Citibank (South Dakota), N.... - FatWallet

Citibank (South Dakota), N.... - FatWallet

Citibank (South Dakota), N.... - FatWallet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

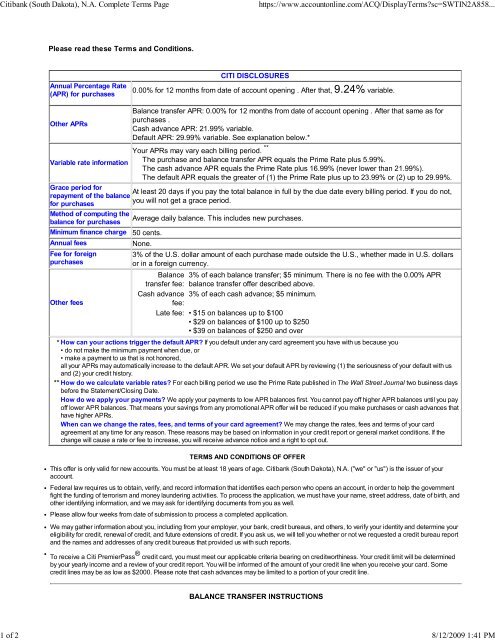

<strong>Citibank</strong> (<strong>South</strong> <strong>Dakota</strong>), N.A. Complete Terms Page https://www.accountonline.com/ACQ/DisplayTerms?sc=SWTIN2A858...<br />

Please read these Terms and Conditions.<br />

Annual Percentage Rate<br />

(APR) for purchases<br />

Other APRs<br />

CITI DISCLOSURES<br />

0.00% for 12 months from date of account opening . After that, 9.24% variable.<br />

Balance transfer APR: 0.00% for 12 months from date of account opening . After that same as for<br />

purchases .<br />

Cash advance APR: 21.99% variable.<br />

Default APR: 29.99% variable. See explanation below.*<br />

Your APRs may vary each billing period.<br />

Variable rate information<br />

**<br />

The purchase and balance transfer APR equals the Prime Rate plus 5.99%.<br />

The cash advance APR equals the Prime Rate plus 16.99% (never lower than 21.99%).<br />

The default APR equals the greater of (1) the Prime Rate plus up to 23.99% or (2) up to 29.99%.<br />

Grace period for<br />

At least 20 days if you pay the total balance in full by the due date every billing period. If you do not,<br />

repayment of the balance<br />

for purchases<br />

you will not get a grace period.<br />

Method of computing the<br />

balance for purchases<br />

Minimum finance charge 50 cents.<br />

Annual fees None.<br />

Fee for foreign<br />

purchases<br />

Other fees<br />

Average daily balance. This includes new purchases.<br />

3% of the U.S. dollar amount of each purchase made outside the U.S., whether made in U.S. dollars<br />

or in a foreign currency.<br />

Balance 3% of each balance transfer; $5 minimum. There is no fee with the 0.00% APR<br />

transfer fee: balance transfer offer described above.<br />

Cash advance 3% of each cash advance; $5 minimum.<br />

fee:<br />

Late fee: • $15 on balances up to $100<br />

• $29 on balances of $100 up to $250<br />

• $39 on balances of $250 and over<br />

* How can your actions trigger the default APR? If you default under any card agreement you have with us because you<br />

• do not make the minimum payment when due, or<br />

• make a payment to us that is not honored,<br />

all your APRs may automatically increase to the default APR. We set your default APR by reviewing (1) the seriousness of your default with us<br />

and (2) your credit history.<br />

** How do we calculate variable rates? For each billing period we use the Prime Rate published in The Wall Street Journal two business days<br />

before the Statement/Closing Date.<br />

How do we apply your payments? We apply your payments to low APR balances first. You cannot pay off higher APR balances until you pay<br />

off lower APR balances. That means your savings from any promotional APR offer will be reduced if you make purchases or cash advances that<br />

have higher APRs.<br />

When can we change the rates, fees, and terms of your card agreement? We may change the rates, fees and terms of your card<br />

agreement at any time for any reason. These reasons may be based on information in your credit report or general market conditions. If the<br />

change will cause a rate or fee to increase, you will receive advance notice and a right to opt out.<br />

TERMS AND CONDITIONS OF OFFER<br />

• This offer is only valid for new accounts. You must be at least 18 years of age. <strong>Citibank</strong> (<strong>South</strong> <strong>Dakota</strong>), N.A. ("we" or "us") is the issuer of your<br />

account.<br />

• Federal law requires us to obtain, verify, and record information that identifies each person who opens an account, in order to help the government<br />

fight the funding of terrorism and money laundering activities. To process the application, we must have your name, street address, date of birth, and<br />

other identifying information, and we may ask for identifying documents from you as well.<br />

• Please allow four weeks from date of submission to process a completed application.<br />

• We may gather information about you, including from your employer, your bank, credit bureaus, and others, to verify your identity and determine your<br />

eligibility for credit, renewal of credit, and future extensions of credit. If you ask us, we will tell you whether or not we requested a credit bureau report<br />

and the names and addresses of any credit bureaus that provided us with such reports.<br />

• To receive a Citi PremierPass ® credit card, you must meet our applicable criteria bearing on creditworthiness. Your credit limit will be determined<br />

by your yearly income and a review of your credit report. You will be informed of the amount of your credit line when you receive your card. Some<br />

credit lines may be as low as $2000. Please note that cash advances may be limited to a portion of your credit line.<br />

BALANCE TRANSFER INSTRUCTIONS<br />

1 of 2 8/12/2009 1:41 PM

<strong>Citibank</strong> (<strong>South</strong> <strong>Dakota</strong>), N.A. Complete Terms Page https://www.accountonline.com/ACQ/DisplayTerms?sc=SWTIN2A858...<br />

Just follow these simple steps to start saving money by transferring balances from your high-interest credit cards.<br />

1. After receiving your card, you may call our customer service number to transfer your high rate balances.<br />

2. You may transfer any amount, but the total amount including any balance transfer fee must be less than your available<br />

revolving credit line. You should not transfer the amount of any disputed purchase or other charge. If you do, you may<br />

lose your dispute rights. You may not transfer balances from other accounts issued by <strong>Citibank</strong> (<strong>South</strong> <strong>Dakota</strong>), N.A. or<br />

its affiliates.<br />

3. Continue to pay the other credit card issuer until we notify you in writing that we have approved the balance transfer.<br />

When we do, we pay the amount of the balance transfer directly to that issuer.<br />

4. Keep your account in good standing. If you default under any card agreement you have with us, you may lose any<br />

promotional APR on the balance transfer. We may not approve future balance transfers either.<br />

ThankYou ® Network<br />

Citi PremierPass ® Card Terms and Conditions<br />

• As a cardmember ("you") of the Citi PremierPass Card ("Card Account"), you will earn one ThankYou ®<br />

purchase point ("ThankYou SM Purchase Points") for every dollar spent on all purchases made on your Card.<br />

In addition, you will earn one ThankYou ® flight point ("ThankYou Flight Points") for every three miles flown<br />

when airline tickets are purchased using your Card Account. The total number of ThankYou ® Purchase and<br />

ThankYou ® Flight Points ("ThankYou Points") that may be earned on your Card is 100,000 per calendar year<br />

(eligible purchases appearing on your January - December billing statements), only 50,000 of which may be<br />

ThankYou ® Flight Points. The calendar year limit will include any ThankYou ® Purchase and ThankYou ®<br />

Flight Points you may be eligible to receive, unless we tell you otherwise. You may earn ThankYou ® Points as<br />

long as your Card Account is open and current.<br />

• ThankYou ® Flight Points are earned for miles flown based on the city of origin and the city of destination<br />

provided to us when an airline ticket is purchased. We will determine how many ThankYou ® Flight Points will<br />

appear on your billing statement based upon airline travel distance information published by OAG Worldwide,<br />

Inc., our source of independent flight schedule information, unless we tell you otherwise. ThankYou ® Flight<br />

Points will post to your Card Account approximately six to eight weeks following the initial departure date of<br />

travel referenced on your airline ticket transaction.<br />

• If you are approved for a Card Account, a ThankYou ® Network Member Account ("ThankYou Member<br />

Account") will be set up for you. ThankYou ® Purchase Points post to your Card Account at the close of each<br />

billing cycle, and at that time are transferred to your ThankYou ® Member Account. However, ThankYou ®<br />

Flight Points are not transferred to your ThankYou ® Member Account unless we transfer, or have previously<br />

transferred, an equal or greater number of ThankYou ® Purchase Points. ThankYou ® Purchase and Flight<br />

Points are not eligible for redemption until they are transferred to your ThankYou ® Member Account.<br />

ThankYou ® Points may not be redeemed and may be lost if your Card Account is not open or current.<br />

• ThankYou ® Points will not expire as long as you have qualifying purchase activity at least once every 18<br />

months unless we terminate ThankYou ® Network-in which case you will have only 90 days from the<br />

ThankYou ® Network termination date to redeem all your accumulated ThankYou ® Points. ThankYou ®<br />

Network rewards and the ThankYou ® Point levels required for specific rewards are subject to change without<br />

notice.<br />

• We may revise any of the terms and conditions with 30 days prior written notice. Any revisions may affect your<br />

ability to use the ThankYou ® Points you have already accumulated.<br />

2 of 2 8/12/2009 1:41 PM<br />

Close