by Anderson <strong>and</strong> Reeb (2003). The impact of that study is<br />

reflected in its high ranking on the frequently cited articles list in family business research<br />

(Chrisman, Kellermans, Kam, Chan & Liano, 2010). Anderson <strong>and</strong> Reeb compare the<br />

performance of large, publicly traded family <strong>and</strong> non-family firms in the United States. They<br />

find that family firms outperform non-family firms in specific circumstances, such as when<br />

the former have a family member as managing director. This outcome has led to more<br />

research focused on the question of why family firms outperform non-family firms. For<br />

instance, Miller <strong>and</strong> Le Breton-Miller (2005) undertook a large qualitative research project to<br />

reveal the success factors of 58 large family firms that had been successful for an extended<br />

period of time. They identify four factors that drive successful strategies: comm<strong>and</strong>,<br />

continuity, community, <strong>and</strong> connections. The findings of this research have been successfully<br />

tested using a sample of small, first-generation family firms (Miller, Le Breton-Miller, &<br />

Scholnick, 2008). The results of the study done by Miller et al., (2008) reflect the prediction<br />

done by Dyer (2006). He argues that within family businesses, the subgroup of clan family<br />

firms, ceteris paribus, will have the highest performance. Clan family firms are firms who are<br />

owned <strong>and</strong> managed by family members highly committed to both the success of the firm <strong>and</strong><br />

the family. Small, first-generation family firms are the stereotype of this subgroup (Dyer,<br />

2006). The four success factors (Miller & Le Breton-Miller, 2005) are in line with the<br />

findings presented in other influential articles focusing on the potential positive<br />

characteristics of family firms (e.g., Aldrich & Cliff, 2003; Chrisman, Chua & Sharma, 2005;<br />

Sharma, 2004).<br />

Research into the positive outcomes of family involvement for a business typically adopts a<br />

normative approach to the distinctiveness of family firms. However, too much emphasis on<br />

the positive aspects may lead to an underestimation of the potential harmful effects of family<br />

influence on a business. To fully capture the effect of family involvement on a business, all<br />

factors – both positive <strong>and</strong> negative – count.<br />

4

As early as 1982, Tagiuri <strong>and</strong> Davis (1996) acknowledged that family firms have several<br />

unique, inherent attributes, <strong>and</strong> that each of these key attributes can be a source of benefits<br />

<strong>and</strong> a source of disadvantages. Given their latent positive <strong>and</strong> negative potential, these<br />

attributes are labeled as bivalent attributes. These bivalent attributes are the immediate<br />

consequences of the overlap of the family, business, <strong>and</strong> ownership systems. Jaffe (2007)<br />

refers to this notion when he argues that the characteristics of a family business can lead to<br />

conflict or difficulties if they become extreme.<br />

Tagiuri <strong>and</strong> Davis (1996) identified seven bivalent attributes of the family firm:<br />

• Simultaneous roles,<br />

• A lifelong common history,<br />

• Emotional involvement <strong>and</strong> ambivalence,<br />

• A private language,<br />

• Mutual awareness <strong>and</strong> privacy,<br />

• A shared identity, <strong>and</strong><br />

• The meaning of the family company.<br />

The bivalent attributes are mutual related <strong>and</strong>, in some cases, probably do overlap. For<br />

example, the role of the founder reflects attributes two <strong>and</strong> three – lifelong common history,<br />

<strong>and</strong> emotional involvement <strong>and</strong> ambivalence, respectively. The founder often plays a crucial<br />

role in building a successful firm, but if the founder neglects to train or create sufficient<br />

favorable conditions for a new generation to come into play, the whole business may age<br />

(Jaffe, 2007). This negative effect can be even worse when the incumbent leader is reluctant<br />

to let go <strong>and</strong> when the business culture is not innovative (“this is the way we do things around<br />

here”). The positive effect of a lifelong common history can be a deep tacit knowledge that is<br />

transferred to the next generation.<br />

In family firms, the simultaneous roles as owner <strong>and</strong> manager can explain the reduced need<br />

for governance mechanisms, as interests are aligned. This absence of significant agency<br />

costs, is seen as a competitive advantage for family firms relative to firms with dispersed<br />

ownership <strong>and</strong> external managers (Schulze, Labatkin, Dino & Buchholtz, 2001). A negative<br />

effect stemming from role overlap arises when family harmony prevents decision making in<br />

the firm. This occurs, for instance, when there is clearly one capable successor but all siblings<br />

are installed as new directors because family harmony is prioritized. Schulze et al. (2001)<br />

argue in this respect that there are specific agency costs for family firms that should be take<br />

into account. For example children in management positions can acts as free riders because<br />

they know that their parents will not discipline them.<br />

With respect to shared identity <strong>and</strong> the meaning of the family company, Sharma (2004)<br />

suggests that the alignment of goals that different stakeholders are striving to achieve is an<br />

important predictor of family firm performance. A mismatch can lead to serious conflicts that<br />

can harm the family business. A shared identity helps to align such goals.<br />

5

Jaffe (2007) describes the attribute of private language as family members having a special<br />

shorth<strong>and</strong> language – they share information quickly <strong>and</strong> therefore get things done<br />

efficiently. However, this does not imply that families know how to communicate about<br />

sensitive issues. Issues that are not discussed can develop into conflicts that can eventually<br />

make it impossible to continue to work together. Furthermore, Flören (2004) suggests that<br />

taboo subjects exist within families <strong>and</strong>, by implication, within family businesses. Such<br />

topics are left buried in order to avoid disrupting the family harmony.<br />

Another aspect relates to the phenomena of mutual awareness <strong>and</strong> privacy; family members<br />

have a keen awareness of each other’s circumstances. This gives them insights into how they<br />

can support one another. At the same time, this awareness can stimulate the feeling that one is<br />

“living in a fishbowl” – maintaining a private life outside the family business is not easy,<br />

which can make family members feel oppressed (Tagiuri & Davis, 1996).<br />

This discussion of the bivalent attributes reveals the complexity confronted by stakeholders in<br />

a family firm. In the next section, the resource-based view is introduced as a theoretical<br />

framework that can be used to analyze the distinct attributes in detail.<br />

1.3.2 Familiness<br />

Tagiuri <strong>and</strong> Davis (1996) suggest that family firms have unique resources that create positive<br />

<strong>and</strong> negative outcomes for the firm. This notion has more recently been referred to as the<br />

“familiness” of the firm (Sirmon & Hitt, 2003). Habbershon <strong>and</strong> Williams (1999) describe<br />

familiness as the unique bundle of resources created by the interaction of family <strong>and</strong> business<br />

that can stimulate competitive advantage. In this thesis, the resource-based view (RBV) is<br />

used as the theoretical foundation for underst<strong>and</strong>ing the distinctive attributes of a family firm.<br />

The theoretical assumptions of the RBV can be specified to fit the family firm context<br />

(Habbershon & Williams, 1999).<br />

The RBV is one of the most influential theoretical frameworks in the field of strategic<br />

management (Barney, Wright & Ketchen, 2001; Newbert, 2007). Wernerfelt (1984)<br />

introduced the notion that firms can be analyzed by focusing on their resources rather than<br />

their products. A resource is defined by Wernerfelt (1984, p. 172) as “anything which could<br />

be thought of as a strength or weakness of a firm.” The key objective of RBV is to establish a<br />

causal relationship between resources <strong>and</strong> a long-term competitive advantage. Barney (1991)<br />

argued that resources should have four characteristics to establish a competitive advantage.<br />

Such resources, which are labeled “strategic resources,” should be: valuable, rare, difficult to<br />

imitate, <strong>and</strong> non-substitutable. Examples include reputation, patents, <strong>and</strong> unique knowledge<br />

(Barney, 1991; Crook, Ketchen, Combs, & Todd, 2008). Barney based the RBV on two<br />

assumptions: resources are heterogeneously distributed among firms <strong>and</strong> they are imperfectly<br />

mobile. These assumptions allow for differences in firm resource endowments to exist <strong>and</strong><br />

persist over time. Both assumptions therefore allow for resource-based competitive<br />

advantages.<br />

6

The RBV has proven its value as an appropriate theoretical framework in the field of family<br />

business research (Chrisman, Chua & Zahra, 2003). Within this framework, the competitive<br />

advantage of a firm can be discussed by referring to the firm’s underlying resources, specific<br />

strategies <strong>and</strong> skills, <strong>and</strong> thereby allows for differentiation among family firms instead of<br />

regarding the family effect as a specific advantage that is common to all family firms.<br />

Habbershon <strong>and</strong> Williams (1999) stipulate that this focus on underlying resources, specific<br />

strategies <strong>and</strong> skills is the appropriate level of analysis for assessments of family firm<br />

advantages. This is also acknowledged by Melin <strong>and</strong> Nordqvist (2007), who state that<br />

overemphasizing the similarities between family firms downplays the differences <strong>and</strong> can<br />

lead to an overly simplistic view on family firms. The RBV, therefore, is an appropriate<br />

framework for focusing on the distinctive resources of family firms <strong>and</strong> for analyzing the<br />

firms’ unique traits.<br />

Various scholars, in turn, discuss possible sources of competitive advantage among family<br />

firms (Carney, 2005: Eddleston, Kellermans & Sarathy, 2008; Habbershon & Williams,<br />

1999; Miller & Le Breton-Miller, 2005; Miller et al., 2008; Sirmon & Hitt, 2003). Sirmon<br />

<strong>and</strong> Hitt (2003) discuss five possible family-firm-specific resources <strong>and</strong> their corresponding<br />

positive outcomes:<br />

• Human capital is defined as the acquired knowledge, skills, <strong>and</strong> capabilities of<br />

individuals. The positive attributes related to human capital that stem from family<br />

influence include extraordinary commitment, warm relationships <strong>and</strong> the potential for<br />

deep, firm-specific tacit knowledge.<br />

• Social capital is the goodwill or other benefits generated by various social relations<br />

(Adler & Kwon, 2002). Social capital in the family firm is based on strong network<br />

ties, shared languages <strong>and</strong> narratives, trust, norms <strong>and</strong> obligations. All of these<br />

components are embedded in the family <strong>and</strong> can lead to the development of human<br />

capital.<br />

• Patient financial capital is capital that is invested for an extended period of time <strong>and</strong><br />

thus carries little threat of liquidation on short notice. In this regard, the generational<br />

outlook of family members creates a focus on a long-time horizon instead of shortterm<br />

results.<br />

• Survivability capital represents the pooled personal resources that family members are<br />

willing to loan, contribute, or share for the benefit of the family business. Such capital<br />

can help the firm through poor economic times.<br />

• Governance structure is relevant in that the mutually-shared objectives, trust <strong>and</strong><br />

family bonds found in family firms reduce more formal governance costs.<br />

However, familiness is not always a positive characteristic. Habbershon <strong>and</strong> Williams (1999)<br />

coins the terms “distinctive familiness” <strong>and</strong> “constrictive familiness” to differentiate between<br />

the positive <strong>and</strong> negative sides of familiness. “Distinctive familiness” st<strong>and</strong>s for the<br />

enhancement of family <strong>and</strong> business capital stocks that occurs as a consequence of a balanced<br />

flow of capital between these systems. On the other h<strong>and</strong>, “constrictive familiness” reflects<br />

the negative outcome caused by an excess flow of capital in one direction. Sharma (2008)<br />

7

emphasizes in this respect the need for a balance in the input <strong>and</strong> output of resources from the<br />

family to the business <strong>and</strong> vice versa.<br />

In general, the RBV emphasizes that the availability of appropriate resources is a necessary,<br />

but insufficient, condition for achieving a long-term competitive advantage. <strong>Resources</strong> must<br />

be managed in a way that leads to capabilities that make it possible to achieve a competitive<br />

advantage (Sirmon & Hitt, 2003). Therefore, the management of these strategic resources is<br />

discussed in the next section.<br />

1.3.3 Management of strategic resources<br />

Tagiuri <strong>and</strong> Davis (1996) suggest that the success of a business will depend on whether the<br />

bivalent characteristics are effectively managed. The effective management of these attributes<br />

should result in a positive outcome for the business dimension, as well as for the family <strong>and</strong><br />

ownership dimensions. The idea that long-term prosperity of the family business system<br />

requires positive outcomes in both the business dimension <strong>and</strong> the family dimension is<br />

widely acknowledged (e.g., Ward, 1987; Litz, 2008; Sharma, 2004). Sharma (2004) argues<br />

that recognition of the intertwinement of family <strong>and</strong> business leads to the definition of highperforming<br />

family firms as organizations that take financial <strong>and</strong> non-financial goals into<br />

account when attempting to meet the expectations of various stakeholders, including the<br />

family, the business, <strong>and</strong> owners. Figure 1.2 depicts the performance of family firms in a<br />

matrix. The expression “warm hearts <strong>and</strong> deep pockets” st<strong>and</strong>s for those family business<br />

systems that have achieved high levels of emotional <strong>and</strong> financial capital, the preferred state a<br />

the family firm. Sharma proposes that family firms can overcome low levels in one of the two<br />

dimensions in the short term. However, in the long term, family firms need to achieve<br />

positive scores in both dimensions.<br />

Figure 1.2: Matrix of family <strong>and</strong> business dimensions<br />

Business dimension<br />

Positive<br />

Negative<br />

Source: Sharma, 2004<br />

Positive<br />

<strong>Family</strong> dimension<br />

Negative<br />

I<br />

II<br />

Warm hearts <strong>and</strong> deep pockets Pained hearts but deep pockets<br />

High financial <strong>and</strong> high emotional High financial but low emotional<br />

capital<br />

capital<br />

III<br />

IV<br />

Warm hearts but empty pockets Pained hearts <strong>and</strong> empty pockets<br />

Low financial but high emotional capital Low financial <strong>and</strong> low emotional<br />

capital<br />

Litz (2008) takes a somewhat broader approach by proposing that a family business system<br />

can be compared to a Möbius strip, which is a mathematical concept. A Möbius strip can be<br />

described as “a b<strong>and</strong> of paper given a 180 degree twist prior to having its two ends<br />

8

connected” (see Figure 1.3, based on Litz, 2008, p. 219). In other words, each system’s<br />

output becomes another system’s input. This phenomenon occurs in family firms when crosssystem<br />

transfers occur. Consider, for example, a next-generation member who becomes an<br />

employee of the family business. The family’s child <strong>and</strong> the firm’s wages are transferred<br />

across systems to become the other systems’ inputs: workforce for the firm <strong>and</strong> income for<br />

the family. Litz joins Sharma (2004) in arguing that if long-term success is to be possible,<br />

there must be synergy within the subsystems (net positive effect of the transfers within each<br />

dimension) <strong>and</strong> symmetry in the overall balance of transfers between the two subsystems.<br />

Figure 1.3: Möbius strip<br />

Source: turbosquid.com<br />

The viewpoints discussed in this section demonstrate that family business scholars widely<br />

acknowledge the idea that family firms have distinctive characteristics that stem from the<br />

interaction of the family, business, <strong>and</strong> ownership subsystems. These characteristics are<br />

bivalent, as they carry latent positive <strong>and</strong> negative potential. Furthermore, when these<br />

characteristics have a positive effect (distinctive familiness), they can be regarded as strategic<br />

resources that lead to competitive advantage. Before the research questions for this<br />

dissertation are presented, it is necessary to underst<strong>and</strong> the implications of the results from<br />

previous research on this topic. These research results are discussed in the next section.<br />

1.4 Existing research findings<br />

Relatively little empirical research has focused on the concept of familiness (Astrachan,<br />

2010). Astrachan notes in this respect that “the sources from which these strategic resources<br />

emerge, the ways in which they can change over time, <strong>and</strong> the means through which they can<br />

be nurtured <strong>and</strong> preserved, are not well explored” (2010, p.8). Sirmon <strong>and</strong> Hitt (2003)<br />

identify human, social, survivability, <strong>and</strong> patient capital, as well as governance structures as<br />

possible family-firm-specific strategic resources (see section 1.3.2). More specifically, social<br />

capital <strong>and</strong> tacit knowledge, as elements of human capital, are regarded as key strategic<br />

resources for which family involvement plays an important role (e.g., Arregle, Hitt, Sirmon &<br />

Very, 2007; Cabrera-Suárez, De Saá-Pérez & Garcia-Almeida, 2001; Pearson, Carr & Shaw,<br />

2008; Royer, Simons, Boyd & Rafferty, 2008; Sharma, 2008; Sirmon & Hitt, 2003). In<br />

9

additional, social capital theory is viewed as a promising theory for further development of<br />

the “familiness” construct (Arregle et al., 2007; Pearson et al., 2008).<br />

In order to analyze whether these proposition hold, the findings of previous empirical<br />

research on the topics of social capital <strong>and</strong> tacit knowledge are reviewed in this section. This<br />

review also helps to identify the gaps in the existing knowledge on these topics <strong>and</strong> highlights<br />

areas in need of additional research. As social capital is the core construct considered in<br />

Chapters 2, 3, <strong>and</strong> 4, the empirical findings related to social capital are bundled <strong>and</strong> discussed<br />

in this section. The empirical findings from previous research on tacit knowledge are<br />

discussed in Chapter 5.<br />

Tacit knowledge<br />

Tacit knowledge differs from explicit knowledge in that it is knowledge stored in routines,<br />

values, norms, etc., rather than in h<strong>and</strong>books (Grant, 1991). Furthermore, actors need skills to<br />

apply tacit knowledge, which are gained through experience (Chirico, 2008), <strong>and</strong> tacit<br />

knowledge is difficult to transfer (Cabrera-Suárez et al., 2001). Therefore, Hoy <strong>and</strong> Sharma<br />

(2010) identified not only the specific knowledge of a firm but also the transferability of that<br />

knowledge as key strategic resources to manage. Research on possible hurdles in the<br />

knowledge management process reveals three main categories of barriers in the knowledge<br />

transfer process: trust; conflicts <strong>and</strong> rivalry; <strong>and</strong> social structure <strong>and</strong> networks (see Chapter<br />

5). These findings reveal a strong link between tacit knowledge, as a component of human<br />

capital, <strong>and</strong> social capital. The transfer of tacit knowledge appears to be one of the potential<br />

positive outcomes of social capital (Zahra, Hayton, Neubaum, Dibrell & Craig, 2008).<br />

Furthermore, the transfer of tacit knowledge during business transfer is a topic attracting<br />

considerable interest (Zahra, Neubaum & Larranetta, 2007). The theoretical construct of the<br />

tacit knowledge climate (Cabrera-Suárez et al., 2001) therefore seems to be an appropriate<br />

construct to test among family <strong>and</strong> non-family firms.<br />

Social capital<br />

Social capital is a concept that can be studied at multiple levels. In this dissertation, the focus<br />

is on the group level: owner groups in private firms <strong>and</strong> copreneurs. Lee’s review (2009) <strong>and</strong><br />

Payne, Moore, Griffis, <strong>and</strong> Autry’s (2010) systematic analysis of social capital in the<br />

management domain are the starting points of this review.<br />

Payne et al. (2010) analyze social capital research in 14 major management journals. These<br />

journals were selected because they had previously been used in similar management<br />

reviews. As the focus of this dissertation is on private firms, especially family firms, Payne et<br />

al.’s (2010) analysis is extended to include key journals within the field of family business<br />

research that are not among the selected management journals. This is done on the basis of<br />

the list of journals used by Debicki, Matherne III, Kellermans, <strong>and</strong> Chrisman (2009) in their<br />

analysis of the contributions in the family business research field. This leads to the inclusion<br />

of eight additional journals that featured three or more family business articles between 2001<br />

10

<strong>and</strong> 2007 (the review period used by Debicki et al., 2009). The Journal of <strong>Family</strong> Business<br />

Strategy, a journal launched in 2010 with a specific focus on family business research, is also<br />

included.<br />

Payne et al. (2011) distinguish between conceptual <strong>and</strong> empirical papers. They also use a<br />

typology to distinguish between the individual or collective level <strong>and</strong> an internal or an<br />

external focus. This framework leads to a two by two matrix. Every article is labeled using<br />

these criteria. In this dissertation, the focus is on the empirical findings at the group level.<br />

Therefore, the articles included are those labeled as “collective” <strong>and</strong> “empirical” in Payne et<br />

al.’s (2011) gross list. These articles are covered in column two of Table 1.1. Payne’s time<br />

frame ranges from 1989 to 2008. Therefore, this review extends the time frame to include<br />

2009, 2010, <strong>and</strong> 2011. For these years, the selected journals were searched for articles in<br />

which social capital was the core construct. The results were limited to articles in which<br />

“social capital” was used as a key work or in the abstract. The numbers of articles that were<br />

found in this manner in the various journals are given in column four of Table 1.1. The same<br />

procedure was followed for the nine additional journals. For this group, the search covered<br />

the period from 1998 to 2011. These results are shown in column four in the lower part of the<br />

table.<br />

The next step was to filter these findings based on the criteria that reflected the focus of this<br />

dissertation: empirical research with a quantitative approach, a context of private firms in a<br />

for-profit sector, <strong>and</strong> the group level as the level of analysis. The numbers of articles that met<br />

these criteria are given in columns three <strong>and</strong> five. Column three covers the articles in Payne<br />

et al.’s (2011) review that met these criteria, while column five covers the articles published<br />

in the additional years by the journals reviewed by Payne et al. <strong>and</strong> those published in the<br />

additional journals from 1998 to 2011.<br />

11

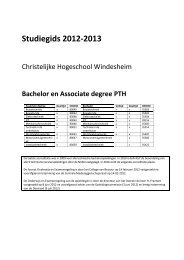

Table 1.1: Social capital research in major management <strong>and</strong> family business journals, 1998-2011<br />

Journals reviewed by Payne et al. (2011)<br />

Review period 1998-2008 Met criteria 2009-2011 Met criteria<br />

Academy of Management Journal 11 3 0 0<br />

Academy of Management Review 0 0 0 0<br />

Administrative Science Quarterly 3 1 0 0<br />

Entrepreneurship Theory & Practice 0 0 11 2<br />

Journal of Business Venturing 1 0 7 1<br />

Journal of Management 0 0 2 0<br />

Journal of Management Studies 4 1 1 0<br />

Journal of Organizational Behavior 2 0 1 0<br />

Management Science 2 0 2 0<br />

Organization Science 4 0 3 0<br />

<strong>Strategic</strong> Management Journal 8 2 3 1<br />

Journal of Applied Psychology 0 0 3 0<br />

Personnel Psychology 0 0 0 0<br />

Organizational Behavior & Human Decision Processes 0 0 0 0<br />

Total number of articles from Payne’s et al. review 35 7 33 4<br />

Additional journals based on review by Debicki et al. (2009)<br />

Review period 1998-2011 Met criteria<br />

Corporate Governance 9 0<br />

<strong>Family</strong> Business Review 4 2<br />

International Small Business Journal 10 3<br />

Journal of Business Research 10 1<br />

Journal of Small Business Management 9 3<br />

Organization Studies 7 1<br />

Small Business Economics 18 3<br />

New family business journal launched in 2010<br />

Journal of <strong>Family</strong> Business Strategy 4 1<br />

Total number of articles from additional journals 71 22<br />

The analysis of Payne et al.’s (2011) review highlights the Academy of Management Journal<br />

<strong>and</strong> <strong>Strategic</strong> Management Journal as key contributors with roughly half of the total<br />

empirical articles on social capital. In 2009-2011, Entrepreneurship Theory & Practice paid a<br />

lot of attention to social capital (11 articles). From 2009 to 2011, 33 articles were published<br />

on this topic in comparison to a total of 35 articles in the previous ten years. These figures<br />

indicate that the construct of social capital <strong>and</strong>, more specifically, empirical studies of this<br />

construct at a collective level are viewed as increasingly relevant. The relatively large number<br />

of articles from the additional journal list can be viewed as a signal that the social capital<br />

theory is seen as relevant within the fields of family businesses, <strong>and</strong> small <strong>and</strong> medium sized<br />

enterprises. A comparison of the figures from column three <strong>and</strong> five to the total for all<br />

selected articles shows that only one-fifth of all articles met the specific criteria of<br />

quantitative research within private firms at the group level. Overall, while the figures in<br />

Table 1.1 reflect the growing interest in social capital theory, they also emphasize that<br />

relatively little attention has been paid to quantitative research at the group level. The key<br />

findings from the individual papers are discussed in Table 1.2.<br />

12

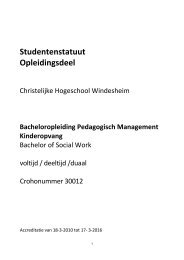

Table 1.2: Empirical trends in social capital studies of private firms<br />

Study<br />

Journal 1<br />

Sample Key constructs of social capital Key findings on social capital<br />

Aartsad et<br />

al. (2010)<br />

ETP<br />

Acquaah<br />

(2007)<br />

SMJ<br />

Audretsch<br />

et al.<br />

(2011)<br />

ISBJ<br />

Berent-<br />

Braun &<br />

Uhlaner<br />

(2012)<br />

SBE<br />

Bamford<br />

et al.<br />

(2006)<br />

JSBM<br />

Brewton<br />

et al.<br />

(2010)<br />

JFBS<br />

Carr et al.<br />

(2011)<br />

ETP<br />

Chua et<br />

al. (2011)<br />

JBV<br />

Hydroelectric<br />

micro-power<br />

start-ups<br />

(Norway)<br />

CEOs of<br />

medium <strong>and</strong><br />

large firms<br />

(Ghana)<br />

Participants<br />

in a new<br />

venture<br />

workshop,<br />

(US)<br />

Non-r<strong>and</strong>om<br />

group of FB<br />

(18<br />

countries)<br />

New<br />

ventures in<br />

bank sector<br />

(US)<br />

Small <strong>and</strong><br />

mediumsized<br />

family<br />

firms (US)<br />

Small family<br />

businesses<br />

(US)<br />

New<br />

ventures with<br />

varying<br />

levels family<br />

involvement<br />

(US)<br />

Dyadic social capital measured with<br />

network structure<br />

Three types of networking: firms,<br />

government, <strong>and</strong> community; firms:<br />

buyers, suppliers, <strong>and</strong> competitors<br />

Mobilization of contacts (structural<br />

dimension)<br />

Results indicate that firms lacking social<br />

capital can enhance performance through<br />

cohesion with firms rich in social capital.<br />

Entrepreneurs can benefit by mimicking the<br />

networking patterns of successful colleagues.<br />

Social capital developed from managerial<br />

networking <strong>and</strong> social relationships with top<br />

managers at other firms, government officials<br />

(political leaders <strong>and</strong> bureaucratic officials),<br />

<strong>and</strong> community leaders enhances<br />

organizational performance.<br />

Positive relationships are found for groups<br />

with pre-existing professional interactions for<br />

founding a firm after the workshop (=<br />

accelerator).<br />

Owner focus on shared wealth Owner focus on shared wealth acts as a<br />

mediating variable for the relationship<br />

between family governance practices <strong>and</strong> the<br />

financial performance of the family business.<br />

Size of top management team (TMT),<br />

exit of founder/ CEO<br />

Adjustment strategies, family-tobusiness<br />

intermingling, way of life<br />

Collective/internal social capital<br />

stemming from family members; split<br />

into structural, cognitive, <strong>and</strong><br />

relational dimensions<br />

<strong>Family</strong> involvement: ownership,<br />

governance, <strong>and</strong> management<br />

The exit of the founder/CEO has negative<br />

impact on performance. The size of the top<br />

management team has a moderating effect.<br />

The set of social capital variables contributes<br />

significantly to the explanation of firm<br />

resilience for rural, but not urban, firms. Of<br />

note is the negative relationship between firm<br />

resilience <strong>and</strong> the crossover of family <strong>and</strong> firm<br />

tasks for rural firms. The lone significant<br />

social capital variable for urban businesses<br />

was the meaning of the firm for the business<br />

owner.<br />

Scales are developed <strong>and</strong> tested to measure<br />

internal social capital in family firms. A<br />

positive association is found with knowledge<br />

sharing, cohesion, work satisfaction, <strong>and</strong><br />

family satisfaction, while a weak link is found<br />

with firm performance.<br />

<strong>Family</strong> involvement increases the ability to<br />

borrow family social capital. <strong>Family</strong><br />

involvement has a positive influence on new<br />

venture debt financing.<br />

1 AMJ = Academy of Management Journal, ETP = Entrepreneurship Theory & Practice, FBR = <strong>Family</strong><br />

Business Review, ISBJ = International Small Business Journal, JFBS = Journal of <strong>Family</strong> Business Strategy,<br />

JBV = Journal of Business Venturing, JMS = Journal of Management Sciences, JSBM = Journal of Small<br />

Business Management, SMJ = <strong>Strategic</strong> Management Journal, SBE = Small Business Economics.<br />

13

Study<br />

Journal 2<br />

Danes et al.<br />

(2009) FBR<br />

Fang et al.<br />

(2010) ISBJ<br />

Fitzgerald et<br />

al. (2010)<br />

JSBM<br />

Maurer et al.<br />

(2011)<br />

OS<br />

Miller et al.<br />

(2007) ISBJ<br />

Molina-<br />

Morales &<br />

Martinez -<br />

Fernández<br />

(2009) SMJ<br />

Pennings et<br />

al. (1998)<br />

AMJ<br />

Pérez-Luno<br />

et al. (2011)<br />

JBR<br />

Sample Key constructs of social capital Key findings on social capital<br />

Small <strong>and</strong><br />

medium-sized<br />

family firms (US)<br />

CEOs or Top<br />

management team<br />

tenants of<br />

incubator<br />

program (Taiwan)<br />

<strong>Family</strong> social capital (FSC):<br />

djustment strategies, family<br />

functioning, family-to-business<br />

intermingling, way of life,<br />

generation, <strong>and</strong> family/firm<br />

congruity<br />

Tenant-incubator social capital:<br />

relationship, shared cognition, <strong>and</strong><br />

incubator’s referral position<br />

Copreneurs (US) FSC: receptivity of the family to<br />

the community, family functional<br />

integrity, <strong>and</strong> community support<br />

Project leaders in<br />

firms in machine<br />

engineering<br />

industry<br />

(Germany)<br />

Small business<br />

owners (family<br />

<strong>and</strong> non-family)<br />

(US)<br />

Key-informant<br />

SMEs (Spain)<br />

Accounting firms<br />

1880-1990<br />

(Netherl<strong>and</strong>s)<br />

R&D managers in<br />

medium-firms<br />

(Spain)<br />

Intra-organizational social capital<br />

structural: the number of intraorganizational<br />

ties; relational:<br />

strength of ties <strong>and</strong> trust<br />

Membership in network: years,<br />

personal friendship, activities,<br />

shared vision, continuance,<br />

resource sharing<br />

FSC has no short-term effect, but it has a<br />

long-term significant effect on gross<br />

revenue variance <strong>and</strong> owners’ success<br />

perceptions. Adjustment strategies have a<br />

positive effect.<br />

Tenants of incubation programs uniquely<br />

leverage their social capital with their<br />

incubator <strong>and</strong>, in turn, enhance their own<br />

interorganizational learning <strong>and</strong><br />

performance.<br />

Business owners’ engagement in at least<br />

one socially responsible activity is<br />

positively associated with a positive<br />

attitude about the community <strong>and</strong> a wellfunctioning<br />

family.<br />

No association is found between the<br />

structural dimension of social capital <strong>and</strong><br />

intra-organizational knowledge transfer.<br />

There is a positive association for tie<br />

strength, while the relation between intraorganizational<br />

trust <strong>and</strong> intraorganizational<br />

knowledge transfer is<br />

insignificant.<br />

A shared vision <strong>and</strong> high risk resource<br />

sharing among network members<br />

significantly benefit members’ businesses.<br />

<strong>Strategic</strong> networking (cooperation) has a<br />

positive impact.<br />

Social interaction <strong>and</strong> trust The impact of social capital decreases<br />

beyond a certain point of development. In<br />

fact, the effect of social interactions <strong>and</strong><br />

trust on firm value creation follows an<br />

inverted U-shaped curve.<br />

Social capital proxy of<br />

professionals' ties to potential<br />

clients<br />

Relational side of external social<br />

capital<br />

Human <strong>and</strong> social capital strongly predict<br />

firm dissolution (source of competitive<br />

advantage). Effects depend on specificity<br />

(uniqueness) <strong>and</strong> non-appropriability (the<br />

ownership status of the capital).<br />

Social capital per se exerts a weak<br />

influence on radical innovations. Social<br />

capital <strong>and</strong> the tacitness of knowledge<br />

have a positive join effect on radical<br />

innovations (SC as moderator) but no<br />

moderation with knowledge complexity.<br />

2 AMJ = Academy of Management Journal, ETP = Entrepreneurship Theory & Practice, FBR = <strong>Family</strong><br />

Business Review, ISBJ = International Small Business Journal, JFBS = Journal of <strong>Family</strong> Business Strategy,<br />

JBV = Journal of Business Venturing, JMS = Journal of Management Sciences, JSBM = Journal of Small<br />

Business Management, SMJ = <strong>Strategic</strong> Management Journal, SBE = Small Business Economics.<br />

14

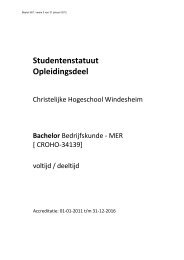

Study<br />

Journal 3<br />

Reagans et<br />

al. (2003)<br />

ASQ<br />

Samuelsson<br />

& Davidson<br />

(2009)<br />

SBE<br />

Sorenson et<br />

al. (2009)<br />

FBR<br />

Stam &<br />

Elfring<br />

(2008) AMJ<br />

Oh et al.<br />

(2004) AMJ<br />

Uhlaner et<br />

al. (2007)<br />

SBE<br />

Werbel &<br />

Danes<br />

(2010)<br />

JSBM<br />

Wu (2008)<br />

JMS<br />

Yli-Renko et<br />

al. (2001)<br />

SMJ<br />

Sample Key constructs of<br />

social capital<br />

Project teams of<br />

medium-sized<br />

firms<br />

New venture<br />

longitudinal<br />

(Sweden)<br />

Small family<br />

firms (US)<br />

Founding teams,<br />

ICT sector<br />

(Netherl<strong>and</strong>s)<br />

Members of work<br />

groups in SMEs<br />

(Korea)<br />

Private family <strong>and</strong><br />

non-family firms<br />

(Netherl<strong>and</strong>s)<br />

New small family<br />

businesses (US)<br />

Hong Kong-based<br />

Chinese familyowned<br />

SMEs,<br />

manufacturing<br />

sector<br />

Young firms in<br />

five hightechnology<br />

sectors<br />

(UK)<br />

Network status:<br />

internal density <strong>and</strong><br />

external range<br />

Instrumental social<br />

capital of all team<br />

members <strong>and</strong> social<br />

reinforcement<br />

Collaborative<br />

dialogue <strong>and</strong> ethical<br />

norms<br />

Network centrality<br />

<strong>and</strong> bridging ties<br />

Group closure,<br />

intergroup<br />

horizontal bridging,<br />

<strong>and</strong> intergroup<br />

vertical bridging<br />

Ownership<br />

commitment,<br />

collective norms,<br />

<strong>and</strong> shared goals<br />

Spousal workfamily<br />

conflict<br />

(WFC) <strong>and</strong> spousal<br />

commitment<br />

Network ties,<br />

repeated<br />

transactions, <strong>and</strong><br />

trust, with<br />

information sharing<br />

as mediating<br />

variable<br />

Relation with major<br />

client: social<br />

interaction,<br />

customer network<br />

ties, <strong>and</strong><br />

relationship quality<br />

Key findings on social capital<br />

Social network variables have positive effects on team<br />

performance. The use of these network criteria to build teams<br />

would improve their performance.<br />

SC is relatively successful in explaining progress in the<br />

creation process for a minority of innovative ventures, but<br />